Much continues to be said about the economy—namely, whether we’re in a bubble, and if so, how bad the crash after the “pop” will be.

This past March, I wrote an article titled It’ll get worse before it gets better. My summary was as follows:

When it comes to the U.S. economy, it’ll get worse before it gets better. But my hope is that it gets better by November 2026, here’s why:

Elections

Mid-term elections occur in November 2026. If Republicans want to maintain control of the House, Senate, and state/local seats, then positive change must occur by then.

Economy

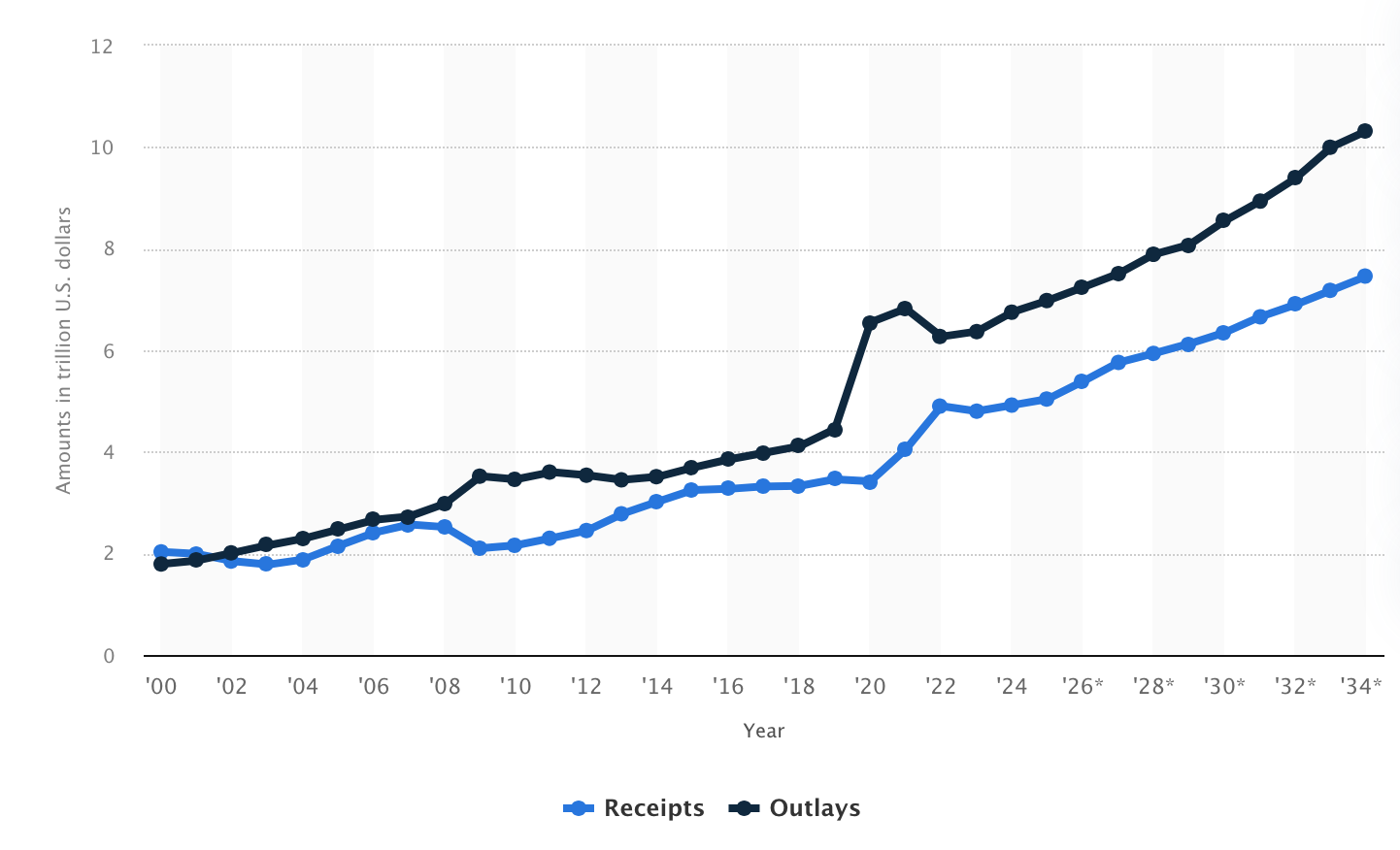

Our nation’s debt-to-GDP ratio is over 100%; if this were to continue, we will be unable to pay for Social Security in 10 years. Though both political parties have contributed to this problem over the past 24 years, it’s unreasonable to think they can both bring it down in another 24 years—that’s simply too long, and not likely to come to fruition. Thus, decades of overspending need to be reined in over a shorter period of time than it took to build it up.

Expediency

Though shifting employees from public-sector (government) jobs to private-sector jobs will help lower government spending, that shift doesn’t happen overnight. The private sector can’t just build infrastructure or capacity quickly. Moreover, many businesses and non-government organizations depend on government contracts and grants; cuts in these will also impact unemployment and delay growth.

Thus, this is why the current administration is moving fast to tear things down, because it will take time to build them back up, and they only have until next November.

The question is, can they do it in such a way that doesn’t break the entire economy.

Eight months later, I’m covering where we stand.

If I have any recommendations for you readers, it’s these:

Diversify your investments by sector and region (international)

Spend within your means, build up your savings, pay off/stay out of debt to the degree that you’re able

Work hard, become good at something, be irreplaceable in your workplace

Most importantly, the administration must do things that propel our economy forward and help common Americans

Elections

In the recent November elections we saw the first part the above summary play out—positive change must occur or the people will voice their concerns at the ballot box. With regard to the economy, positive change has not occurred, thus the economy was a key component to Democrats’ wins.

One of the narratives around Mamdani’s win in New York City is that young people there are fed up with capitalism. Burdened with student debt, unable to find a job, and unable to buy a home, the American Dream does not seem achievable for many of them, so they are looking for a different system. Back in 2020, billionaire conservative Peter Thiel articulated this appeal of socialism for millennials and warned that something must be done to address their concerns.

So, let’s talk about the economy then.

Economy

I have more charts showing negative economic indicators than I have room for in this article, so I’ll just highlight some important ones.

The only thing that seems to be doing well is the stock market, and that’s due to “The Magnificent Seven”—Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA, and Tesla—which account for 40% of the S&P 500. Consider this: the S&P 500 has nearly doubled in just five years.

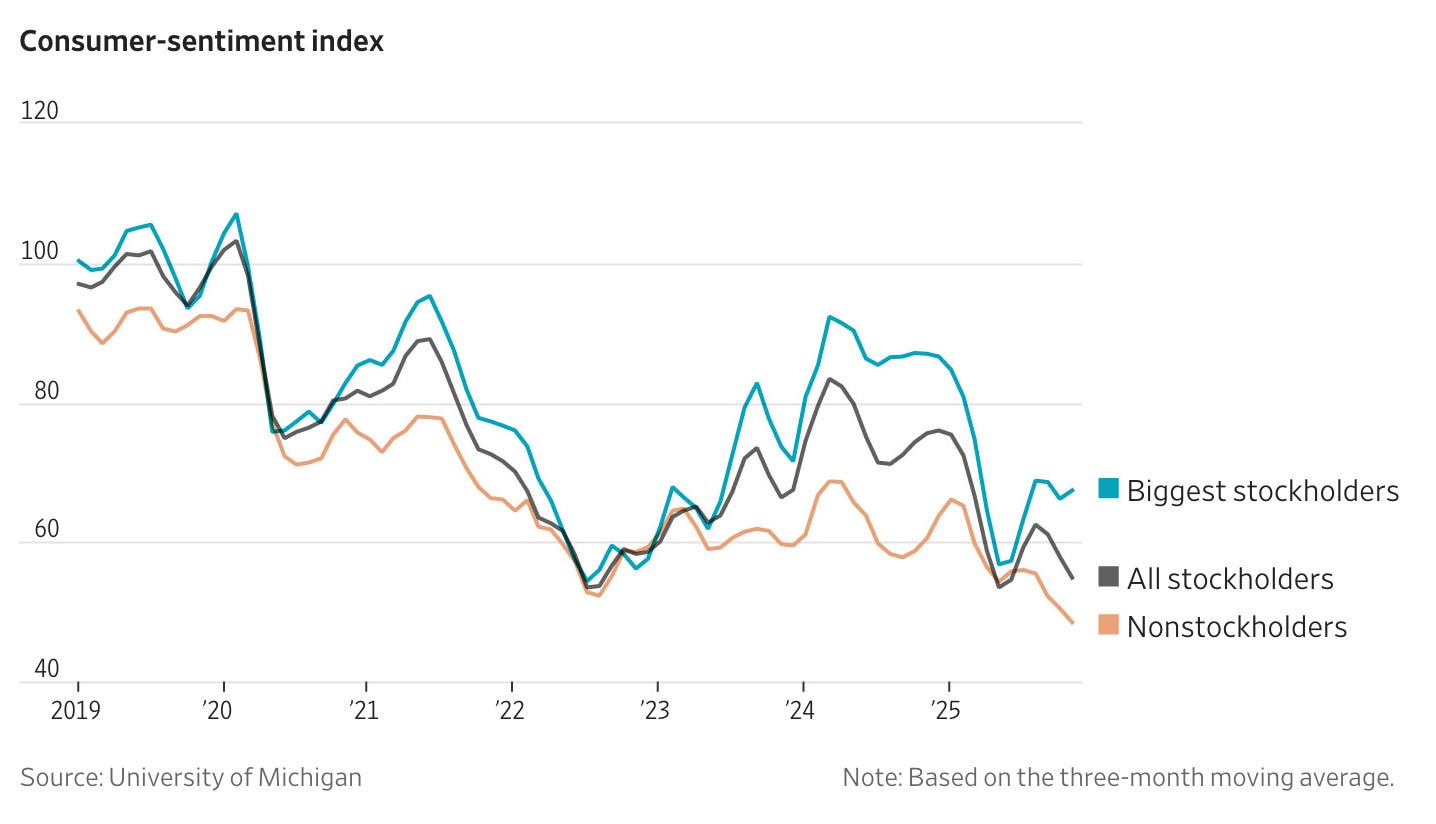

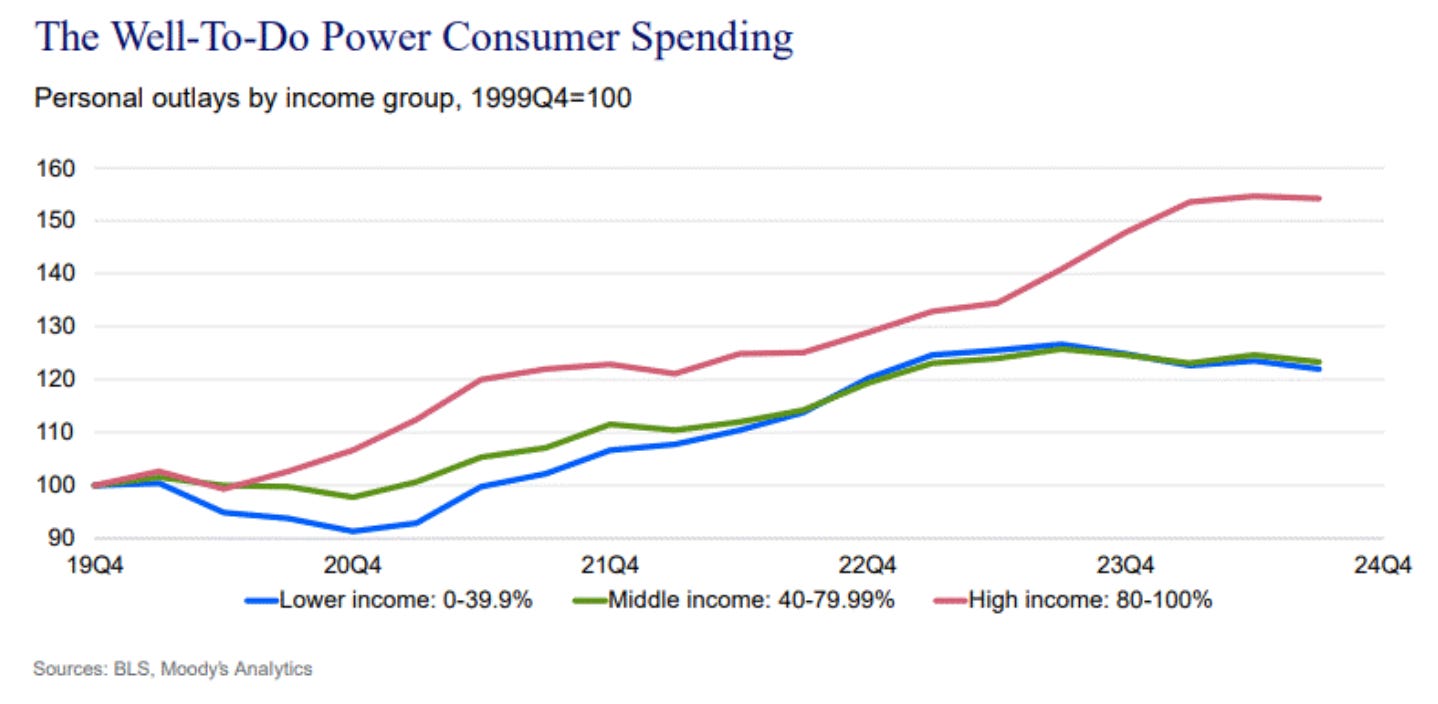

The title of this Wall Street Journal article captures the dichotomy of our economy: Feeling Great About the Economy? You Must Own Stocks. It’s an excellent read that highlights our current K-shaped—one in which affluent Americans are doing well, while lower-income Americans are struggling (and voicing their concerns)—see chart below:

My concern here is two-fold: the obvious one is the squeeze on low-income families, the other is that affluent Americans are driving much of the spending in our economy and if that stops, then there might be an accelerating downward spiral.

Artificial Intelligence

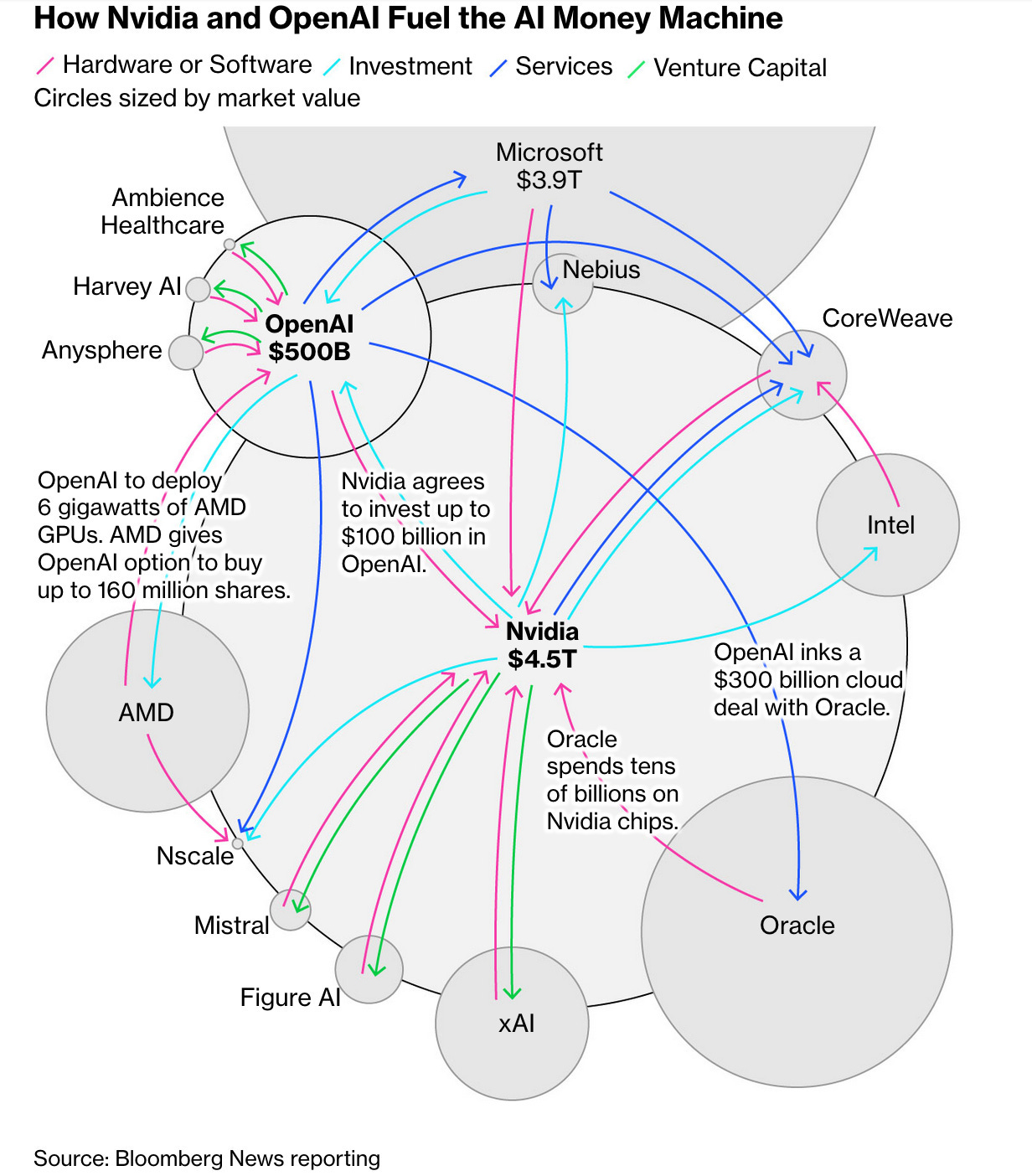

The thing I struggle with most here is that much of the stock market growth is driven by spending on AI; however, I’m not seeing (my first use of this phrase) where AI is producing value for our economy (yet). I fully admit that there are a lot of things I don’t know in this world, so I may be missing something here, but it all seems very self-perpetuating:

I use AI almost daily. It’s very useful, it saves me a lot of time on things that I do on my computer. In that regard, it makes me more efficient, but that’s not the case for everyone, and I don’t have a number for how my efficiency (or others’) is impacting the economy. I do know it didn’t help me do yard work today.

Aside from construction on data centers, which is sizeable, I’m just not seeing (second use of this phrase) where it’s driving job growth. Perhaps it’s so transformational that we don’t even know how it will change our job market. The only thing I am seeing is that the demand for service jobs will go up—these are the things AI can’t do well (yet).

If there’s a bright side to the AI spending, it’s that the majority of AI-related capital expenditures are being financed through cash and earnings rather than debt. Goldman Sachs analyst Eric Sheridan had this to say: “while some features of the current period rhyme with past bubbles, and the circularity of deals warrants caution, public market valuations and capital market activity levels remain below their Dot-Com peaks.” And, “most of the Mag 7 continue to generate outsized free cash flows, engage in stock buybacks, and pay dividends—behavior seldom seen during the Dot-Com Bubble.”

The same report cautions, “While valuations and funding models suggest we are not yet in a bubble, the significant outperformance of technology has indeed led to a dangerous degree of market concentration across geographies, sectors, and stocks. The US market’s consistent outperformance over the past 15 years—which has resulted in it accounting for over 60% of the global stock market—is largely attributable to the technology sector’s record share of the US index. Such concentration is extreme, with the top 10 US companies alone making up nearly a quarter of the global public equity market.”

The bottom line advice from Goldman: diversify your stocks by region and sector, and consider the energy requirements for those data centers.

My thoughts: now might be a good time for the US to invest more in nuclear energy, after all, Microsoft is doing it by reopening Three-Mile Island to power its data centers.

Tariffs, Trade, and Manufacturing

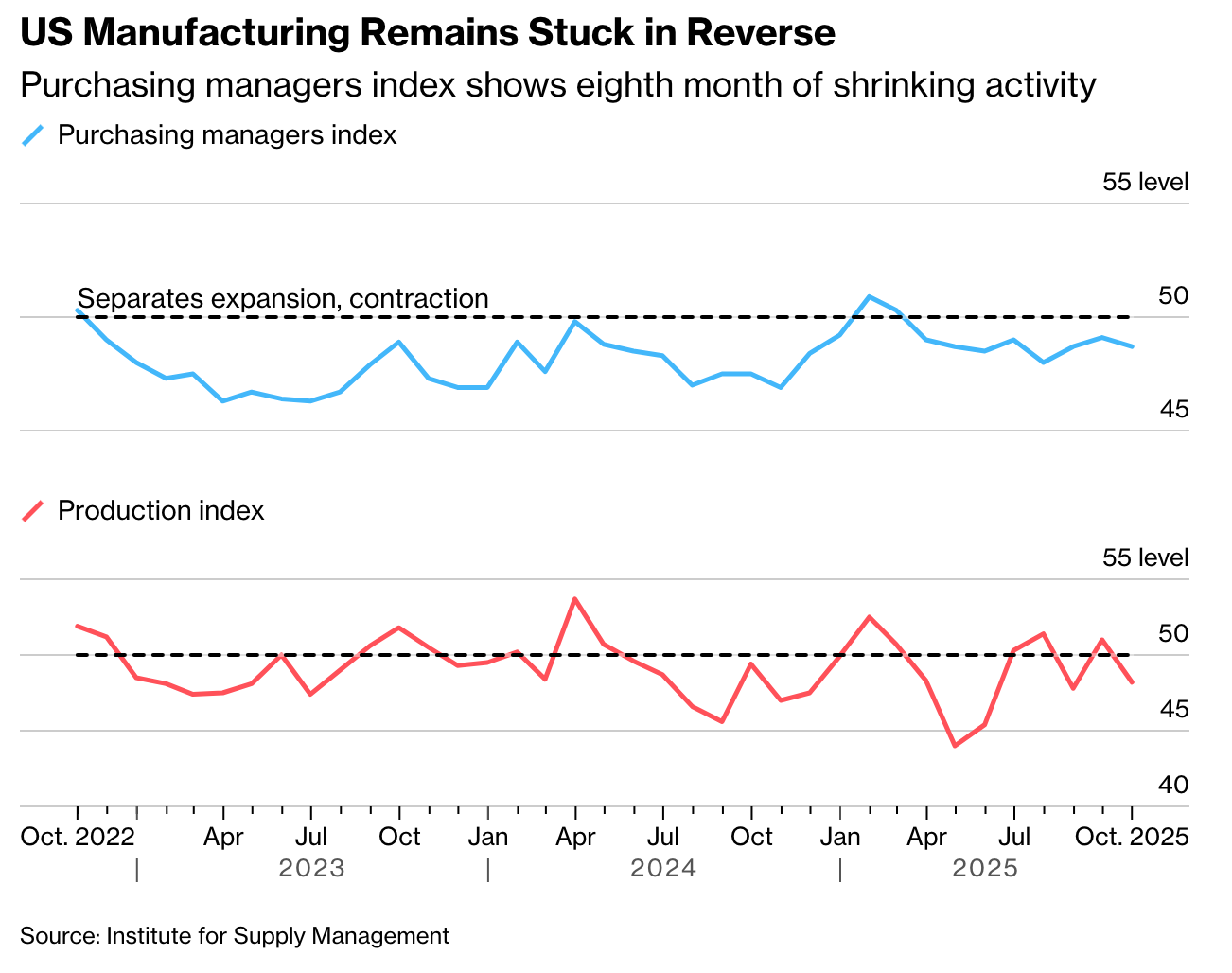

I’m also not seeing (third use of this phrase) a net-positive impact of tariffs. Most of the time consumers pay the increased cost, and the intended purpose of increasing manufacturing in the US does not seem to be panning out:

There’s simply too much uncertainty for companies to commit to building manufacturing facilities that would result in jobs. Part of that uncertainty comes from the economy, and part of that comes from whipsawing trade policies.

Jobs & Personal Finance

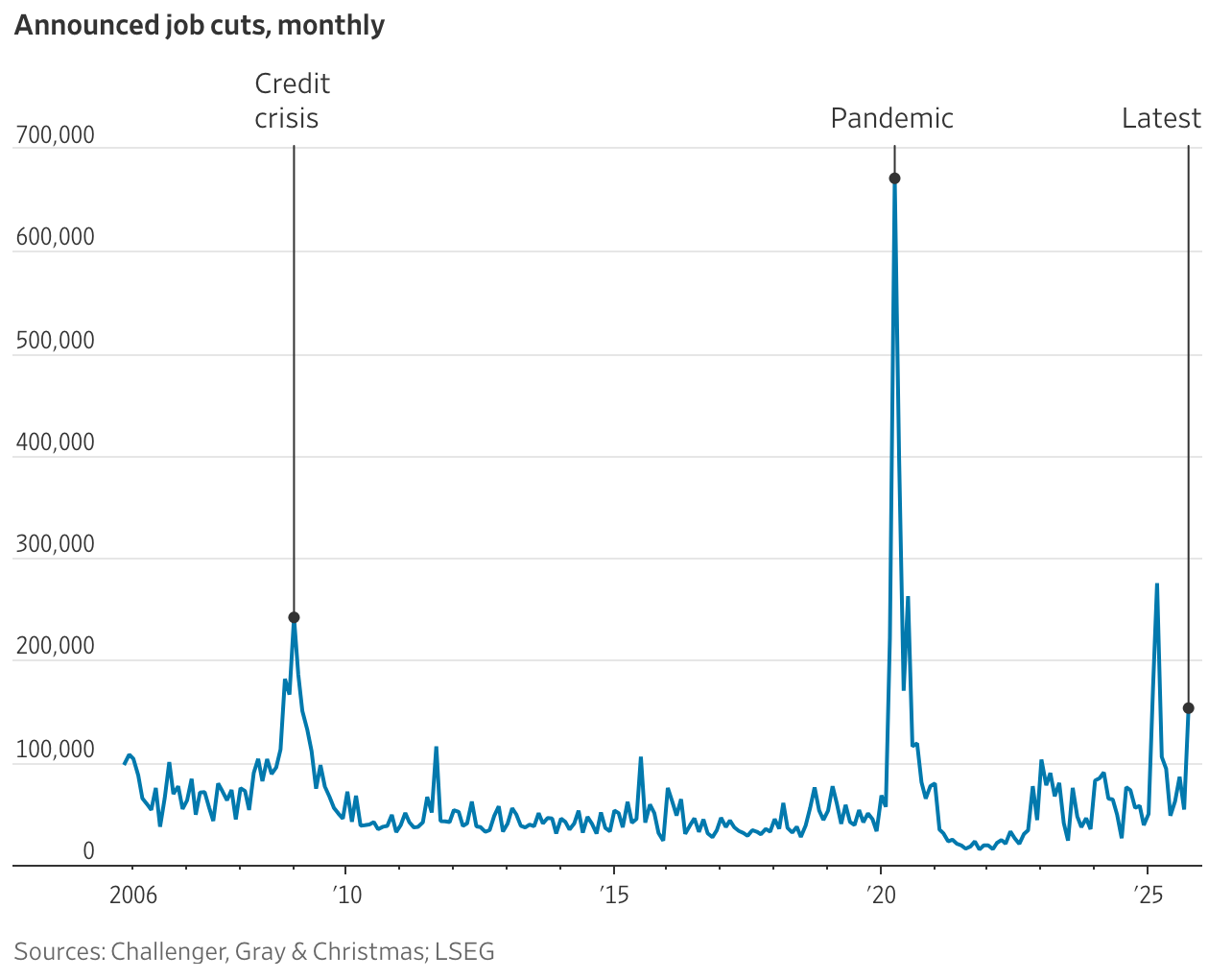

Speaking of job growth, the recent round of tens-of-thousands of layoffs isn’t helping the economy or consumer sentiment. Over a million jobs have been cut so far this year—that’s 65% more than this time last year, and the highest since COVID.

Interest rates continue to be high and uncertainty about the economy means that companies are cautious about growth and hiring. This, I believe, is why Christmas stuff and advertisements are out earlier than usual (more on this later). Companies are thinking, ‘Grab as much of the spending as early as possible,’ because the bill will come due.

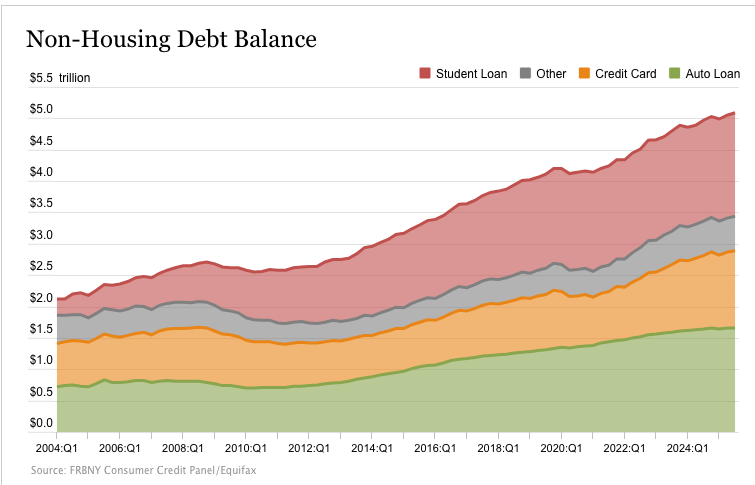

Speaking of bills, total household debt is up:

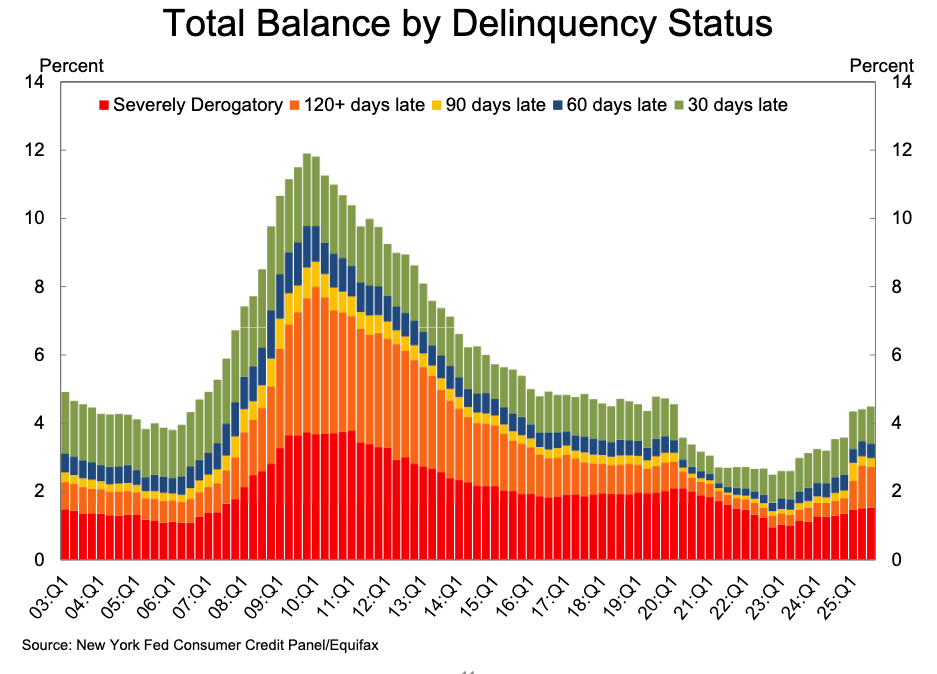

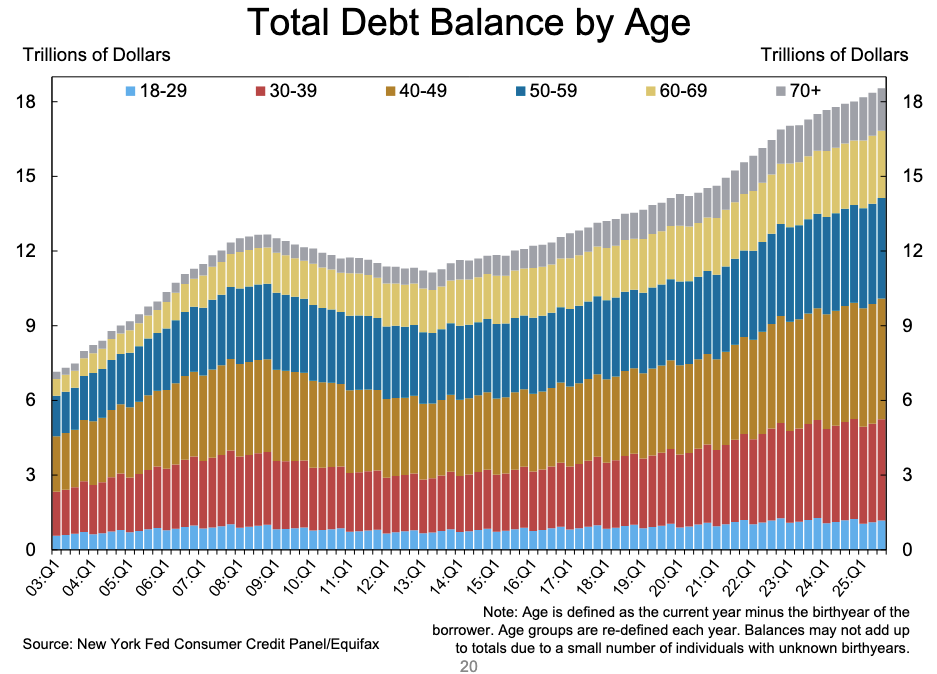

Again, more charts here than I have space for, but here are four that stand out from the Fed:

1. The number of people who are severely derogatory and 120+ days delinquent on paying debt is up:

2. A growing portion of this debt is being held by 30 year olds:

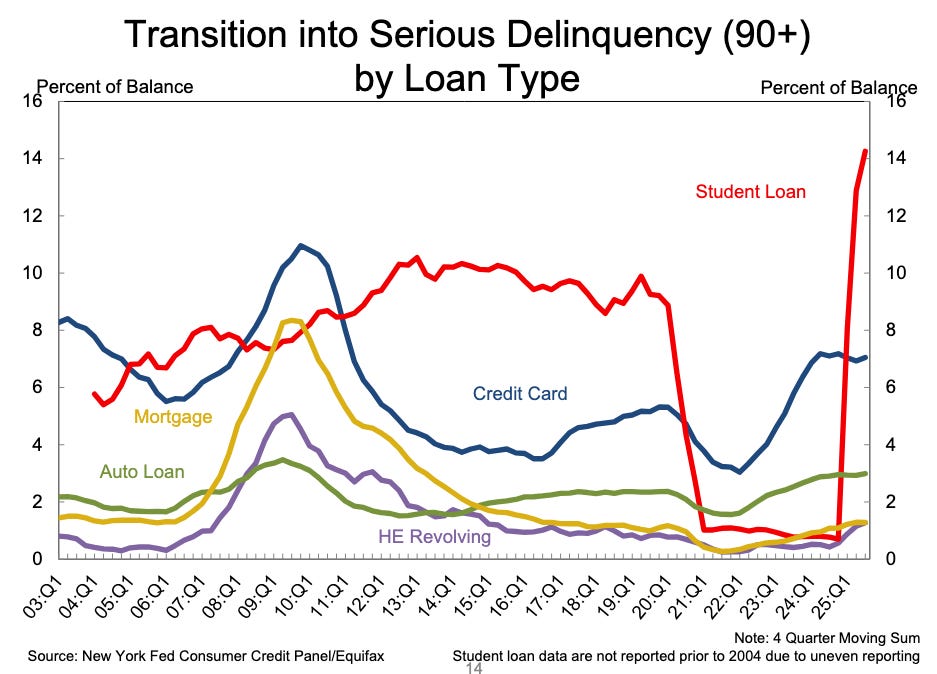

3. Student loan delinquency has spiked, and auto loan delinquency has risen:

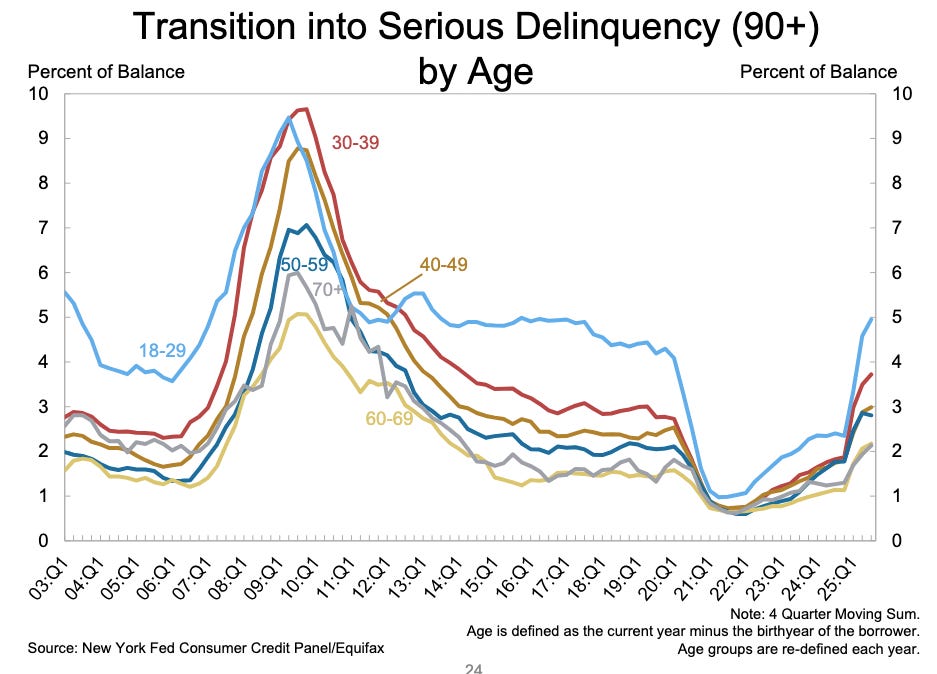

4. Those people in their 20s and 30s are most delinquent in paying their bills:

This all brings us full circle to elections. Young people need jobs, and things must stabilize for companies to hire people.

I haven’t even talked about Social Security here, which was my primary concern in my original article. Bottom line: the situation hasn’t improved, because government spending versus income haven’t improved.

Expediency

I see two reasons why companies rolled out Christmas decorations, music, and advertisements the day after Halloween—two months before the actual holiday1: 1) Nostalgia—Christmas “feels” good for most Americans, so when consumer sentiment is down, they’re helping people feel better. They do this, ultimately, to help their own 2) Revenue—Because, when the music stops (pun intended), they need to capture as much of the seasonal spending as soon as they can…and who knows when it will stop.

Once January (or December) rolls around and credit card bills come due from Christmas spending, the impact on consumer credit will be telling. As Warren Buffett is famous for saying, “Only when the tide goes out do you discover who’s been swimming naked.”

Something must propel the economy forward. Foreign relations, the federal budget, housing, jobs—these things must be addressed. Americans are looking for normalcy, economic confidence, and hope that things will get better…sooner rather than later.

For reference, this is like advertising for Valentines on December 21st and Independence Day on May 11th.