Caveat: Lest anyone accuse me of suffering from the Dunning-Kruger Effect, I’ll state up front, I’m not an economist. So, everything you read here is mainly amateur conjecture based on conversations with others, articles I’ve read, a little bit of logic, and maybe some expectation management. I could be wrong.

Summary

When it comes to the U.S. economy, it’ll get worse before it gets better. But my hope is that it gets better by November 2026, here’s why:

Elections

Mid-term elections occur in November 2026. If Republicans want to maintain control of the House, Senate, and state/local seats, then positive change must occur by then.

Economy

Our nation’s debt-to-GDP ratio is over 100%; if this were to continue, we will be unable to pay for Social Security in 10 years. Though both political parties have contributed to this problem over the past 24 years, it’s unreasonable to think they can both bring it down in another 24 years—that’s simply too long, and not likely to come to fruition. Thus, decades of overspending need to be reined in over a shorter period of time than it took to build it up.

Expediency

Though shifting employees from public-sector (government) jobs to private-sector jobs will help lower government spending, that shift doesn’t happen overnight. The private sector can’t just build infrastructure or capacity quickly. Moreover, many businesses and non-government organizations depend on government contracts and grants; cuts in these will also impact unemployment and delay growth.

Thus, this is why the current administration is moving fast to tear things down, because it will take time to build them back up, and they only have until next November.

The question is, can they do it in such a way that doesn’t break the entire economy.

A More Detailed Analysis

Elections

Our current two-party system is marked by pendulating government control, swinging from one party to another. Republicans, currently in control of the House, the Senate and the Presidency (the trifecta), have until the November 2026 mid-term elections before they’ll be judged on what they’ve accomplished this term. If Americans aren’t happy, then they’ll express it at the polls and potentially give the lead in congress to Democrats, making future policy agreement between Congress and the President very difficult.

Republican Control

There are 435 US Representatives, each of whom hold two-year terms, meaning all 435 seats will be up for election in November 2026. Currently, Republicans hold 218 seats, Democrats hold 214 seats, and three are vacant. In order pass a bill in the House, 218 votes are required. Thus, if all the Republicans vote together, they can pass a bill in the House.

There are 100 US Senators, each of whom hold staggard six-year terms, resulting in roughly one third of them being elected every two years. In the US Senate, 33 seats will be up for election next November. Of the current 100 Senators, 53 are Republican, 45 are Democrat, and two are Independent. In order to pass a bill in the Senate, 51 votes are needed. Thus, if all the Republicans vote together, they can pass a bill in the Senate.

In the Electoral College, Trump received 312 votes to Harris’ 226. In the popular vote, Trump won 49.8% of the votes while Harris received 48.3%.

This is to say, the Republicans currently enjoy the pendulum on their side, especially in the federal government, but also among the populace, based on the most recent election. However, if voters are not happy next November, then they will voice it at the election box.

And, in addition to federal elections, there will be numerous state and local elections as well. The state and local election outcomes in November 2024 reflected federal election outcomes and will likely do similar in November 2026.

American Politics

A fortunate aspect of American politics is that it can be difficult to make lasting change due to the time and effort required to do so. An unfortunate aspect of American politics is that it can be difficult to make lasting change due to the time and effort required to do so.

This is what the designers of our country’s government intended—a political system that encourages conflict and cooperation to avoid tyranny and mob rule. And this is why we have a separation of our government vertically—federal, state, and local levels—and horizontally—across legislative, executive, and judicial branches. (I won’t discuss the shifting weight of power among these, to include the power of executive orders, but the weight does and has shifted over time.)

Due to the shifting of government control by different political parties, and the limits on powers at each level, it takes time to make lasting change—compromise and agreement are required. This can be said about everything else the government has power over, to include economic policy and change.

All of this is to say, if the changes being undertaking by the current administration don’t make positive impacts to voters by next November, then Republicans will lose the majority, along with any potential plans they have. But, this also means two other things:

It CAN get worse before it gets better, as long as it gets better by November.

It MUST get worse and get better very fast in order for positive changes to occur by November.

Now, let’s talk about why things likely need to get worse before they get better.

Economy

We have a problem—our country has more debt than it does income.

And, just like your personal finances, this is untenable in the long run. You can’t just keep getting new credit cards to pay bills without the entire system coming crashing down and the repo man coming to get your car and you being unable to pay for basic necessities.

So let’s break down each of these components to see how we got here and what the impact is.

National Deficit

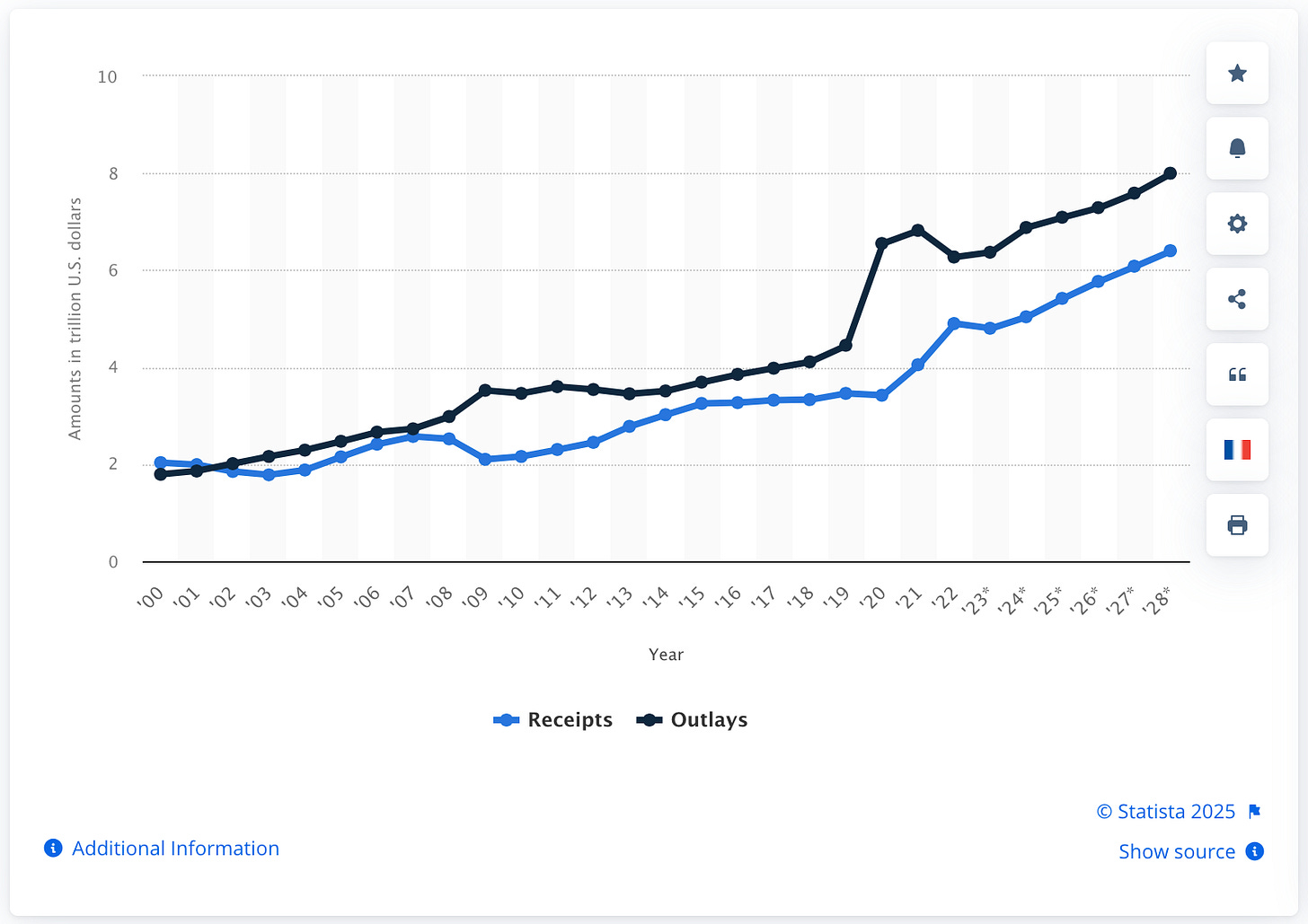

The primary problem is that our nation is spending more than we’re bringing in. The chart below shows the total receipts (money coming in) and outlays (money going out) of the US federal budget. Each year that there is more money going out than there is coming in, we have a deficit. When there’s more money coming in than there is going out, it’s a surplus.

Another way to visually understand this data is using the chart below, which show the difference between the receipts and outlays for each year (the yearly spread between the two lines in the above graph).

As you can see, the last time we had a surplus was in 2001. Ever since then we’ve had a deficit.

National Debt and Interest Payments

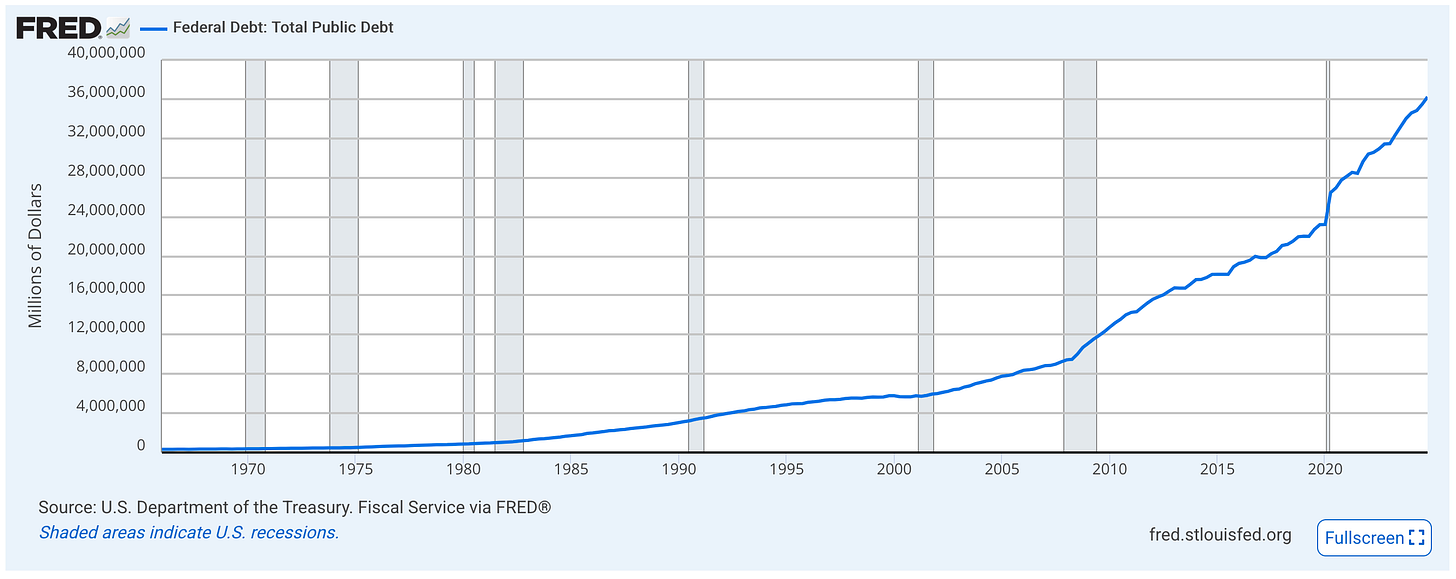

All of that deficit (overspending) adds up each year and contributes to our nation’s overall debt, which currently stands at over $36 Trillion dollars.

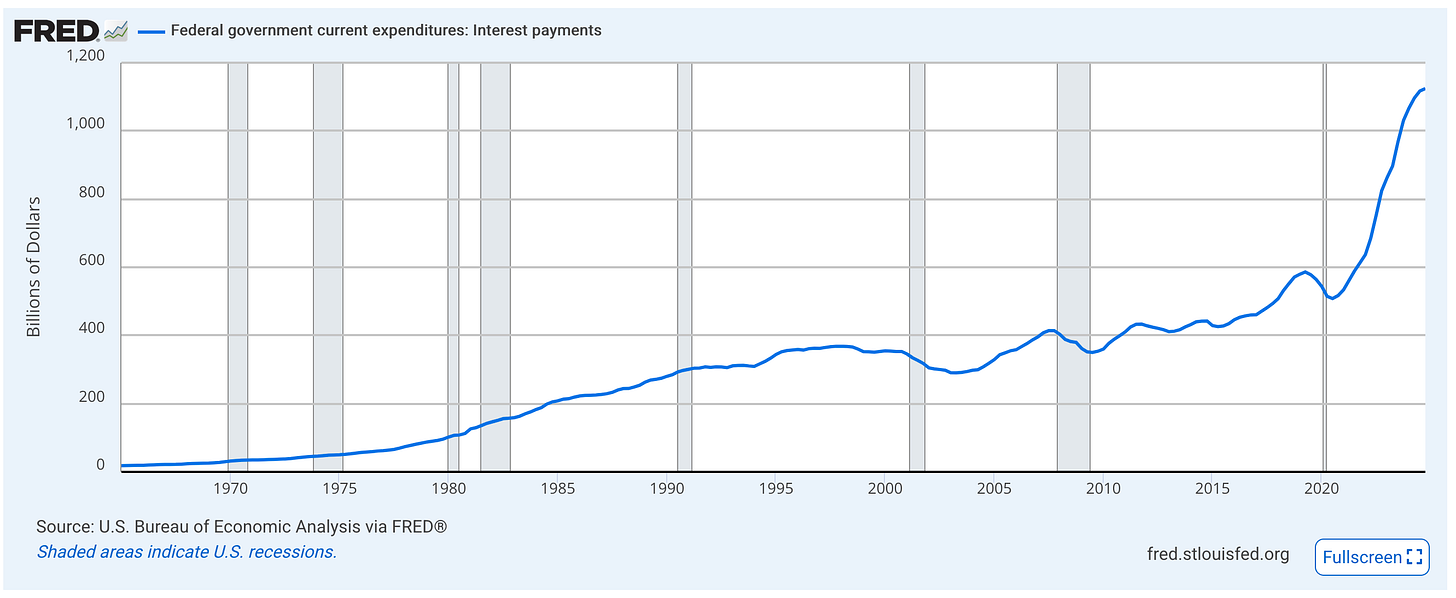

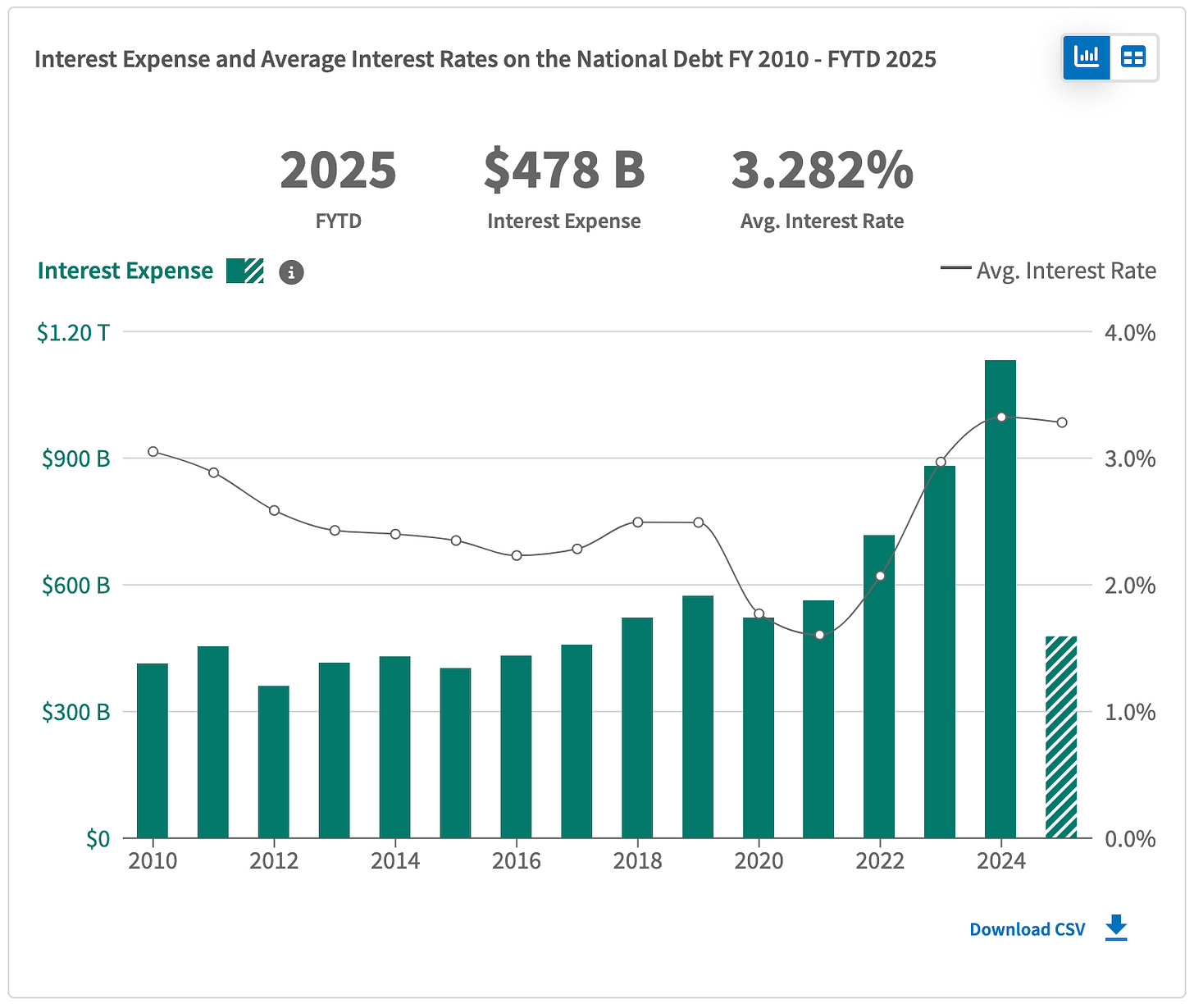

And as the debt added up, the interest payments on that debt began to increase:

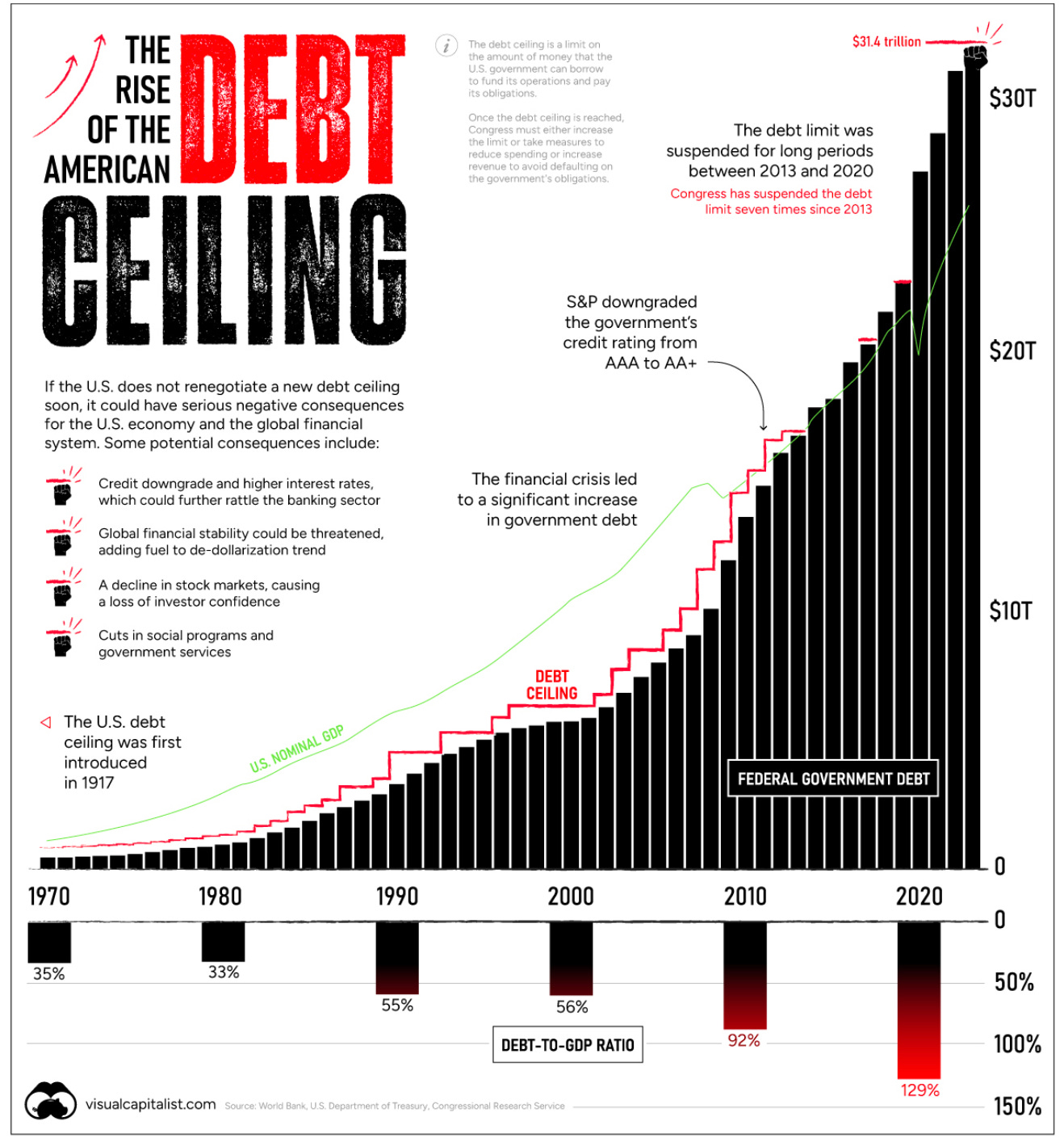

The debt ceiling, a self-imposed limit on the amount of US debt we have, is supposed to prevent our country from going too far in debt. Unfortunately, government leaders just kept raising that ceiling or ignoring (suspending) it. As both political parties enjoyed being in power at certain times during the past 24 years, they’re both to blame for this.

As the Visual Capitalist article this image is from describes, there are three potential consequences of the US not being able to pay its debt: higher interest rates, erosion of our international credibility, and financial sector turmoil. Let’s explore each.

1) Higher interest rates

The first potential consequence is that interest rates rise because there’s more risk that the US might not be able to pay back its debt. To understand this, think about how banks use a debt-to-income (DTI) ratio to determine how credit worthy an individual is for a loan. If an individual’s DTI is too high, then banks won’t lend money to them, or they’ll do so at a higher interest rate to account for the increased risk of loaning money to someone who might not be able to pay back the loan. You can see how this adds to the individual’s problems—they already have a lot of debt as a percentage of their income, then they get more debt at a higher interest rate, which further adds to the percentage of their income that must go to pay their debt.

In this context, our national “income” is referred to as our Gross Domestic Product (GPD), which is a factor of consumer spending, government spending, investments that businesses make to grow/improve, and net exports (exports minus imports).

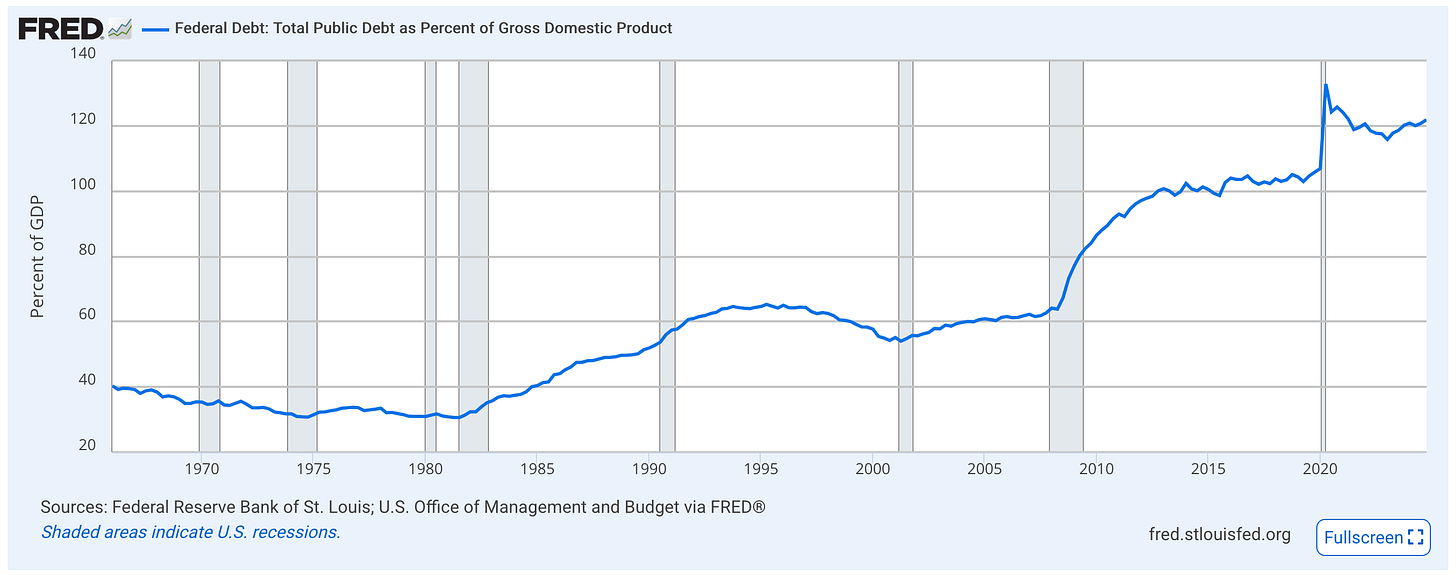

The measurement we use isn’t DTI, but debt-to-GDP ratio. Our debt-to-GDP ratio really started to become a problem back in 2012, where our debt started to exceed our nation’s GDP. Said another way, all of our income is used to pay off interest.

And, as you can see in the chart below, the interest rate on our debt and the resulting interest expense have grown sharply the past five years.

2) Erosion of our international credibility

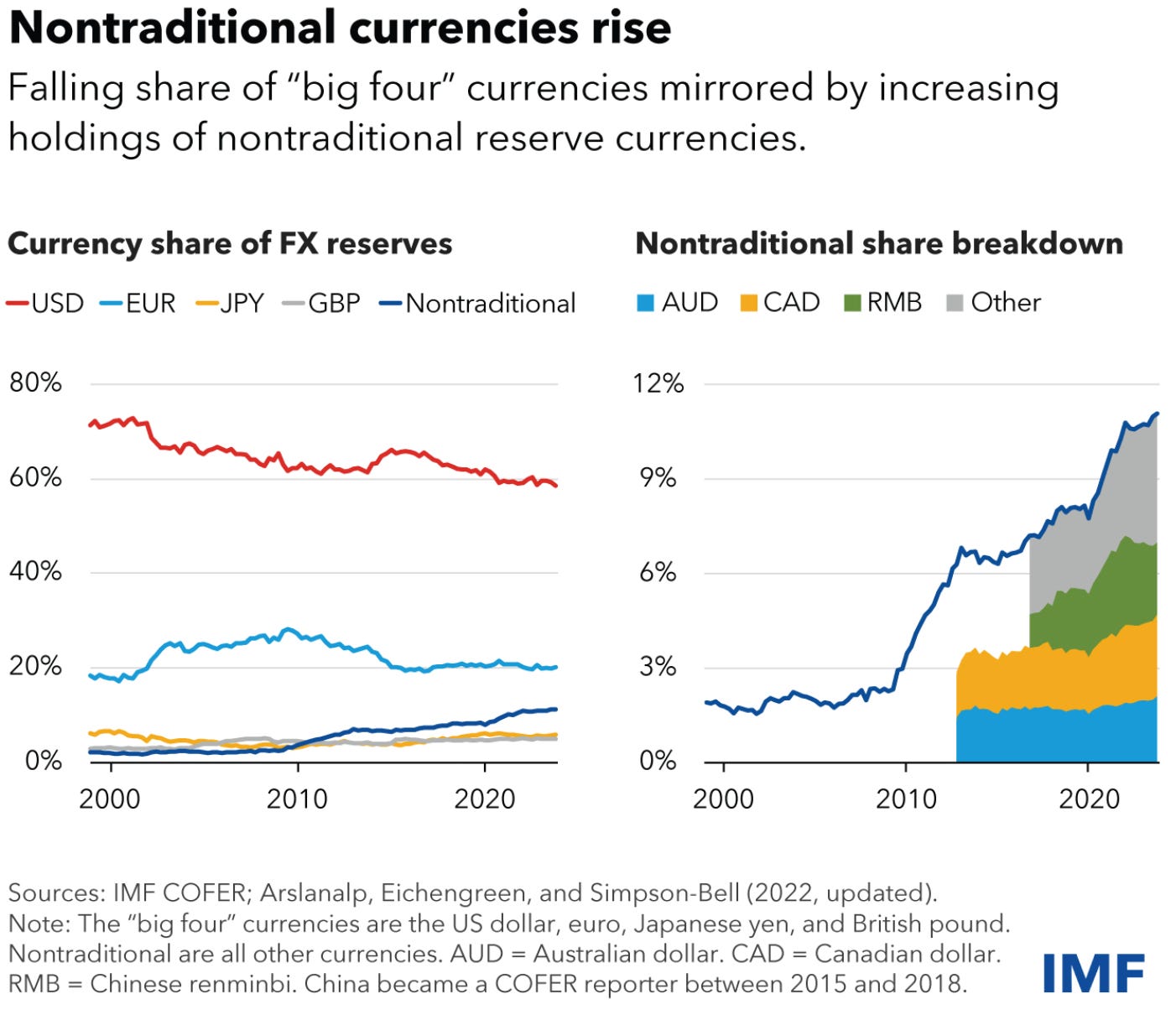

Due to the strength of the US economy, most countries use the US dollar as the primary currency for international transactions (otherwise known as a country’s reserve currency). However, instead of holding actual US cash for these transactions, foreign banks hold what are called “treasury securities,” or “Treasuries,” for short.

To get US Treasuries, foreign entities must buy them from the US, and in return they are also promised a certain rate of interest on this “loan” to the US. Treasuries vary in type and length, so the amount of interest also varies based on the type of treasury that is purchased.

US Treasuries are backed by the full faith and credit of the US, which means our government promises to repay them, and because we’ve done a really good job of repaying them (thanks to our strong economy), they are considered low risk and thus commonly used.

US Treasuries being the primary reserve currency for other nations is great for us, because it means other countries invest in America. However, if concerns rise that we cannot or will not repay them, then countries will diversify their reserve currency by buying from other countries instead of the US.

In the 19th century and first half of the 20th century, the United Kingdom’s pound sterling was used as the primary reserve currency, but by the middle of the 20th century the US dollar rose to dominancy. In 1970, the US dollar represented nearly 85% of global currency reserves, now it represents less than 60%.

But this begs the question, what bills must we actually pay?

Internationally, as a sovereign nation with a dominant military, we could simply not pay the interest (or principle for that matter) on these Treasuries to these other countries and declare “Come and take it,” as occurred in the Battle of Thermopylae, the American Revolutionary War, and the Texas Revolution. Alas, this would most likely result in another war.

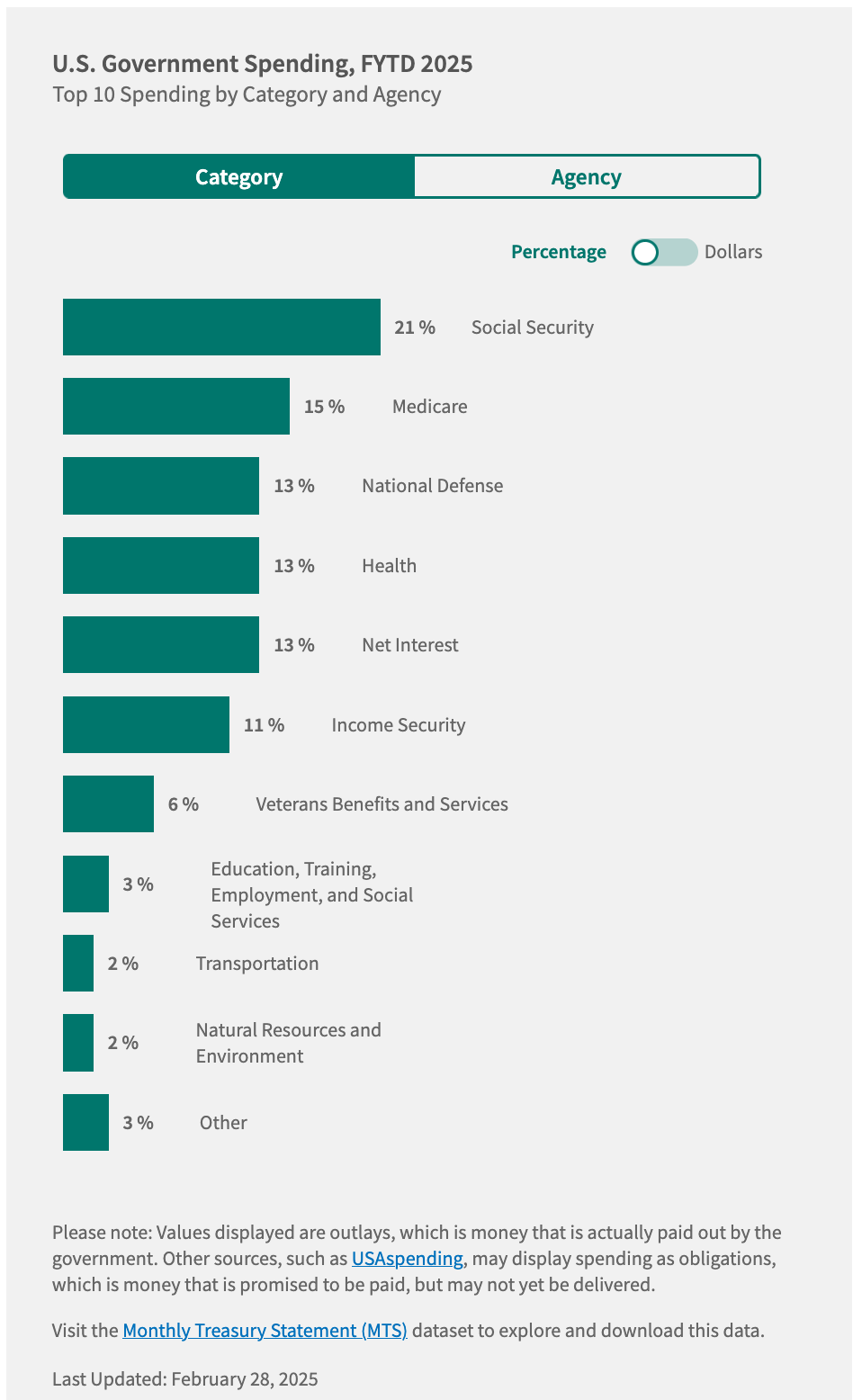

Domestically, with regard to our own nation’s “must pay” bills, the US Congress has established mandatory spending on certain programs such as Social Security, Medicare, and unemployment compensation. Of all our nation’s government spending, Social Security is the largest.

And here’s the problem, according to the 2024 annual Old-Age, Survivors, and Disability Insurance (OASDI) trustees report by the Social Security Administration (SSA), the projected depletion date for the combined OASDI trust funds is 2035, a year earlier than in last year’s report. Yes, folks, absent any changes, our nation’s Social Security fund will be gone in 10 years:

Incremental budget changes might help it last a little longer, but not much. So, large-scale changes are needed to how we spend money as a nation. Much like your personal income at home, we can fix this by increasing our income (GDP), decreasing our expenses, or both.

3) Financial Sector Turmoil

The last point the Visual Capitalist article makes is that as confidence in our system falls, fewer people and countries will invest in the US, and stock prices will fall. People do not like uncertainty, and that uncertainly plays out in the market as volatility (frequency and magnitude of price changes in the stock market).

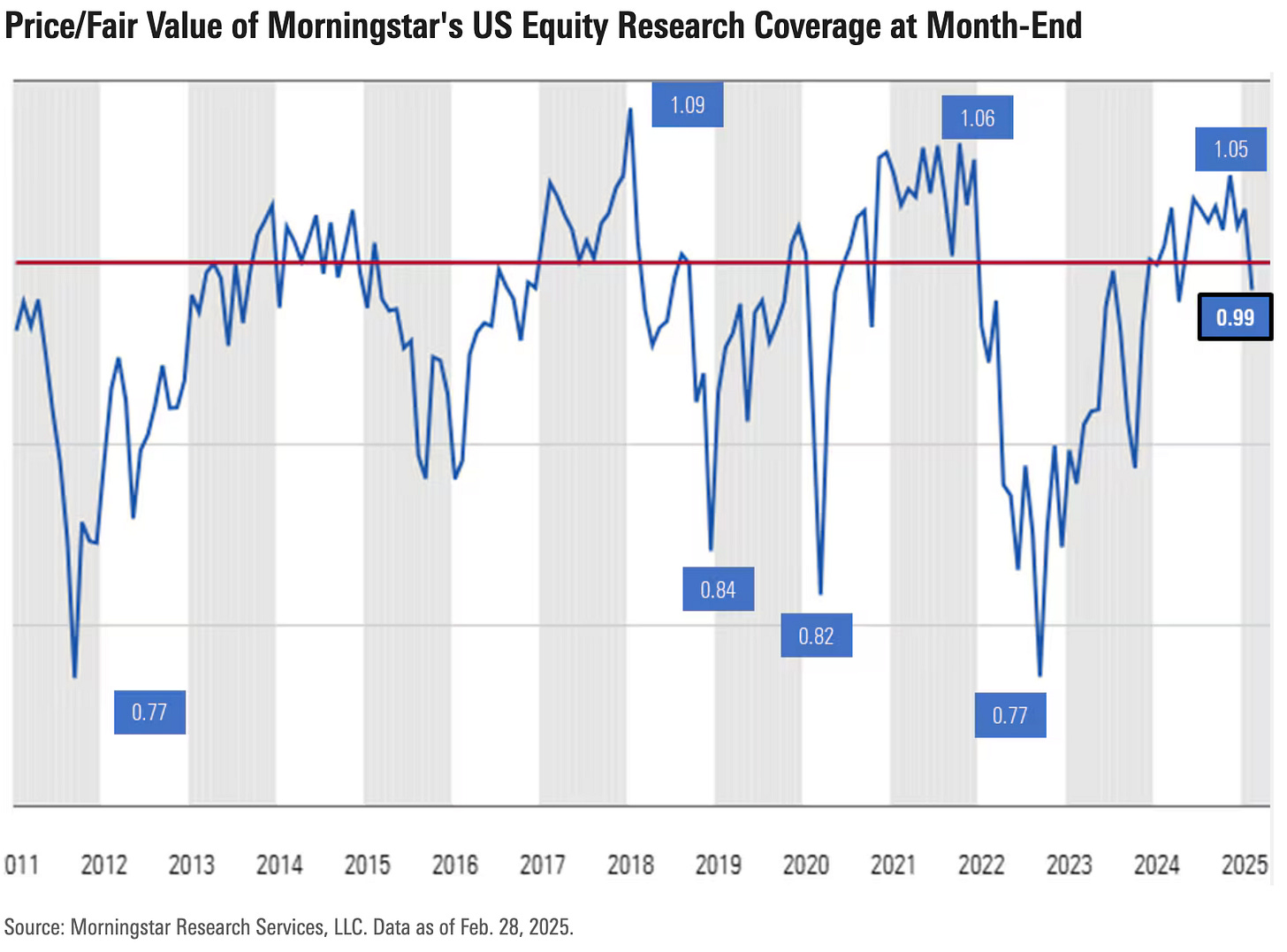

From trade tariffs, to government cuts, to Russia and Ukraine, there is much uncertainty in the world, and in the stock market. And, in case you weren’t paying attention, the S&P lost 8% over this past month.

However, I’m not sure that these factors tell the whole story. Numerous analysts believe that the stock market was already overvalued and in need of a correction anyway. Here’s Morningstar on the up-until-recently overvalued stock market:

So, I think you’re seeing a combination of both factors coming into play in the sell-off—an overvalued market and market uncertainty.

Questions on my mind

Where will private sector jobs come from?

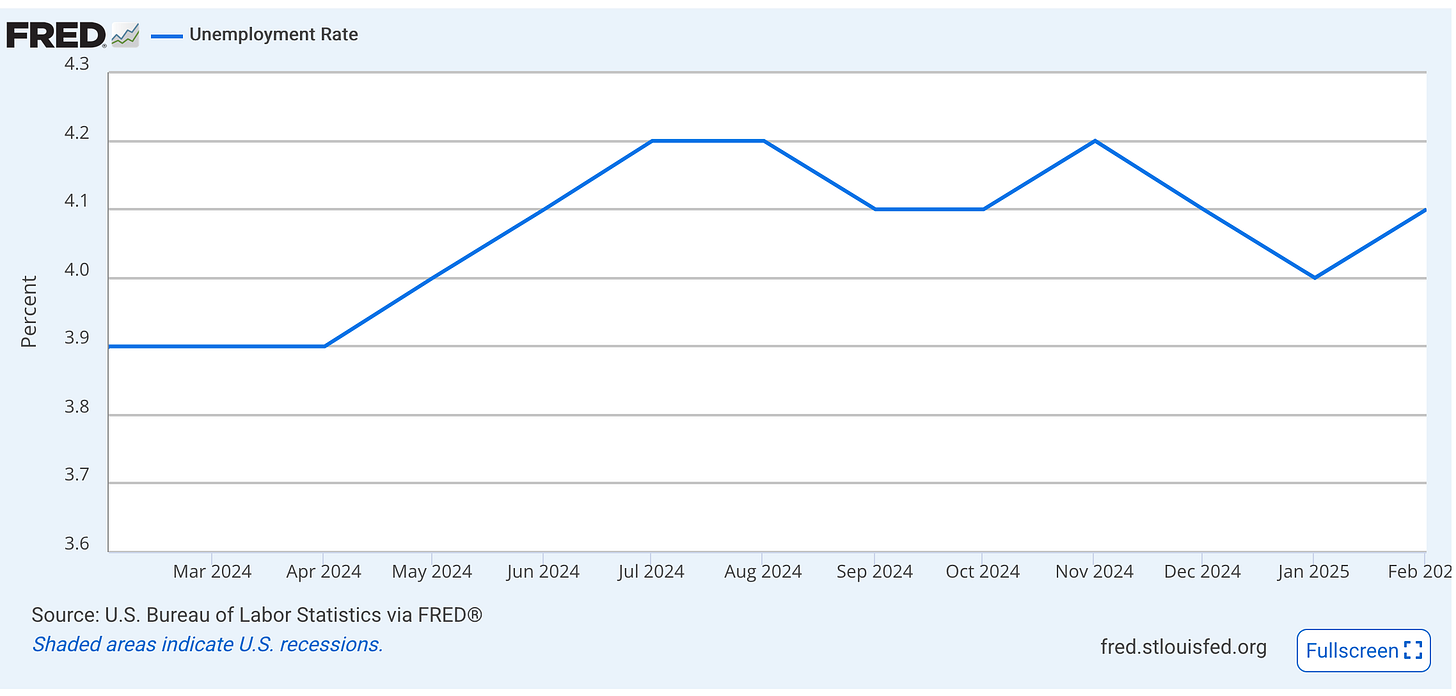

I understand the desire to cut the size of the federal workforce, but this will lead to higher unemployment.

The cuts to government spending will impact businesses and other governmental and non-governmental agencies that have depended on government contracts and grants. These cuts in government spending will indirectly lead to downsizing of businesses and agencies, which will lead to further unemployment. Here’s the current unemployment rate, starting to tick upward:

But, with high interest rates, where will businesses get the money to grow?

For employees to move from public-sector (government) employment to private-sector employment, the private-sector must be hiring. And, for businesses to hire more people, they must be growing.

How long will it take for business to grow?

Current uncertainty about the economy will likely lead to businesses being cautious about growing and taking out loans, even when interest rates lower.

Will the cuts to all spending in the government be enough to get things in line?

No doubt that the millions of dollars in spending cuts that DOGE claims to be making are significant, but keep in mind a cut of $1 million is only 0.0001% of $1 trillion…and our current debt is $36 Trillion. It’s going to take a lot of cuts to add up to something significant.

Will the government cuts be surgical enough to prevent further calamity?

If you cut the system too much, or in the wrong places, the system could grind to a halt. Unfortunately, our current businesses and daily lives are woven into government programs and spending far more than we might realize; if these no longer work as they should, can things keep operating?

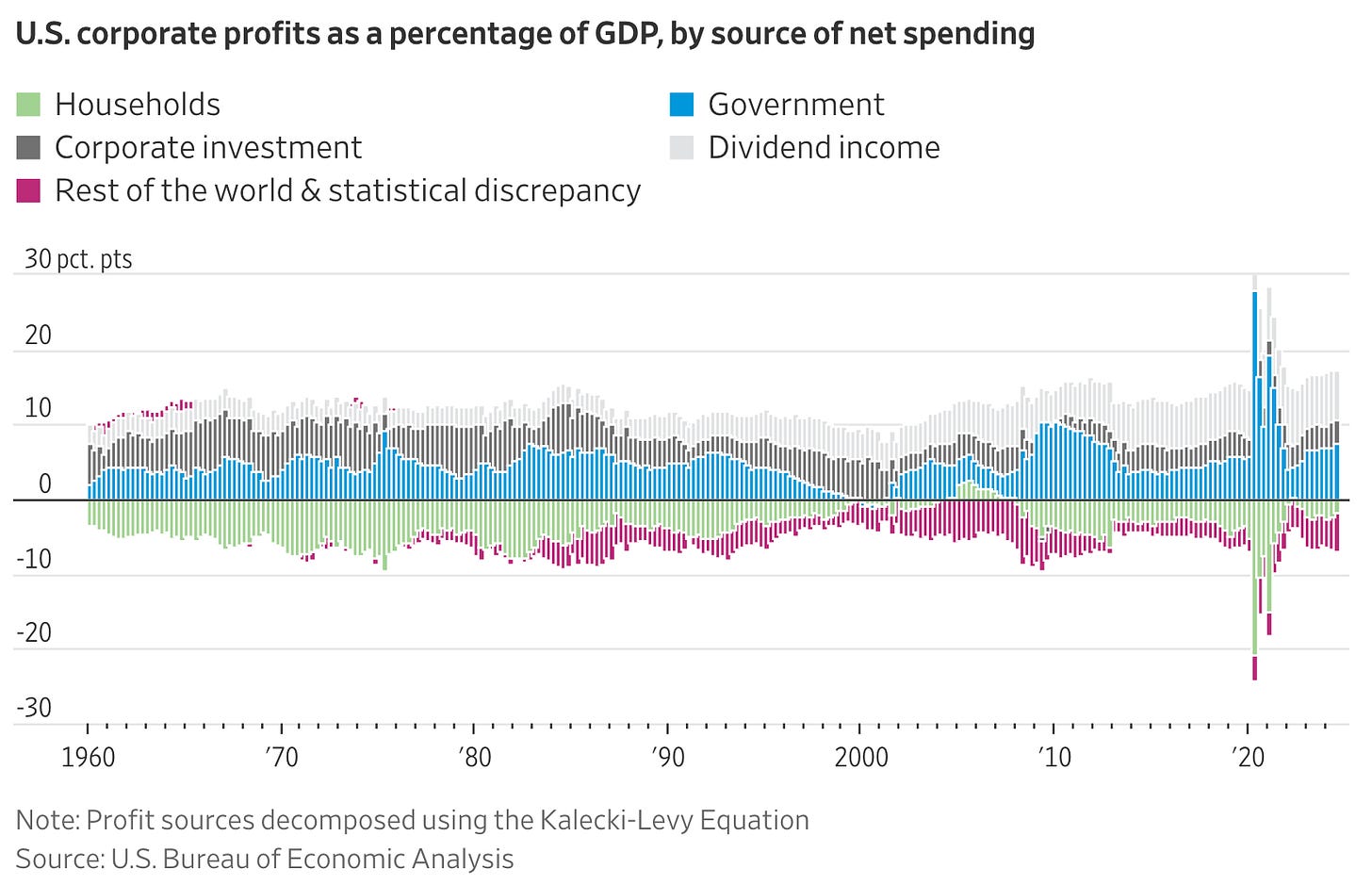

As the WSJ notes, much of our current GDP is based on public-sector (government) spending and investment:

In a research note sent to clients Monday, economists at Morgan Stanley argued that short-term pain for stock markets could be offset by a longer-term gain by the end of this year and into next year, as the shift from public to private spending stokes a broad-based rally that is less reliant on a few technology megacorporations.

It is true that U.S. profit margins recently rising to near-historic highs has a lot to do with the government. An analysis of official figures suggests that almost 60% of the corporate earnings generated between 2022 and the third quarter of 2024 can be attributed to public-sector spending and investment.

Closing Thoughts

In the late 1700s, Alexander Hamilton, James Madison, and John Jay wrote a series of essays intended to influence voters to ratify the constitution and make it stronger. Those essays are now referred to as The Federalist Papers, and every American should read them.

One of the issues they wrote about was how to deal with factions of people acting in their own self-interest against the rights of others or the good of people at large. In Federalist No. 10, Madison argued that we can eliminate factions by 1) eliminating people’s liberty, or 2) make everyone have the same opinions. As you might guess, he states both are impossible, so instead, he discusses how to build a system that best safeguards against the effects of factions. He then makes an argument for a republic in which “fit characters” represent the public good.

For too long, politicians on both sides have acted in a way that served their own interests (mainly, re-election) over the public good. As long as they could print money and kick the can of debt payment to the next administration, short-sightedness ruled the day.

We are no longer able to do that, so things must get worse before they get better. How bad it will get and how long before it gets better is the question at hand.

I believe that America is resilient. We have smart, hard-working people; a culture that promotes ingenuity, opportunity and individual freedom; and we enjoy vast natural resources and near-total geographic isolation.

In the words of President Franklin Delano Roosevelt (FDR) at his 1933 inaugural address,

This great Nation will endure as it has endured, will revive and will prosper. So, first of all, let me assert my firm belief that the only thing we have to fear is fear itself — nameless, unreasoning, unjustified terror which paralyzes needed efforts to convert retreat into advance.

It should be noted, however, that FDR was a Democrat who became President during the middle of the Great Depression. He declared, “I pledge myself to a new deal for the American people,” which included tariff reduction and government-funded initiatives. If the Republican efforts don’t play out by election time, we may end up seeing similar initiatives come back.