9 Things from the week | 12 Oct 25

News from the past week, and a few other things.

NOTE: Easy and great read. Highly recommend.

1. What Makes a True Servant Leader? (Get Back Up Leadership)

In “Get Back Up: Lessons in Servant Leadership,” Air Force Academy classmates Hon Heather Wilson and Gen David Goldfein share four decades of lessons from the marble halls of the Capitol to the sands of the Middle East with humor and humility. Goldfiein, a four-star general and former Chief of Staff of the U.S. Air Force, recounts being shot down in his F-16 over Serbia and other gripping stories. Heather, a former Congresswoman, university president, and Secretary of the Air Force, reveals the tough calls that shaped her leadership. Reunited at the Pentagon 35 years after their cadet days, they weave unforgettable stories into practical lessons for anyone striving to lead with character and serve with purpose.

2. Sharpie Found a Way to Make Pens More Cheaply—By Manufacturing Them in the U.S. (WSJ)

In Maryville, Tennessee, Newell Brands—the maker of Sharpie markers—has built a model for successful, low-cost manufacturing in the U.S. The company’s factory now produces over 500 million Sharpies a year, with nearly every part made domestically except the felt tip. This transformation began in 2018, when then-CFO (now CEO) Chris Peterson challenged his team to match the efficiency of overseas factories. Backed by $2 billion in investments, automation upgrades, and extensive employee retraining, Newell centralized its operations, increased production speed up to fourfold, and boosted quality—all without layoffs or price hikes.

The Maryville facility employs 550 workers, whose average wages have risen by 50% over five years, as many transitioned from manual roles to technical ones like automation engineering. The factory’s innovations—such as robotic systems, real-time vision scanning, and improved sealing to prevent drying—have cut costs, sped delivery, and reduced waste. Once heavily outsourced, Sharpie production has returned home, with additional lines like Clearview highlighters soon to follow. Operating 24/7, the plant produces 1.8 million markers daily, standing as proof that—with commitment, training, and technology—U.S. manufacturing can compete globally.

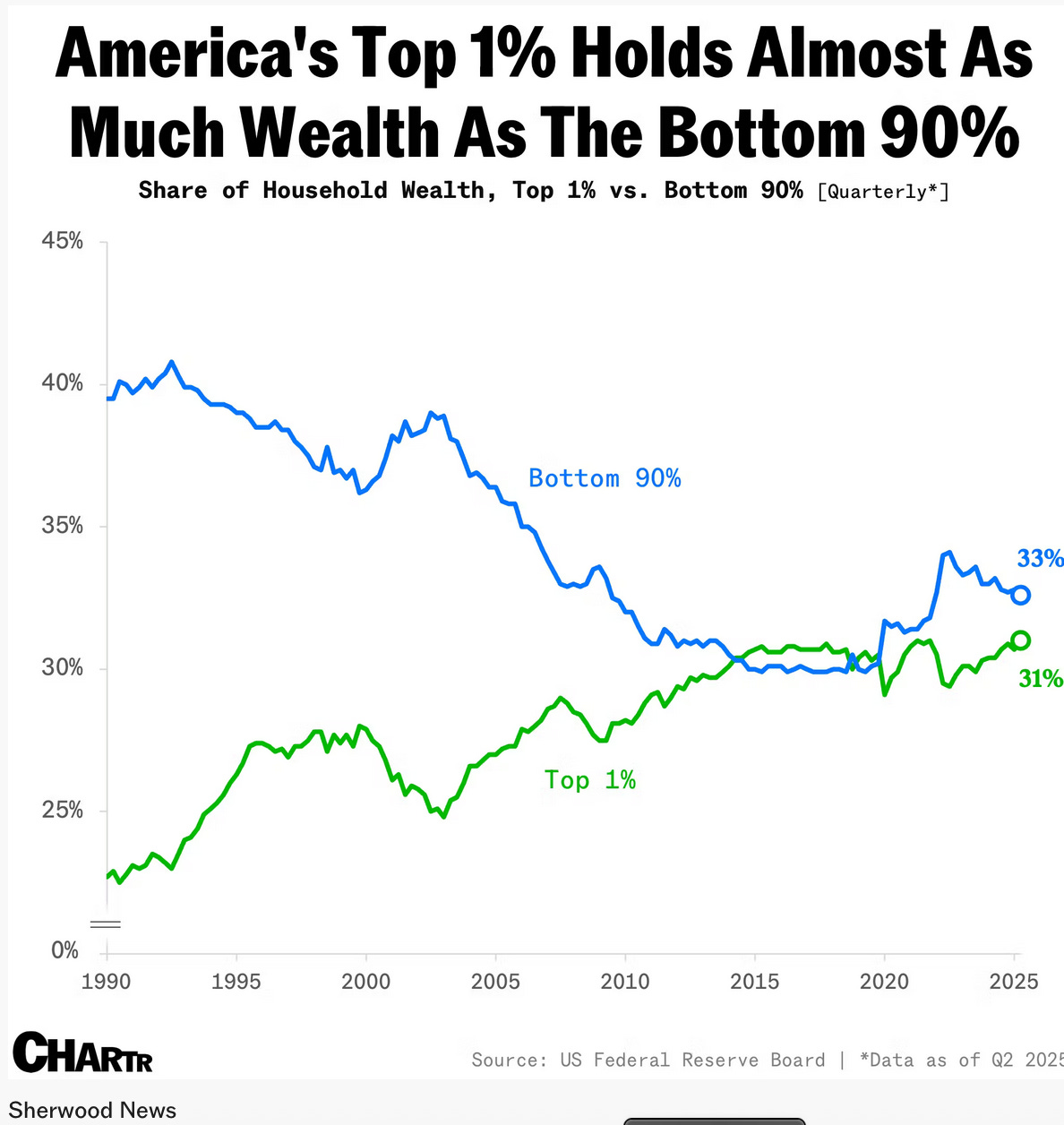

3. America’s top 1% now holds nearly a third of household wealth (Sherwood)

The wealth of America’s top 1% hit a record $52 trillion in the second quarter, according to new Federal Reserve data, widening the gap between the ultra-rich and everyone else. While all income groups saw gains, the top 1%’s wealth jumped 8.5% over the past year—compared with 6.3% for the bottom half—giving them control of nearly one-third of the nation’s total wealth. Their fortunes are increasingly tied to the stock market: the top 1% now own half of all corporate equities and mutual funds, up from 42% in 1990, while the bottom 90% hold just 12.8%. Most of the latter group’s wealth remains in real estate, which has lagged stock performance in recent years.

This concentration of wealth feeds what economists call a “K-shaped economy”—one in which high earners surge ahead while low-income households stagnate. The Bank of America Institute found that after-tax wages for low-income workers grew just 0.9% in August, the slowest pace since 2016, compared with 3.6% for higher earners. Still, rising asset values have fueled spending among the wealthy, with Goldman Sachs estimating that “positive wealth effects” boosted U.S. consumption growth by 0.3 percentage points in Q3. But that strength comes with risk: analysts warn that if markets falter, an economy heavily powered by the spending of the rich could face a swift and serious slowdown.

4. The World’s Highest Bridge Just Opened in China—2,051 Terrifying Feet Into the Sky (Popular Mechanics)

China has broken its own world record for the highest bridge with the opening of the Huajiang Grand Canyon Bridge, which soars 2,051 feet above the Beipan River, surpassing the previous record-holder, the Duge Bridge (1,854 feet). By comparison, the highest U.S. bridge—the Royal Gorge Bridge in Colorado—rises only 956 feet above the Arkansas River.

More than just an engineering feat, the Huajiang Bridge is a tourist attraction featuring a glass elevator leading to a 2,600-foot-high coffee shop, a bungee jumping platform, and a 1,900-foot-tall glass walkway. The bridge stretches 9,777 feet long, with a 4,660-foot main span, cutting a two-hour mountain drive down to just two minutes.

Built over nearly four years, the project underwent extensive testing with 96 vehicles and includes wind deflectors, stabilizing plates, and smart sensors to monitor its structural health. The result: a record-setting, high-tech bridge that blends engineering innovation, tourism, and practicality.

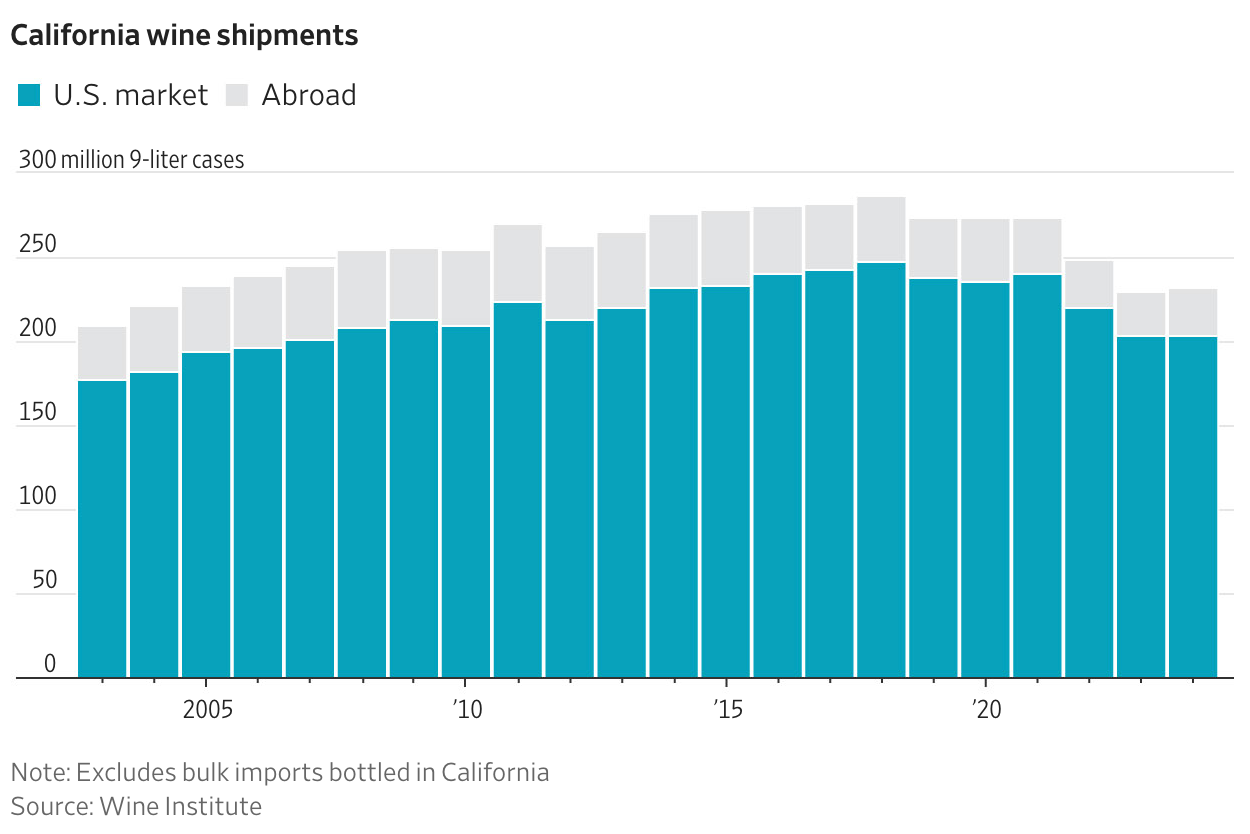

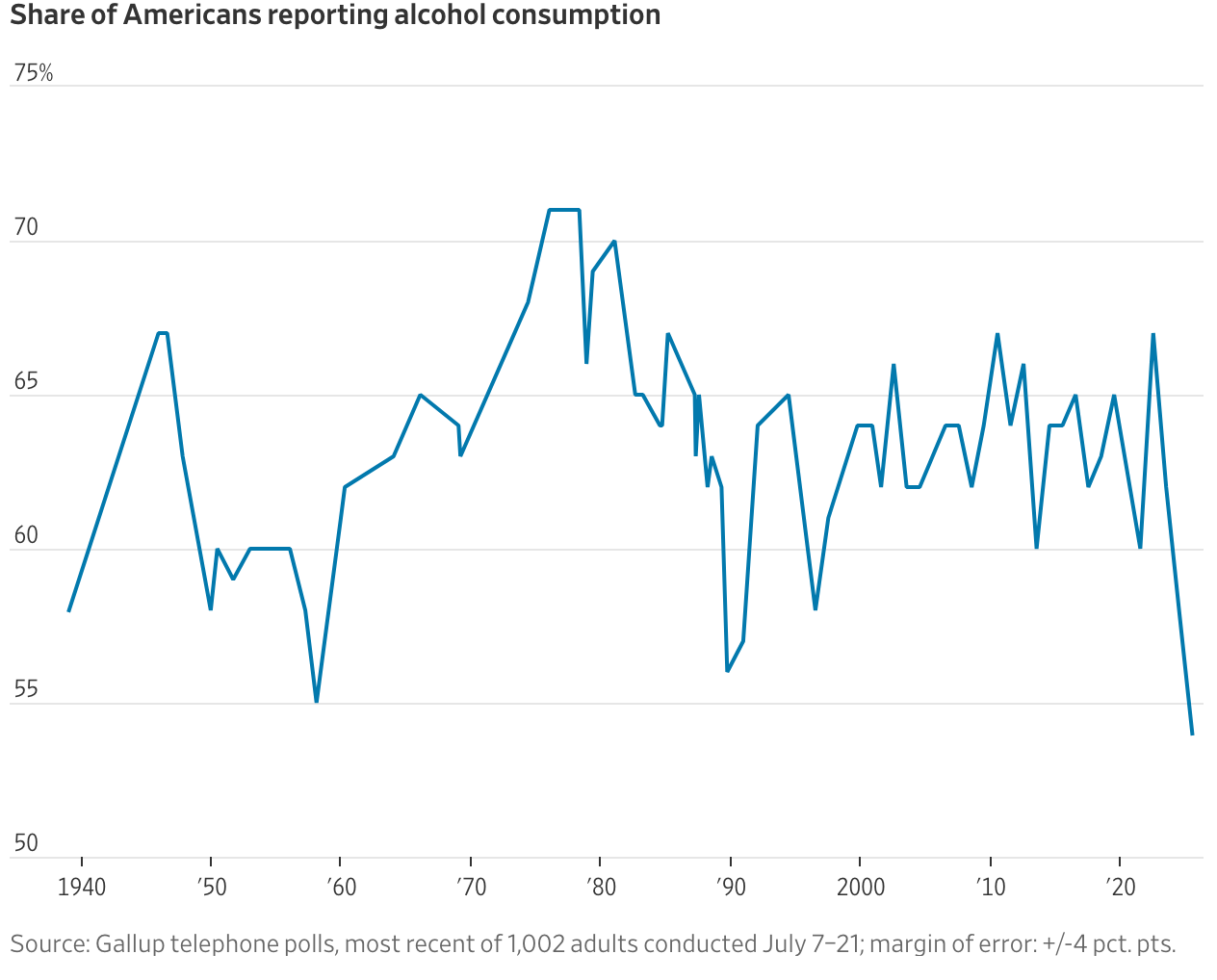

5. California’s Wine Industry Is in Crisis (WSJ)

California’s wine industry is facing its worst crisis since Prohibition, hit by a perfect storm of oversupply, falling demand, and trade turmoil. Wineries are struggling to sell off years of surplus wine as consumers—especially younger generations—drink less, foreign markets dry up under tariffs, and this year’s ideal growing conditions produce yet another massive harvest. The result: an estimated 30% of grapes in Sonoma County will go unsold. Large producers like Jackson Family Wines are slashing grape purchases, cutting prices to stay under the critical $20-per-bottle threshold, and even ripping up vineyards to replant more profitable varietals like Sauvignon Blanc.

The downturn marks a dramatic reversal from the boom years that followed pop culture moments like Sideways and the “French Paradox” craze. For decades, California’s wine country transformed from farmland to a global luxury destination—but now many growers face losses. Longtime farmers such as John Balletto and Steve Dutton are sitting on unsold grapes worth millions, turning to bulk wine sales or even Facebook Marketplace to offload inventory. To survive, some are diversifying back into crops like apples, while others plan to pull up old vines and wait for better market conditions.

The crisis has global echoes—vineyard acreage is shrinking in France, Spain, Chile, and beyond—but tariffs and shifting U.S. drinking habits have hit California especially hard. Wine exports to Canada plunged 96% after retaliatory tariffs, cutting off the state’s largest foreign market. Industry leaders predict up to 5,000 acres of vineyards may be removed in the coming years, leaving stretches of fallow land where premium grapes once grew. Yet growers like Balletto remain optimistic, betting on new experiences—music, lawn games, tram tours—to lure younger consumers back to wine and keep the tradition alive.

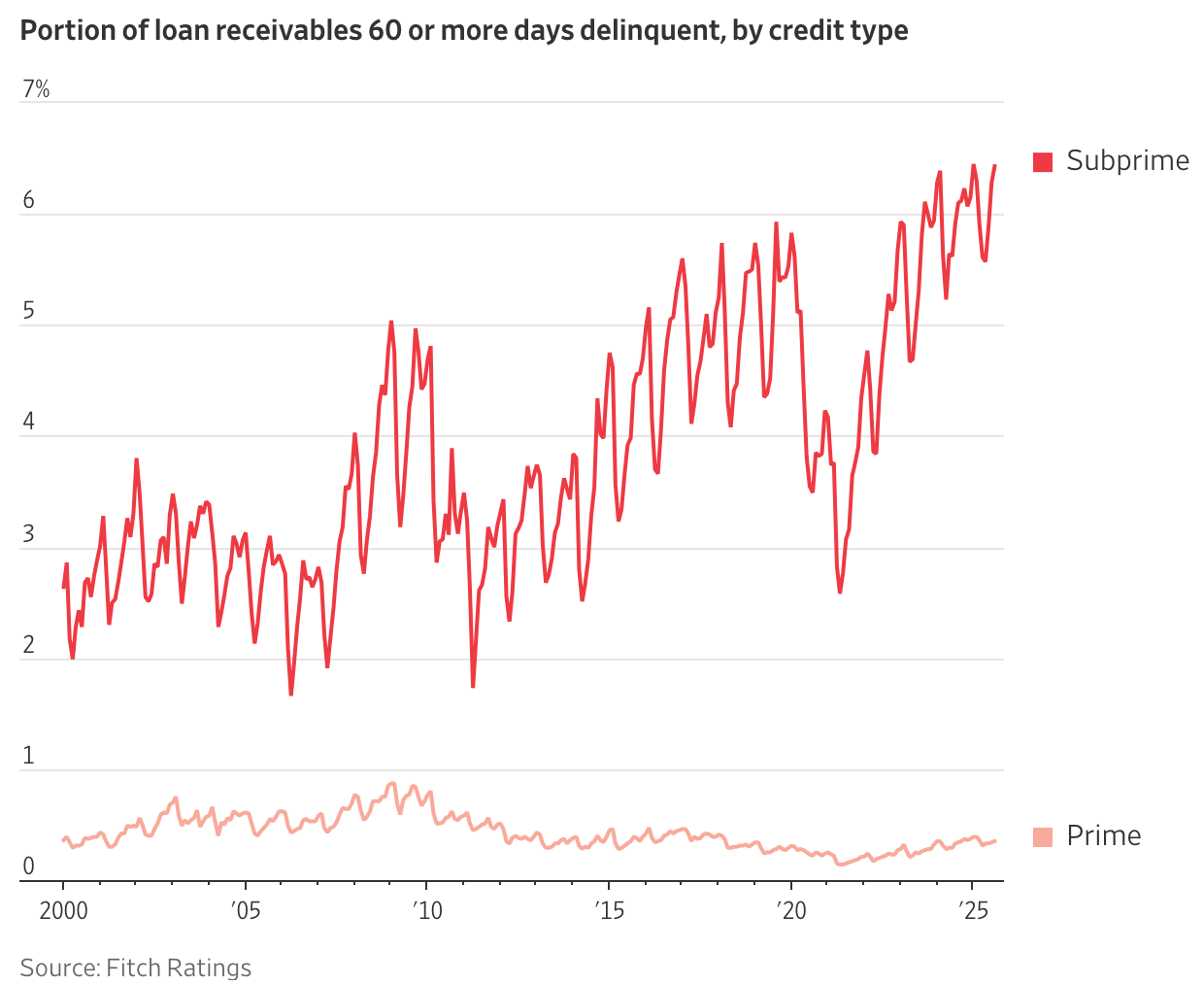

6. Americans Are Falling Behind on Their Car Payments (WSJ)

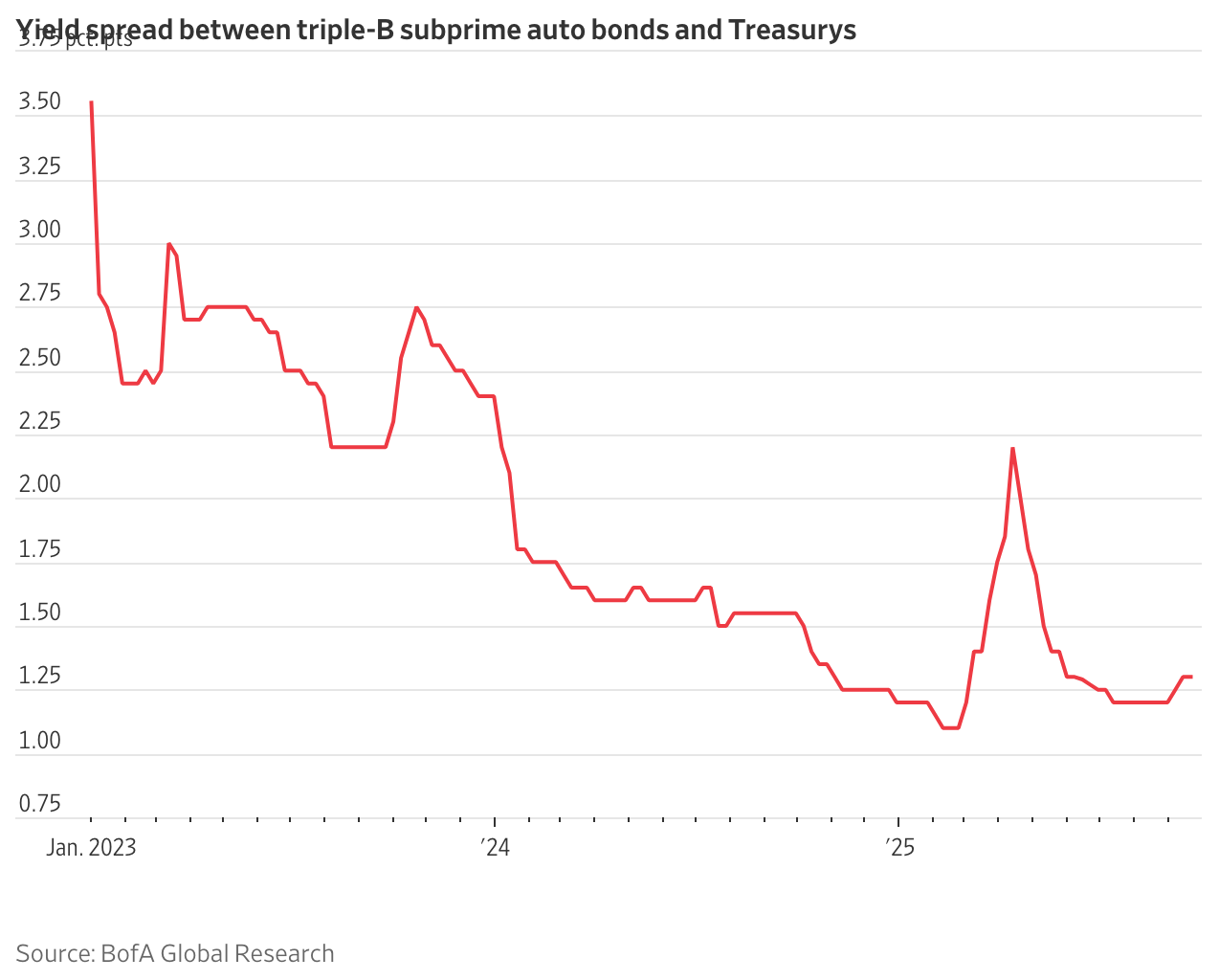

More Americans are falling behind on car payments, exposing growing financial strain among lower-income buyers. With vehicle prices and interest rates still high, many stretched their budgets with longer loans—pushing subprime delinquencies to a record 6%, the highest since 2009. Repossessions hit 1.7 million last year, and about one in five auto loans now exceeds $1,000 a month.

Economists say wages haven’t kept up with costs, leaving many buyers overextended. Lenders like Ford and GM are loosening credit to clear inventory, while Wall Street continues to buy subprime auto-loan bonds despite the risks. The trend highlights a broader reality: even with a strong economy, many Americans are struggling just to keep their cars.

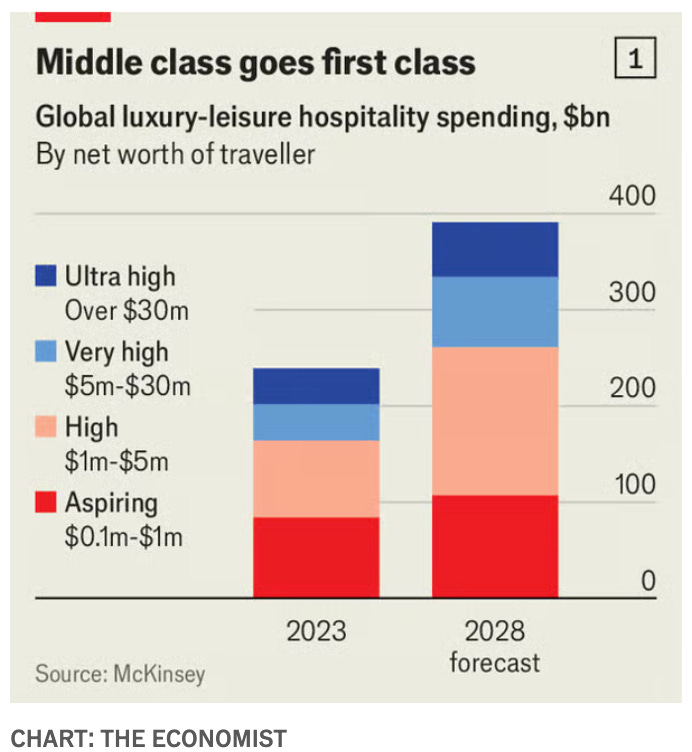

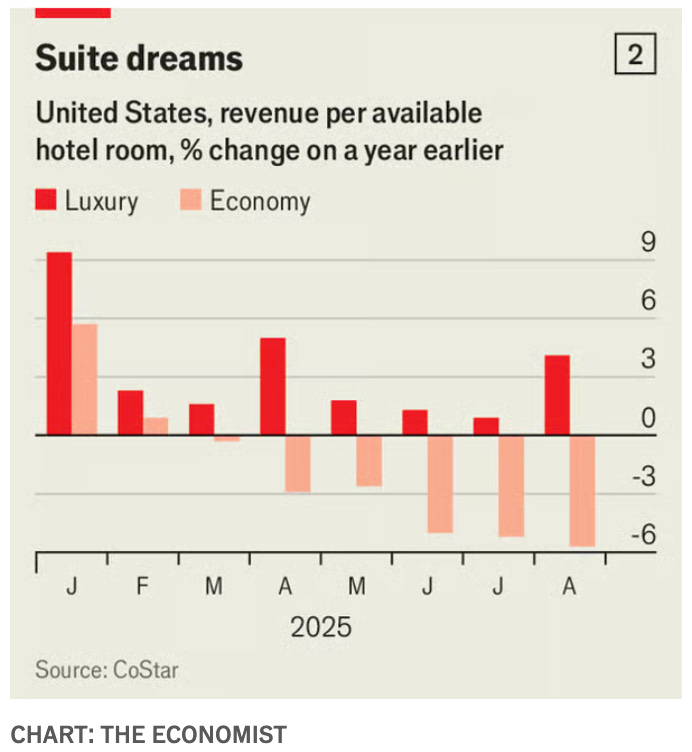

7. Luxury goods are out, but luxury travel is in (Economist)

While luxury goods sales are slowing, luxury travel is booming. Wealthy consumers are spending less on handbags and designer clothes but more on high-end hotels, first-class flights, and exclusive experiences. Global luxury-hospitality spending is projected to reach $390 billion by 2028, up from $239 billion in 2023. Even as economic uncertainty lingers, luxury hotel revenues and private jet deliveries are rising, with fashion houses like LVMH, Bulgari, and Armani entering the travel space through branded hotels and luxury trains.

Analysts say the shift reflects a broader move from buying things to buying experiences—a luxury vacation still feels exclusive in a world where designer goods are ubiquitous. But the expansion carries risks. As more high-end hotels open and “aspirational” travelers enter the market, the industry could dilute its exclusivity, echoing past missteps in luxury fashion. Some hotels are also pushing room rates higher, banking on post-pandemic “revenge travel.”

Experts suggest that the path forward lies in authentic exclusivity and personalization, not mass expansion. Brands like Hermès and Rocco Forte Hotels, which focus on small scale, steady prices, and bespoke service, show that true luxury may depend less on opulence—and more on the human touch.

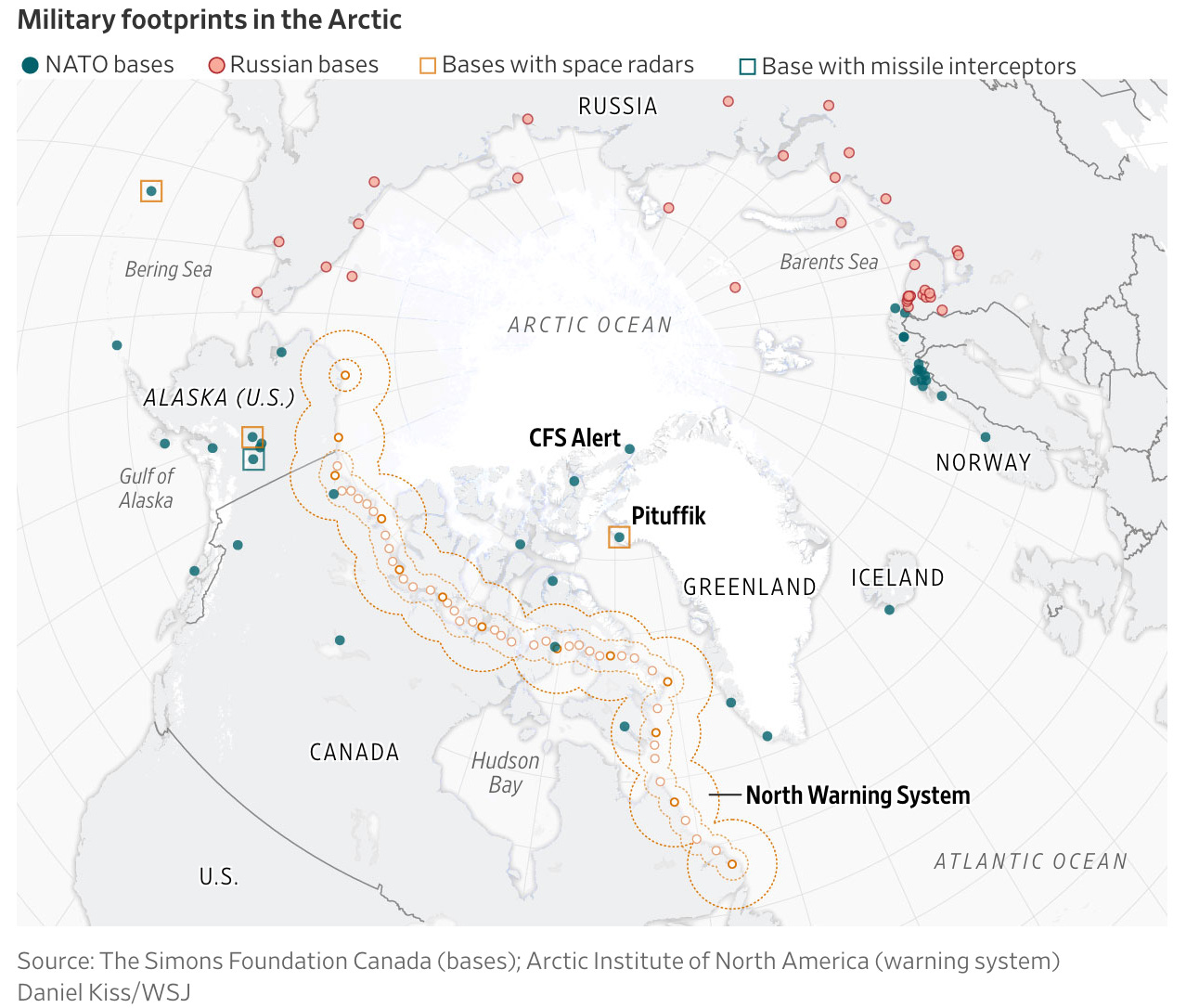

8. Inside the West’s Race to Defend the Arctic (WSJ)

A harrowing Arctic voyage by the Canadian cargo ship Nunalik underscores how far the West lags behind Russia and China in developing and defending the Arctic, now a critical geopolitical frontier. Battling blizzards, icebergs, and hurricane swells, the vessel carried supplies for Canada’s northernmost spy outpost, only to arrive 30 minutes late and be denied docking for the weekend—a small but telling sign of logistical dysfunction in Western Arctic operations.

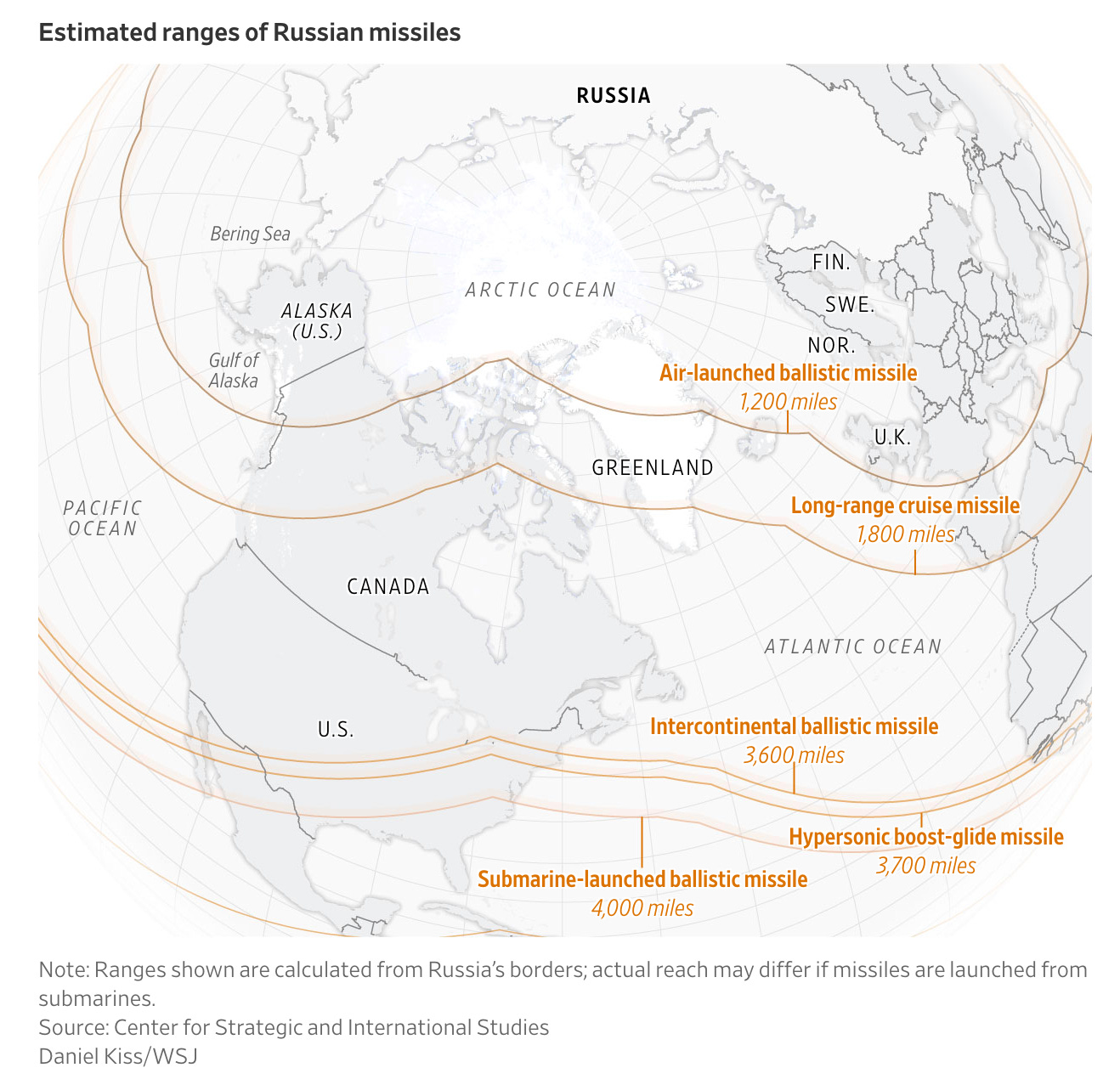

The Arctic’s strategic importance is growing fast. Russia has built a vast military presence across the region, including nuclear assets, while China has declared itself a “near-Arctic state” and increased its patrols. Meanwhile, NATO’s capabilities remain sparse and outdated. Experts warn that the West is “starting from scratch” in the high north after decades focused on the Middle East, even as the Arctic becomes central to missile defense and great-power rivalry.

The U.S. and Canada are investing billions to modernize radar systems and develop new early-warning and missile-tracking technologies, but harsh conditions and vast distances make construction and supply nearly impossible much of the year. Analysts say that establishing deterrence in the Arctic will require massive funding, new technology, and sustained focus—an effort “as hard as exploring space,” one expert said. For now, ships like the Nunalik symbolize both the determination and the disarray of the West’s Arctic ambitions.

9. How bad is America’s icebreaker gap with Russia? (Economist)

In a chilly Helsinki testing tank, Finnish engineers refine the art of icebreaker design, an area where Finland dominates the world. The small Nordic nation—whose ports all freeze each winter—has designed 80% of the world’s icebreakers and built more than half. As competition in the Arctic heats up, the U.S. is turning to Finland for help: President Trump has announced plans to buy 15 Finnish icebreakers, part of a broader effort to close America’s “icebreaker gap” with Russia and China.

Finland’s expertise was forged by necessity and honed over decades—even building ships for Russia during the Cold War before cutting ties after Moscow’s invasion of Ukraine. Its vessels, like the sideways-sailing Baltika and the high-tech Polaris, combine innovation with efficiency: the latter cost just $147 million and took three years to build, compared with America’s delayed and overbudget $1.9 billion icebreaker program.

While Russia operates around 50 polar icebreakers, America has only three—a critical shortfall as northern shipping routes grow busier and geopolitical tensions rise. Under the ICE Pact, Finland, Canada, and the U.S. are expanding Arctic shipbuilding capacity, with Finland already constructing Canada’s new Polar Max. Finnish shipyards could deliver U.S. vessels within the decade, though protectionist laws and domestic opposition may slow progress. For now, Finland’s icebreaker prowess could be key to keeping the U.S. from getting frozen out of the Arctic.