👋 Hello Reader, I hope you had a great week.

Here are a few things that crossed my desk last week.

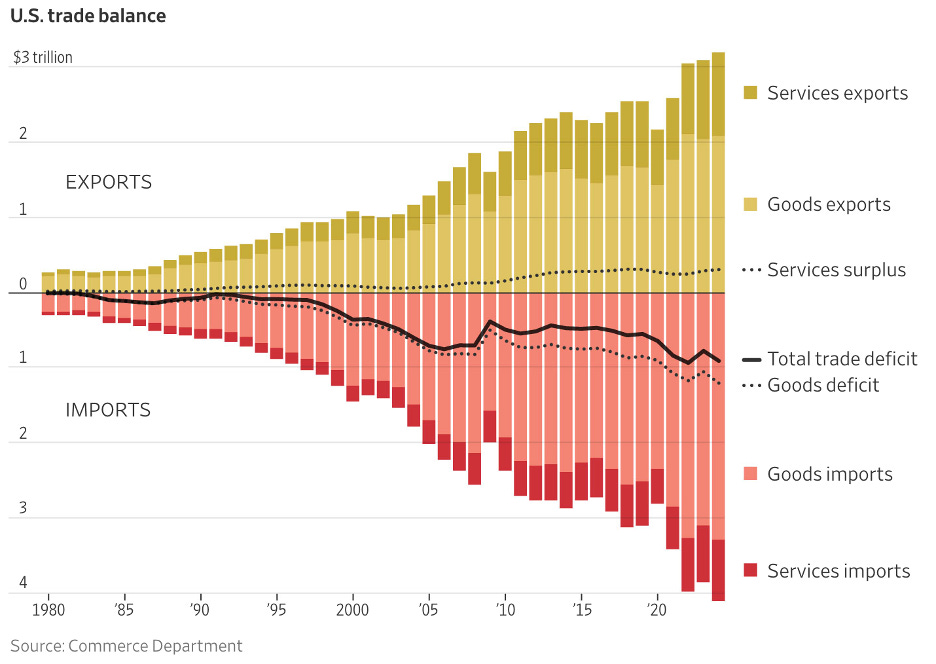

1. What to Know About the U.S. Trade Imbalance, in Charts

President Trump on Wednesday unveiled the centerpiece of his tariff agenda, saying he will impose sweeping import taxes on goods from all nations. He called the levies necessary to rebuild the U.S. economy and to retaliate against nations he described as engaging in unfair trade practices. The levies include a 10%, across-the-board tariff on imports from all countries, and higher rates for other nations the White House considers bad actors on trade. China, for instance, now faces a base tariff rate of 54%. The tariffs are pegged to amounts it said other countries impose on the U.S. In many cases, those amounts appear to match a basic formula: the size of a country’s goods-trade imbalance with the U.S., divided by how much America imports from that nation. (Canada and Mexico were excluded from the reciprocal tariff regime, though many of their exports to the U.S. are still subject to the 25% tariffs Trump imposed in March.)

2. Americans Are Sitting on a Cash Pile as Stocks Reel

Cash is looking more and more attractive these days. Stocks tumbled after President Trump escalated his trade war against the rest of the world. But rather than scooping up shares trading at cheaper prices, many investors are opting to keep their cash on hand. Investors poured more than $60 billion into money-market funds in the first few days of April. That has sent assets in such funds to a record $7.4 trillion as of Thursday, according to Crane Data going back to 1972.

3. Wall Street is hungry for loans. Enter: Burrito bonds

One way to understand today’s financial world is that everything is a cash flow. There’s a $14 trillion market in which loans are sliced, packaged, and sold to investors, who collect the repayments. Most are mortgages, but recent deals have tapped into payment streams for home heat pumps, private jet leases, and IP addresses. It’s all “a bit spicy,” even for the Janus Henderson executive who does this for a living. The partnership announced last week between DoorDash and Klarna to offer installment loans for food delivery is the latest effort to turn normal commerce into Wall Street-bound cash flows. Takeout bonds — say, Non-Amortizing Culinary Holdings Obligations (NACHOs) — will feed a growing appetite from private credit funds, which have raised billions of dollars and are running out of things to buy. Buy-now-pay-later loans make sense for big purchases, where they are cheaper than credit-card balances that might be carried for months at huge interest cost. But people who need to spread their sushi dinner over a few paychecks might not be able to afford the sushi at all, and we’ve added another one-click option to obscure that fact.

4. Baby Boomers Regain Top Spot as Largest Share of Home Buyers

In a shift that underscores changing dynamics in the housing market, baby boomers now make up the largest generational group of home buyers, according to the National Association of Realtors®.

5. How North Korea Cheated Its Way to Crypto Billions

North Korea’s success reflects the major resources dedicated to the task. The regime commands more than 8,000 hackers as though they were in a military unit, with the country’s brightest minds. State support means its hackers can wait months or years to exploit a single slip in a company’s digital security. Pyongyang’s desperation for cash, and its lack of concern for diplomatic blowback, have fueled its drive to be better than anyone else.

6. The New Pepsi Challenge: Saving Pepsi From Years of Decline

Times are tough for legacy sodas, and they aren’t likely to be helped by Health and Human Services Secretary Robert F. Kennedy Jr. referring to sugary, carbonated drinks as “poison.” Energy drinks and niche beverages billed as healthier have been grabbing market share for years, and the U.S. soda market now resembles a slowly melting ice cube. U.S. sales volume of Coca-Cola branded sodas slid 14% between 2010 and 2023, according to the most recent annual data from industry tracker Beverage Digest, but Pepsi’s volume, including for Diet Pepsi and Pepsi Zero Sugar, plummeted 32%. In February, an analyst put the obvious question to PepsiCo Chief Executive Ramon Laguarta: What was going on?

7. The MIT Scientist Behind the ‘Torpedo Bats’ That Are Blowing Up Baseball

When Aaron Leanhardt was a graduate student in physics at the Massachusetts Institute of Technology, he was part of a research team that cooled sodium gas to the lowest temperature ever recorded in human history. What his colleagues didn’t realize was that in the rare moments when Leanhardt wasn’t toiling away at the lab, he was moonlighting as a speedy shortstop in a local amateur baseball league. Leanhardt was good enough to play in a 2001 All-Star Game at a minor-league stadium in Lowell. He hit .464 that season. “We didn’t even know about that,” said David Pritchard, a professor emeritus at MIT. More than two decades later, the baseball world suddenly knows all about the 48-year-old Leanhardt. He’s the inventor of the so-called “torpedo bat,” perhaps the most significant development in bat technology in decades. The idea behind the new design was to help batters make more contact at a time when strikeouts are at an all-time high. Leanhardt eventually came to think about the bat as having what he describes as a “wood budget.” The goal was to use as much of that budget as possible in the ideal spot—six or 7 inches below the tip—without sacrificing swing speed. With that theory in mind, Leanhardt dreamed up a bat that looked unlike anything the sport has ever seen. To turn his vision into a reality, his concept had to comply with MLB’s bat specifications. Rule 3.02 specifies that bats must be “a smooth, round stick not more than 2.61 inches in diameter at the thickest part and not more than 42 inches in length.” Surprisingly, the torpedo bat qualifies. At this point, Leanhardt says, he is on a “first-name basis with everyone who operates the lathe for every bat manufacturer in baseball.” The last step was generating buy-in from players. Initially, the uptake was slow. But after the Yankees’ home-run barrage on the opening weekend of the season, that is no longer an issue.

8. ‘It Had Teeth’: A 3-Year-Old Discovers Ancient Treasure in Israel

A 3½-year-old in Israel recently made an important archaeological discovery. The child, Ziv Nitzan, was hiking with her family last month on a dirt trail about 25 miles outside Jerusalem when a small rock caught her attention. She was drawn to it, she said in an interview translated from Hebrew by her mother, because “it had teeth on it.” Naturally, Ziv picked it up. When she rubbed off the dirt, “she noticed that it was something very special,” her mother, Sivan Nitzan, said. The alluring pebble turned out to be a 3,800-year-old Egyptian amulet, engraved with the design of an insect known as a scarab and dating from the Bronze Age, according to the Israel Antiquities Authority, which later collected it.

Have a great week!

The Curator

Two resources to help you be a more discerning reader:

AllSides - https://www.allsides.com/unbiased-balanced-news

Media Bias Chart - https://www.adfontesmedia.com/

Caveat: Even these resources/charts are biased. Who says that the system they use to describe news sources is accurate? Still, hopefully you find them useful as a basic guide or for comparison.