6 Things from the week | 21 Sep 25

News from the past week, and a few other things.

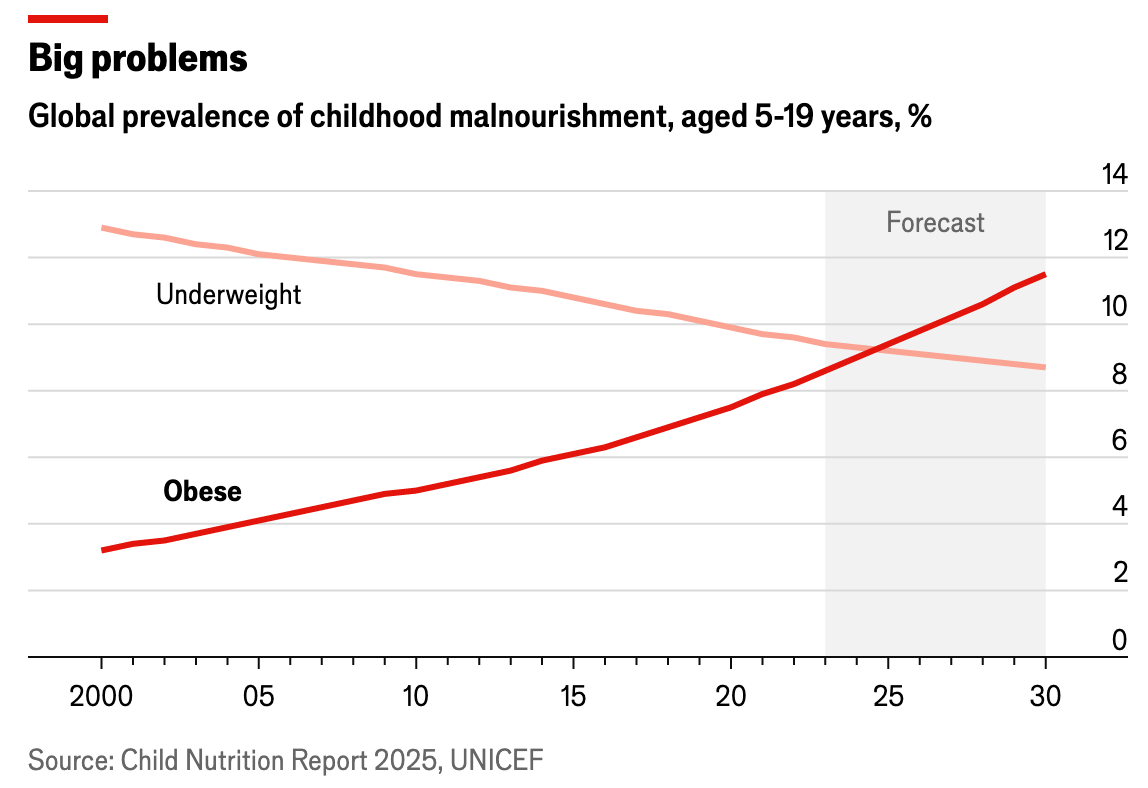

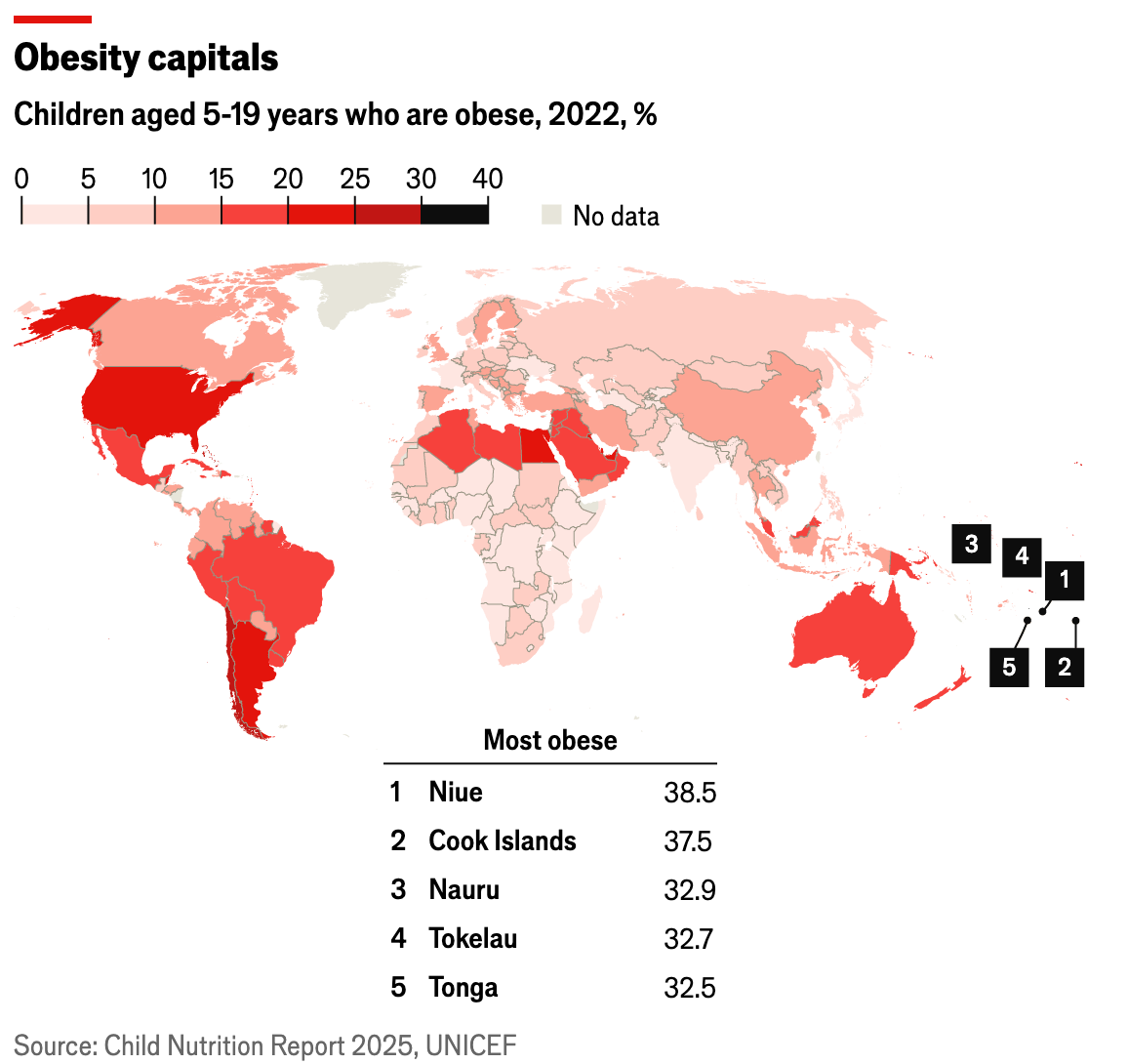

1. A world map of childhood obesity (Economist)

A new UNICEF report shows that, for the first time, childhood obesity has overtaken severe undernutrition worldwide. One in five children aged 5–19 is overweight, and half of them are obese. Rates are particularly alarming in the South Pacific, where nearly 40% of children in Niue and the Cook Islands are obese. The United States ranks in the top 20 with a 20% rate, while Hungary leads Europe at 15%.

The problem stems from the global spread of cheap, ultra-processed foods that have replaced fruits, vegetables, and proteins in children’s diets. In many low- and middle-income countries, more than half of infants consume sugary foods or drinks daily, and packaged baby foods often contain excessive sugar, salt, or additives banned under UN food standards. With ultra-processed foods costing about 50% less than healthier options, homes and schools alike serve meals high in calories but low in essential nutrients.

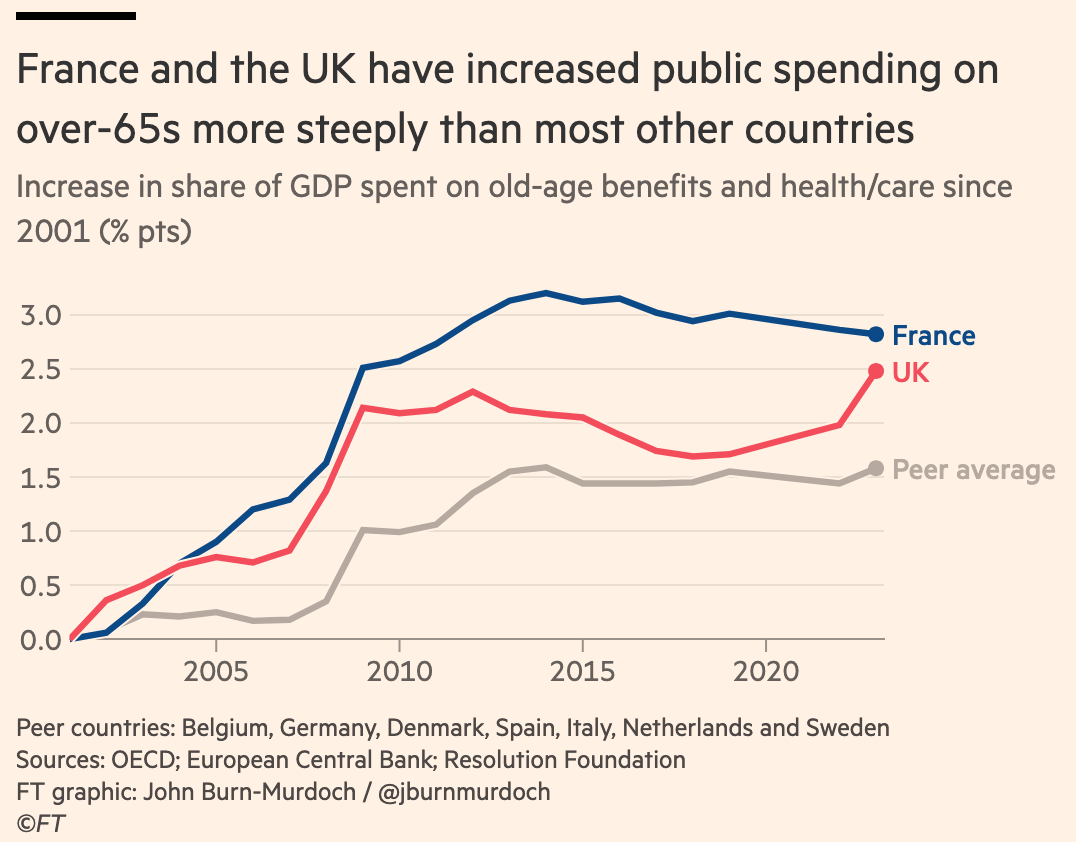

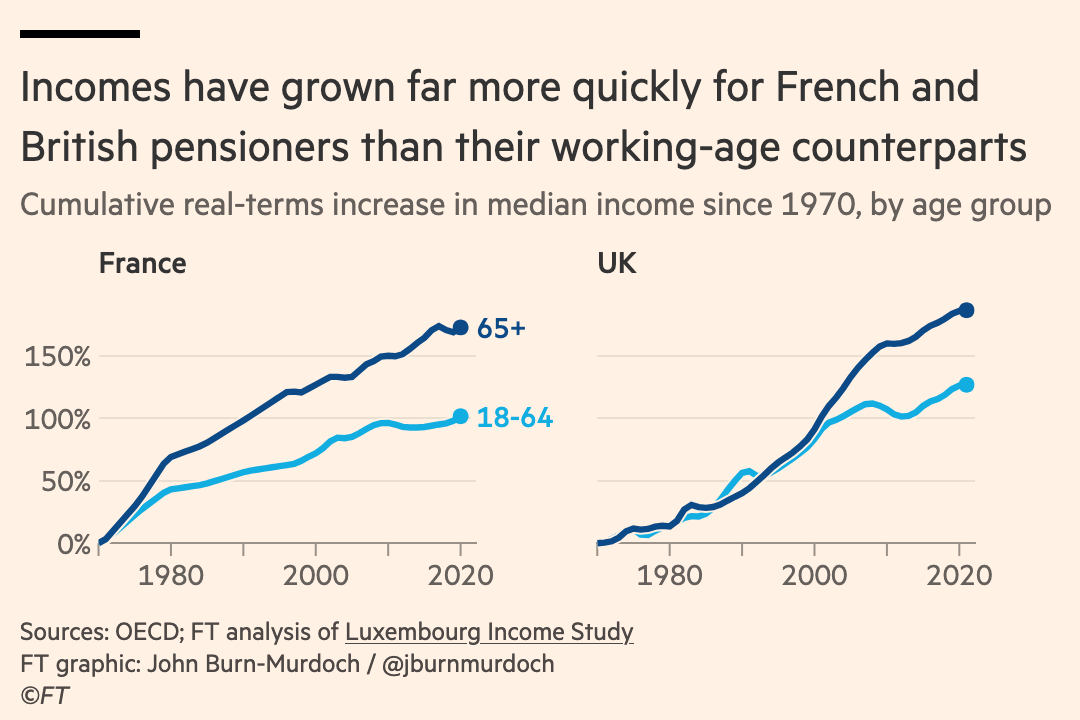

2. France and Britain are in thrall to pensioners (Financial Times)

Over the past two decades, both the UK and France have struggled to control the soaring costs of ageing populations because politicians who propose even modest pension reforms face fierce backlash from voters, the media, and opposition parties. Leaders such as Theresa May, Andy Burnham, Michel Barnier, François Bayrou, and Emmanuel Macron all attempted to address the issue and paid a steep political price, while public finances in both countries have steadily worsened as pension spending outpaces revenue growth.

In Britain, the “triple lock” on state pensions guarantees annual increases at the highest of inflation, wage growth, or 2.5%, ensuring pensioner incomes rise faster than those of the working population and driving intergenerational inequality—children are now more likely to live in poverty than their great-grandparents. Meanwhile, healthcare and elderly care costs have doubled since 2000, crowding out other public investments and fueling debt, as efforts to make wealthier pensioners shoulder more of the burden keep collapsing under political pressure.

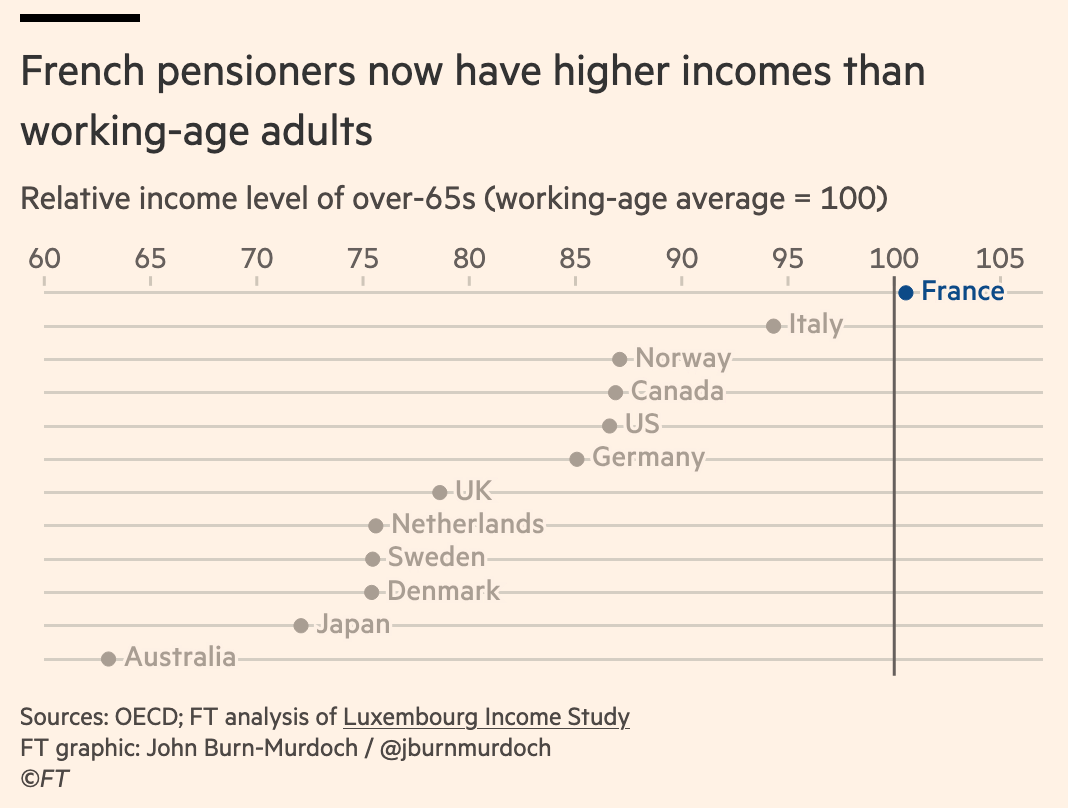

France’s situation is even more extreme. Pensioners there receive some of the most generous benefits in the West and retire earlier than most peers, with over-65s now enjoying higher average incomes than the working-age population. Proposals to raise the retirement age or delay benefit increases have sparked mass protests and toppled governments, even as pensions consume such a large share of the budget that, without them, France would exceed NATO’s 2% defense spending target.

3. American Decline: Depopulation Is Possible — and Could Cause a Crisis (AEI)

The most important demographic trend of the 21st century will be depopulation, and the United States is likely to experience this shift in the years ahead, AEI’s Nicholas Eberstadt warns. Fertility and immigration have historically served as the demographic engines that power the US, but both are faltering today.

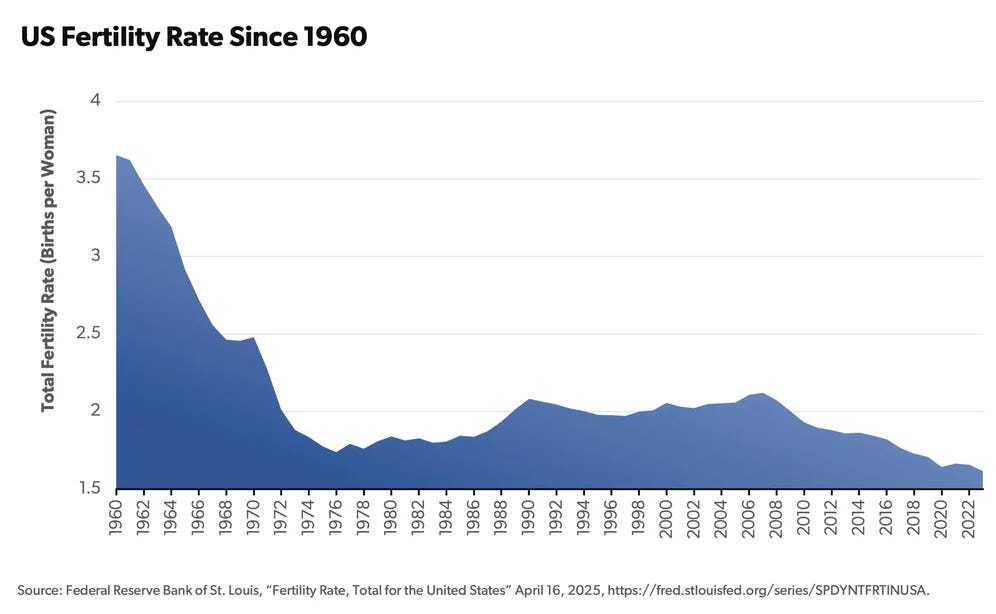

Depopulation Begins: Between 1972 and 2007, the annual fertility rate for the US was just barely below the replacement rate of 2.1. In 2008, that number began to slide even further. Today, the US has a fertility rate of 1.6. Although this is higher than nearly all rich countries globally, it is almost 20 percent below the estimated 2.1 births per woman needed for long-term population stability.

The Burdened Population: The Census Bureau estimates US deaths will exceed births in 2038, forcing the US population into decline. Immigration may prevent this, but net immigration is falling under the current presidential administration. Without immigration, the working-age population would shrink and burden the remaining labor force, which has already faced a drop in older Americans’ participation since COVID-19 and the flight of prime-age men (25–54).

4. The Two-Speed Economy Is Back as Low-Income Americans Give Up Gains (WSJ)

The U.S. economy is increasingly split into two realities. On one side are higher earners, older homeowners, and those with strong investment portfolios, who continue to spend freely as their wealth grows thanks to soaring home values, robust stock markets, and low-rate mortgages locked in before interest rates rose. Luxury sectors like premium air travel and high-end real estate are thriving as wealthy Americans account for nearly half of all consumer spending, up sharply from a decade ago.

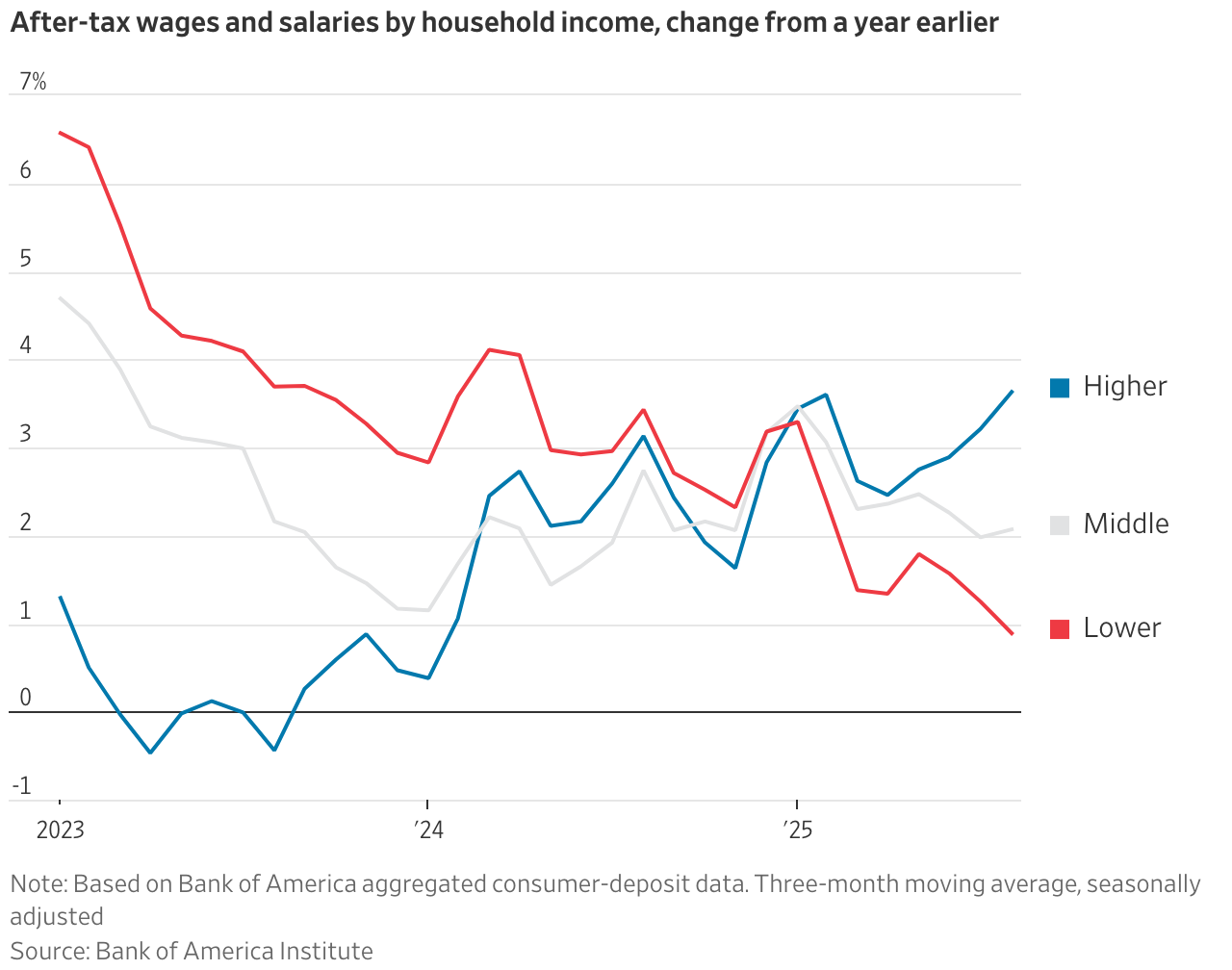

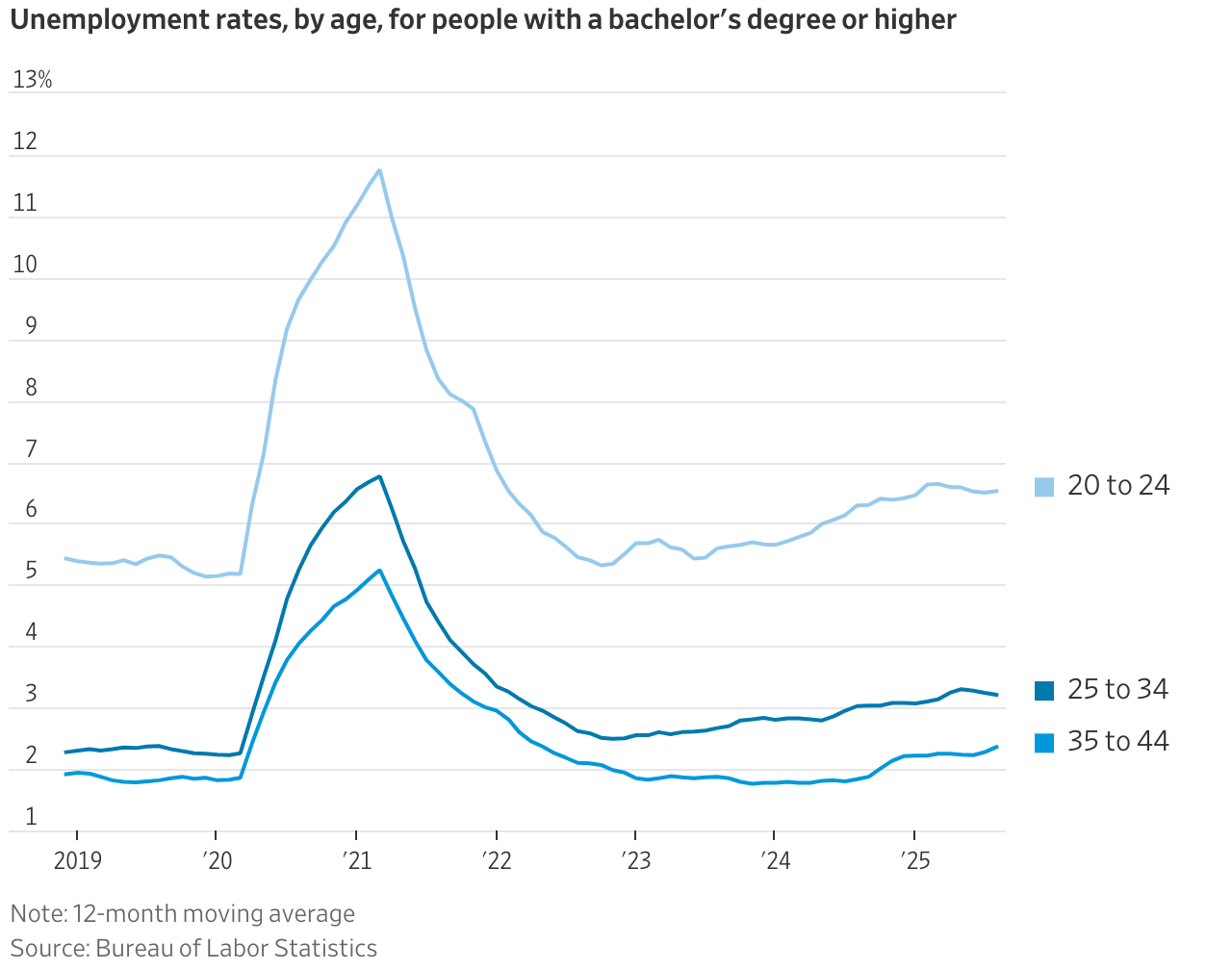

On the other side, low-income workers, younger people, and many Black Americans are facing wage stagnation, job losses, and rising living costs. After pandemic-era labor shortages briefly boosted earnings for low-wage workers, wage growth for the bottom third has slowed to its weakest pace since 2016, while job growth has cooled and unemployment among young college graduates and Black workers has climbed. Housing affordability has worsened as home prices soared 50% since before the pandemic, locking many younger households out of ownership and deepening intergenerational inequality.

The divide is especially stark among younger Americans, who now report some of the lowest levels of economic optimism in decades as they struggle with high rents, limited savings, and growing fears of job automation from technologies like AI. Economists warn that while affluent households continue to buoy certain parts of the economy, the growing financial strain on younger and lower-income groups threatens to widen the gap between the “asset-rich” and those living paycheck to paycheck.

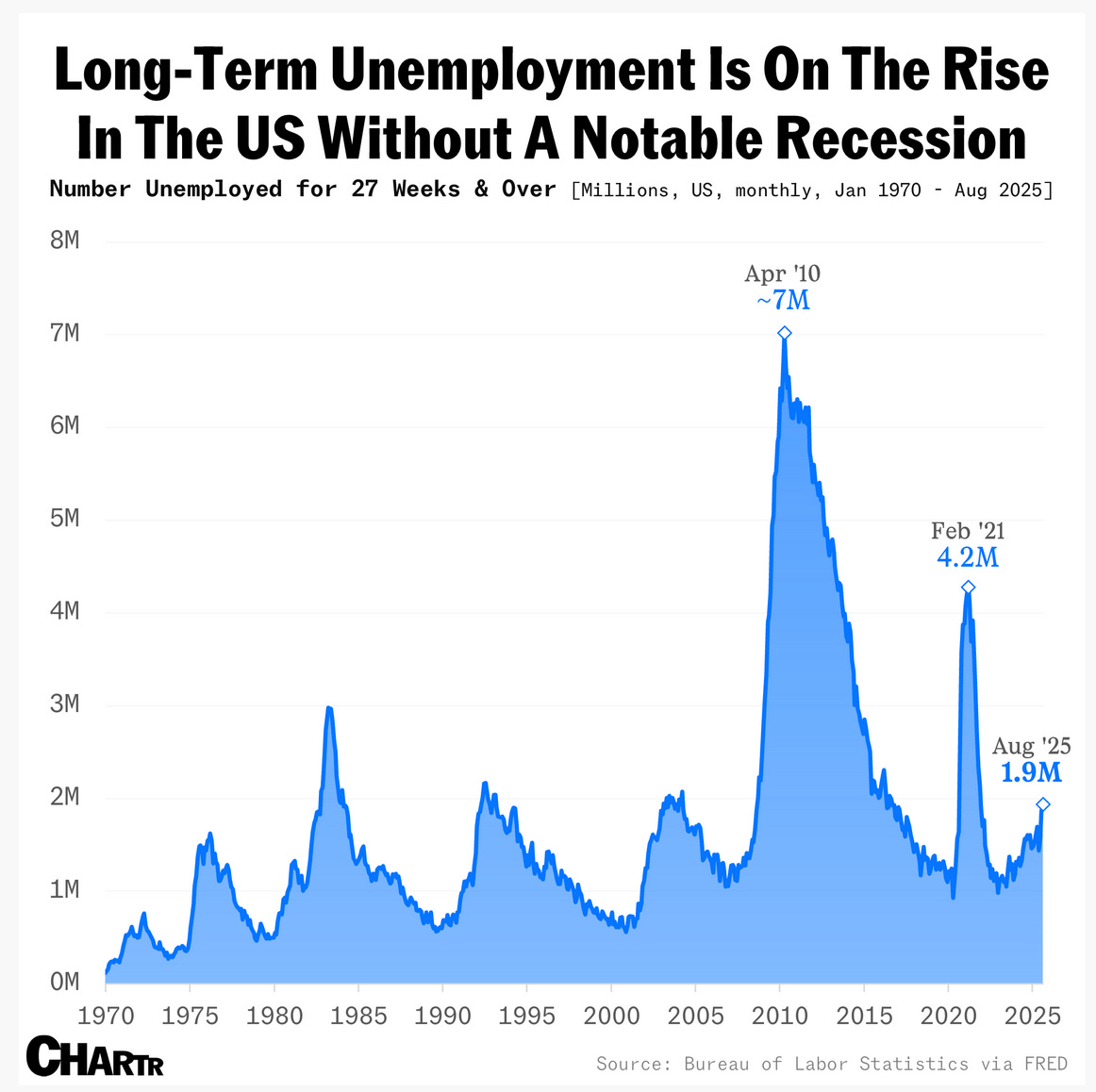

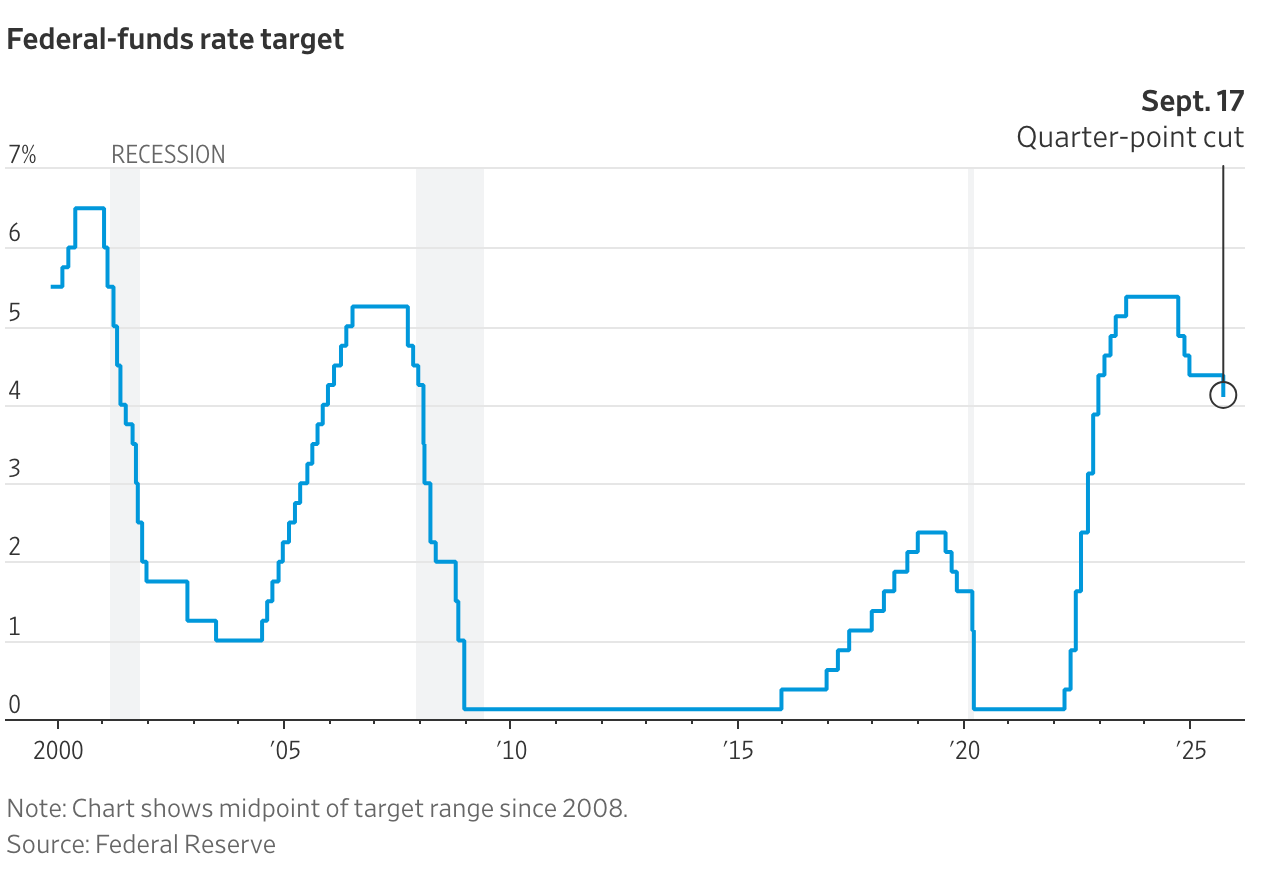

5. Fed Lowers Rates by Quarter-Point, Signals More Cuts Are Likely (WSJ)

The Federal Reserve cut interest rates by a quarter point, its first reduction in nine months, lowering the benchmark federal-funds rate to a range of 4% to 4.25%. The decision reflects growing concern about labor-market weakness outweighing earlier fears about inflation, with Fed Chair Jerome Powell saying that “downside risk is now a reality.” Eleven of twelve voting members supported the move, while one dissenter favored a larger half-point cut. A narrow majority of officials project at least two more cuts this year, suggesting additional reductions at the October and December meetings, though others expect fewer or none.

The rate cut comes amid evidence that job gains have slowed sharply: payroll growth for the three months ending in August averaged just 29,000 jobs, down from 150,000 in June and the lowest since pandemic disruptions. Unemployment has edged up to 4.3%, and immigration curbs may also be limiting labor supply. Inflation, meanwhile, has crept higher in recent months, with a core measure rising to 2.9% in July from 2.6% in April, complicating the Fed’s balancing act between supporting jobs and containing prices.

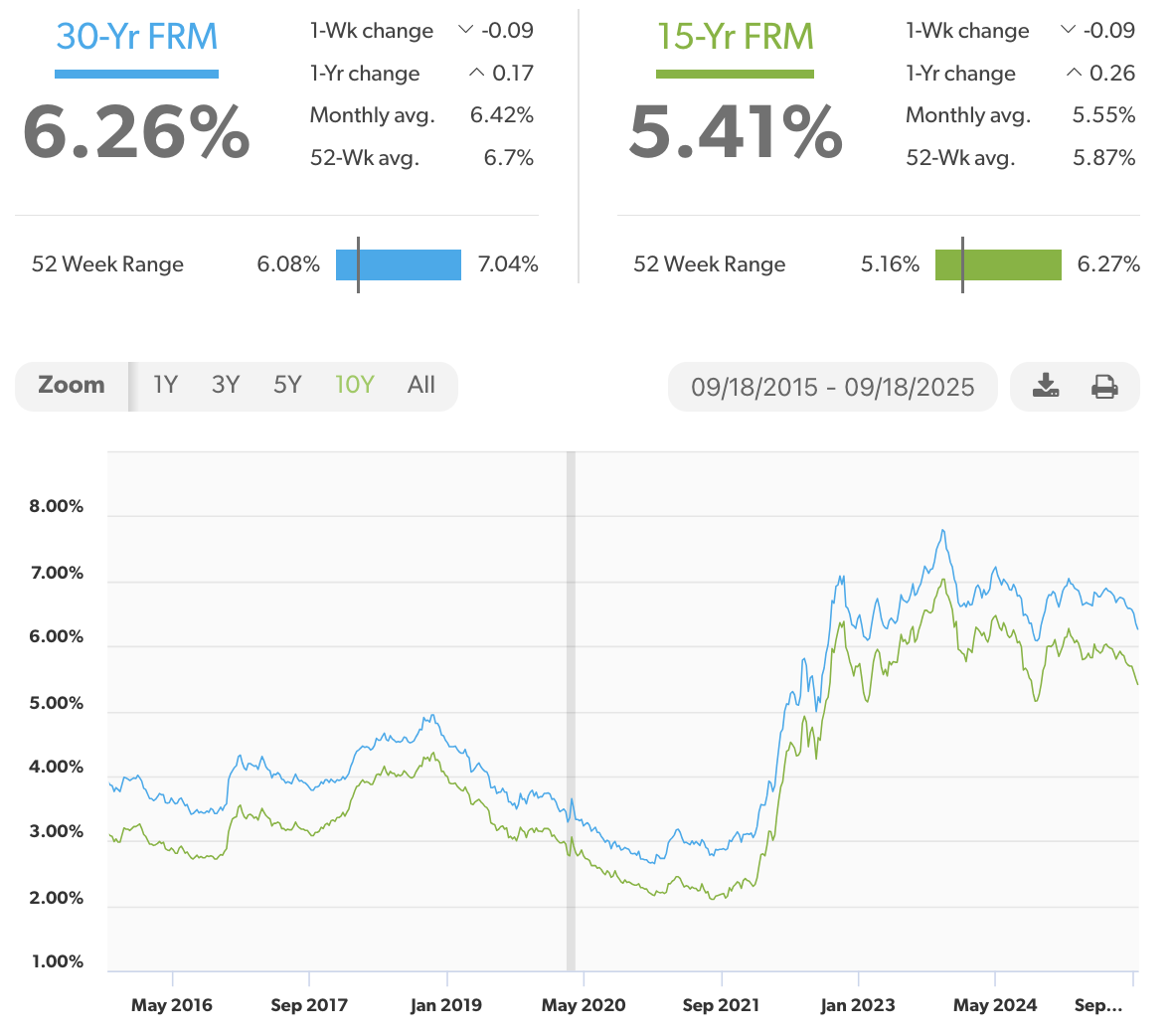

NOTE: Impact on home interest rates:

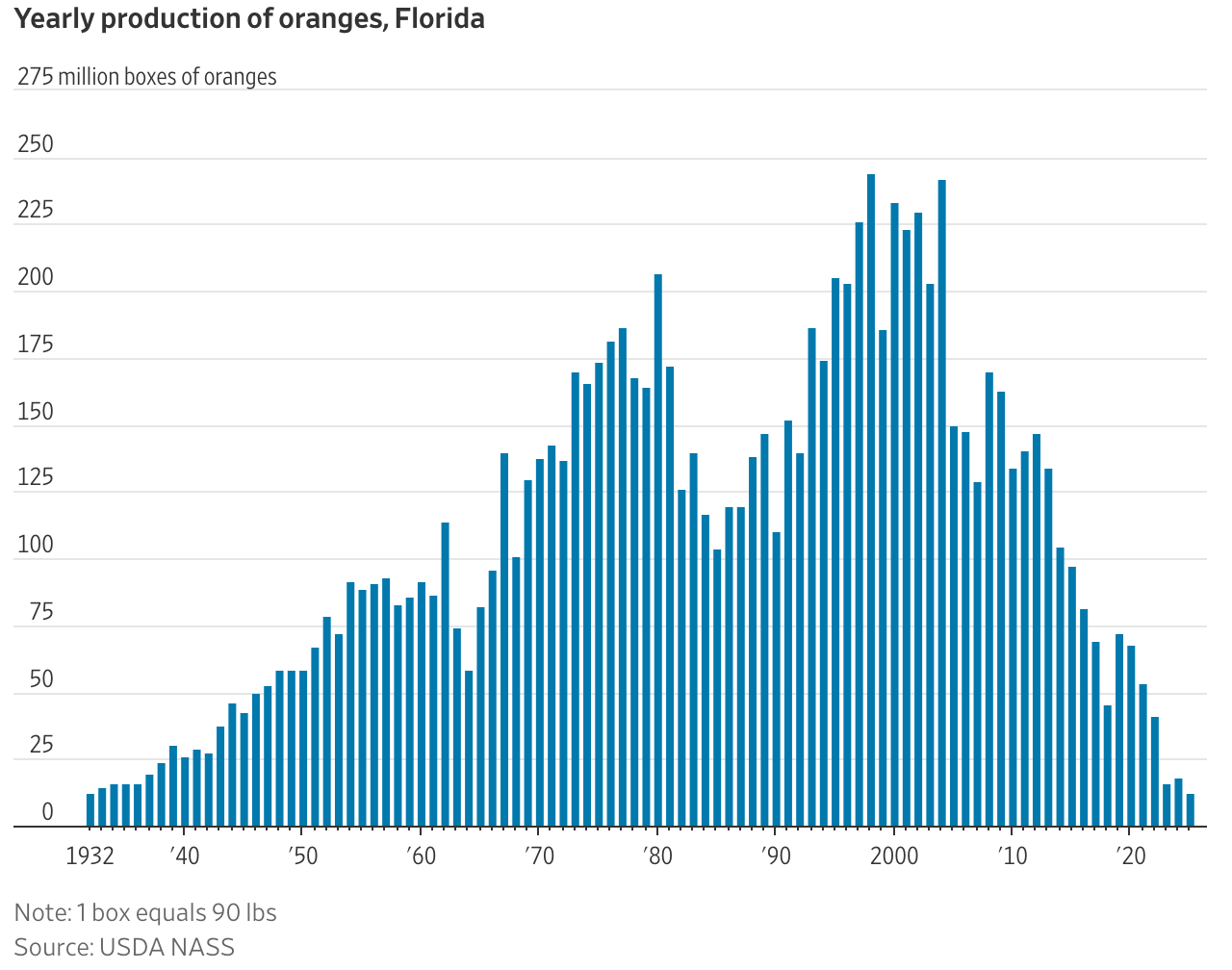

6. Florida Orange Output Lowest Since the Great Depression (WSJ)

Florida’s orange production has collapsed to its lowest level since 1932, with the 2024–25 marketing year yielding just 12.2 million boxes — a 32% drop from the previous year and an 82% decline since 2010. Output is now only a fraction of the nearly 150 million boxes produced two decades ago, as the state continues to face compounding challenges to its citrus industry.

Citrus greening disease, spread by the Asian citrus psyllid, has devastated groves for over twenty years by producing small, bitter fruit that falls off trees prematurely, with no known cure available. Storm damage has added to the crisis: Hurricane Milton in 2023 hit the heart of Florida’s citrus belt before growers had fully recovered from Hurricane Ian in 2022, and with 71% of the crop concentrated in just five counties, storms can quickly wipe out years of work since trees take years to mature.

These setbacks have forced many farmers to sell land to real estate developers, while the shortage has sent orange juice prices soaring — averaging $11.80 per gallon in August, up nearly 20% from a year earlier. Futures prices for frozen concentrated orange juice spiked to record highs last year before retreating but remain far above historical norms, reflecting the long-term supply crunch facing the industry.