25 Things from the...past few weeks | 6 Nov 25

News from the past week, and a few other things.

It’s been a few weeks since I sent out a newsletter—I’ve been busy with travel and some side projects. But I’m back now. So, apologies up front for the longer selection (I’m catching up).

This week: grade inflation at Harvard gets addressed, massive job cuts, AI, credit scores, rising insurance costs, real estate, marriage, obesity, the economy, island building in the Pacific, and more. Lots here, but trust me, it’s meaty.

International

1. See the Secret Networks Smuggling Drugs to the U.S. From Latin America (WSJ)

America’s demand for illegal drugs such as fentanyl and cocaine continues to sustain a vast, highly organized smuggling network that stretches from Asia and Latin America to U.S. borders. Traffickers use everything from fast “go-fast” boats and semi-submersible “narco-subs” to cargo ships and passenger cars to move drugs north while evading authorities.

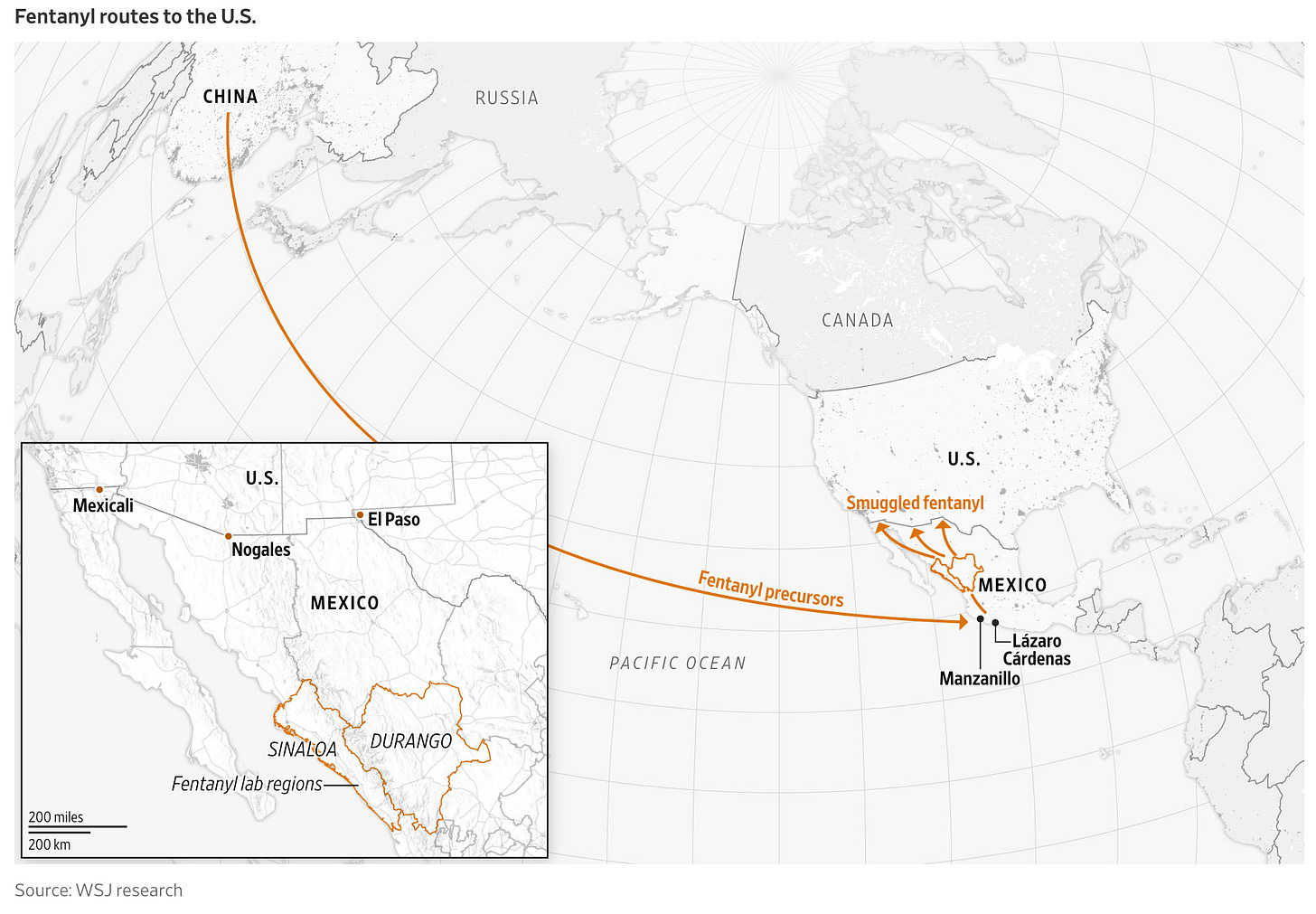

Fentanyl production begins with chemical precursors purchased from China and Southeast Asia, which are shipped to Mexico’s Pacific ports, processed in rudimentary labs in Sinaloa, and smuggled across the U.S. border—mostly through ports of entry like Nogales, Arizona. Roughly 80% of fentanyl seizures occur along the southwest border, where authorities intercepted nearly 12,000 pounds last year.

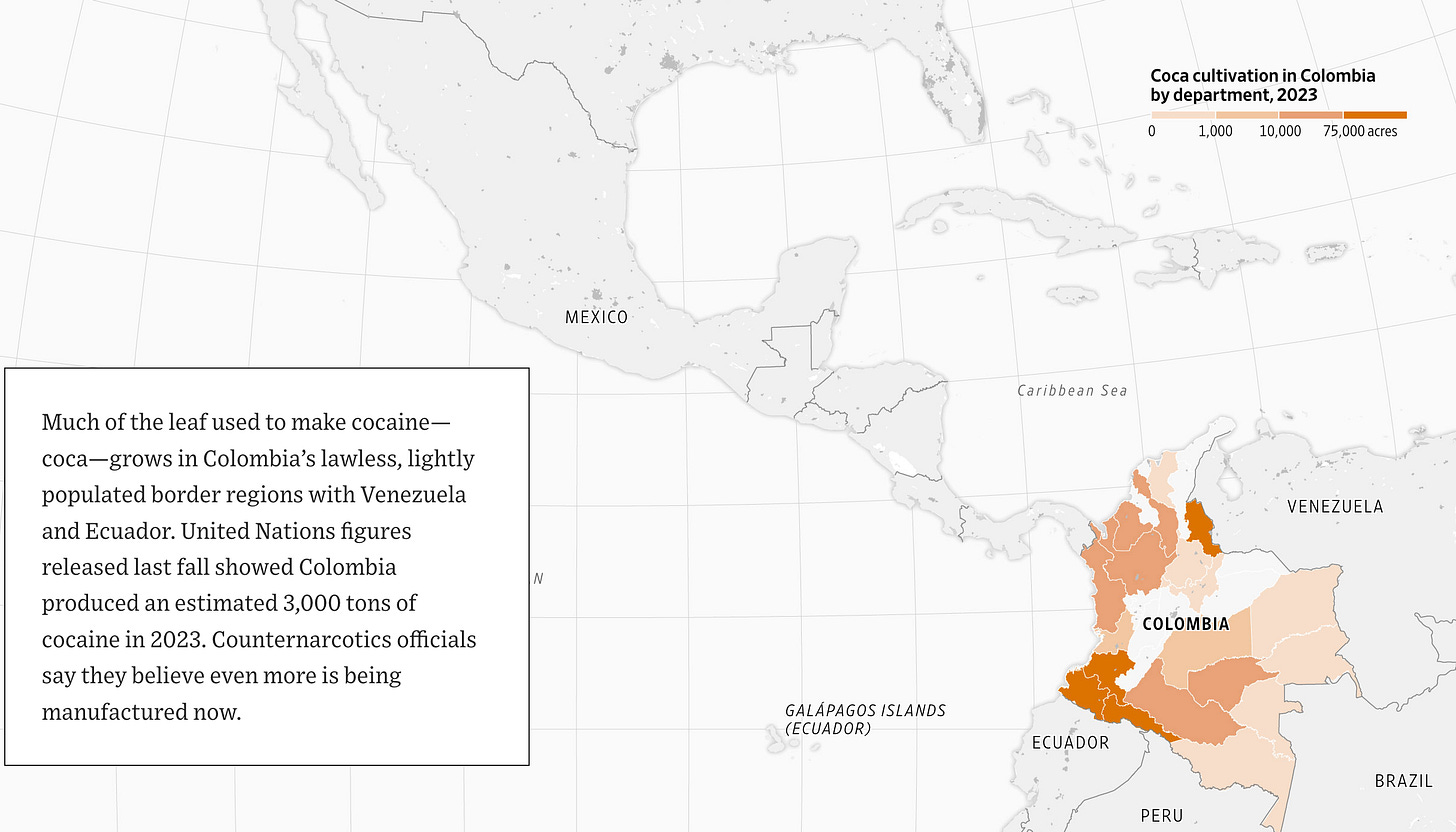

Cocaine, by contrast, is largely produced in Colombia, where armed groups control coca-growing regions and ship tons of the drug via Pacific and Caribbean routes through Ecuador, Venezuela, and Central America. Global cocaine production has surged to record levels, with Colombian output reaching an estimated 3,000 tons in 2023. While fentanyl seizures have declined slightly, cocaine trafficking and busts are rising, with routes now extending as far as Australia and Europe.

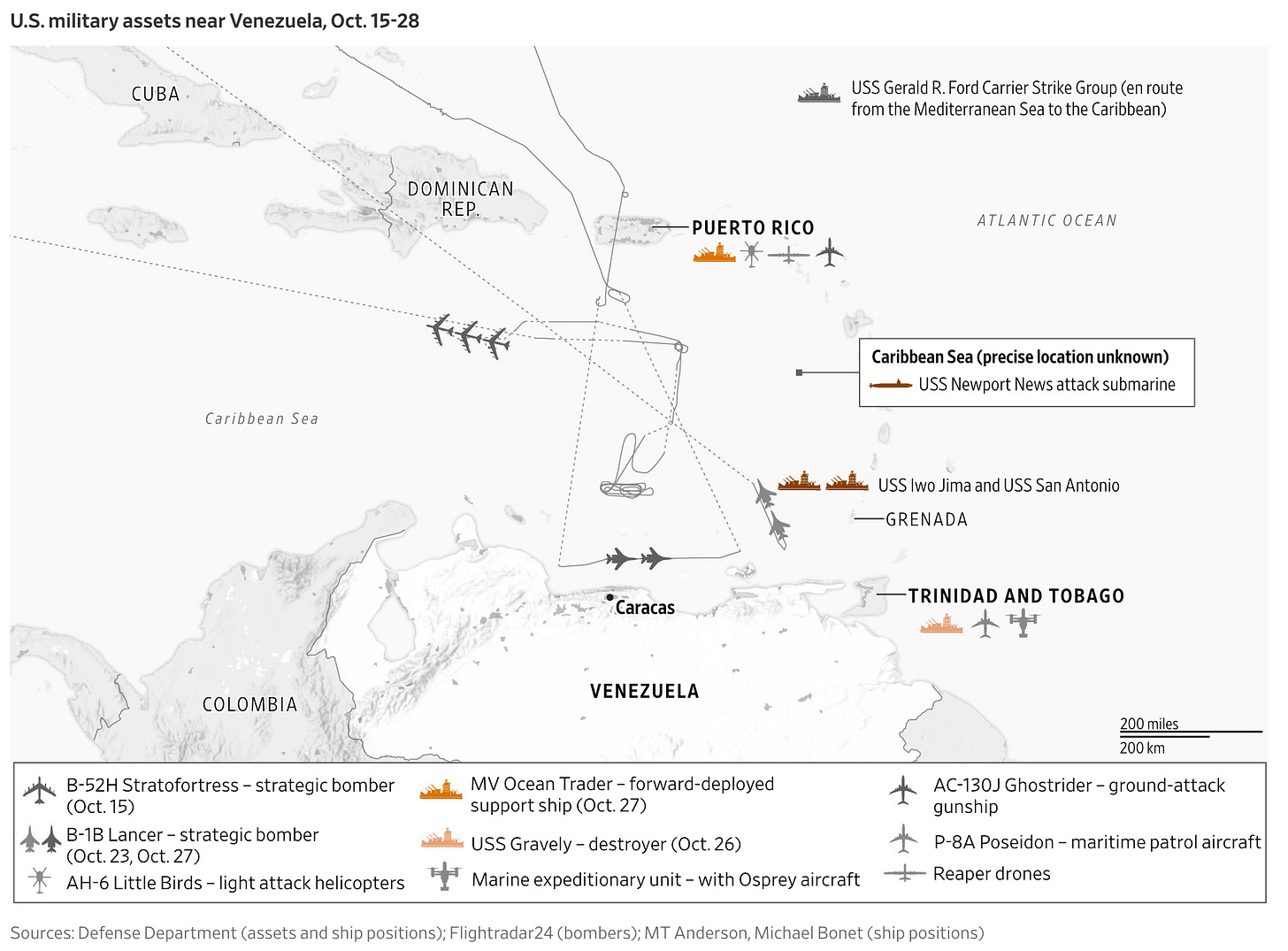

In response, the U.S. has launched its largest regional military buildup since the 1980s, deploying bombers, fighter jets, and naval forces to the Caribbean under what the Trump administration calls a renewed war on “narcoterrorists.” Critics, however, say the campaign risks blurring the line between counternarcotics enforcement and geopolitical confrontation, particularly with Venezuela’s Maduro regime.

NOTE: Article contains many interesting charts.

2. Vietnam Is Building Islands to Challenge China’s Hold on a Vital Waterway (WSJ)

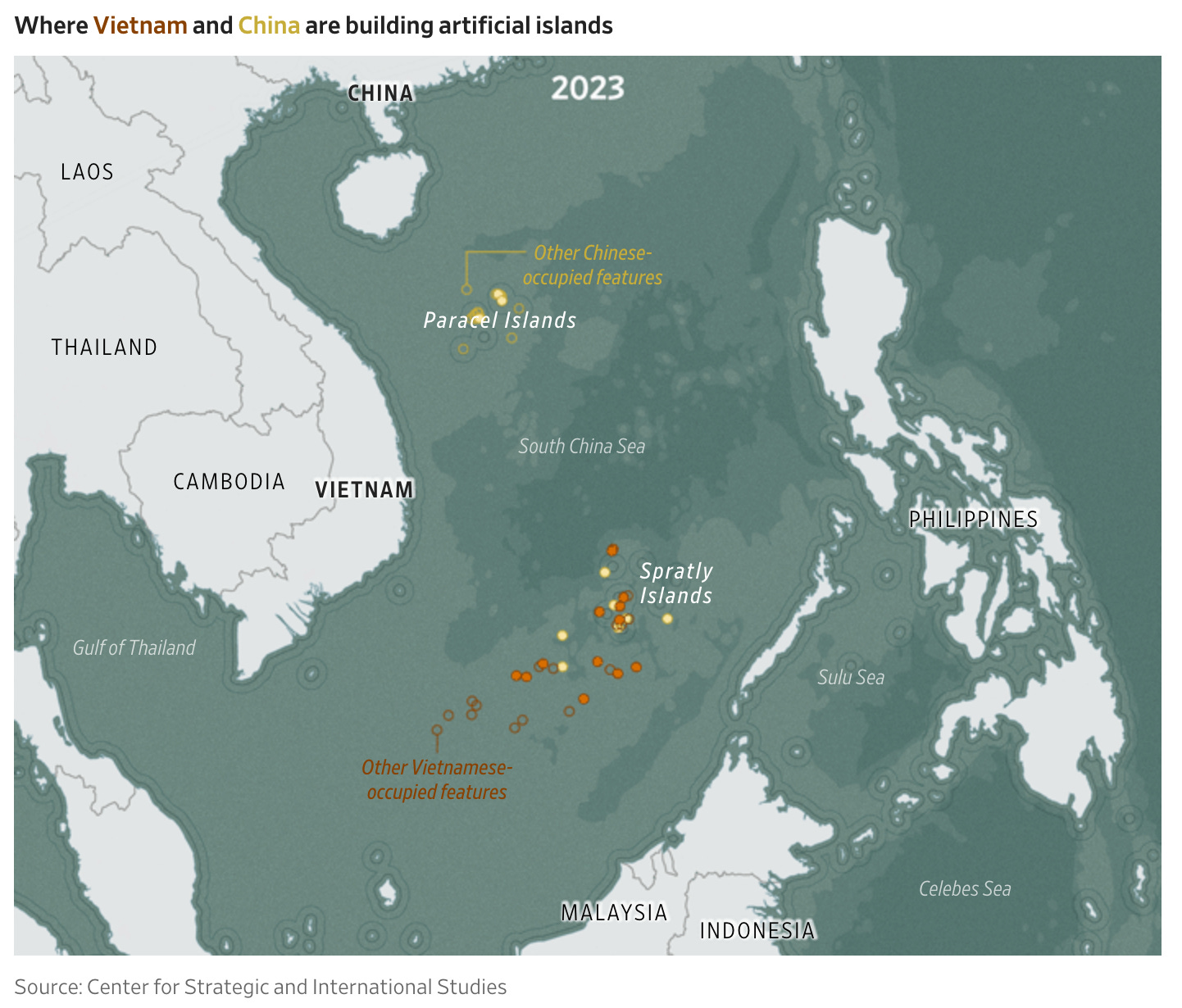

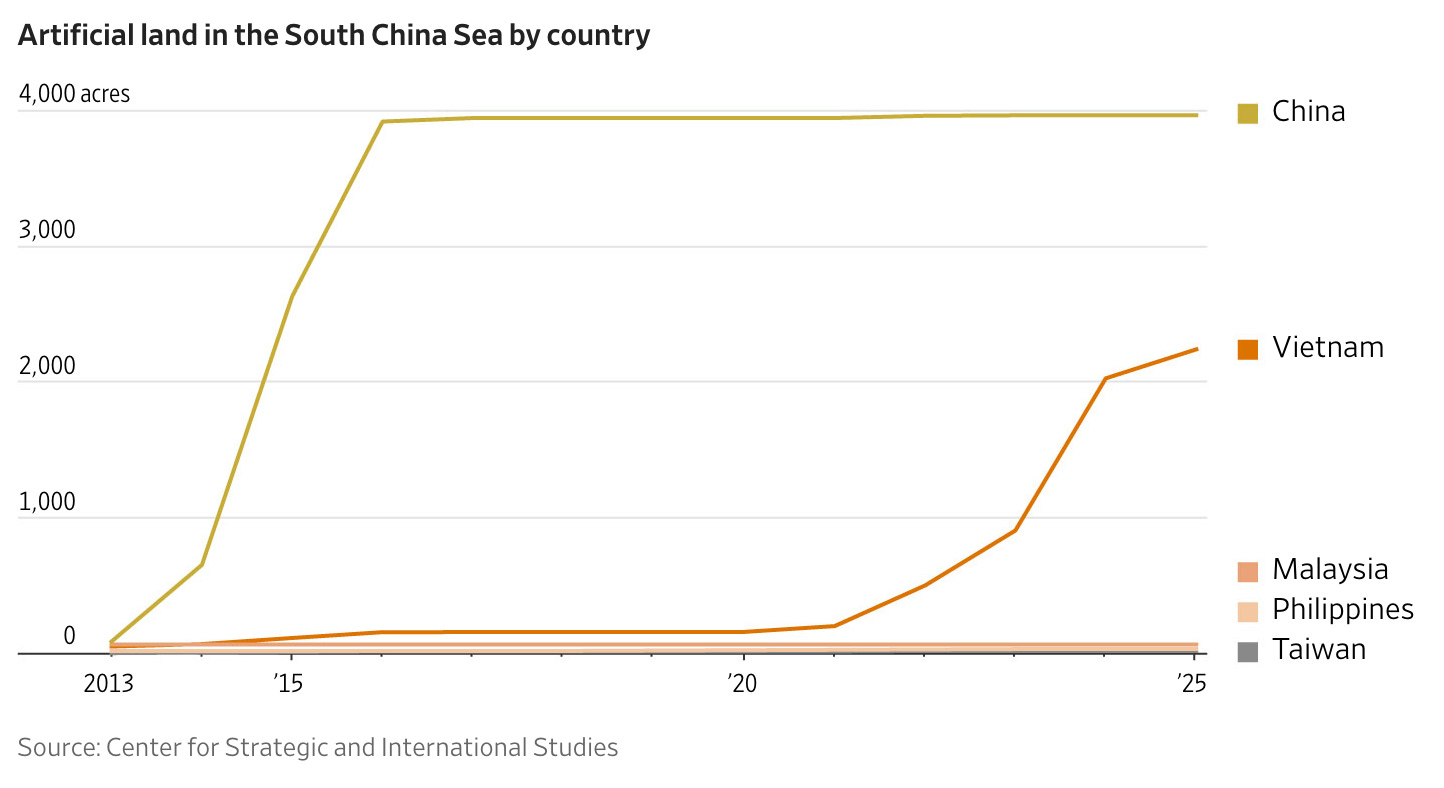

Vietnam has dramatically expanded its presence in the disputed South China Sea by using dredging to build artificial islands, increasing its territory more than tenfold over the past decade. Unlike China’s aggressive militarization of the region, Vietnam’s expansion has drawn little international criticism—largely because it is viewed as a potential counterbalance to Beijing’s dominance.

While the U.S. has condemned China’s island-building, it has not publicly opposed Vietnam’s actions, likely seeing them as strategically useful. A U.S. State Department official reiterated only that all claimants should resolve disputes peacefully and in accordance with international law.

Despite the rapid growth of its outposts, analysts note that Vietnam’s smaller navy and air force would struggle to defend them in an all-out conflict. Regional governments have mostly remained silent, viewing Hanoi’s actions as defensive rather than a threat to navigation or maritime rights, unlike China’s militarized installations.

Artificial Intelligence

3. OpenAI, Nvidia Fuel $1 Trillion AI Market With Web of Circular Deals (Bloomberg)

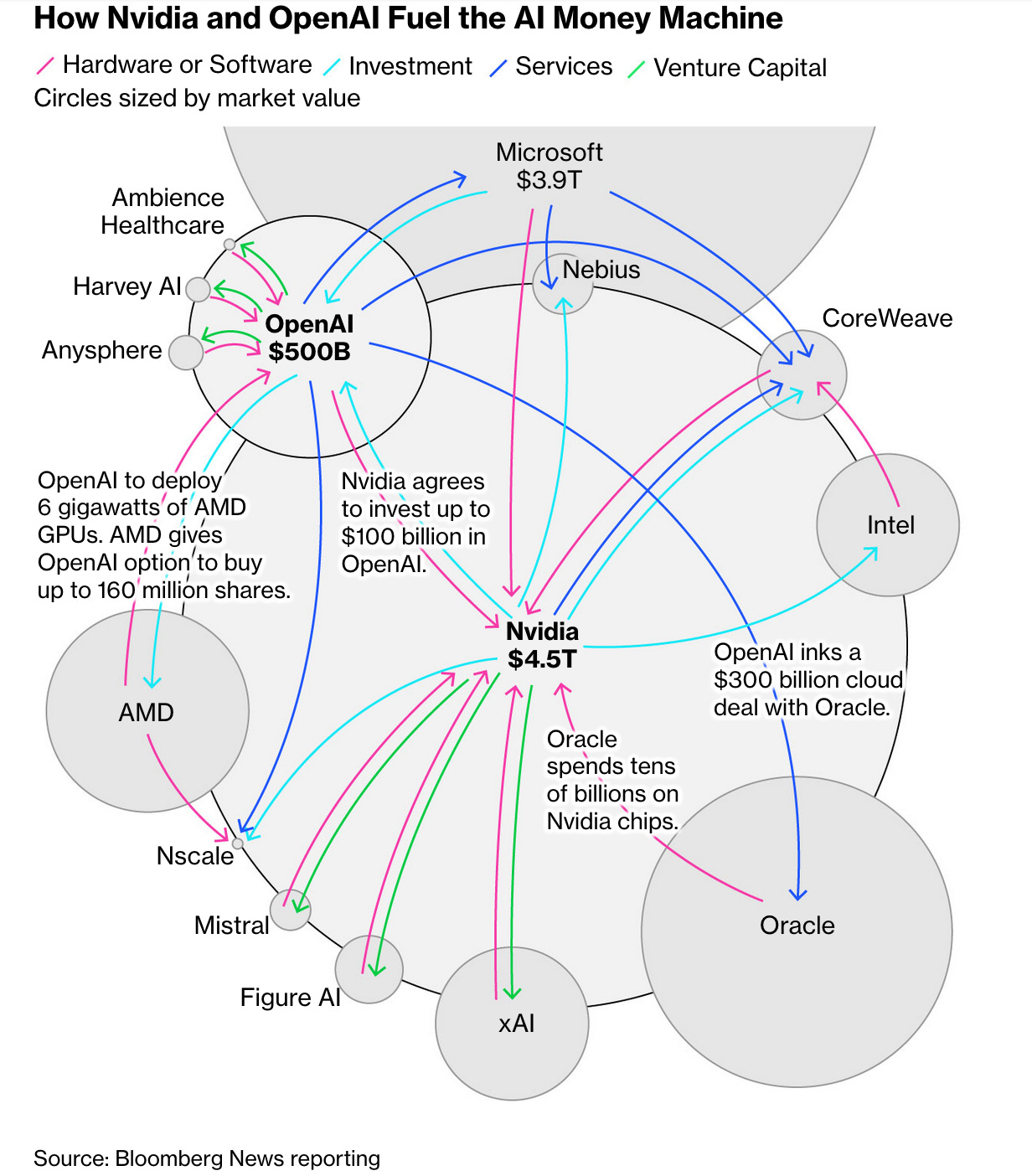

Nvidia and OpenAI are at the center of an increasingly interconnected and self-reinforcing network of AI investments that some analysts warn could be fueling a trillion-dollar bubble. Two weeks after Nvidia agreed to invest up to $100 billion in OpenAI—money that would be used to buy Nvidia chips—OpenAI struck a similar multibillion-dollar partnership with AMD, becoming one of its largest shareholders. These “circular” deals, in which companies invest in each other and use those funds to buy one another’s products or services, have drawn scrutiny for potentially inflating the AI market without producing corresponding profits.

OpenAI has now signed data-center and chip deals with Nvidia, AMD, and Oracle worth as much as $1 trillion combined, despite burning cash and not expecting to turn profitable until late in the decade. Nvidia, meanwhile, is investing in dozens of AI startups—including Elon Musk’s xAI and cloud-infrastructure firm CoreWeave—that depend on its processors, creating a tightly bound ecosystem of mutual financial interests. Oracle’s low margins on Nvidia-powered cloud services and its own heavy spending have heightened skepticism about the sustainability of such arrangements.

Industry leaders argue the partnerships are necessary to meet explosive demand for computing power and accelerate progress toward artificial general intelligence (AGI). But critics liken today’s frenzy to the dot-com era, when companies used reciprocal deals to inflate valuations. While Nvidia’s enormous profits give it staying power, OpenAI’s massive spending ambitions and reliance on debt and creative financing have raised the stakes. As one analyst put it, OpenAI’s Sam Altman now has “the power to crash the global economy for a decade—or take us all to the promised land.”

NOTE: Just one image (of one of many) of data centers being built:

4. What Happened When Small-Town America Became Data Center, U.S.A. (WSJ)

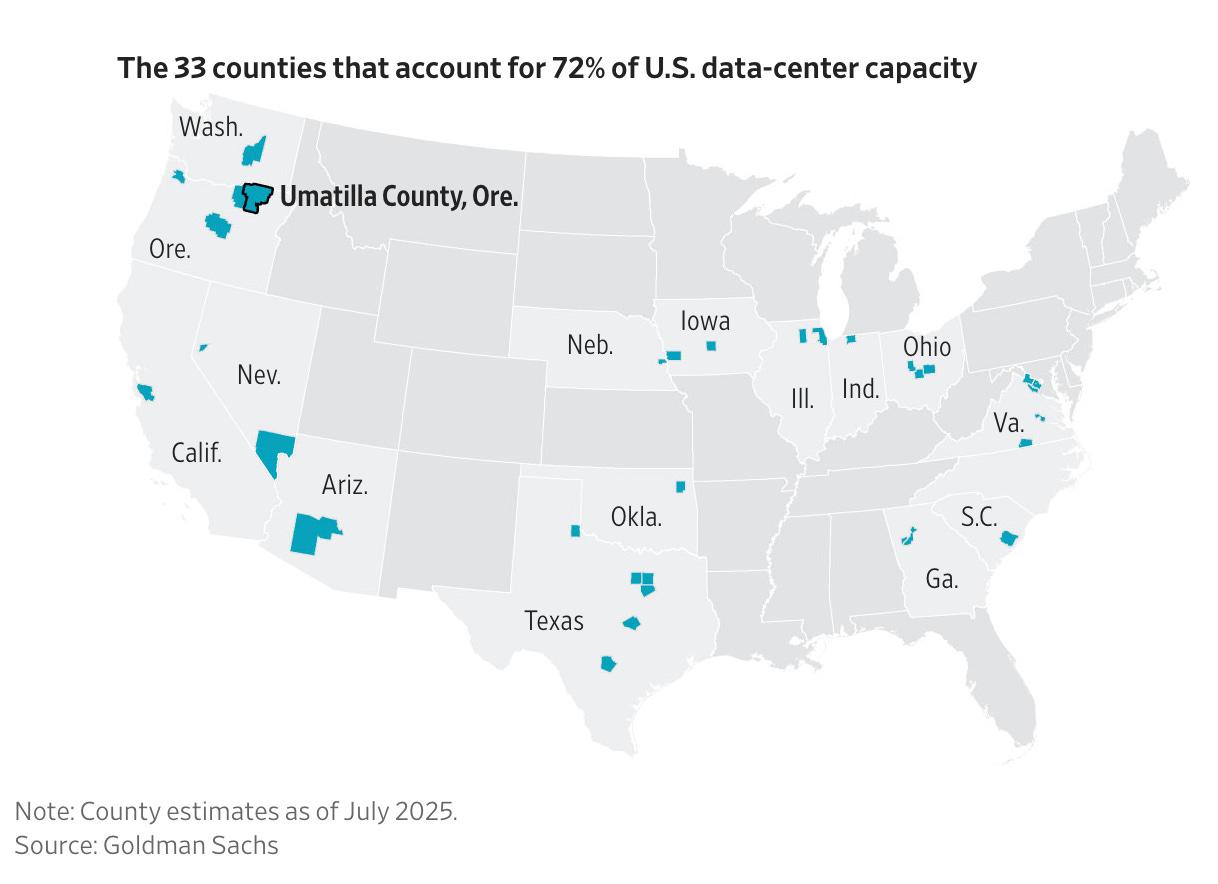

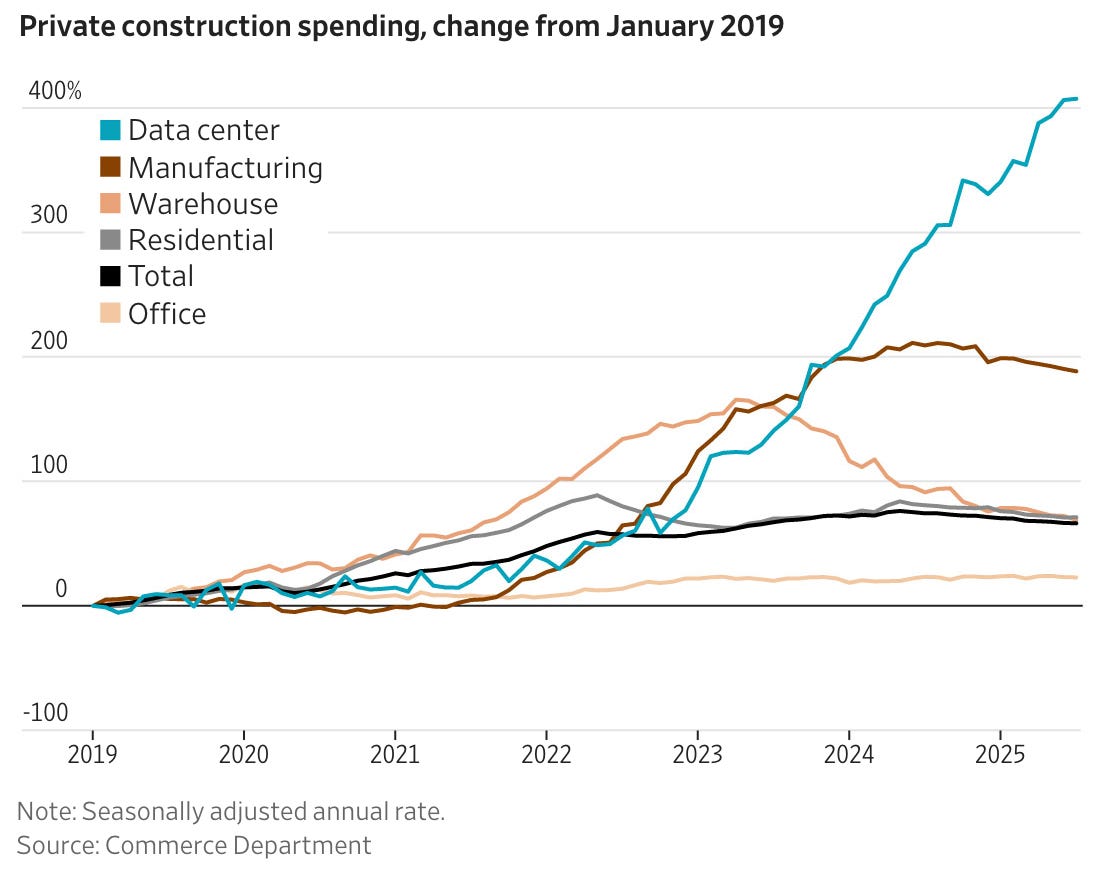

Fueled by the nation’s race to expand cloud capacity and artificial-intelligence computing power, hyperscale data-center construction has exploded, concentrating roughly 72 percent of capacity in just 1 percent of U.S. counties. Communities from Oregon to Michigan are vying for projects, lured by corporate investment, tax deals, and the promise of long-term prosperity. In northeast Oregon alone, thousands of construction workers have poured in, inflating city budgets, driving new housing developments, and remaking the local economy.

Yet the boom brings uncertainty. Permanent employment at the data-centers is modest, leaving locals uneasy about what happens when construction slows. Rising costs of living and political clashes over how to use new tax revenues underscore both the promise and fragility of the moment.

City officials remain bullish, betting that AI and cloud growth will continue to fuel expansion. Amazon says it plans to double its data-center capacity by 2027. For now, Umatilla’s fortunes—and the lives of people like Leon-Tejeda—are tethered to the tech industry’s relentless push to build the digital infrastructure of the future.

5. Big Tech Is Spending More Than Ever on AI and It’s Still Not Enough (WSJ)

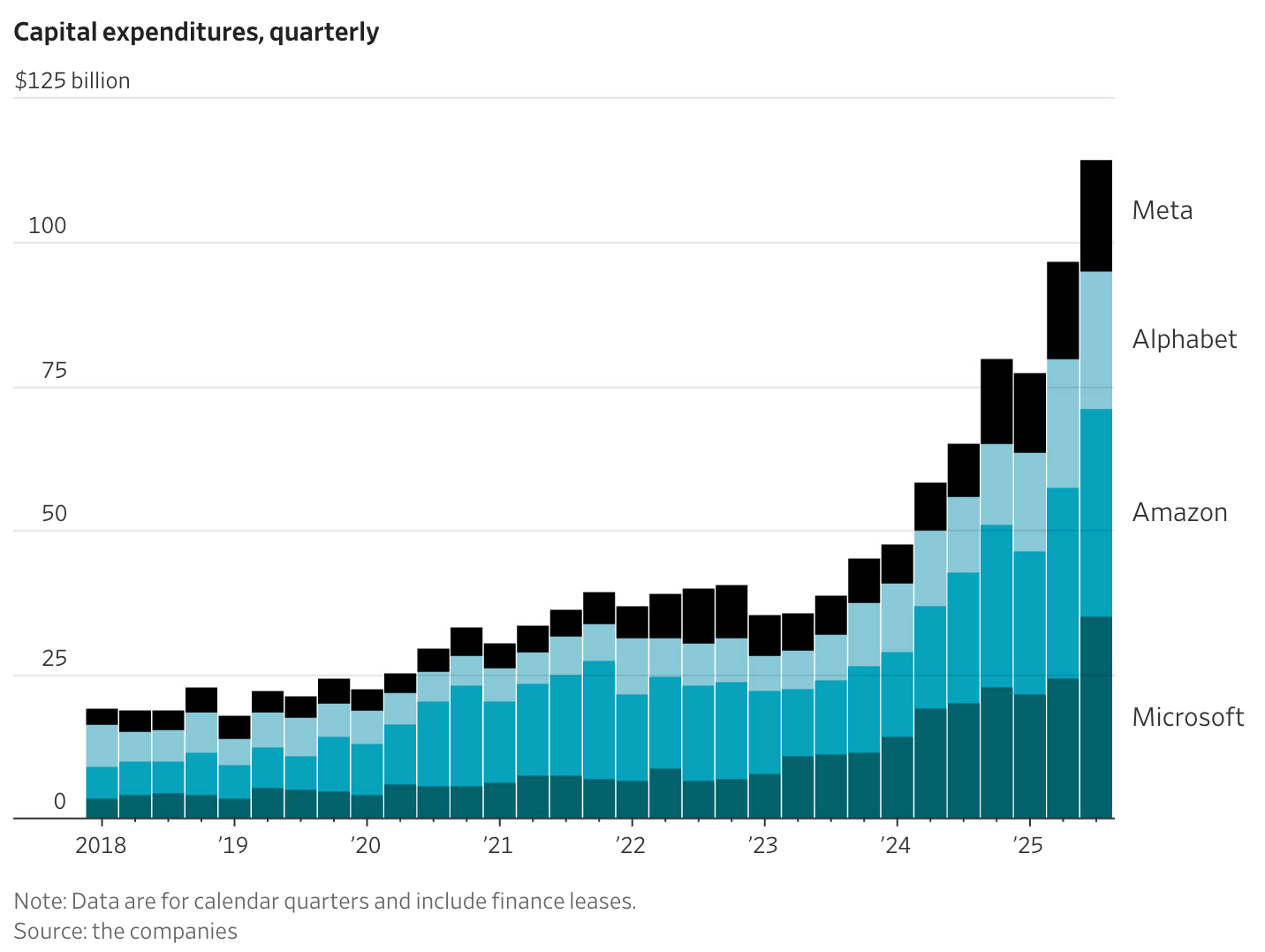

Silicon Valley’s biggest companies plan to spend a staggering $400 billion on artificial intelligence this year—and they say it still isn’t enough. Meta, Microsoft, Amazon, Alphabet, and Apple are racing to expand computing power and data-center capacity as AI demand surges, with many pledging to boost investments even further in 2026.

Microsoft says demand for its cloud and AI services has outstripped capacity, prompting plans to double its data-center footprint within two years. Amazon is also rushing to add cloud capacity, while Meta is diverting resources from its core businesses to AI research, despite investor unease. Alphabet raised its annual capital spending forecast to as much as $93 billion, saying the investments are already generating billions in new revenue.

Investors are split: Amazon and Alphabet shares rose after their earnings calls, while Meta fell 11% and Microsoft nearly 3%. Analysts worry about the risk of an AI bubble, given unclear returns and limited paying users. Yet executives argue the greater danger lies in underspending and falling behind in the race toward artificial general intelligence (AGI)—the elusive goal of machines surpassing human intelligence.

As companies pour billions into infrastructure, questions remain about when—or whether—these massive bets will yield profits. Still, the tech giants insist they must “front-load” investment now to secure a future advantage in what they see as the defining technology race of the decade.

6. Can AI replace junior workers? (Economist)

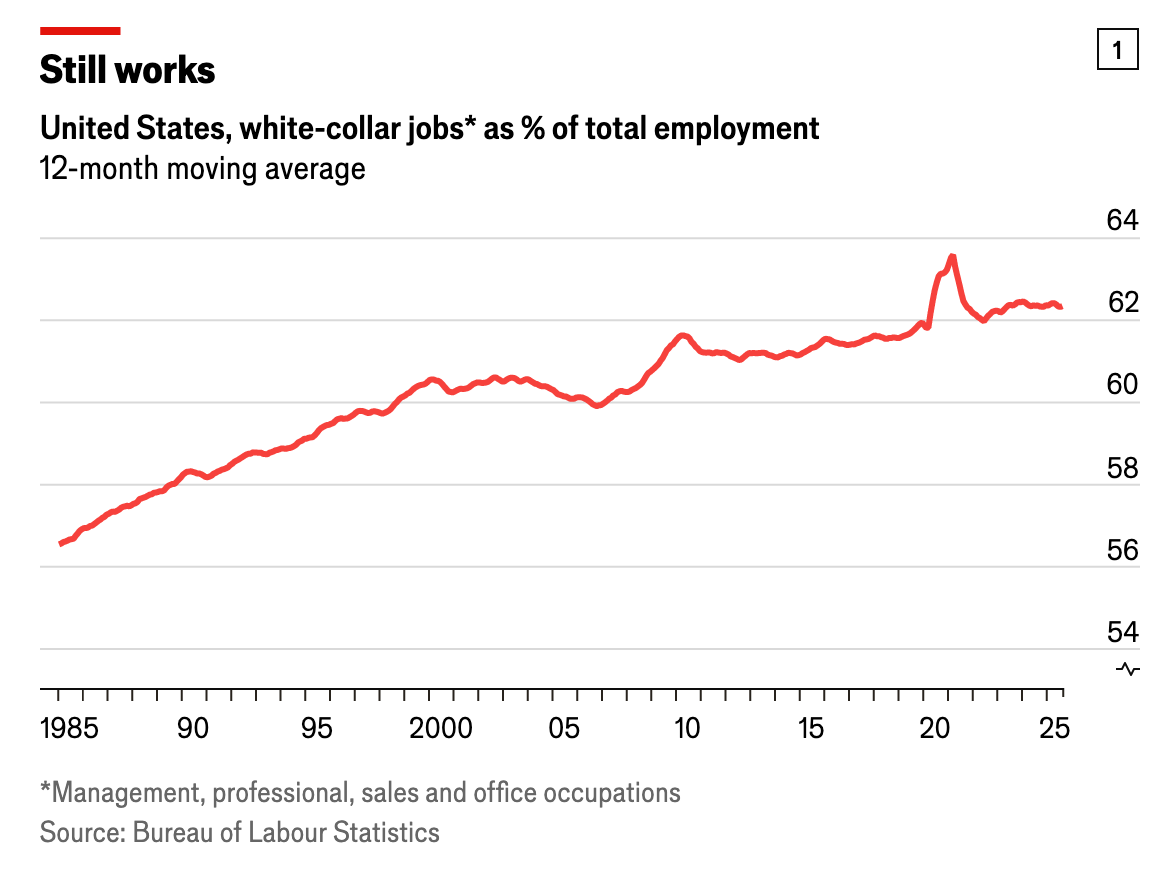

America’s economy remains strong overall, but job growth is slowing, with only 22,000 jobs added in August compared to 158,000 in April—raising questions about whether generative AI is beginning to displace human workers.

So far, broad data show no evidence of an AI-driven job collapse. White-collar employment, the sector most exposed to automation, has stayed steady, and research from Yale finds little change in the types of jobs people hold since ChatGPT’s 2022 debut.

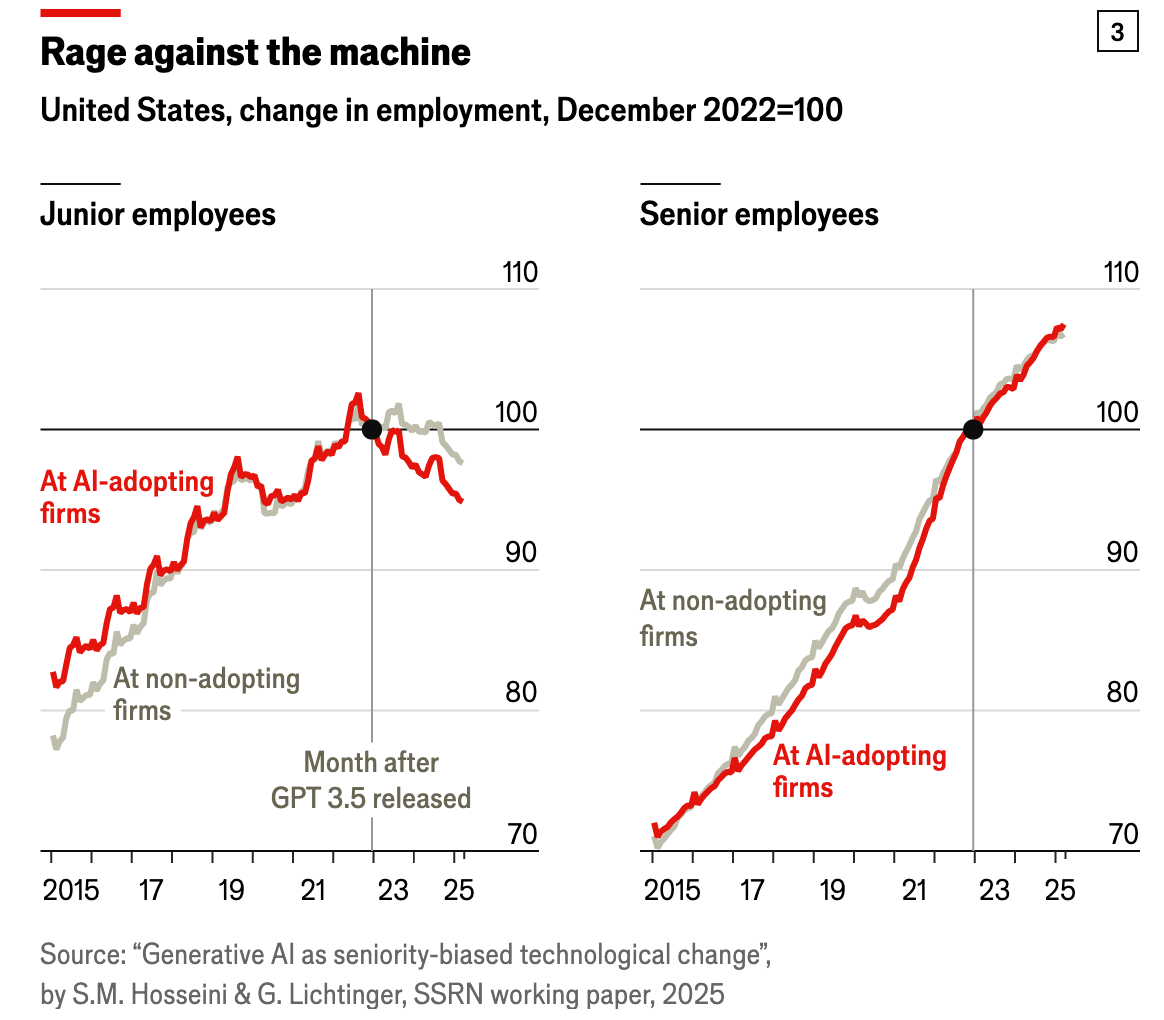

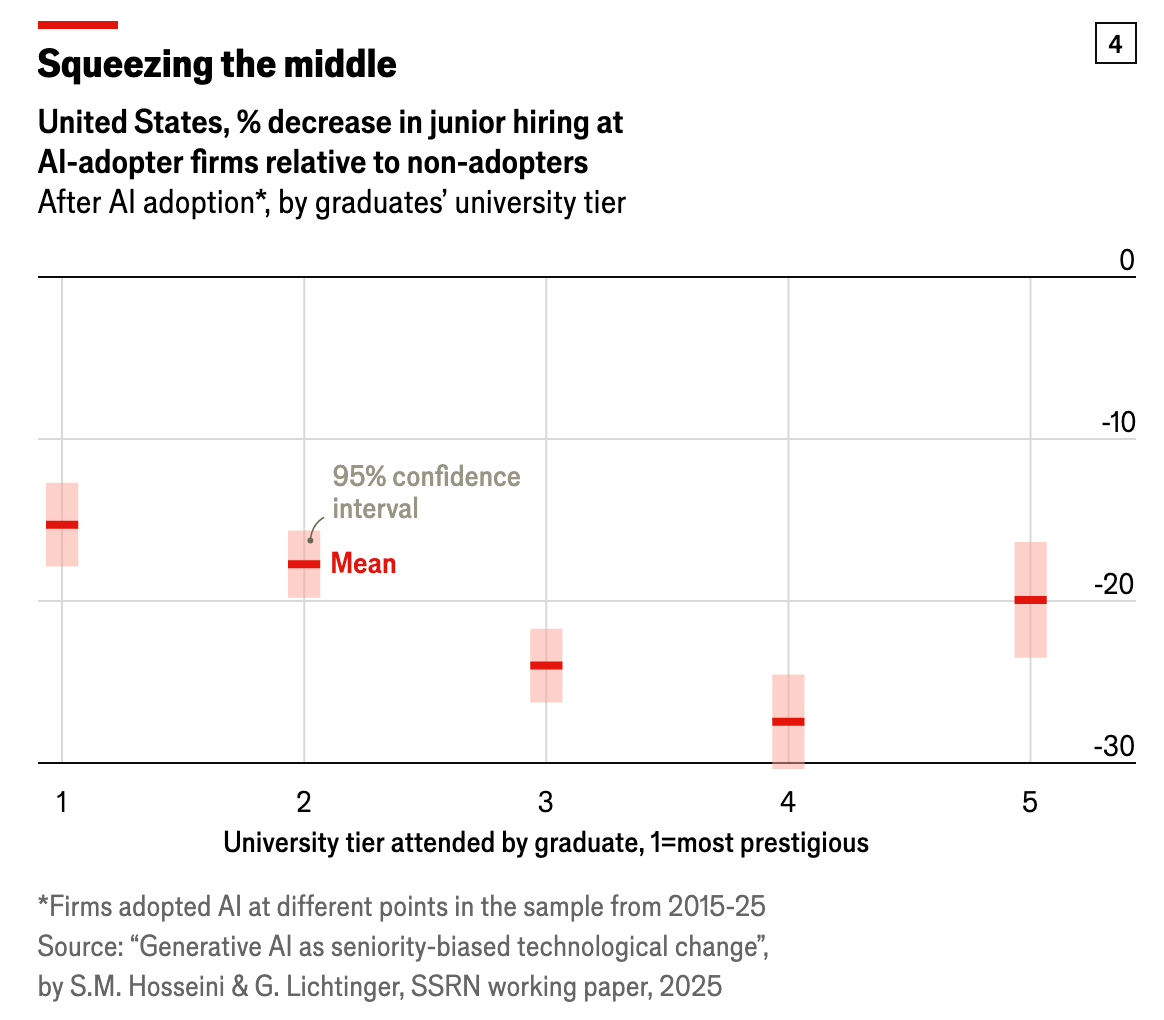

However, a new Harvard study suggests early signs of AI’s subtle impact on hiring patterns. Among more than 10,000 “AI adopter” firms—companies hiring specialists to integrate AI into their workflows—junior hiring fell 7.7% more than at firms not using AI. Senior-level hiring was unaffected, implying that entry-level, cognitively demanding tasks (like debugging code or reviewing documents) are the first to be automated.

The study also found that mid-tier university graduates have been hit hardest, while top-tier grads retain roles for their expertise and lower-tier ones remain attractive for cost reasons. Still, researchers caution that only 17% of workers were at AI-adopting firms, and recent hiring volatility makes it difficult to isolate AI’s full impact.

Jobs

7. Tens of Thousands of White-Collar Jobs Are Disappearing as AI Starts to Bite (WSJ)

Major U.S. companies are slashing white-collar jobs at an accelerating pace, signaling a new era of leaner corporate operations. Amazon, UPS, and Target have all announced deep cuts—tens of thousands of management and professional roles—while firms such as General Motors, Booz Allen Hamilton, and Rivian have followed suit. Once prized for stability, office jobs are increasingly being replaced or consolidated as companies adopt artificial intelligence and face investor pressure to boost efficiency.

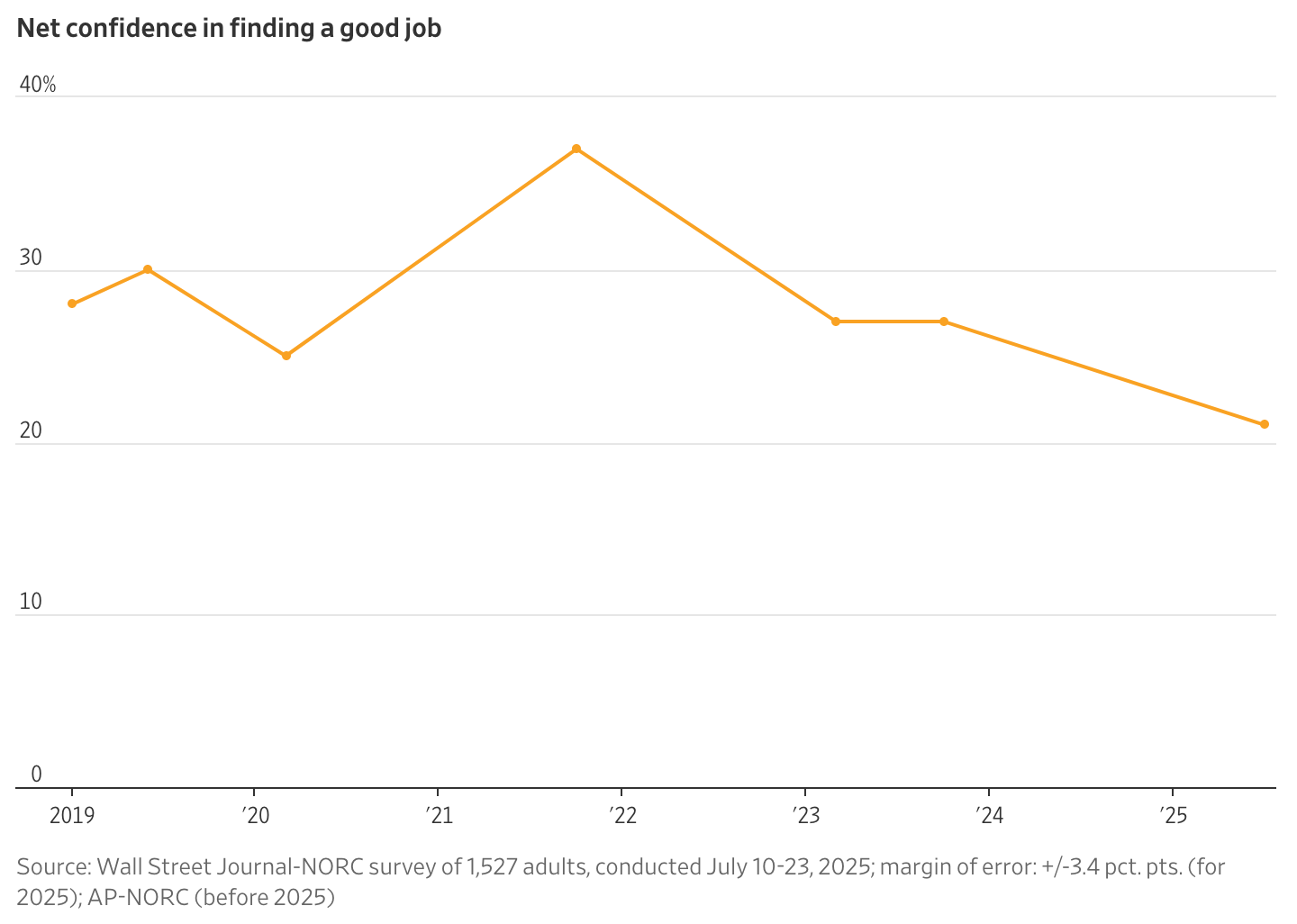

The shift has left many educated, midcareer professionals struggling to find work in a stagnant job market. Nearly two million Americans have been unemployed for six months or longer, and only one in five say they are confident they could find a good job soon. While blue-collar fields like construction, healthcare, and hospitality still face worker shortages, white-collar hiring has frozen, with companies demanding highly specific skills and often rejecting qualified applicants for not being a “perfect match.”

AI is amplifying the trend. Many roles—especially in human resources, sales, accounting, and software development—are now being automated. Some firms, like consulting company SBI, have replaced most of their programmers with AI that “writes its own Python,” dramatically cutting costs and staff.

The result is a widening divide: manual and technical trades are booming, but office work is contracting. For laid-off professionals like Chris Reed, a former tech salesperson now selling cars after depleting his savings, and new graduates like Baylor alum Kobe Baker, entry into or return to white-collar employment feels increasingly out of reach. What’s emerging, economists warn, is a “white-collar recession”—a restructuring of the American workplace where fewer people do more work, and the promise of steady professional employment is no longer guaranteed.

8. Why Companies Are No Longer Hanging On to Employees (WSJ)

Corporate America is ending its post-pandemic firing freeze, marking a major shift in the U.S. labor landscape. After years of “labor hoarding”—keeping workers amid hiring shortages—many large companies are now cutting staff as the job market softens and economic uncertainty rises. In recent weeks, major employers including Amazon, UPS, Target, and Meta have announced tens of thousands of layoffs, reversing years of caution about reducing headcount.

The change reflects a more “1990s-style” mindset in which companies view job cuts as a way to streamline operations and boost profits. Executives cite overlapping roles, slower decision-making, and rising labor costs as reasons for trimming staff. Investors have largely rewarded these moves: shares of Amazon, UPS, and Target all rose after their layoff announcements. Many firms also appear more confident they can hire again later without the struggles seen after the pandemic’s reopening, when competition for workers was fierce.

Several forces are driving the trend. Companies that overhired during the pandemic are now right-sizing, while others are preparing for higher tariffs, weaker demand, and expanding AI automation, which executives expect will replace certain roles. The unemployment rate, once at a record 3.4% in 2023, has risen to 4.3%, and consumer expectations for further job losses are growing.

Economists warn, however, that widespread layoffs could threaten an already fragile labor market—especially with the U.S. adding only 22,000 jobs in August before data releases were delayed by the government shutdown. While some of these layoffs may reflect industry realignment and optimism about AI efficiencies, sustained job cuts could tip the economy from slow growth into contraction.

9. UPS Cuts 48,000 Jobs in Management and Operations (WSJ)

UPS has eliminated 48,000 management and operations positions as part of a major restructuring effort aimed at cutting costs and improving efficiency. The company disclosed the reductions—which included 14,000 management roles and 34,000 operations jobs—in its latest earnings report. These cuts, achieved through layoffs and buyouts, significantly exceed earlier plans announced in January and April 2024, when UPS had projected a total of about 32,000 job reductions.

Chief Executive Carol Tomé, the first outsider to lead UPS, said the company continues to find opportunities to streamline costs and is “positioned to run the most efficient peak in our history.” Since taking over during the pandemic, Tomé has shifted UPS’s focus toward profitability over volume, reducing dependence on major customers like Amazon, whose shipments have fallen by over 21%.

UPS has already closed 93 buildings this year, cut back on leased vehicles and seasonal workers, and saved about $2.2 billion through restructuring and automation. While third-quarter profit and revenue declined, both exceeded expectations, driving shares up nearly 7% in afternoon trading. The company said it expects further efficiency gains and continued reductions in Amazon-related volume as it heads into the holiday season.

10. Amazon Lays Off 14,000 Corporate Workers (WSJ)

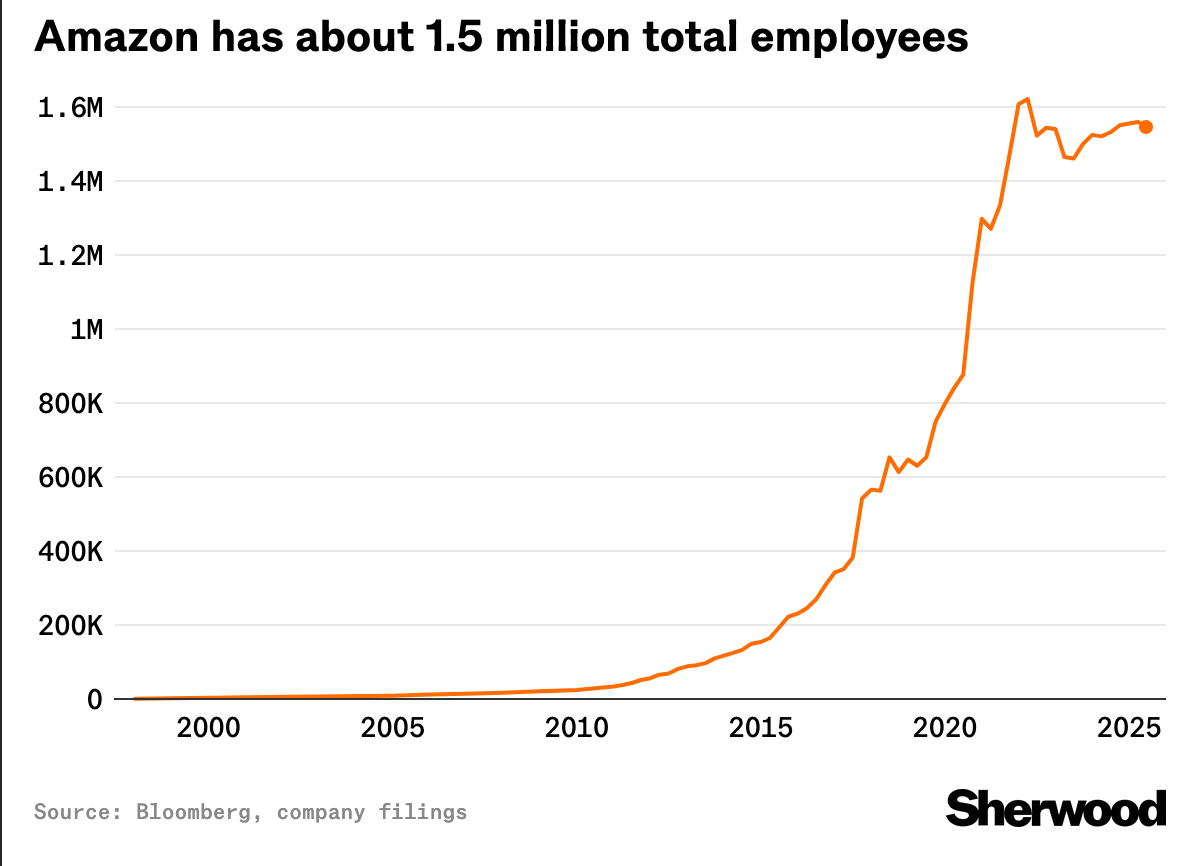

Amazon announced 14,000 initial layoffs, with total reductions potentially reaching up to 30,000 corporate positions—around 10% of its white-collar workforce. The cuts, which affect departments including human resources, cloud computing, and advertising, are part of CEO Andy Jassy’s multiyear cost-cutting campaign aimed at streamlining operations and investing more heavily in artificial intelligence.

Senior Vice President Beth Galetti told employees the reductions are meant to reduce bureaucracy and redirect resources toward Amazon’s “biggest bets” and customer priorities. Affected employees will have 90 days to seek new internal roles.

The layoffs reflect broader corporate trends, as major U.S. companies—including Meta, JPMorgan, and Walmart—tighten hiring or downsize, often citing efficiency gains from AI adoption.

This is Amazon’s largest workforce reduction since 2022, when it cut 27,000 jobs following over-expansion during the pandemic’s online-shopping surge. Amazon says generative AI will increasingly reshape its operations and workforce in coming years.

11. Walmart, Once a Byword for Low Pay, Becomes a Case Study in How to Treat Workers (WSJ)

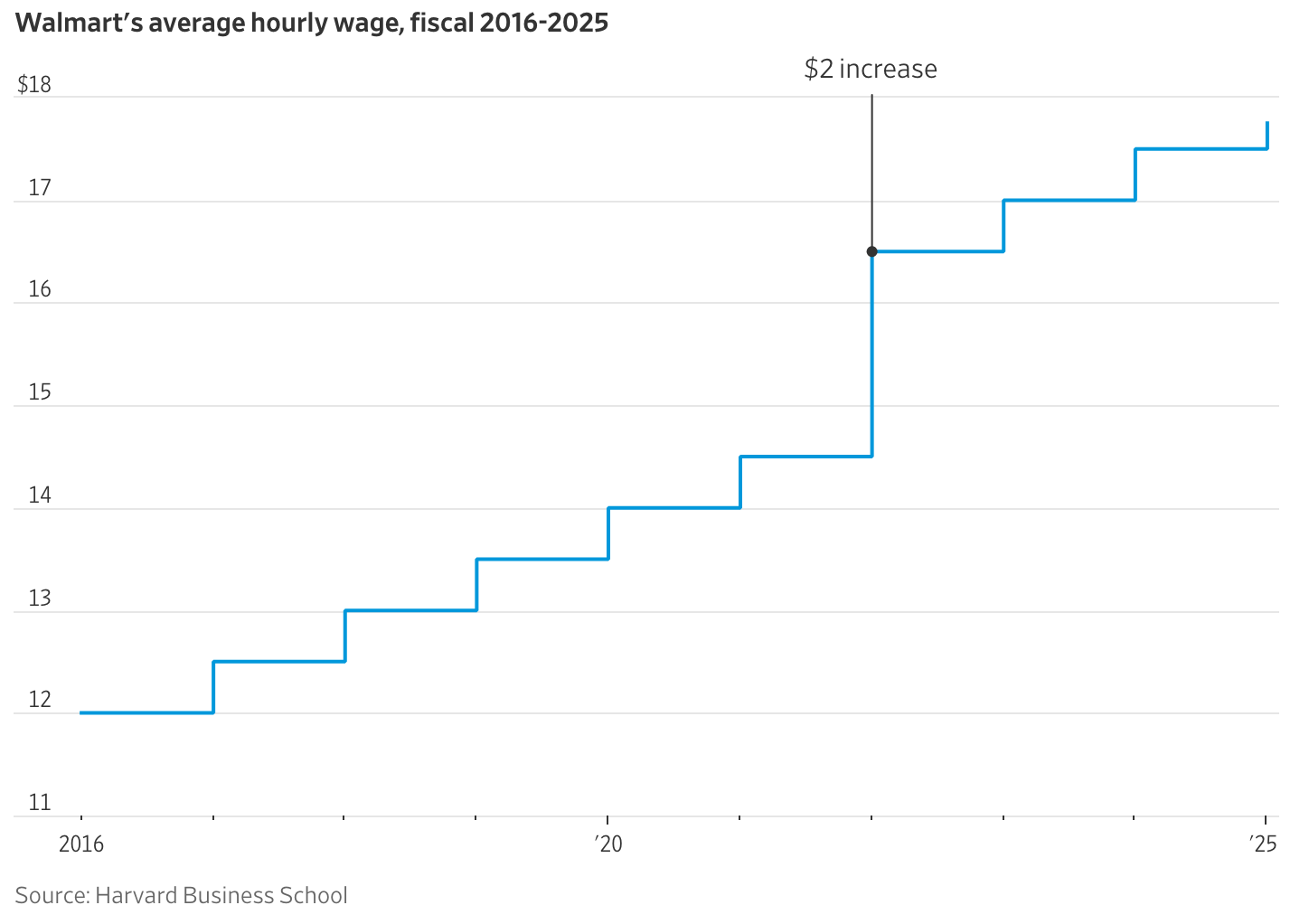

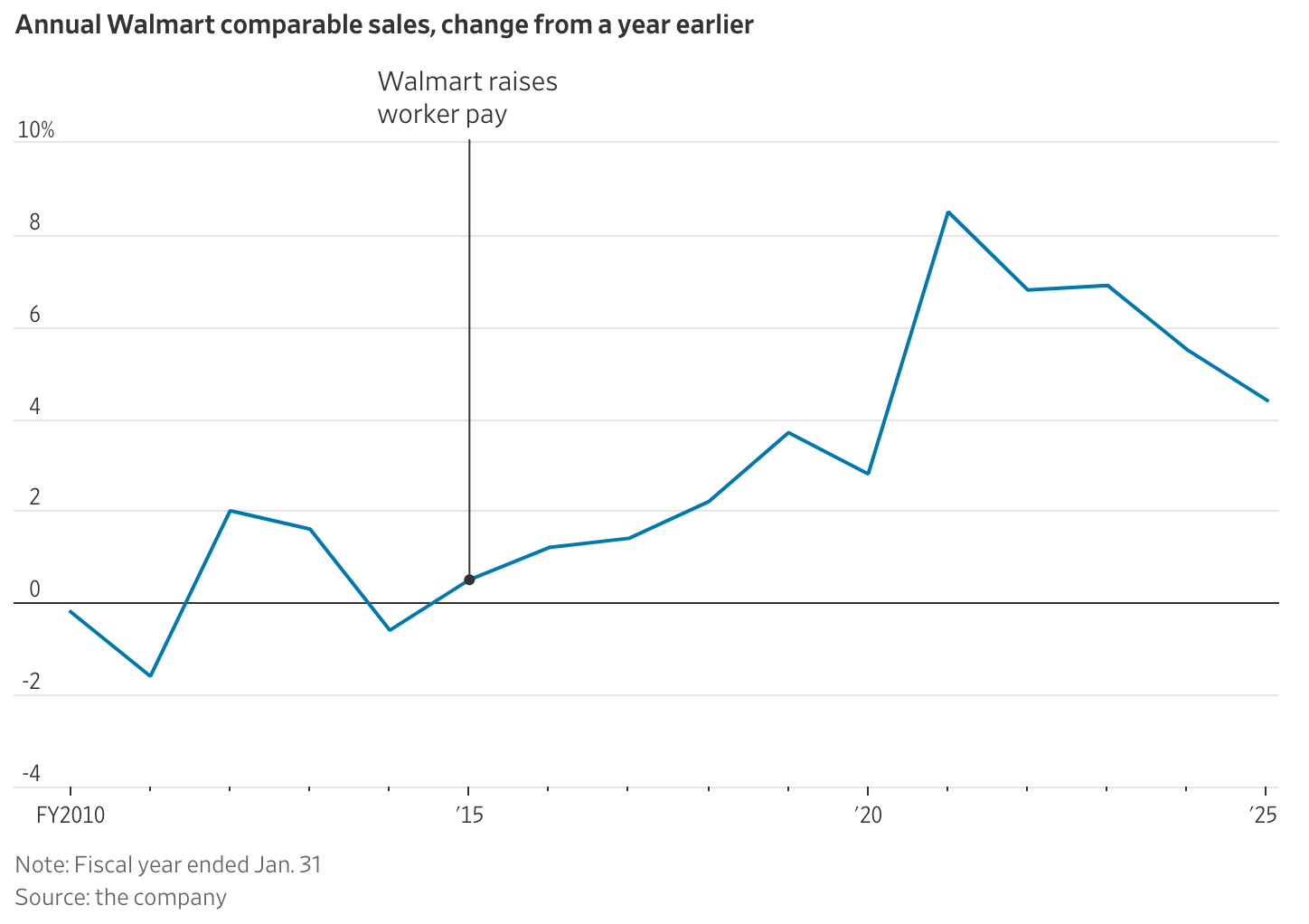

In 2015, Walmart made history by raising its starting wage to $9 an hour, boosting pay for nearly half its U.S. hourly workforce. The move initially alarmed Wall Street—shares dropped 10%, erasing $21.5 billion in market value—but it has since become a Harvard Business School case study in long-term success.

Then–new CEO Doug McMillon pushed the wage hike not as charity but as a business strategy: turnover was high, morale was low, and customer experience was faltering. By improving pay, training, and store organization, Walmart aimed to reduce attrition, strengthen operations, and compete more effectively with Amazon. Though the $2.7 billion investment temporarily hurt profits, it ultimately revitalized sales and operational efficiency.

Since then, Walmart’s U.S. sales have grown every year, and its stock has more than doubled over five years. Average hourly pay has risen from about $12 in 2015 to over $18.25 in 2025, with expanded benefits such as paid family leave, tuition-free education, and promotion pipelines through regional training academies. Employee retention has improved by more than 10%.

The company now blends higher wages, automation, and AI-driven efficiency to maintain a stable 2.1 million-person global workforce while growing revenue. McMillon calls Walmart’s transformation a “system”—proof that investing in workers can drive profitability, innovation, and long-term competitiveness, even in an era of technological disruption.

12. See How the Average U.S. Worker Has Changed Over 250 Years (WSJ)

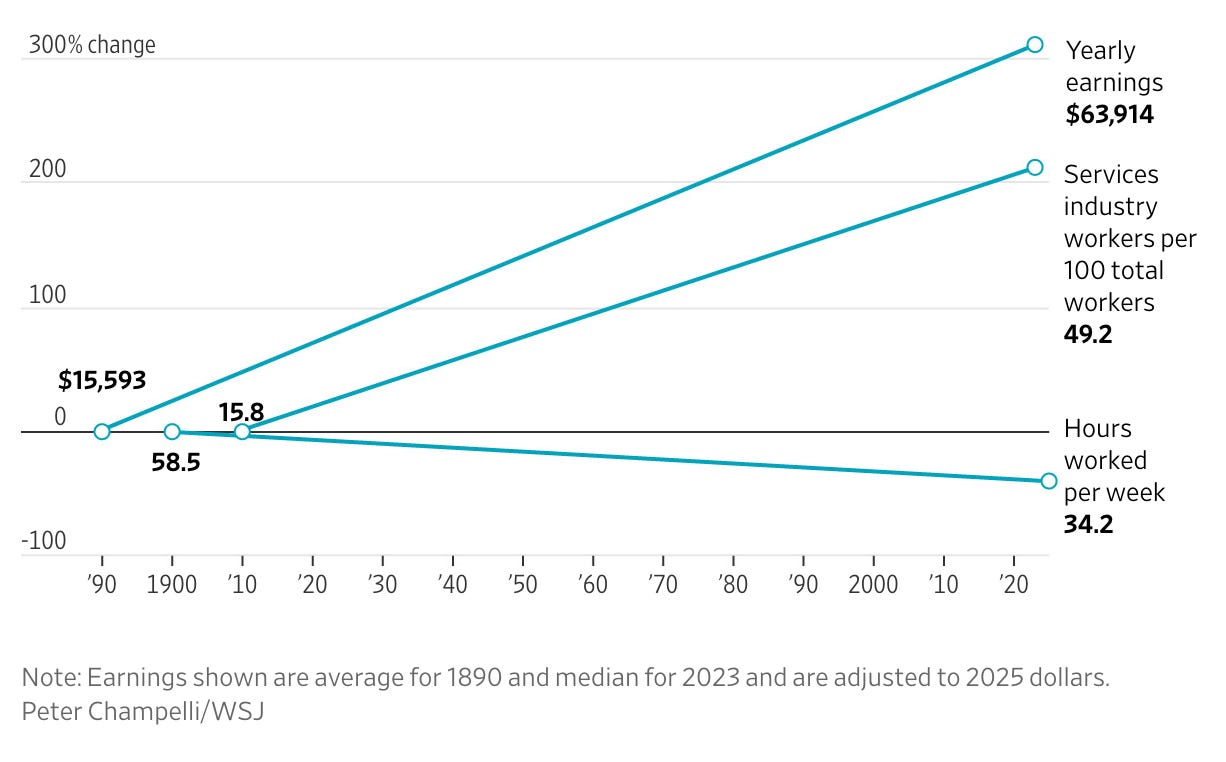

Over nearly 250 years, the U.S. workforce evolved from a small, agrarian population to a diverse, service-driven labor force exceeding 150 million workers today.

1774–1800: On the eve of the American Revolution, the colonies’ economy was primarily agricultural, with roughly 800,000 workers—most earning less than $1 per day. By 1800, 83% of America’s 1.68 million workers labored on farms, and about one-third were enslaved.

1820–1860: The invention of the cotton gin fueled agricultural expansion across the South, where enslaved labor became central—comprising up to 70% of the workforce in some states. By 1860, the U.S. workforce had grown to 11.1 million, with sharp regional divides: industrializing North vs. slave-dependent South.

1910: Industrialization and immigration transformed the economy; 36.2 million people were working, with 22% foreign-born, and manufacturing emerging as a dominant sector.

1950: After World War II, the manufacturing boom made up 26% of employment, with nearly 57 million workers overall, and shorter workweeks (about 41 hours).

1979–2000: U.S. manufacturing employment peaked in 1979 with 20 million workers before steadily declining. By 2000, women comprised nearly half the workforce, as the service industry became the nation’s primary economic engine.

NOTE: More charts in the article itself.

Economy

13. What Investors Learned From Tech Earnings, in Charts (WSJ)

The latest earnings reports from major tech companies revealed a mixed picture, highlighting both the power and the risks of the ongoing artificial intelligence investment boom. Strong results from Amazon helped lift the Nasdaq to its seventh consecutive monthly gain—its longest streak since 2018—while heavy spending plans from Microsoft and Meta led to sharp selloffs, with Meta losing $215 billion in market value in a single day.

Tech leaders including Meta, Alphabet, Microsoft, and Amazon told investors they will continue to increase capital spending in 2026, pouring hundreds of billions of dollars into AI infrastructure. Yet many investors remain uneasy, questioning when and how such massive investments will generate returns, and whether the surge echoes the dot-com bubble.

Despite these concerns, today’s AI titans remain highly profitable: Meta and Alphabet both reported record revenues. However, their collective cash flow has declined over the past two years as spending accelerates. Meanwhile, valuations have soared—Nvidia became the world’s first company to reach a $5 trillion market cap, while Apple and Microsoft each crossed $4 trillion for the first time.

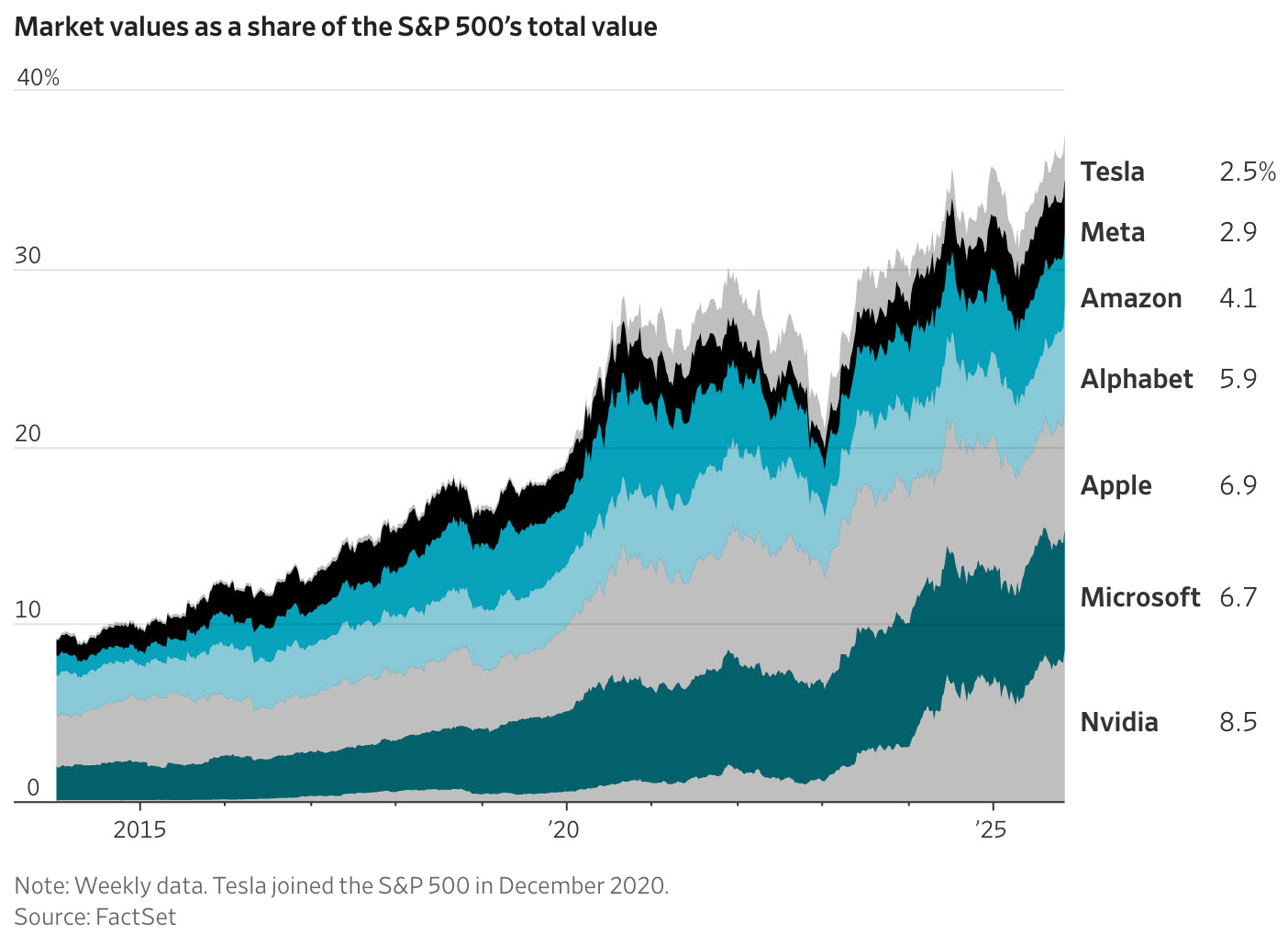

Together, the “Magnificent Seven”—Apple, Alphabet, Amazon, Meta, Microsoft, Nvidia, and Tesla—now account for roughly 38% of the S&P 500’s total market value, giving their stock movements outsized influence on the entire market. At the same time, these firms are taking on record levels of debt to fund AI initiatives, a major shift for companies once known for vast cash reserves. Meta, for instance, recently issued $30 billion in bonds, joining other firms like Oracle in borrowing heavily to sustain their AI expansion.

In short, Big Tech’s AI spending spree has fueled record valuations and market dominance—but also heightened fears that Wall Street’s future may now hinge on whether these colossal bets ultimately pay off.

14. The Warning Signs Lurking Below the Surface of a Record Market (WSJ)

Wall Street investors are growing more cautious amid the market’s most volatile stretch since summer. As signs of economic strain emerge, money is flowing into defensive sectors such as utilities, healthcare, and consumer staples—industries that generate steady profits regardless of the business cycle. These traditionally safe havens are on track to lead the S&P 500 for the first time since mid-2022, while investors also seek safety in bonds and gold, driving Treasury yields below 4%.

Beneath the surface, investors are pulling back from economically sensitive stocks like banks, retailers, homebuilders, and airlines. Recent bankruptcies at First Brands and Tricolor, along with fraud concerns and loan losses at regional banks such as Zions and Western Alliance, have raised alarms about hidden fragilities in the credit market. The spread on junk bonds—a measure of perceived risk—has widened to its highest level since June.

Still, overall corporate earnings remain strong, with analysts expecting 16% growth in the year ahead, the best since 2021. Optimists argue that fundamentals are solid and the economy is merely cooling, not contracting. But others warn that the AI-driven stock rally has masked underlying weakness in the “real economy,” where labor markets are softening and low-income consumers are cutting back.

In short, while megacap tech and AI enthusiasm continue to prop up markets, investors are quietly pivoting toward safety—signaling growing unease that the economy’s underlying strength may not match Wall Street’s exuberance.

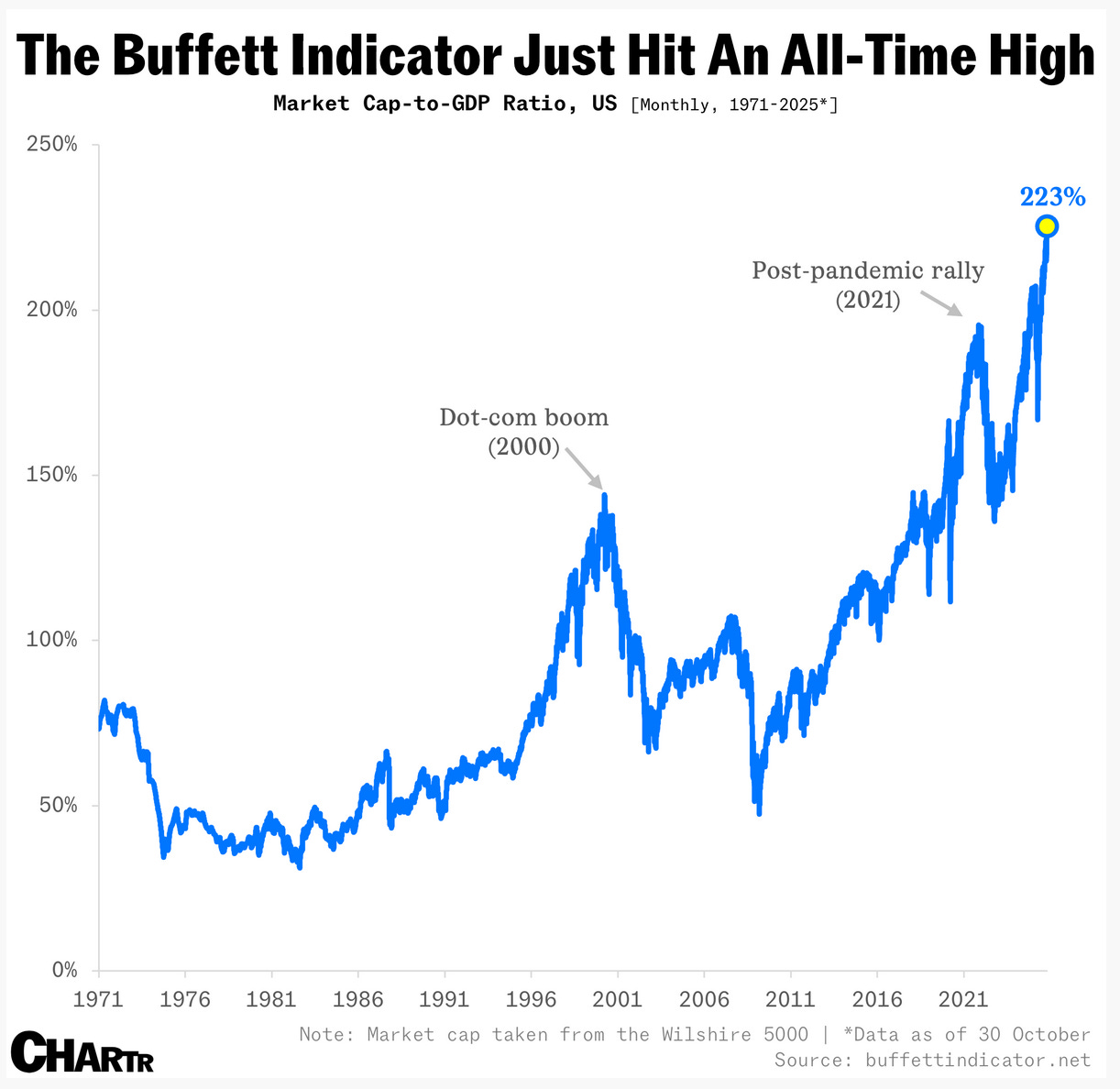

15. The Buffett Indicator just hit an all-time high (Sherwood)

The Buffett Indicator—the ratio of total U.S. stock market value to GDP—has reached a record 225%, signaling potential overvaluation and prompting warnings of a possible market correction. Traditionally viewed by Warren Buffett as “the best single measure of where valuations stand,” the metric suggests stocks are far pricier relative to the size of the economy than at any point in history.

Other red flags are flashing too: investors are paying record prices for each dollar of S&P 500 revenue, and just eight tech giants now make up about 40% of the index’s value. However, analysts note reasons for caution—not panic. Many major U.S. firms earn nearly half their revenue overseas, making their valuations appear inflated relative to domestic GDP, and corporate profit margins remain at record highs above 14%.

With interest rates falling, inflation stabilizing, and AI optimism driving growth expectations, some investors argue that today’s lofty valuations are justifiable—at least for now. The result is a 2025 market defined by both record highs and record anxiety.

Personal Finance

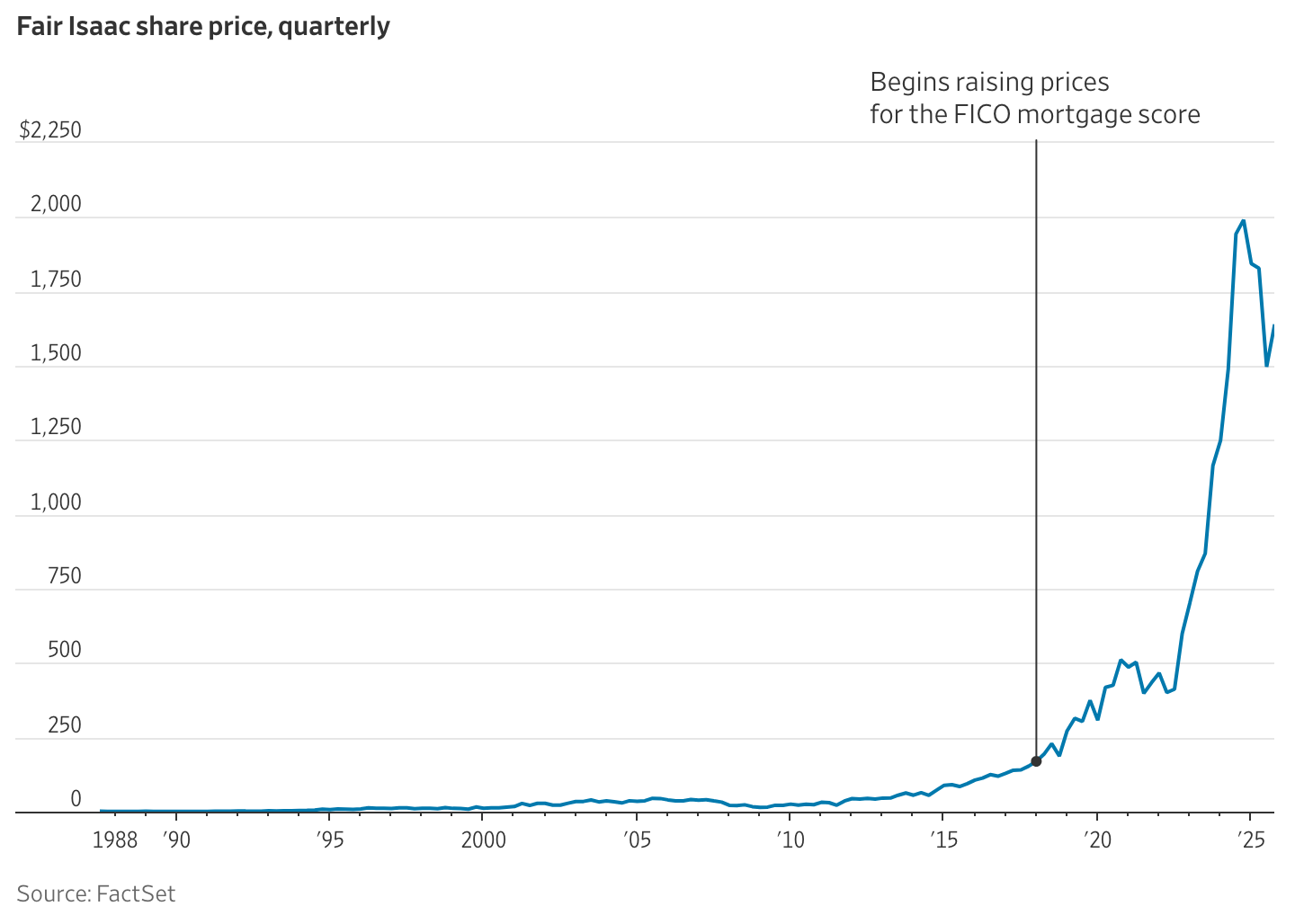

16. A Fight Over Credit Scores Turns Into All-Out War (WSJ)

A fierce battle has erupted over control of the U.S. credit-scoring system, long dominated by FICO. For decades, Fair Isaac Corp.’s FICO score has determined roughly 90% of lending decisions, but the three major credit bureaus—Equifax, Experian, and TransUnion—are challenging that monopoly with their rival product, VantageScore.

Tensions spiked after FICO doubled its mortgage-score price to $10, prompting regulators to accuse it of anticompetitive behavior. The Federal Housing Finance Agency has since allowed VantageScore to be used for many mortgages, signaling the start of real competition. FICO’s CEO defends the higher prices as ensuring “safety and soundness,” while critics say they burden lenders and borrowers alike.

Now, both sides are racing to win over lenders and Washington policymakers—each claiming to champion consumer access to credit—while fighting for control of the single number that governs who gets loans and at what cost in America.

17. Runaway Insurance Costs Bring Back Talk of Price Caps (WSJ)

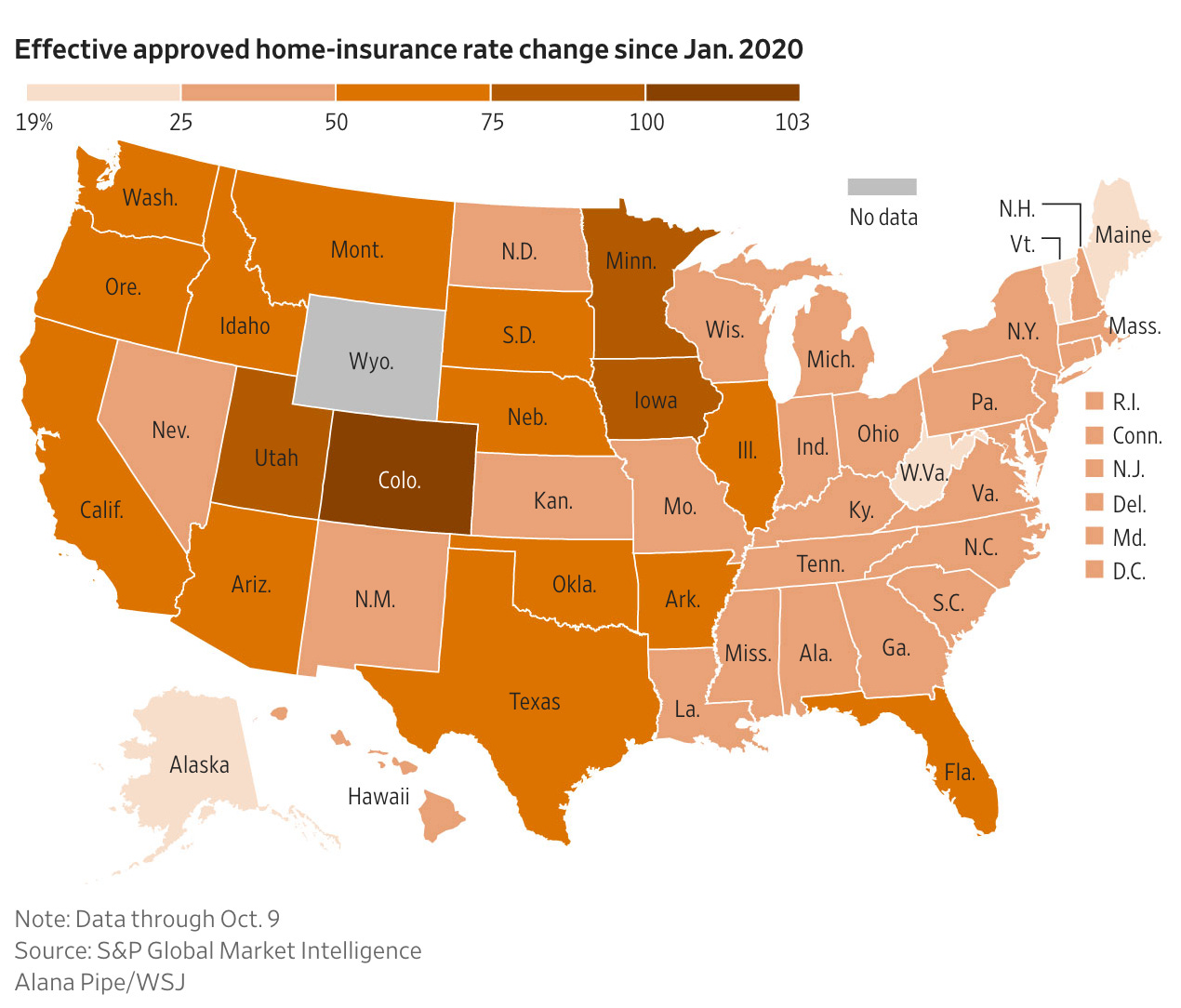

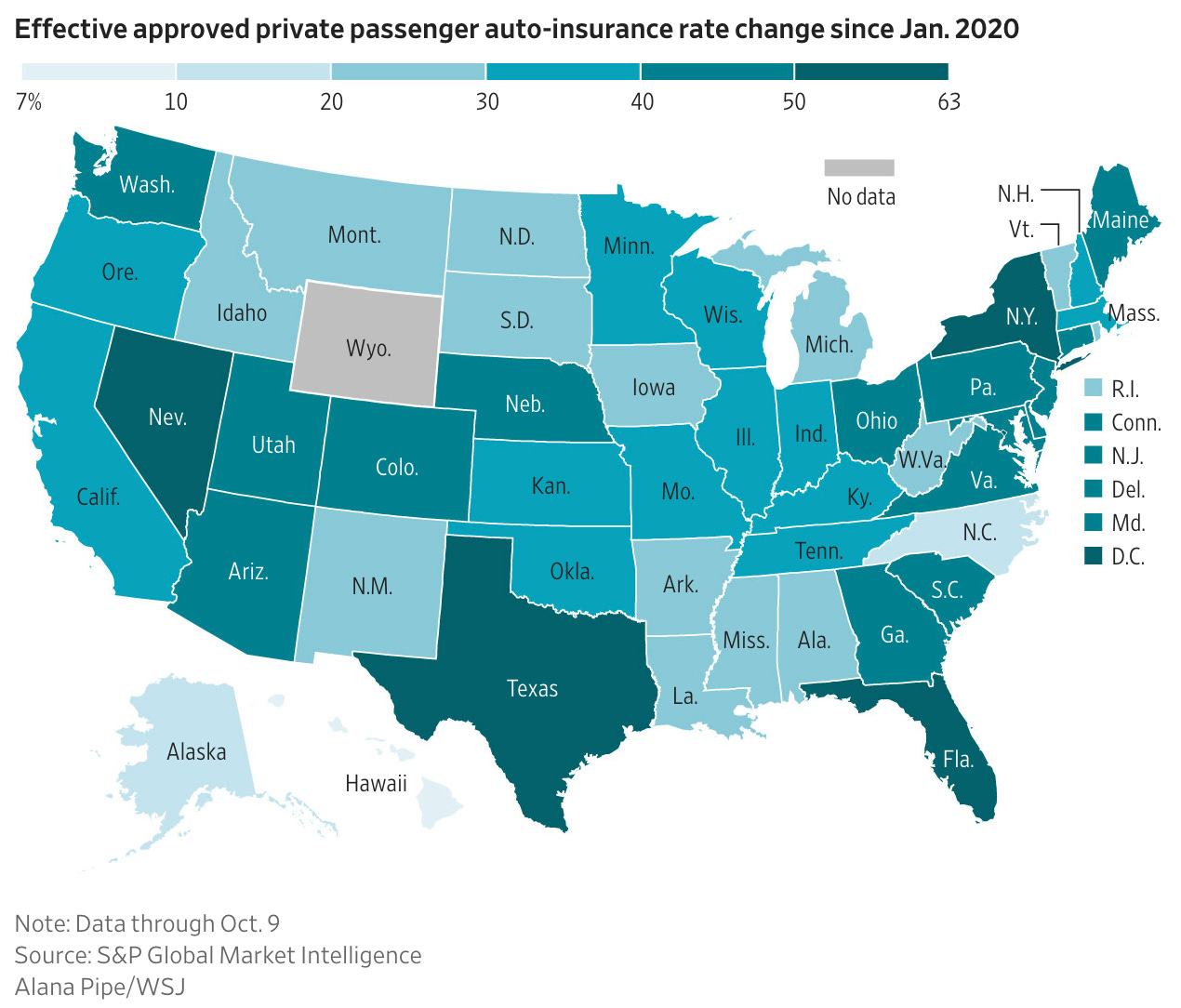

America is facing a home and auto insurance cost crisis, with premiums rising far faster than inflation—and some states are responding with price controls. Since 2020, average home-insurance rates are up 50% and auto-insurance rates 42%, compared with a 26% rise in consumer prices. In response, Illinois, Louisiana, New York, and Michigan are among the states proposing or enacting measures to cap or roll back rate increases.

Supporters say caps are necessary to protect consumers from what they see as unaffordable and arbitrary hikes—such as Illinois homeowners facing double-digit increases from State Farm. Critics, including insurers and analysts, argue that price controls distort markets, discourage competition, and ultimately lead companies to withdraw from high-risk states, worsening availability.

The insurance industry, long regulated at the state level since the 19th century, remains a unique case of private enterprise under political oversight. Some states like California are now reversing course, approving steep increases to lure insurers back after years of restrictive caps drove major companies away.

The debate has become politically charged: in Louisiana, Governor Jeff Landry pushed new powers to block “excessive” premiums, sparking a feud with his own insurance commissioner, Tim Temple, who warned that politicizing rate decisions would deepen the crisis.

Across the country, policymakers are walking a tightrope—trying to balance consumer protection with market stability—as Americans struggle to keep up with surging insurance bills and shrinking coverage options.

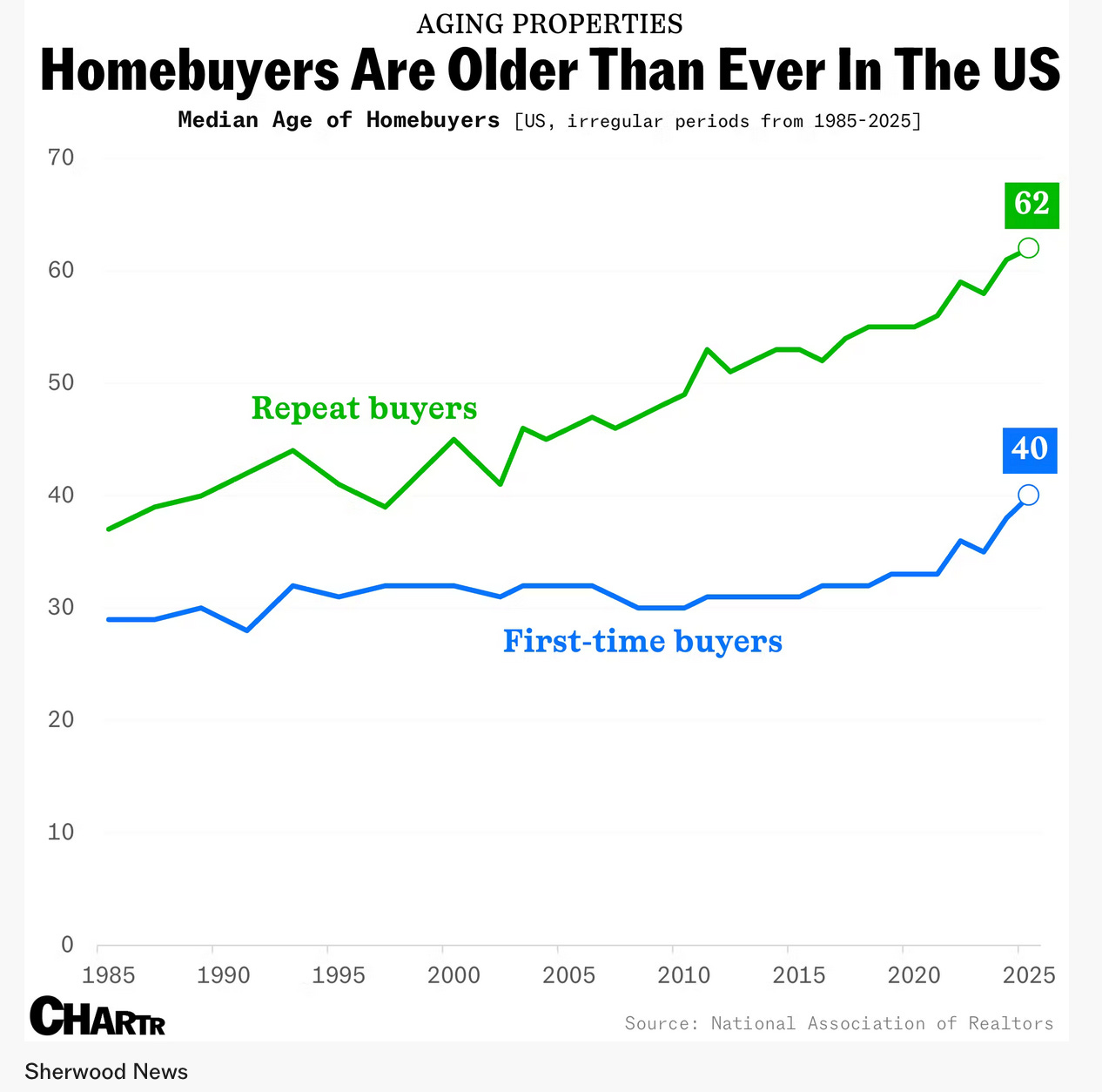

18. First-Time Home Buyer Share Falls to Historic Low of 21%, Median Age Rises to 40 (NAR)

The National Association of REALTORS®’ 2025 Profile of Home Buyers and Sellers shows that first-time home buyers now make up just 21% of the market—a record low—while their median age has reached an all-time high of 40.

Economists say the drop reflects a severe shortage of affordable homes. Compared with 2007, the share of first-time buyers has fallen by half, meaning fewer young adults are building housing wealth or moving up the property ladder. Wealthier repeat buyers, often armed with equity and cash offers, dominate the market, creating what analysts call a “tale of two cities.”

NAR leaders warned that delaying homeownership by a decade can cost families about $150,000 in lost equity on a typical starter home. They urged policymakers to tackle the root of the affordability crisis by expanding housing supply—through reforms that free up existing inventory, ease zoning and permitting restrictions, repurpose underused properties, and modernize construction methods—to help restore access to homeownership and rebuild the American Dream.

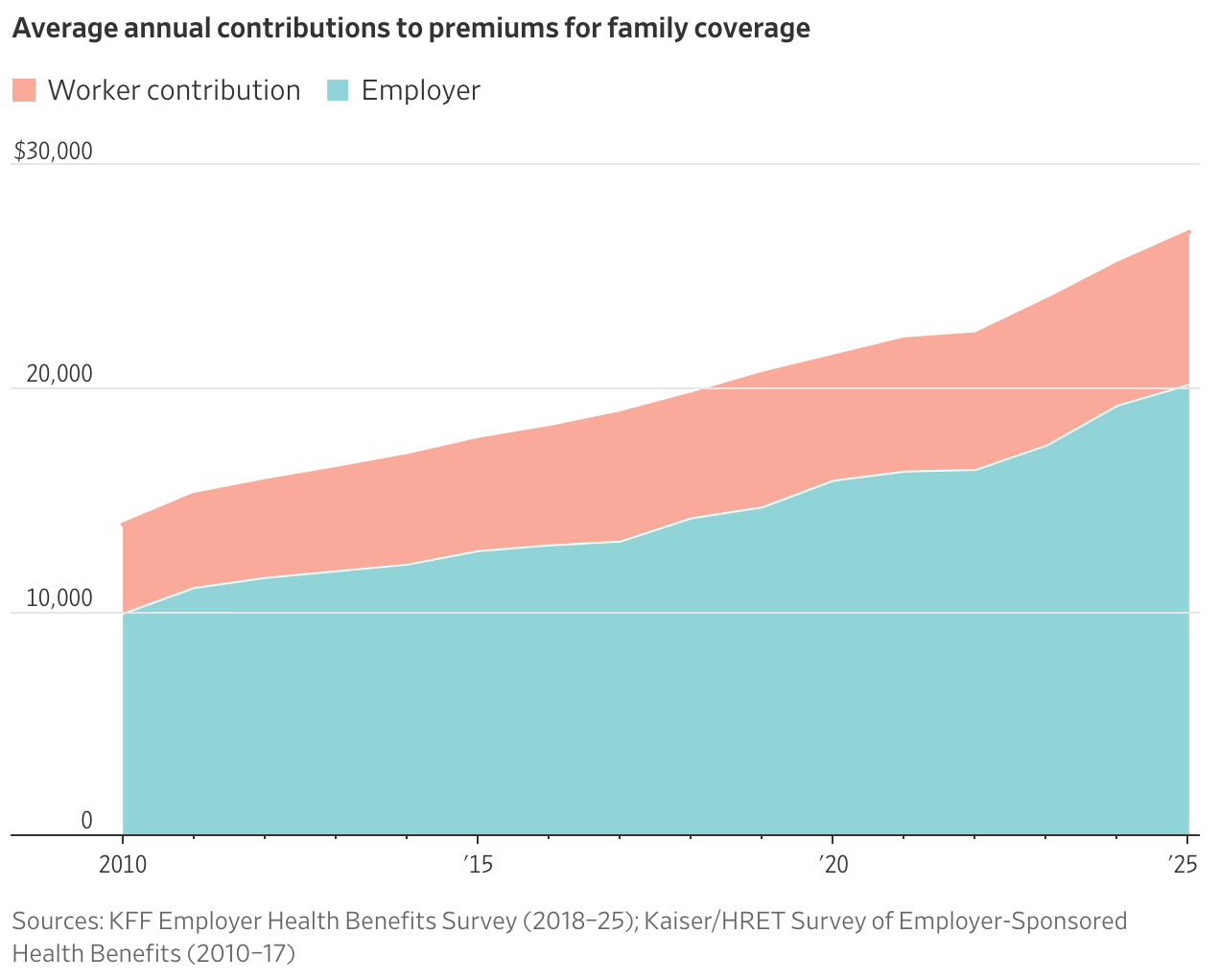

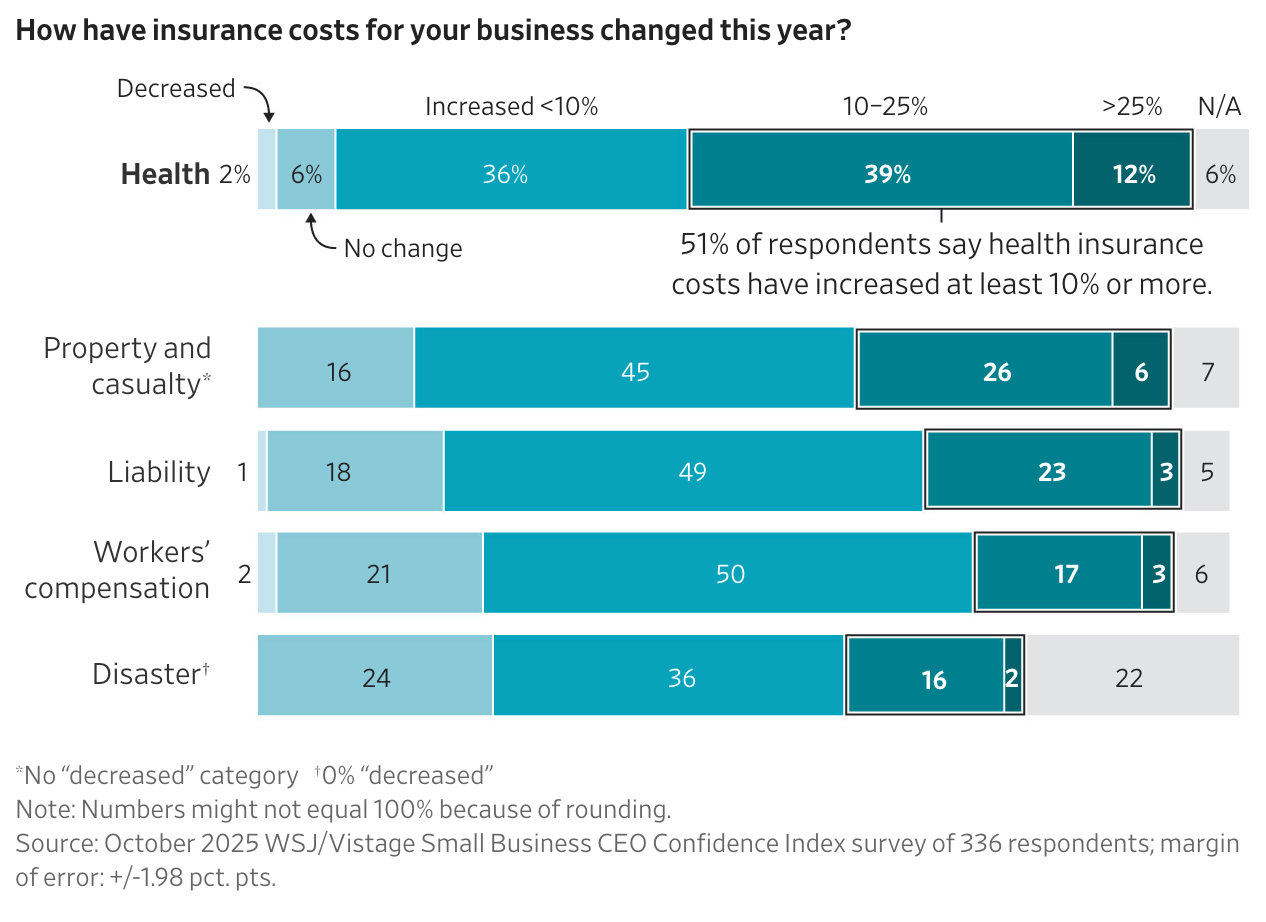

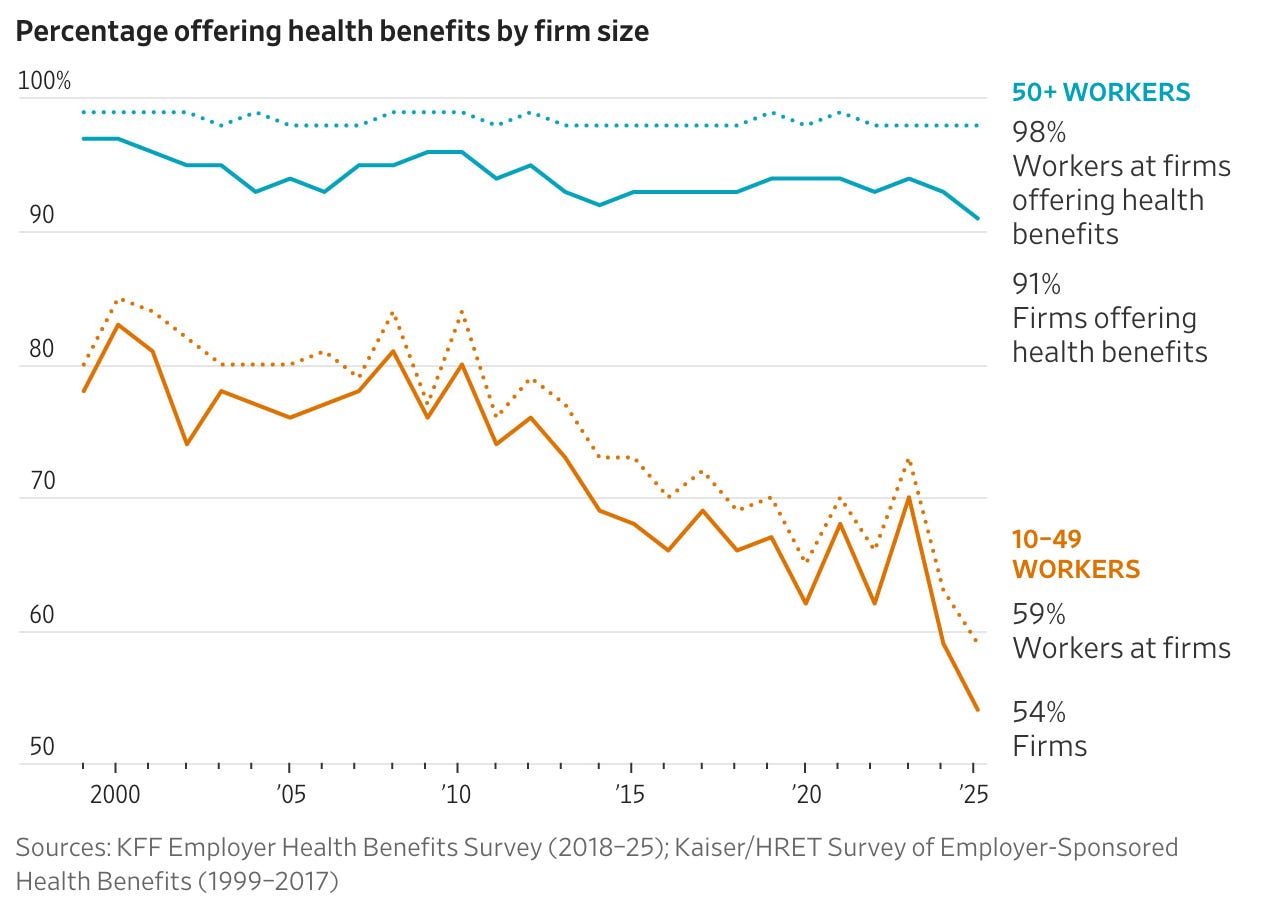

19. The Average Cost of a Family Health Insurance Plan Is Now $27,000 (WSJ)

Health-insurance costs in the U.S. are climbing at their fastest pace in years, marking the third consecutive annual surge. According to the nonprofit KFF, the average cost of employer-sponsored family coverage reached nearly $27,000 in 2025, up 6% from last year and more than 20% higher than three years ago—rising faster than both inflation and wages.

Employers cite higher healthcare spending as the main driver. Rates of chronic conditions such as cancer are increasing, hospitals have raised prices, and expensive new treatments—especially GLP-1 weight-loss drugs like Wegovy and Zepbound—are adding billions in costs. Many insurers are tightening their underwriting or refusing new business, making coverage harder to obtain and costlier to renew.

To manage the rising burden, companies are increasingly shifting costs to workers—raising deductibles, copays, or employee premium contributions. Even long-standing employers who once covered full premiums, like William Duff Architects, are now requiring staff to pay extra for broader provider networks. Smaller firms are hit hardest: over half of small businesses say their health-insurance costs rose 10% or more this year, and growing numbers are dropping traditional coverage altogether, replacing it with health-reimbursement accounts or other alternatives.

Economists warn that as premiums outpace economic growth, rising healthcare costs will continue to squeeze wages, hiring, and small-business margins, deepening what many describe as America’s employer-insurance affordability crisis.

Education

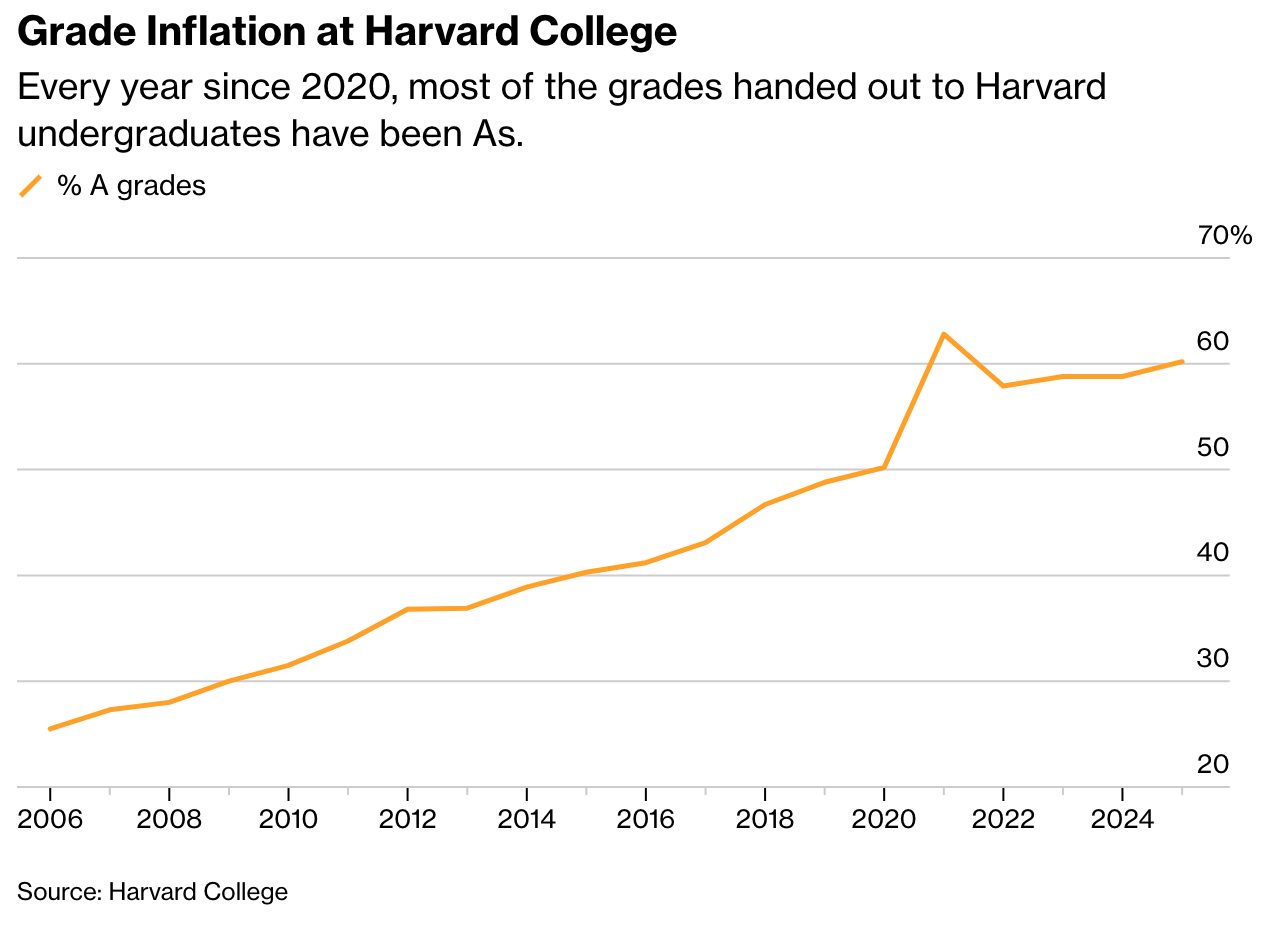

20. Harvard Says It’s Been Giving Too Many A Grades to Students (Bloomberg)

More than 60% of grades at Harvard College are now A’s, a sharp rise from 40% a decade ago and less than 25% twenty years ago, according to a new report from the Office of Undergraduate Education. The study, led by Dean Amanda Claybaugh, warns that rampant grade inflation is eroding Harvard’s academic culture and diminishing the meaning of achievement.

Claybaugh cited several causes, including professors’ fears of discouraging enrollment by grading too harshly, administrative pressure to show empathy for struggling students, and student pushback for higher grades. The report urged faculty to share median grades, track grading trends, and possibly introduce A+ grades to better recognize exceptional performance.

The findings come amid federal scrutiny of universities and new calls for “grade integrity.” Despite the overall trend, the number of first-year students with perfect GPAs fell 12% last year, which Claybaugh called a hopeful sign that grade inflation can be reversed.

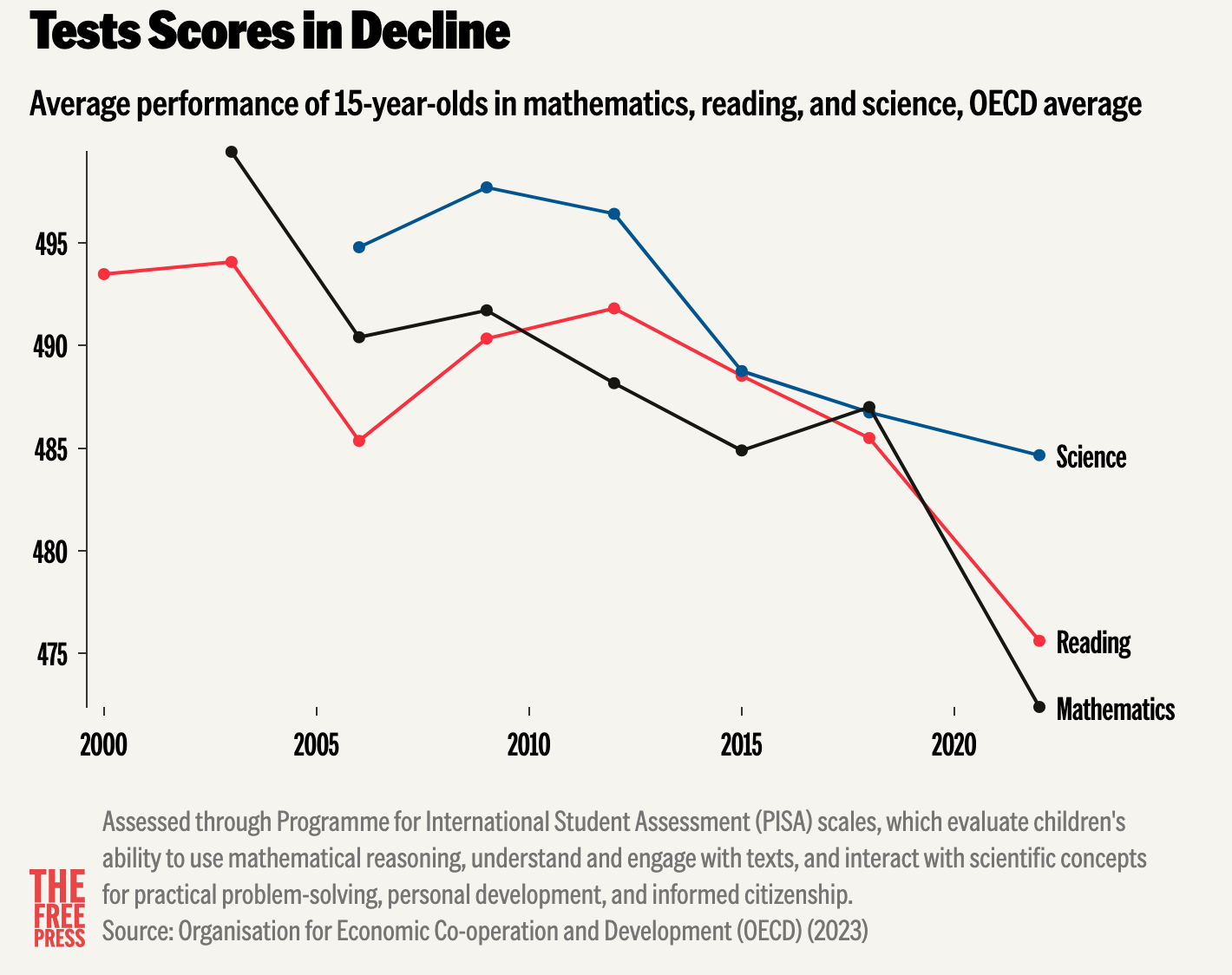

21. The Dawn of the Postliterate Society (FP)

Two great educational transformations have occurred in human history—the 18th-century “reading revolution” and today’s “screen revolution.”

In the 1700s, literacy spread rapidly beyond elites as cheap books and education flourished, creating the greatest transfer of knowledge in history. Reading reshaped how people thought: it fostered logic, analysis, and reason, giving rise to the Enlightenment, democracy, capitalism, and modern science. Books demanded sustained attention, deep comprehension, and reflection, forming the cognitive foundation of modern civilization.

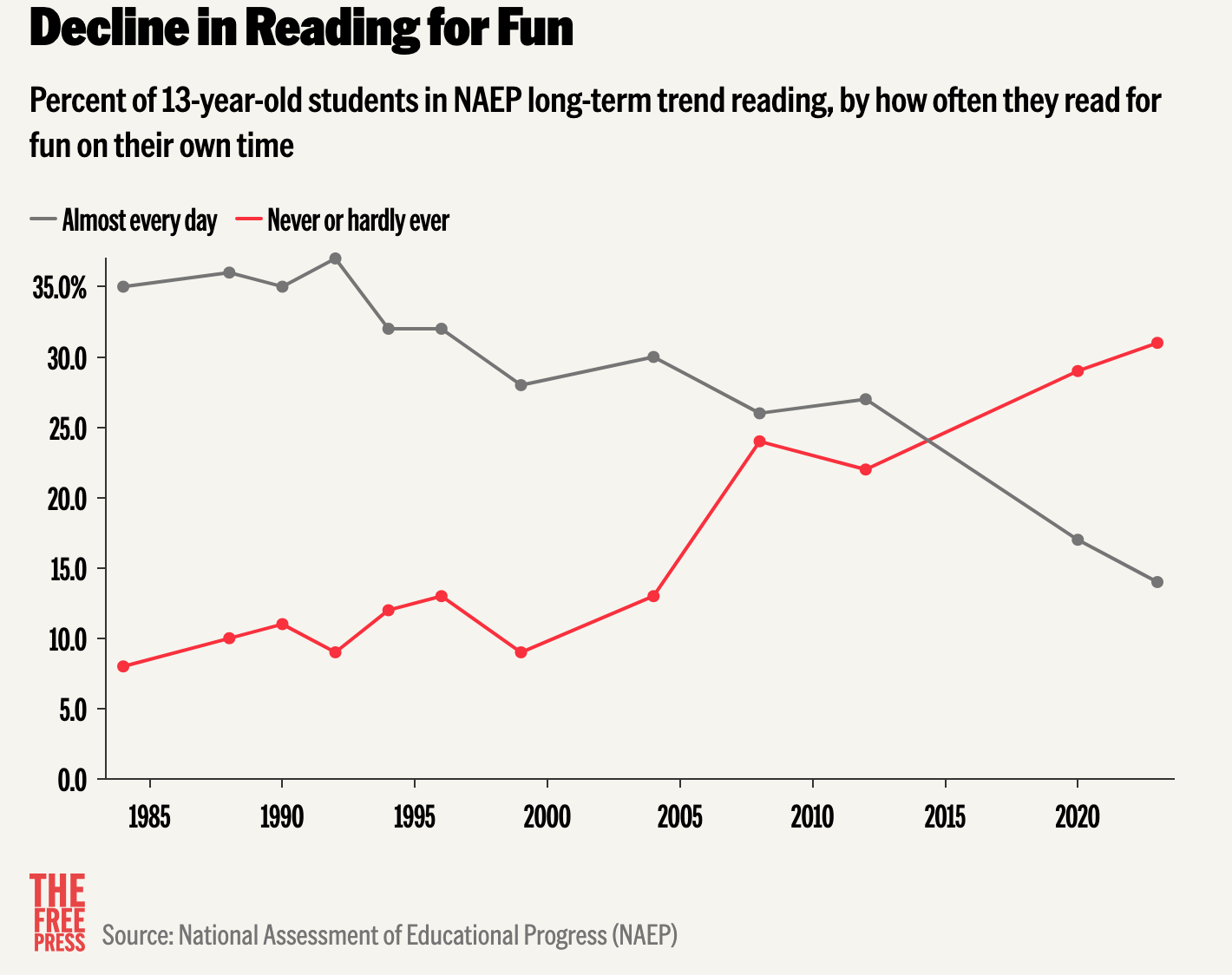

Now, the author argues, we are living through the reverse—a collapse of literacy driven by smartphones and screens. Reading for pleasure has fallen sharply, children’s literacy rates have plunged, and many students can no longer follow classic texts. The rise of hyper-addictive, short-form media has shortened attention spans and eroded the ability to think critically or sustain complex reasoning.

The result, the essay warns, is a “postliterate” society: cognitive decline, cultural stagnation, and a collapse of serious thought. As print fades, so does rational public discourse—replaced by emotional, tribal, and populist politics. Just as print once helped overthrow feudal ignorance, the screen age now threatens liberal democracy itself, draining citizens of the intellectual habits needed for freedom.

In essence, the piece contends that the reading revolution built the modern world—and the screen revolution may be dismantling it.

Health

22. The US obesity rate keeps declining, but diabetes cases have hit a new high (Sherwood)

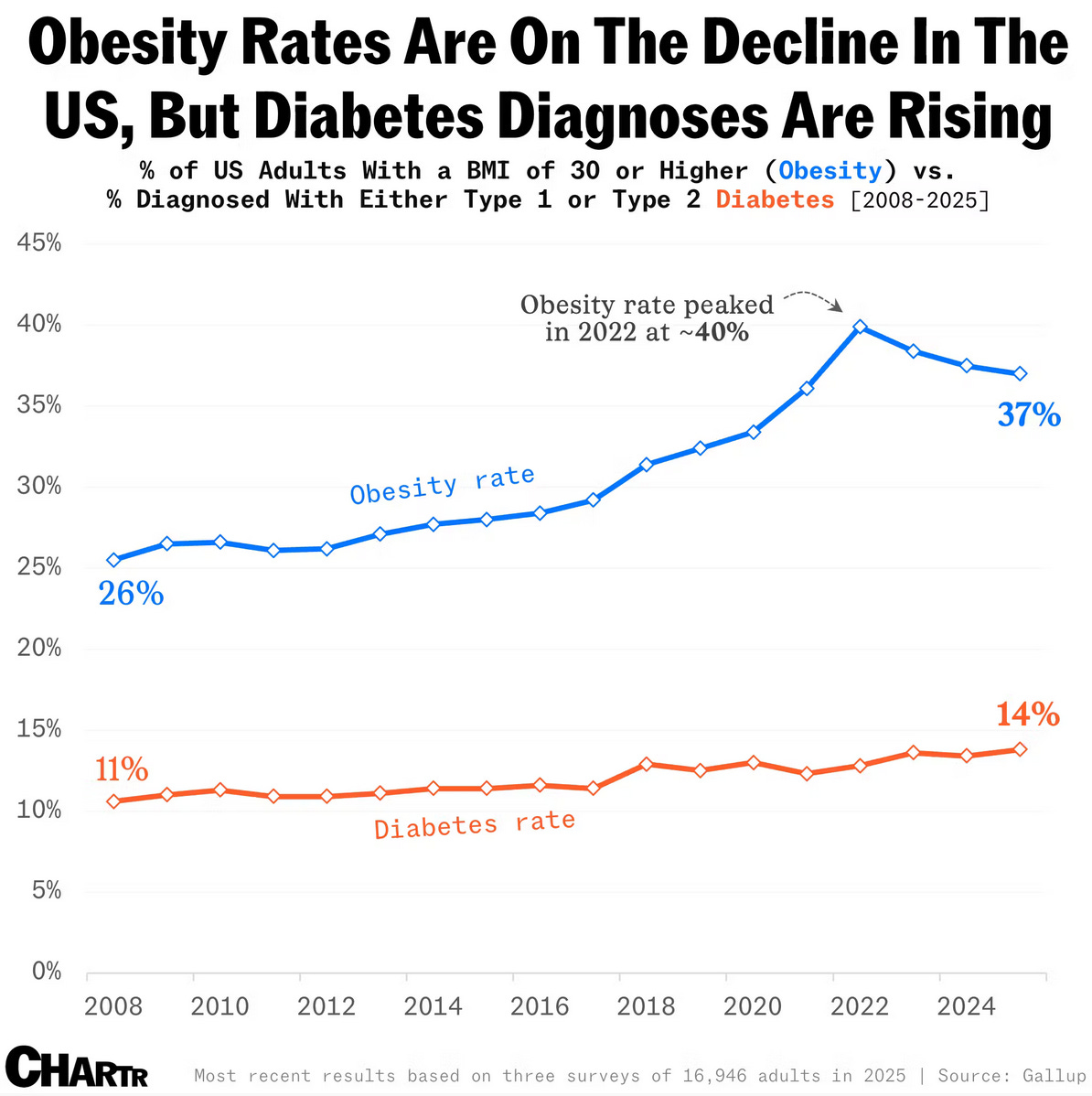

Gallup’s 2025 National Health and Well-Being Index shows that U.S. obesity rates have fallen to 37%, down from a record 39.9% in 2022—a decline equivalent to roughly 7.6 million fewer obese adults. The drop coincides with a sharp rise in the use of GLP-1 weight-loss drugs such as Ozempic and Wegovy, with 12.4% of U.S. adults now reporting use, more than double the rate from 2024.

The data show a stronger impact among women, whose obesity rate has decreased faster than men’s, reflecting higher rates of GLP-1 usage.

However, Gallup also reports a contradictory trend: the prevalence of diabetes (Type 1 and 2 combined) has reached an all-time high of 13.8% of adults, up from 11.4% a decade ago. This divergence suggests that while GLP-1 drugs effectively reduce obesity, they are not a comprehensive solution for metabolic health.

Despite recent progress, the U.S. continues to rank among the world’s most obese nations.

23. Some 60,000 kids have avoided peanut allergies due to landmark 2015 advice, study finds (CBS)

A decade after research first showed that feeding peanut products to infants could prevent allergies, new evidence confirms the approach is working on a national scale. A study published in Pediatrics found that since 2015, when U.S. health guidelines began recommending introducing peanuts as early as 4 months, roughly 60,000 children have avoided developing peanut allergies.

Analyzing data from dozens of pediatric practices, researchers found peanut allergy rates among children under age 3 dropped 27% after 2015 and more than 40% after expanded 2017 guidelines. Though overall food allergies remain common—affecting about 8% of U.S. children, including 2% with peanut allergies—the shift marks a major public-health success.

For decades, doctors advised delaying exposure to allergenic foods until age 3, but the 2015 LEAP trial by Dr. Gideon Lack proved early introduction could cut allergy risk by over 80%, with benefits lasting into adolescence. Still, adoption has been uneven: only 29% of pediatricians and 65% of allergists report consistently following the updated guidance, slowed by confusion and hesitation among parents and providers.

Experts say the findings reinforce that early, small exposures to foods like peanut butter, milk, and soy can safely train the immune system and prevent lifelong allergies. “There are fewer kids with food allergies today because of this effort,” said study author Dr. David Hill, calling it a model for how evidence-based public health guidance can reshape childhood health outcomes.

24. Why Married Couples Stay Together (American Story Lines)

Marriage in America appears strong overall: the divorce rate is declining, and about 80% of married people say they’re satisfied with their relationships. Still, about one in three marriages eventually ends in divorce, and around one in five married adults have at least contemplated leaving their spouse. Secular women are the most likely to have considered divorce, while religious couples are less likely to do so.

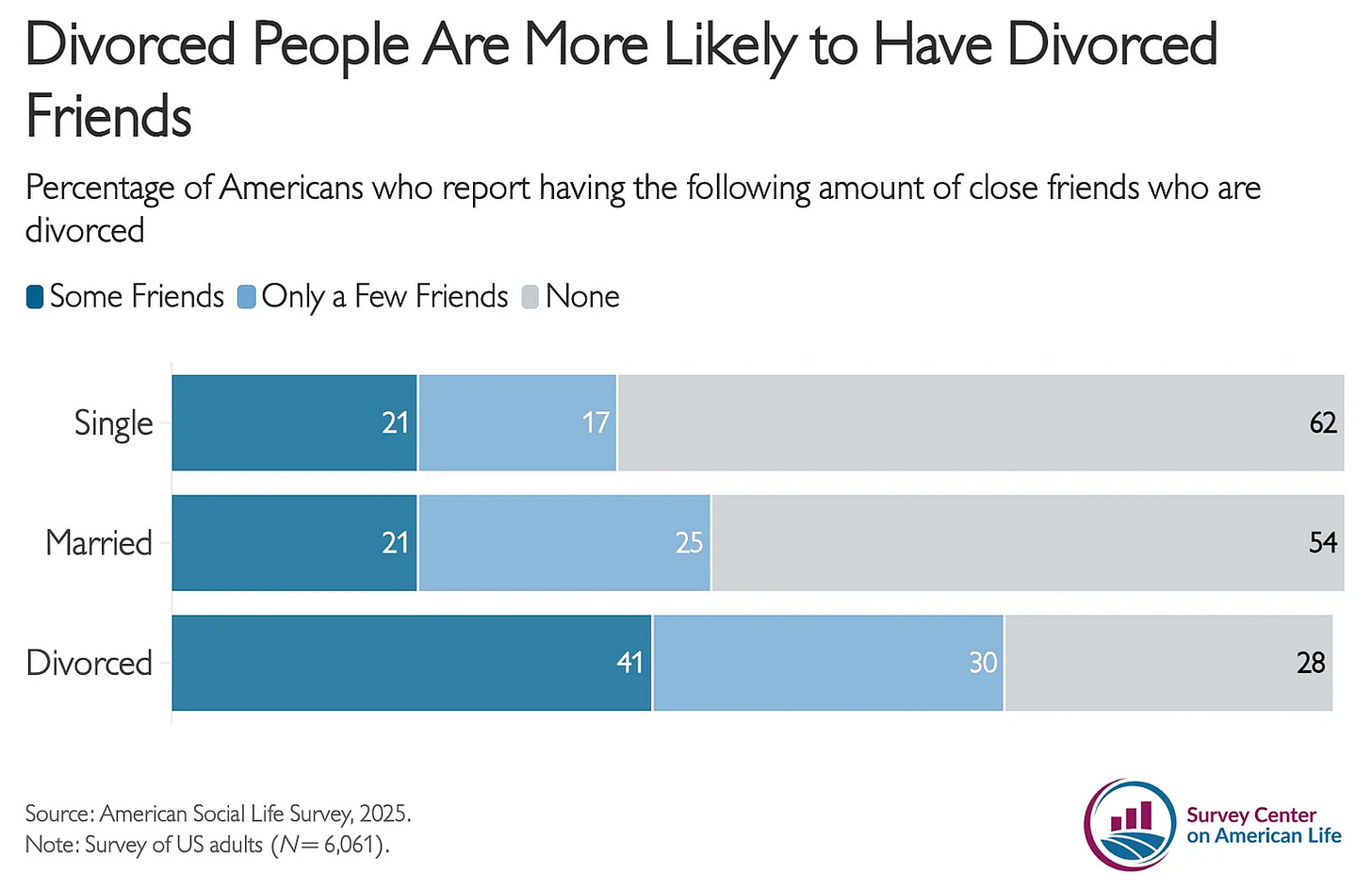

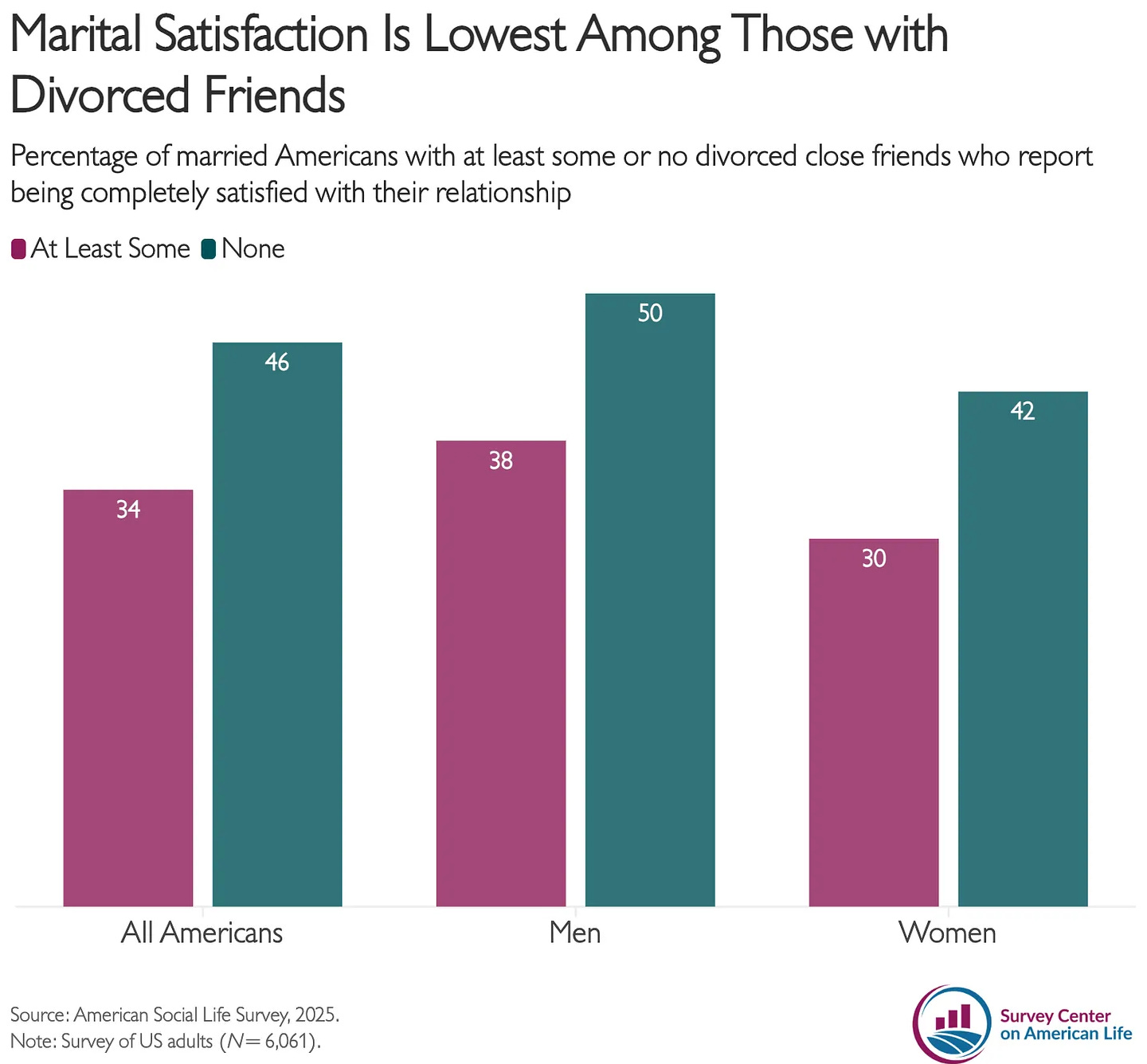

Research shows that social networks play a powerful role in marriage stability. People with divorced friends are significantly more likely to divorce themselves—one study found a 75% increase in risk when a friend divorces. Married individuals without divorced friends report higher relationship satisfaction, while those surrounded by divorce are more likely to feel unhappy.

Interviews reveal that supportive social circles can help couples work through difficulties, while friends who have divorced may unintentionally push others toward separation. The rise of social media and online forums like Reddit further complicates things by normalizing breakup advice and showcasing “alternate lives,” which can fuel dissatisfaction.

The broader conclusion: marriage success isn’t only about the couple—it depends on the social ecosystem around them. Communities that offer empathy, encouragement, and constructive guidance help strengthen marriages, while networks that normalize quitting can weaken them.

25. Your Friends Could Literally Be Keeping You Young (Vice)

A new National Institute on Aging study finds that close relationships and social engagement can actually slow biological aging—perhaps more effectively than supplements or other wellness habits. Analyzing data from over 2,000 adults, researchers created a measure of “cumulative social advantage,” combining emotional support, friendship depth, and community involvement. Those with stronger social connections showed fewer age-related DNA changes and lower chronic inflammation, both markers of slower cellular aging.

The findings suggest that loneliness and isolation trigger stress responses—raising cortisol, weakening immunity, and accelerating physical decline—while meaningful connection acts as a kind of preventative medicine. People with greater economic stability and education also tended to age more slowly, likely because security fosters stronger relationships.

In essence, the research reinforces a timeless truth: friendships and community are vital to long-term health. Maintaining close bonds, staying socially active, and nurturing trust may be among the most powerful anti-aging tools available—proving that relationships don’t just enrich life, they help extend it.

Great read, I’m especially interested to see how Harvard reverses the “A” trend