First, on a sad note:

1. Spotlighting The World Factbook as We Bid a Fond Farewell

The CIA has retired The World Factbook, one of its oldest and most widely recognized intelligence publications. Originally launched in 1962 as a classified document called The National Basic Intelligence Factbook, it later gained an unclassified companion in 1971, was renamed The World Factbook in the early 1980s, and went fully digital in 1997 on CIA.gov. Over time, it evolved from a print intelligence reference into a globally accessible online resource, expanding its categories and coverage of countries and entities worldwide. The Factbook became a popular reference for researchers, journalists, educators, students, and travelers, and featured more than 5,000 copyright-free photographs, many contributed by CIA officers. Although it has now been discontinued, the publication leaves behind a legacy of accessible global information and public curiosity about world affairs.

Economy

2. This Is Why It’s So Hard to Find a Job Right Now

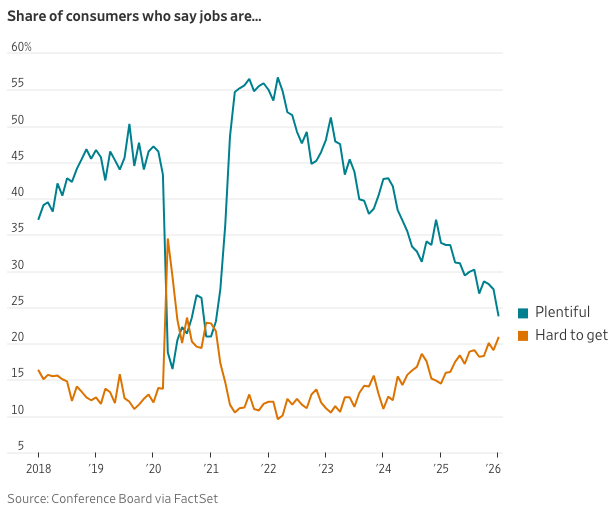

U.S. hiring has slowed sharply due to a mix of factors, including tariff uncertainty, high interest rates, post-pandemic overstaffing in tech, and a drop in worker mobility. With fewer employees quitting—3.2 million in December compared with 4.5 million at the 2022 peak—employers have less need for replacement hiring. The hires rate has fallen to 3.3%, well below pre-pandemic levels, even as unemployment remains relatively low at 4.4%.

Immigration restrictions and an aging population have further reduced labor-force growth, lowering the number of jobs the economy needs to add each month to keep unemployment stable. Economists estimate that required monthly job growth has fallen dramatically, potentially to as low as 15,000 jobs. While artificial intelligence may be dampening hiring in certain fields, particularly tech and entry-level roles, its aggregate impact remains limited so far. Overall, muted hiring reflects a cautious business environment and slower labor-force expansion rather than widespread layoffs or recession-level weakness.

And separately, from Sherwood:

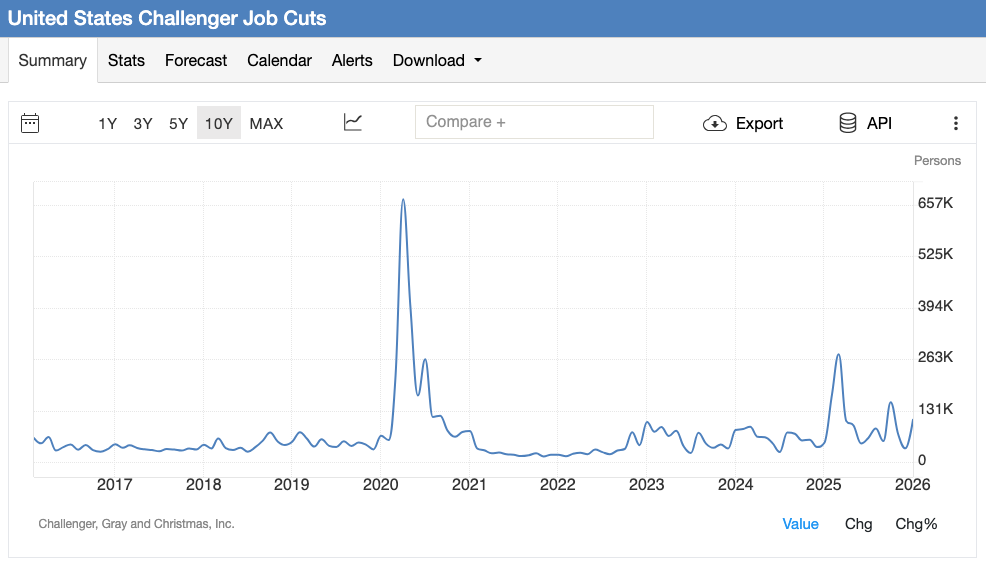

3. Job Cuts Surge in January; Highest January Total Since 2009. Lowest January Hirking on Record

U.S. employers announced 108,435 job cuts in January, up 118% from a year earlier and 205% from December, marking the highest January total since 2009. The largest reductions came from transportation (31,243 cuts, largely from UPS), technology (22,291, including 16,000 from Amazon), and healthcare (17,107, amid inflation and lower reimbursements). Chemical manufacturing also saw notable layoffs tied partly to automation and AI. Companies cited contract losses, economic conditions, restructuring, and closures as the primary reasons, while AI accounted for 7% of January cuts.

Hiring plans were weak, with just 5,306 announced—the lowest January total since tracking began in 2009 and nearly half December’s level. While executives increasingly reference AI in restructuring decisions, broader economic uncertainty and cost pressures appear to be the dominant drivers behind the surge in layoffs and muted hiring outlook.

4. The Federal Government Booked a $1.8 Trillion Deficit Last Year

The federal deficit remained historically high in 2025 at $1.8 trillion—about 6% of GDP—even amid economic expansion and low unemployment. Federal revenue rose to $5.2 trillion, largely from higher income and payroll taxes and $118 billion in tariff revenue, but spending climbed to $7.01 trillion, driven primarily by increased costs for Medicaid, Medicare, and Social Security. The national debt reached $37.9 trillion, nearly 100% of GDP, a level previously exceeded only during World War II and the COVID-19 pandemic. Economists warn that sustained deficits at this level risk higher inflation, rising interest costs, slower growth, and reduced capacity to respond to future crises.

Despite aggressive rhetoric about cutting government, legislative actions have not meaningfully reduced spending. Trump’s major tax-and-spending package is projected to add trillions to future deficits, and continuing resolutions have largely preserved prior spending levels. Efforts such as workforce reductions and rescissions have produced limited savings, while entitlement programs and rising interest payments remain the primary drivers of long-term deficits. Without structural reforms to Social Security, Medicare, and Medicaid, deficit growth is expected to continue regardless of executive actions.

5. How a $30 Billion Welfare Program Became a ‘Slush Fund’ for States

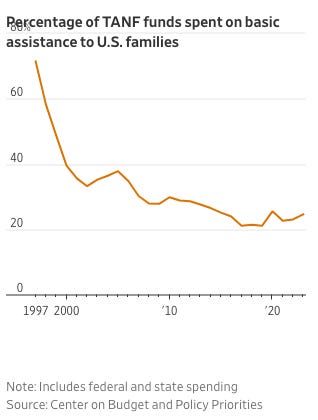

The Trump administration moved to freeze billions in federal welfare funds over fraud concerns, targeting several Democratic-led states, but longstanding problems with the Temporary Assistance for Needy Families (TANF) program span both red and blue states. TANF, a $30 billion block-grant program created in 1996, gives states wide flexibility and limited reporting requirements. Audits across at least 37 states have identified serious oversight deficiencies, including inaccurate reporting, weak documentation, and millions distributed to contractors without clear tracking. Funds have supported initiatives only loosely tied—or unrelated—to TANF’s core goals, such as college scholarships benefiting middle- and upper-income families, antiabortion centers, foster-care programs already funded elsewhere, and in one case, fraudulent spending that led to criminal convictions.

Critics across the political spectrum argue that lax federal oversight and vague statutory rules have allowed TANF funds to function as a budgetary “slush fund,” with only about 20% of impoverished families now receiving direct cash assistance. In 2010, 1.9 million families received direct cash aid; in 2025, that number was down to 849,000. Despite repeated recommendations from the Government Accountability Office to tighten reporting requirements and improve auditing, Congress has not enacted reforms. The administration’s recent funding freeze prompted lawsuits and a temporary court block, while broader legislative efforts have focused on other welfare programs without addressing TANF’s structural weaknesses. Economists and policy analysts warn that without clearer federal standards and accountability measures, misuse and mission drift will likely persist.

Business

6. VCs Are Throwing Money At Recent College Grads To Build Prediction Markets

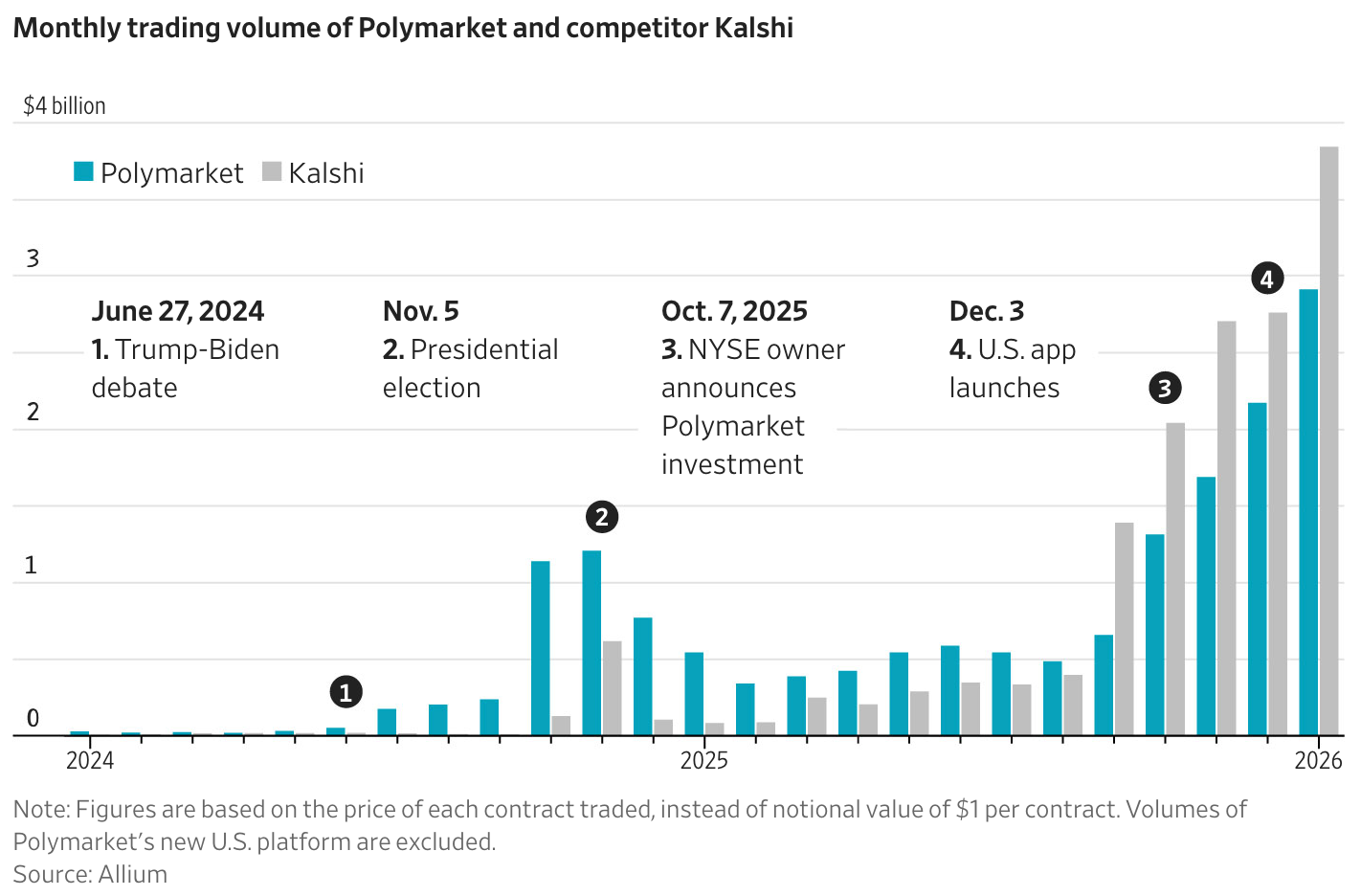

Prediction markets have surged in popularity, drawing $3.7 billion in new funding in 2025 and handling more than $40 billion in wagers on platforms like Kalshi and Polymarket. January alone saw over $10 billion in trading volume. Major investors have pushed valuations to $11 billion and $9 billion respectively, minting young billionaire founders and signaling strong regulatory and political tailwinds. Venture capital firms describe the sector as one of the hottest areas for new founders.

A new wave of startups is expanding beyond simple yes/no contracts into attention markets, long/short-style positions on trends, AI-related hedging products, analytics platforms, and trading terminals built on top of existing exchanges. Some promote prediction markets as insurance-like tools or as benchmarking systems for AI models. Despite rapid growth, profitability remains unproven and concerns persist about manipulation, consumer protections, and the blurred boundary between gambling and finance—yet investor enthusiasm continues to accelerate.

NOTE: You can bet (or start a betting market) on just about anything in Polymarket—from the fed interest rate decision, to sports, to Epstein Island. In the screenshot below there is currently around $200M worth of bets being made on Polymarket…and that’s only 12 markets. I’m guessing there are hundreds of markets.

7. The Wild Markets Behind Polymarket’s ‘Truth Machine’

FBI agents raided Polymarket founder Shayne Coplan’s Manhattan apartment on Nov. 13, 2024, as federal prosecutors investigated whether the crypto-based prediction market was violating anti–money-laundering laws and serving U.S. users in breach of a prior CFTC settlement. Fourteen months later, the investigation was dropped, Polymarket gained powerful backers and mainstream partnerships, and it was cleared to launch a regulated U.S. betting app—helping propel the company to a $9 billion valuation and making Coplan a billionaire.

Polymarket is both a fast-rising “truth machine” and a controversy magnet. Its contracts—priced to imply probabilities—are increasingly cited by media and integrated via partnerships with major platforms, yet much of its core international product remains lightly regulated and largely anonymous, with limited identity checks. That anonymity, along with research alleging signs of wash trading and repeated episodes of suspicious or disputed market resolutions (war-related outcomes, Maduro’s ouster, a Nobel-related wager, and ambiguous bet-settlement calls), fuels concerns about manipulation and insider trading. Polymarket says it complies with applicable laws, bans wash trading, and argues that transparency and social scrutiny make misconduct easier to spot.

The political and regulatory context: Polymarket paid a fine in 2022 and barred U.S. users from its offshore platform, but Americans reportedly continued using it via VPNs and crypto deposits. In 2024, as election betting surged, the company found a warmer reception among Republicans and crypto-friendly investors; 1789 Capital invested, Donald Trump Jr. later became an adviser, and enforcement priorities shifted after Trump took office toward fraud and serious criminal financing. After extensive lobbying and document submissions by Polymarket’s lawyers, prosecutors notified the company on July 1 that the probe was being shelved, closing a dramatic arc from raid to legitimacy and rapid growth.

8. America Is Slow-Walking Into a Polymarket Disaster

Prediction markets—platforms like Kalshi and Polymarket—are rapidly moving from internet subculture into mainstream news. Odds generated by online betting are now being cited on CNN, integrated into coverage by Dow Jones outlets, and even displayed during events like the Golden Globes. The premise is simple: people who wager real money supposedly reveal truer beliefs about future events than polls or pundits. As a result, probabilities about elections, geopolitics, interest rates, and even celebrity outcomes are increasingly framed as news.

The concern is that this “financialization of everything” turns journalism into a form of gambling commentary, with serious consequences. Prediction markets are easily manipulated, opaque, and not consistently more accurate than chance—especially for complex political outcomes. Large bets can distort odds and, once amplified by media coverage, shape public perception or even real-world behavior. Unlike polls, these markets allow wealthy or motivated actors to buy influence directly. By normalizing odds as insight, news organizations risk confusing speculation with knowledge, eroding trust, and encouraging a worldview where every event—from wars to press briefings—is something to bet on rather than understand.

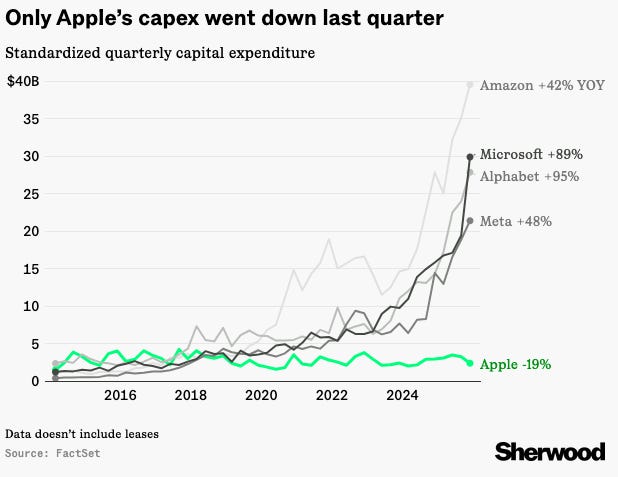

9. Apple is the only Big Tech company whose capex declined last quarter

Big Tech companies are dramatically increasing capital expenditures to build AI infrastructure, with Amazon, Alphabet, Meta, and Microsoft spending record amounts on chips and data centers. Their 2026 projections far exceed expectations: Amazon plans up to $200 billion, Google $175–185 billion, and Meta $115–135 billion, while Microsoft is also expected to spend well above prior forecasts. These massive outlays have weighed on stock performance as investors weigh the risks of heavy upfront investment in uncertain AI returns.

Apple stands apart, with capital spending declining year over year and remaining far below peers. Rather than building massive in-house AI infrastructure, Apple is pursuing a hybrid strategy that relies partly on third-party providers, including a reported $1 billion-per-year deal to use Google’s Gemini for Siri and Apple Intelligence. This approach limits capital risk and keeps spending off its balance sheet, but it also means Apple won’t fully control foundational AI technology if it proves transformative.

Speaking of AI…

Artificial Intelligence

10. Tom Cruise fights Brad Pitt

NOTE: Filmmaker Ruairi Robinson used AI to create a movie-quality fight scene between Brad Pitt and Tom Cruise. It’s made the rounds in social media with many prominent Hollywood folks expressing their concerns.

It’s not just movies. If you seen some of the previous posts I’ve shared, you know AI can generate music as well. I think the videos below do a good job of showing what’s possible with AI and music (good and bad):

Soul/R&B:

Country:

As Rick Beato points out, the good news, for now, is the actual “top songs” are still being sung by humans.

PREDICTION 1: Within five years, you will sit at home on a Friday night and ask AI to make a movie for you based on genre, actors/characters, setting, and length and it will churn out a Hollywood-level flick for you.

From songs to movies to video games, you’ll create all your own entertainment:

11. Google’s Project Genie lets you create your own 3D interactive worlds

Google DeepMind has opened access to Genie 3—a “world model” that generates interactive environments—to the public via Project Genie. Previously framed as a tool for training AI agents, Genie 3 now lets users explore, remix, or sketch AI-generated worlds, choosing perspectives (first-, third-person, or isometric), characters, and movement styles. Access is limited to U.S. users 18+ on Google’s $250/month AI Ultra plan, with Nano Banana Pro producing an editable preview before exploration.

The experience isn’t a full game engine: interactions are game-like but lack traditional mechanics, sessions are capped at 60 seconds, and visuals top out at 720p/24 fps. Even with those constraints, Project Genie offers a rare hands-on look at cutting-edge world-model tech and how DeepMind envisions interactive simulation beyond games.

Link: https://labs.google/projectgenie

PREDICTION 2: Like most things, we as humans will overdo this. At first, it’ll be fun. People will share prompts that they used to create unique and Oscar-worthy films. Infinite movie mashups will be possible and we will create and watch as many of them as we can. It’ll be like eating calorie-free desserts at every meal—desserts that are delicious and have no effect on our waistline or sugar levels.

PREDICTION 3: If you eat dessert at every meal, you soon get tired of dessert. Eventually, every type of film that can be created will and we’ll get tired of it all. We’ll seek out in-person performances where we watch real-people act or sing or dance. It’ll be a breath of fresh air and feel human.

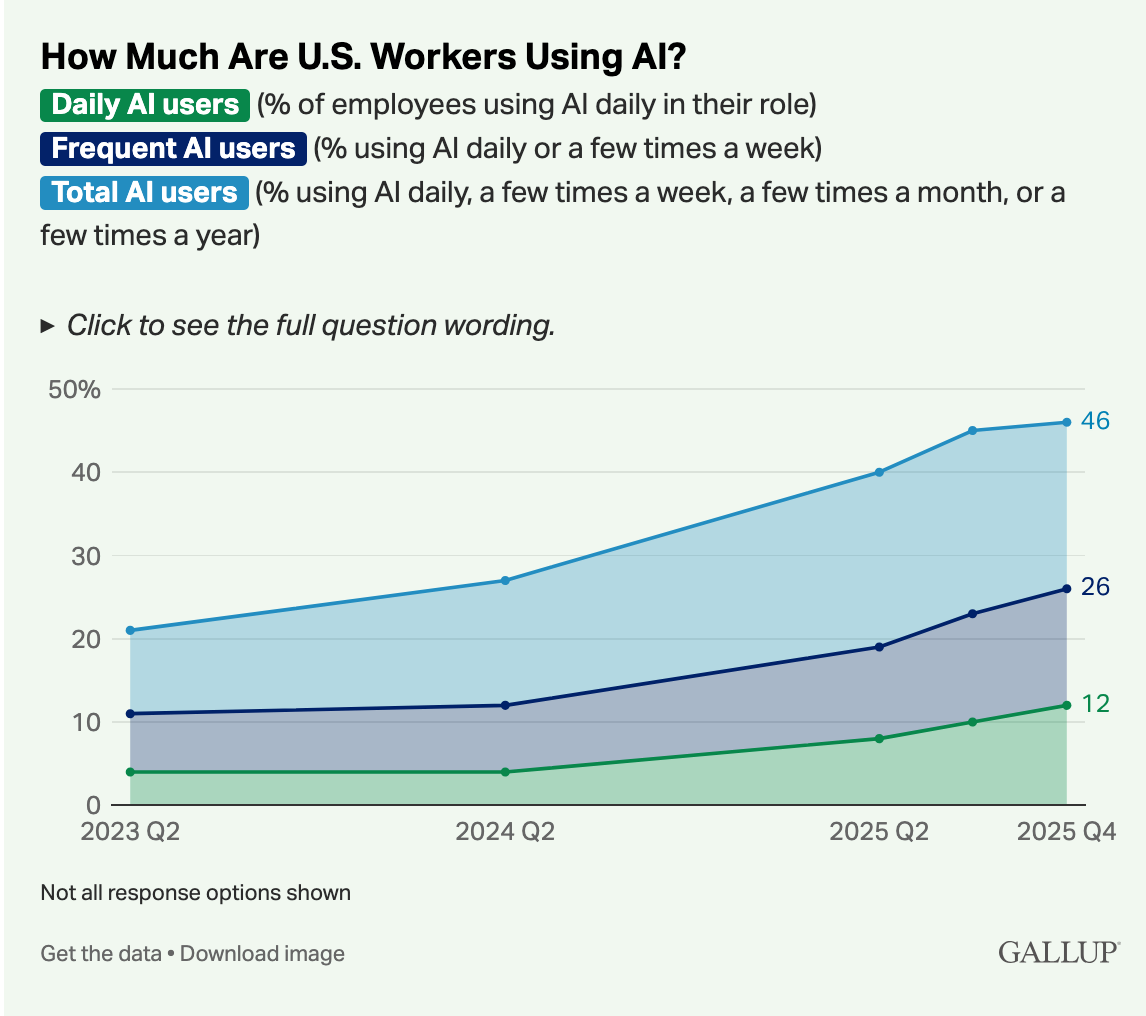

12. Frequent Use of AI in the Workplace Continued to Rise in Q4

Workplace AI use in the U.S. continued its gradual climb in late 2025, driven more by deeper use among existing users than by new adopters. Daily AI use rose from 10% to 12% in Q4, and frequent use (a few times a week or more) increased to 26%. However, overall adoption stalled: nearly half of U.S. workers still say they never use AI at work, and the share of total users (those using AI at least a few times a year) was flat after earlier rapid gains.

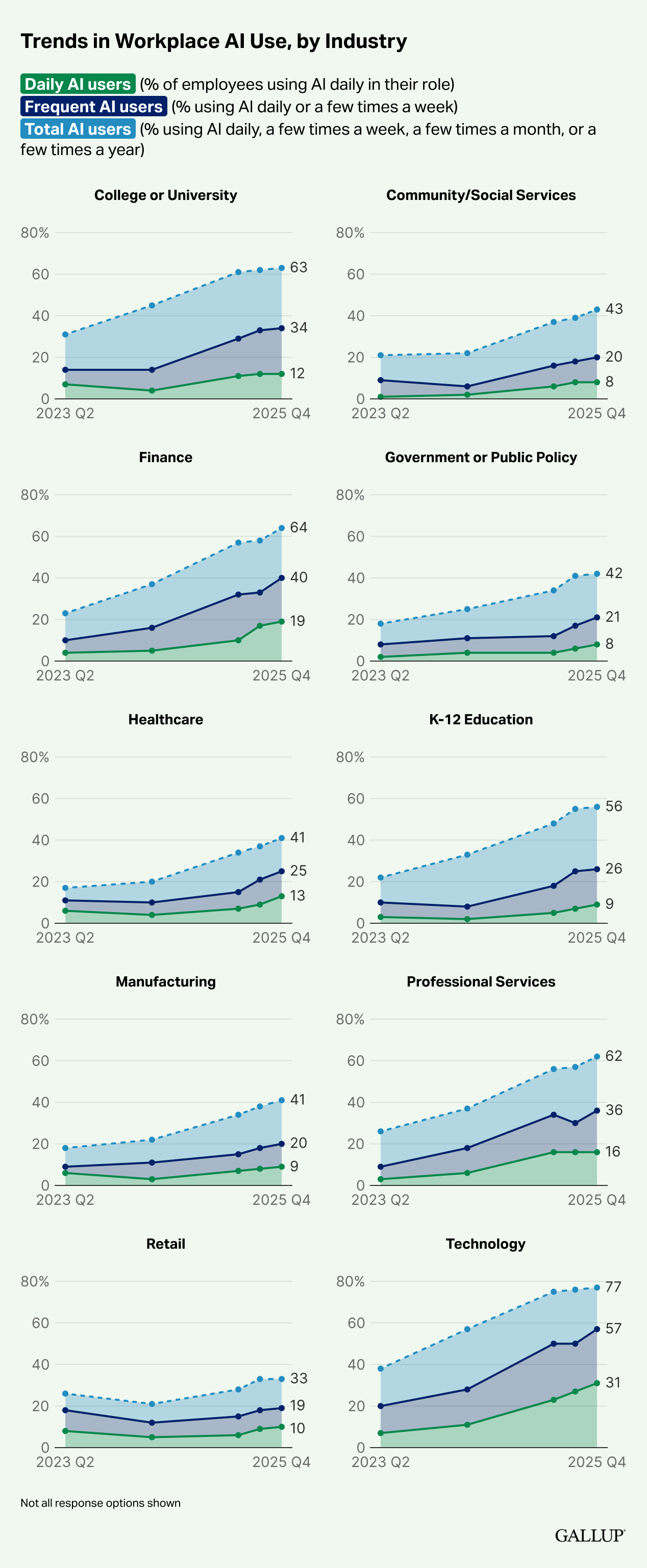

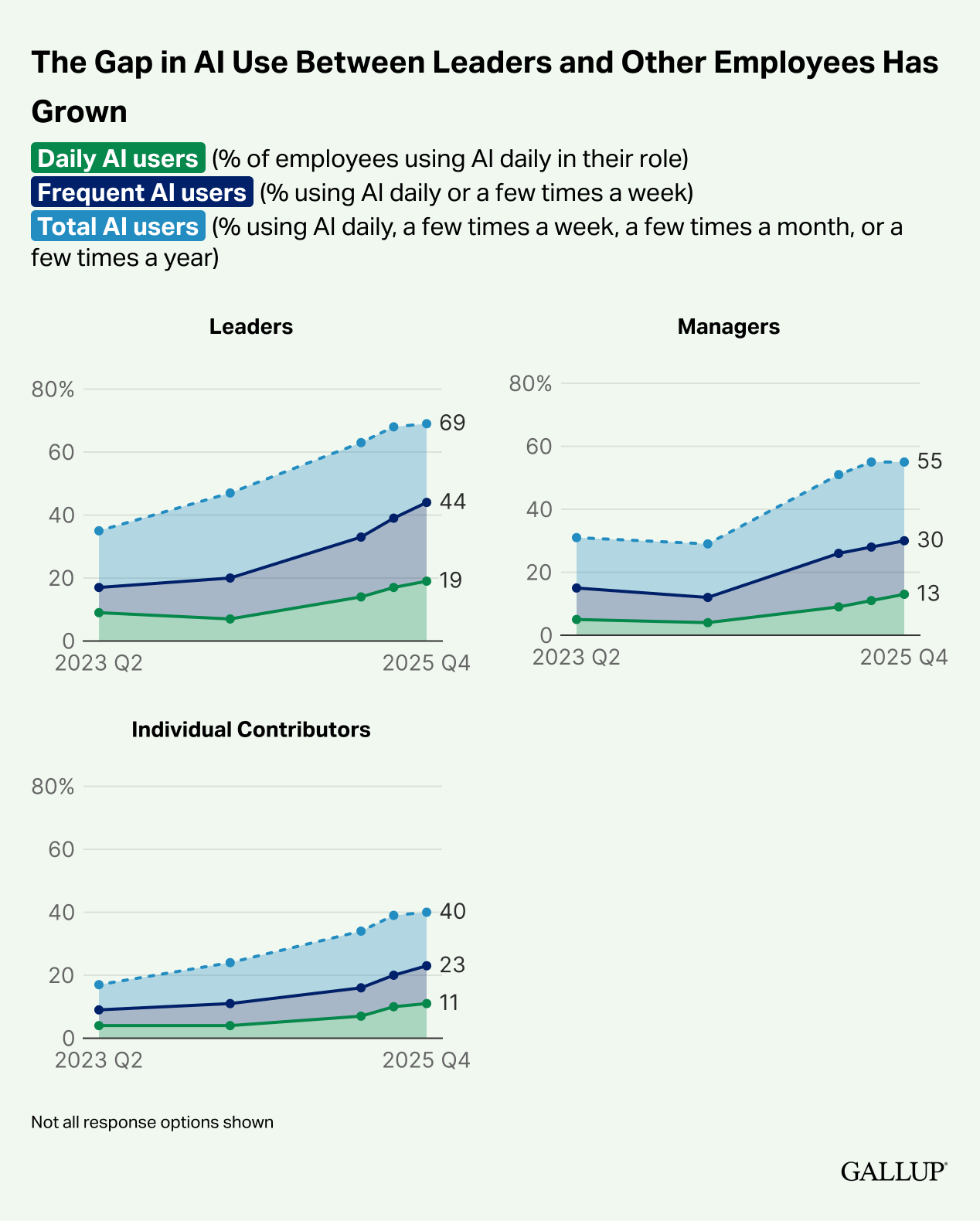

Adoption remains highly uneven. Knowledge-based industries lead by a wide margin, with technology, finance, higher education, and professional services showing the highest use, while retail, manufacturing, healthcare, government, and social services lag far behind. Roles that are remote-capable account for most of the growth, with two-thirds of those workers now using AI, compared with about one-third in non-remote-capable jobs. Leaders also use AI far more than managers or individual contributors, and the gap is widening. According to Gallup, this pattern helps explain why overall adoption appears to be slowing: AI is becoming more embedded among certain industries, roles, and leaders, even as many workers see little relevance or clear use for it in their jobs.

13. OpenAI Plans Fourth-Quarter IPO in Race to Beat Anthropic to Market

The piece highlights the staggering scale and risk of today’s AI arms race. Both OpenAI and Anthropic are burning billions of dollars annually to train new models and operate existing products, with profitability still years away. Anthropic projects it will break even in 2028—earlier than OpenAI—but only after massive capital infusions, including a recent $10 billion raise. The article also touches on CEO concerns about which sectors face the greatest AI-driven job disruption and how seriously companies are taking safety as systems grow more powerful.

At the same time, OpenAI is pursuing what could be one of the largest fundraising efforts in tech history. The company is seeking more than $100 billion in a pre-IPO-style round that would value it around $830 billion. SoftBank is in talks to invest roughly $30 billion, while Amazon has discussed putting in up to $50 billion, with CEO Andy Jassy personally involved in negotiations with Sam Altman. Together, the moves underscore both the enormous financial demands of frontier AI and investors’ belief that a few dominant players could reshape entire industries despite years of losses.

14. The AI frenzy is creating a big problem for consumer electronics

AI enthusiasm is colliding with a hard constraint: memory chips. As demand for AI systems explodes—especially data centers using high-bandwidth memory (HBM)—chipmakers are diverting production away from the standard DRAM used in phones, PCs, cars, and consoles. The result is a severe supply crunch. Prices for consumer DRAM (notably DDR4) have surged dramatically, prompting warnings of higher gadget prices, delayed launches, and falling shipment volumes for smartphones and PCs. While memory is a cyclical industry, this shortage may last longer because AI is structurally reshaping how chips are made, priced, and allocated.

The squeeze is intensified by concentration and incentives. Three firms—SK Hynix, Samsung, and Micron—control over 90% of DRAM revenue and are rapidly shifting capacity to HBM, which is far more profitable but also far more resource-intensive to produce. HBM is expected to generate half of all DRAM revenue by the end of the decade, up from just 8% in 2023. That leaves less supply of basic memory, which makes up a large share of device costs. Big players like Apple and Samsung can better absorb or offset the shock, but others—PC makers, smartphone brands, and especially carmakers—face margin pressure and price hikes. Even planned increases in chip investment will take years to translate into new supply, meaning consumers are likely to feel the effects for some time unless the AI boom itself cools.

Health

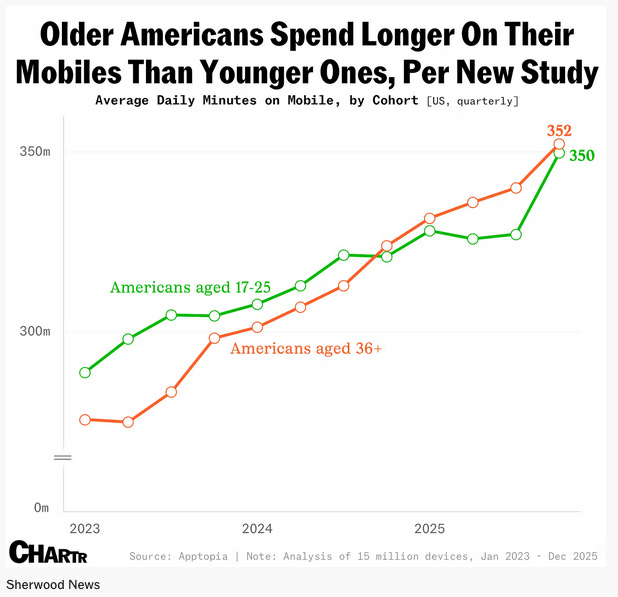

15. Older Americans are spending more time on their phones than younger cohorts, per new data

Concerns about young people’s dependence on new technology have surfaced throughout history, from novels to radio to smartphones. However, recent data suggest younger Americans may no longer be the heaviest phone users. According to Apptopia, 17- to 25-year-olds now spend slightly less time on their phones—about 350 minutes per day—than adults aged 36 and over, who average 352 minutes. This shift has persisted since late 2024 and may reflect younger users intentionally disengaging from technology, while older adults increasingly use companion apps and digital services.

Overall phone use continues to rise across all age groups. The average American now spends 6.3 hours per day on their phone, up from 5.5 hours at the start of 2023. While usage patterns are evolving—such as more video consumption and fewer gaming apps—the total time spent on mobile devices keeps climbing regardless of age.

NOTE: In a previous post, I shared the article, More Americans are living alone than ever before, which discussed a minimalist Chinese app called Sile Me (“Are You Dead?”). The app simply requires users to press a button every two days to confirm they are alive or else alert an emergency contact, has become the top paid app in China’s iPhone App Store. A reader of my newsletter pointed out another app here in the US called, Carely, that is very similar.

This confluence of increased phone use, increased personalized AI use, and increased isolation is going to continue to impact our society in ways that are not healthy.

Entertainment

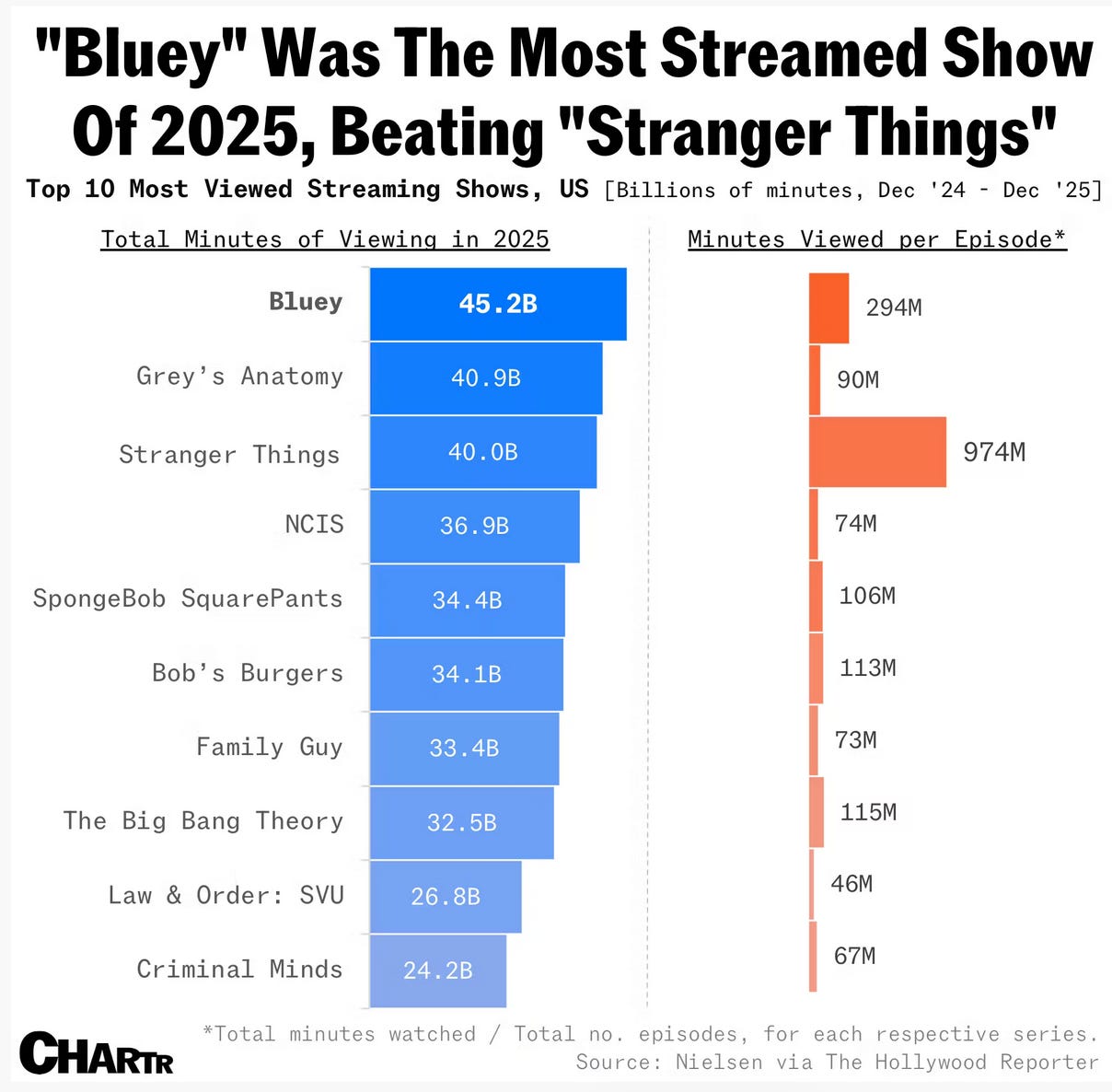

16. “Bluey” is America’s most streamed show for the second year in a row

Bluey dominated U.S. streaming for a second consecutive year, logging 45.2 billion minutes watched in 2025—more than any other show and well ahead of runners-up like Grey’s Anatomy and Stranger Things. With 154 short episodes, Bluey averaged about 294 million minutes per episode, underscoring how repeatable, bite-size content can generate enormous cumulative viewing. Overall U.S. streaming hit a record 16.7 trillion minutes in 2025, up 19% from the year before.

The rankings highlight a structural advantage for long-running shows with deep catalogs: nine of the ten most-watched series were established titles rather than new originals. Limited or short-run series struggle to compete on total minutes, regardless of buzz. Bluey’s cross-generational appeal and 10-minute episode format fit modern viewing habits—often casual or background watching—helping explain why a preschool cartoon now outpaces prestige dramas and blockbuster originals in sheer time spent watching.

For Fun

17. Accidentally Wes Anderson

Wes Anderson is an American filmmaker known for distinct visual style—symmetry and centered framing, distinct color palettes and lateral tracking. This website is a collection of pictures from around the world that mimic that Anderson style. It’s a fun site.

18. The Who - full live from Smothers Brothers Comedy Hour 1967

NOTE: Back in 1967, the band The Who performed on the Smothers Brothers Comedy Hour. At the end of their bit, as planned, they go around smashing their instruments and blow up the drum set. Unfortunately, the base drum was accidentally loaded with three times the amount of explosives expected. You can read more about it here. On the whole, the entire Wikipedia on the Smothers Brothers is worth reading.