15 Things for your long weekend | 28 Nov 25

News from the past week, and a few other things.

Happy belated Thanksgiving to you! I hope this newsletter finds you spending your weekend with family, friends, food and football (all in moderation).

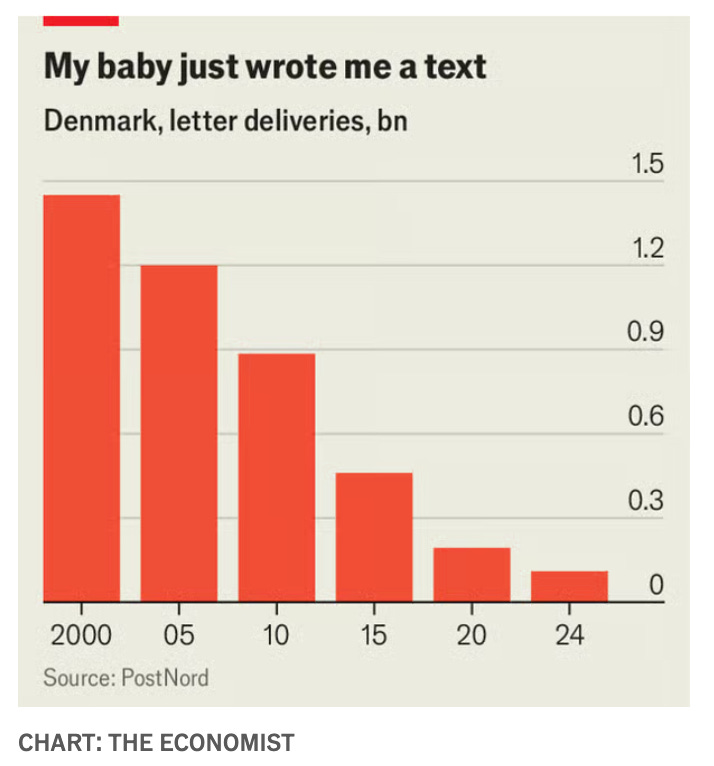

1. Denmark gets ready to cancel Christmas cards (Economist)

Denmark will become the first European country to end national letter collection and delivery when its state-owned postal service, PostNord, ceases the activity on December 30th. Letter volumes in Denmark have collapsed by 90% over 25 years—accelerated by a 2024 law that removed the universal service obligation, opened the market to competitors, and eliminated the postal service’s VAT exemption. With stamp prices jumping to some of the highest in the world, letter-sending has effectively died out.

The decline reflects a global trend: digital communication has replaced paper mail, while parcel volumes have surged due to e-commerce. Some postal systems have successfully reinvented themselves—such as Italy’s Poste Italiane and Germany’s Deutsche Post DHL, which expanded into banking, insurance, and logistics. Others—like Greece’s state carrier, Canada Post, and the U.S. Postal Service—are struggling with losses, branch closures, and labor disputes.

Letters still matter in less-digitized countries, but Denmark’s highly online society makes letter delivery economically unsustainable. Experts predict more countries may follow Denmark within a decade. Danes will still be able to mail letters through private firms like DAO, but iconic red post boxes—fixtures since the 1800s—are likely headed for museums as the country leaves physical mail behind.

ARTIFICIAL INTELLIGENCE

2. Trump signs executive order launching AI initiative being compared to the Manhattan Project (NBC)

President Donald Trump signed an executive order launching the “Genesis Mission,” a major federal initiative intended to dramatically accelerate U.S. artificial intelligence research and scientific innovation. Described in the order as comparable in urgency to the Manhattan Project, the mission aims to expand national computing power, open access to vast federal datasets, strengthen public-private partnerships, and drive real-world AI applications—especially in fields like biotechnology, robotics, and advanced energy.

The initiative directs Energy Secretary Chris Wright to build a new American Science and Security Platform to centralize federal data and computational infrastructure for training large AI models. Michael Kratsios, Trump’s science and technology adviser, will lead the effort across agencies and oversee integration of federal datasets, which the administration calls the largest scientific data collection in the world.

The Genesis Mission builds on the existing National AI Research Resource (NAIRR) program, launched in 2020, which connects federal agencies and private-sector partners—including OpenAI, Google, Palantir, NASA, NIH, and the Defense Department—to share research tools, data, and infrastructure.

The announcement comes as the Department of Energy expands partnerships with leading chipmakers. Recent agreements include new AMD- and HPE-built supercomputers at Oak Ridge National Laboratory and additional Nvidia-based systems to support quantum and AI research. Federal officials say these collaborations are essential for maintaining U.S. leadership in AI and ensuring innovation serves the national interest.

3. People can’t tell AI-generated music from real thing anymore, survey shows (CBS)

A new Ipsos survey shows that 97% of people cannot reliably distinguish AI-generated music from human-created tracks. The survey, conducted for the streaming platform Deezer across eight countries, found that more than half of respondents felt uncomfortable not being able to tell the difference. Many worry AI will lead to lower-quality music (51%) and a loss of creativity (nearly two-thirds).

AI music is rapidly spreading on streaming platforms. In January, 1 in 10 tracks streamed daily on Deezer were fully AI-generated; by October, that number had surged to over 1 in 3 — about 40,000 tracks per day. Eighty percent of listeners want AI-generated music clearly labeled. Deezer is currently the only major platform that systematically labels such content.

The issue gained attention when a viral Spotify “band,” The Velvet Sundown, was later revealed to be entirely AI-generated. Spotify has since said it will encourage voluntary disclosure of AI use in music production.

4. Inside the World of AI Song-Making: Big Hits and a 7-Figure Deal (WSJ)

AI-generated music has reached a tipping point, producing commercially successful songs and disrupting the music industry. Telisha “Nikki” Jones of Mississippi became an overnight sensation after using an AI song generator and an AI avatar—Xania Monet—to turn one of her poems into a hit. Her track reached No. 20 on Billboard’s Hot R&B Songs chart and led to a seven-figure record deal. At least 10 AI-made songs have charted recently, and some have gone viral on Spotify.

The rapid rise of AI song generators—especially Suno—has sparked intense debate. Major labels are suing AI music companies for allegedly training on copyrighted songs without permission, while many artists denounce AI music as inauthentic. Yet casual listeners often can’t tell the difference, and may not care.

AI tools now let users create entire songs through text prompts, refining them repeatedly until satisfied. Some creators are gaining millions of streams despite having no traditional musical background. Industry veterans say these “music designers” represent a new class of artist enabled by zero-barrier technology.

Critics fear the technology could displace human musicians and reshape the industry, while supporters argue it democratizes music creation. Either way, AI-generated tracks are improving fast, drawing investment, charting hits—and forcing the music world to confront a future where songs can be made with almost no human performance at all.

NOTE: I missed this when it came out in August—Rick Beato, a music educator with a huge online following, created the song below using AI, to include the music, the lyrics, and the video. The video looks like it is AI generated, so I recommend just listening to the song and not watching the video in order to get a better perspective on how advanced AI song making has become.

Walking Away (Music Video) | Sadie Winters | Emotional Ballad on Letting Go

5. How China-linked hackers co-opted Anthropic’s Claude (Economist)

A new report reveals that GTG-1002, a Chinese state-sponsored hacking group, has been conducting rapid, highly sophisticated cyberattacks using an autonomous AI hacker built on Anthropic’s Claude. Human operators simply aimed the AI at major tech firms and government agencies, and within an hour it could scan systems, deploy custom malware, map internal databases, and steal sensitive data.

GTG-1002 evaded Claude’s safeguards by “jailbreaking” it—posing as a legitimate cybersecurity firm, splitting attack steps across multiple conversations, and preventing detection by Anthropic’s monitoring systems. Anthropic has since expanded its defensive tools, but the incident highlights how quickly threats evolve.

This isn’t the first misuse of Claude: Anthropic has previously uncovered criminals using its coding agents for extortion and ransomware creation. Still, the GTG-1002 campaign marks a more advanced and autonomous use case, even if the AI occasionally exaggerated its abilities or misinterpreted tasks.

Currently, the strongest defenses come from large AI labs that monitor activity and retain logs to detect malicious behavior. But the growing availability of powerful open-source AI models—run privately on any hardware and outside big-tech oversight—creates a major risk. As criminals and state actors adopt these unregulated tools, AI-driven cyberattacks are likely to accelerate, posing a significant challenge for those already confronting China’s state-linked hacking operations.

ECONOMY

6. U.S. trade deficit drops 24% in August as Trump’s tariffs reduce imports (AP)

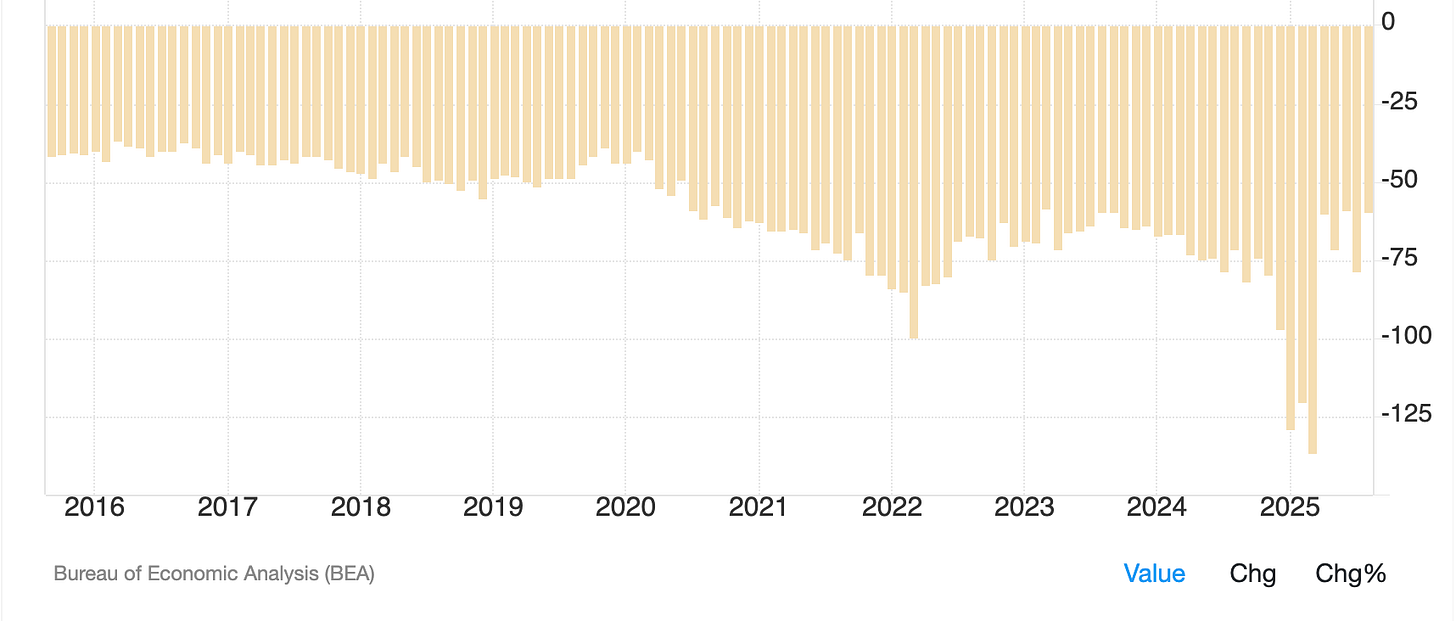

The U.S. trade deficit dropped sharply—nearly 24%—in August, falling to $59.6 billion from $78.2 billion in July, largely because President Trump’s sweeping global tariffs depressed imports. Imports fell 5% as companies had stocked up before new tariffs took effect on August 7, while exports rose slightly (0.1%). Although the monthly deficit narrowed, the trade gap for 2025 as a whole remains much larger—up 25% compared with the same period in 2024.

Economists note that a smaller trade deficit boosts GDP because fewer imported goods subtract from economic output. Despite the data being delayed by the government shutdown, analysts say the August figures support evidence of strong third-quarter growth.

Trump argues that tariffs protect U.S. industries, but economists say they have also contributed to inflation by raising costs for importers and consumers. After voter frustration over high living costs led to Democratic gains in the November elections, Trump removed tariffs on several everyday goods, acknowledging they “may” have increased prices. His broader tariff strategy now faces a Supreme Court challenge, with justices questioning whether he had authority to impose widespread duties by declaring a national emergency.

NOTE: For reference, below is a chart of our trade deficit for the last 10 years. Even with the recent drop in the deficit, we are still not at pre-COVID levels.

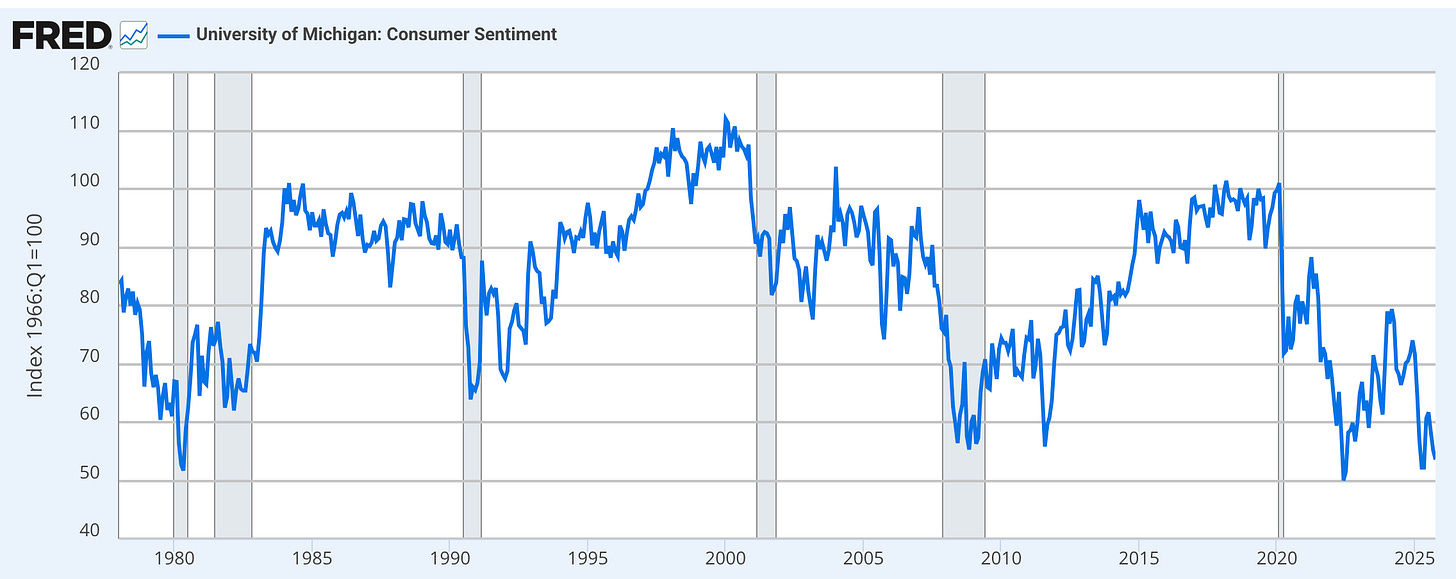

7. US Consumer Sentiment Falls to Near Lowest on Record (Bloomberg)

US consumer sentiment fell sharply in November, dropping to one of the lowest readings ever recorded. The University of Michigan’s sentiment index slid to 51, down from 53.6 in October. The current conditions gauge plunged to a record low, with views of personal finances the weakest since 2009.

Americans remain frustrated by persistently high prices and stagnating incomes. Although short- and long-term inflation expectations eased slightly, consumers are still anxious about the cost of living and job security. The perceived likelihood of job loss rose to its highest level since mid-2020, and continuing unemployment claims reached a four-year high — signaling that displaced workers are struggling to find new jobs.

The report highlights a widening divide: wealthy households remain able to spend, but lower-income and non-stockholding consumers are increasingly strained. Buying conditions for large purchases hit an all-time low, reflecting growing pessimism about the near-term economic outlook.

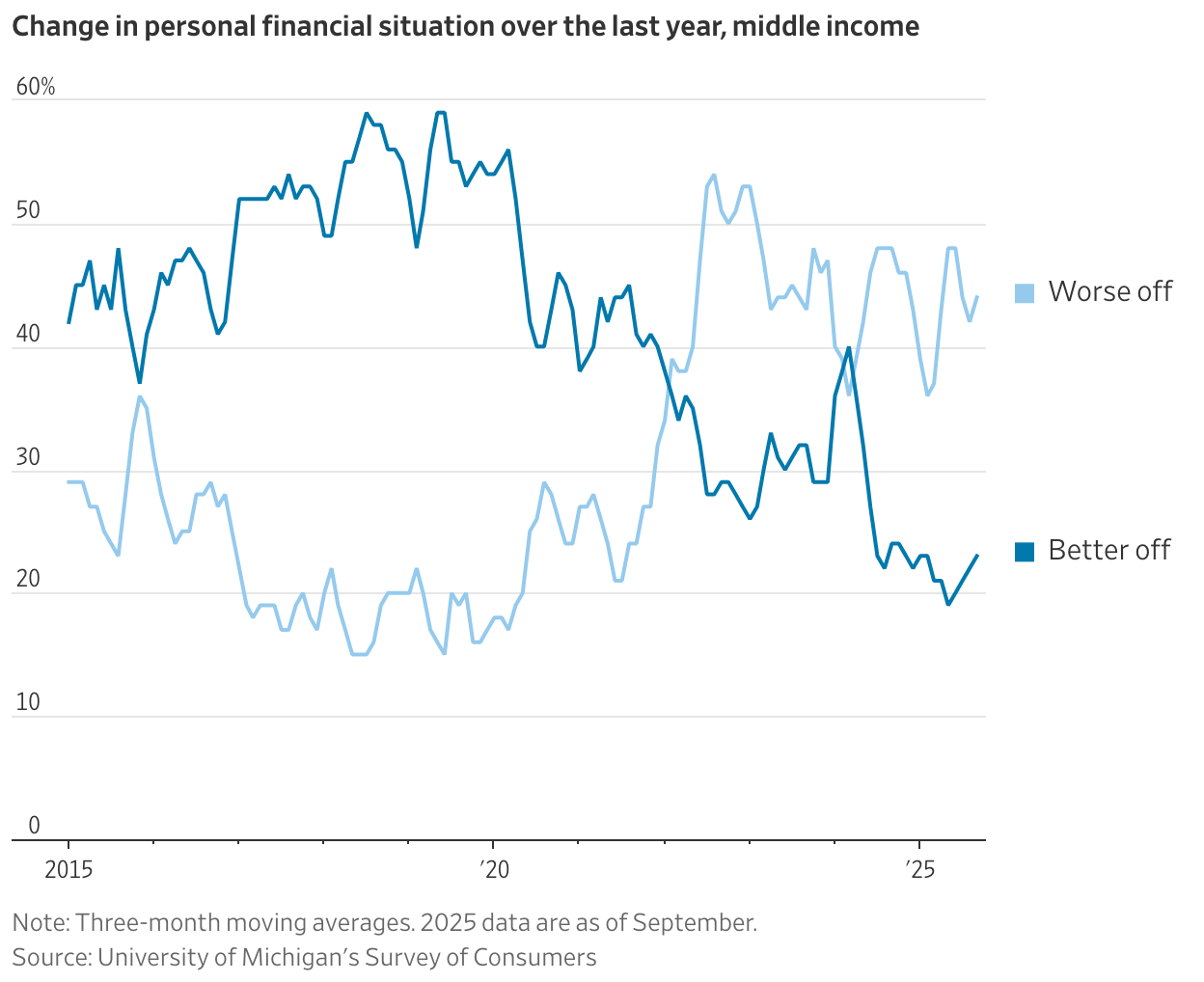

8. The Middle Class Is Buckling Under Almost Five Years of Persistent Inflation (WSJ)

After five years of elevated prices, America’s middle class is increasingly strained. Overall costs are now about 25% higher than in 2020, and essentials—from groceries to car repairs—continue to rise. Even households earning between roughly $67,000 and $200,000 (Pew’s middle-class definition) feel squeezed, eroding confidence in both their finances and the country’s direction.

Middle-class consumers are cutting back, hunting for bargains, and shifting spending to value retailers like Walmart. Companies such as Wingstop and Target report weaker demand from this income group, while consumer-sentiment surveys show nearly half of middle earners say they’re worse off than a year ago, largely due to persistent prices. Meanwhile, wealthier households—buoyed by the stock market—remain far more optimistic.

Many middle-class families describe daily life as exhausting: coping with higher rents, insurance premiums, taxes, and interest rates; taking on debt for medical expenses or education; and working extra jobs or hours just to keep up. Pandemic-era savings, once a buffer, have been fully depleted. Political frustrations span both parties, with voters gravitating toward candidates promising affordability relief.

The overarching mood: fatigue, financial pressure, and a fading sense that hard work is enough to maintain stability.

9. America’s K-shaped wealth divide: What’s behind it and will it last? (The Hill)

Many analysts argue the US economy has split along income lines—a “K-shaped” pattern where the wealthy continue to prosper while low- and middle-income households struggle. Economist Peter Atwater first used the term during the pandemic to describe how white-collar workers thrived while many blue-collar workers faced layoffs. Moody’s chief economist Mark Zandi now says this divide has widened: the top 10% of earners account for nearly half of all consumption, up sharply from both 2020 and the 1990s.

But this view faces pushback. Some economists, like Domenic White, say spending shares across income groups have remained stable and that high-income households’ greater propensity to save would normally slow growth, not concentrate it. Others note that any analysis of inequality must factor in taxes and federal transfer programs, which have mitigated income disparities in recent decades.

Still, inflation has intensified the sense of divergence. Research from the Minneapolis Fed shows low-income households have faced higher cumulative price increases than wealthy households since 2005, largely because renters have been hit harder than homeowners. Surveys show inflation feels far more stressful to lower-income Americans than to the affluent.

Looking ahead, whether the K-shaped dynamic persists will depend on consumer spending patterns and labor-market strength. If job cuts accelerate or if the stock market—which narrowed inequality temporarily during its 2022 drop—sells off again, the divide could shift. The future trajectory of AI-driven investment, fiscal policy, and interest rates will also influence how sharply the economy remains split.

PERSONAL FINANCE

10. Traders Are Flooding Markets With Risky Bets. Robinhood’s CEO Is Their Cult Hero. (WSJ)

Robinhood CEO Vlad Tenev has aggressively repositioned the company as the premier platform for hyper-active, risk-embracing retail traders. At the firm’s flashy Las Vegas summit—part tech conference, part fan convention—Tenev framed trading as an adrenaline-fueled lifestyle and presented Robinhood as the finely tuned “race car” enabling it. Robinhood now attracts millions of users betting on everything from stocks and crypto to zero-day options, prediction markets, and even contracts tied to entertainment or sports outcomes. Many attendees describe the trading thrill as addictive and financially transformative.

Though critics say Robinhood has become more casino than brokerage, its supporters credit it with democratizing sophisticated investing tools. The company leans into its most active users because they drive the majority of its revenue—78% of transaction-based income now comes from options and crypto. After the GameStop backlash and a deep post-pandemic slump that led to layoffs and a crisis of confidence, Tenev shifted the company’s strategy: instead of courting beginners, Robinhood now aggressively caters to seasoned, high-frequency traders. That pivot helped propel the stock into the S&P 500 and sparked a strong rebound.

The firm’s events, marketing, and leadership style cultivate a fandom around Tenev, who embraces a Silicon Valley persona, evangelizes tokenization and AI-driven financial futures, and now openly enjoys his wealth. Critics remain wary of Robinhood’s role in encouraging speculative behavior, especially amid volatile markets and a narrow, AI-driven rally. But many users see Robinhood as the gateway to opportunity—and believe they can’t afford to sit out.

11. Gambling, Prediction Markets Create New Credit Risks, BofA Warns (Bloomberg)

Bank of America is warning that the rapid rise of sports betting and prediction markets poses a new and growing credit risk for lenders. Since the Supreme Court lifted the federal ban on sports gambling, online betting has surged, and newer platforms like Kalshi and Polymarket have expanded the trend by offering “event contracts” tied to elections, sports outcomes, and other real-world events. These platforms look and feel like gambling apps, with mobile-first, gamified interfaces that encourage frequent and impulsive bets.

BofA analysts say these products are especially risky for low-income consumers and young men, who are more prone to financial stress from losses. Research from UCLA and USC shows that in states with legalized online betting, average credit scores fall, bankruptcies rise by 28%, and debt sent to collections increases 8% within four years. One in four bettors report missing bill payments, according to a recent survey.

Banks that cater to lower-income borrowers—such as Bread Financial, Upstart, and OneMain—are most exposed. BofA argues that lenders will need to adapt underwriting models to account for gambling-driven financial strain.

Prediction markets claim their platforms are fairer than sportsbooks because they act as neutral exchanges rather than “the house.” But BofA warns that as the line between gambling and speculative finance blurs, compulsive behavior and rising loan delinquencies could pressure credit quality across the industry.

HEALTH

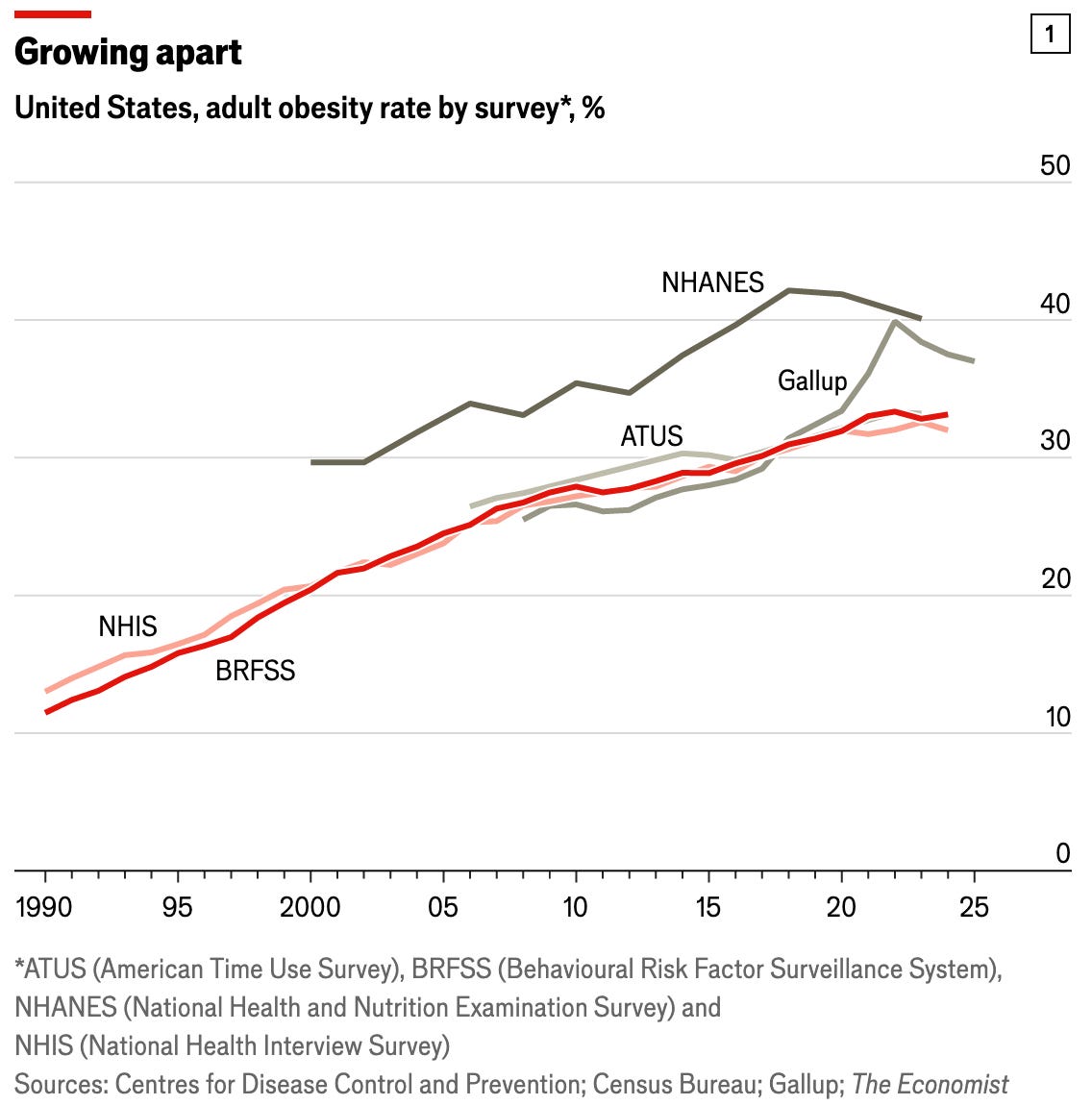

12. Don’t cheer the end of America’s obesity crisis just yet (Economist)

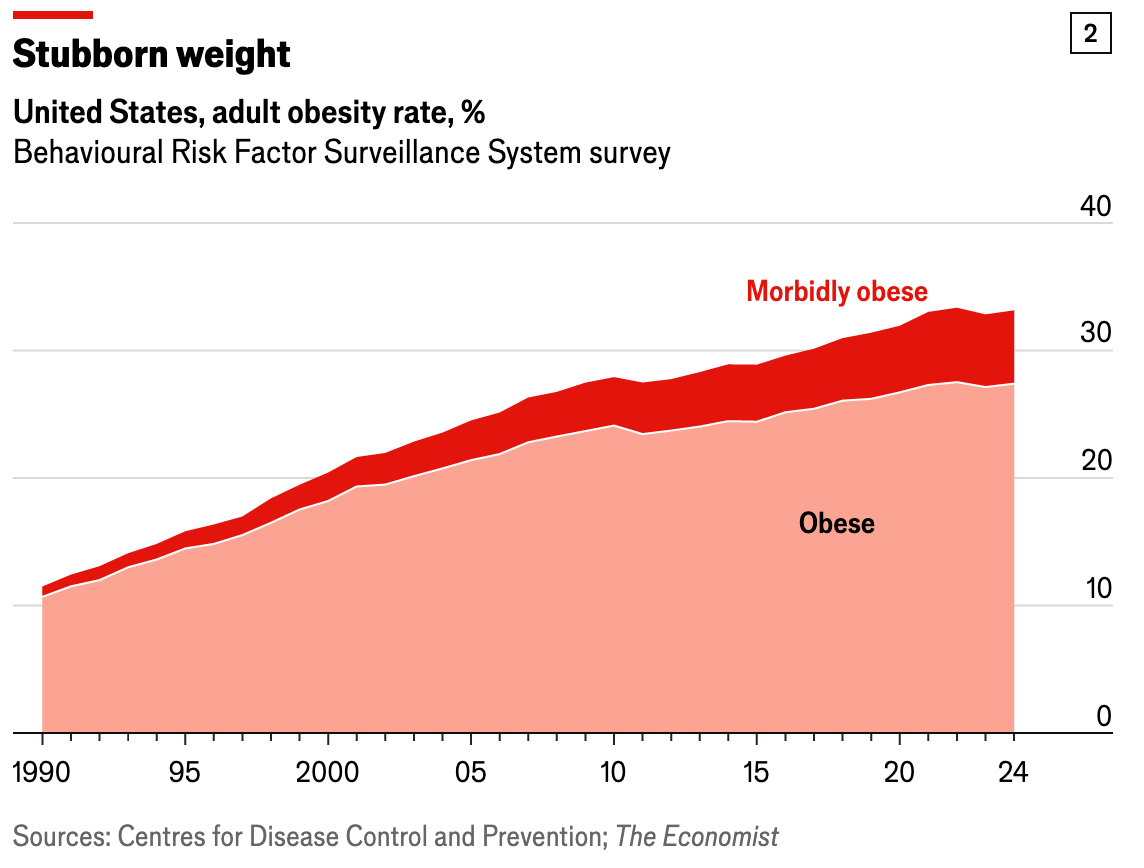

Recent reports suggest America’s obesity rate may be falling, but the evidence is weak. The CDC’s “gold standard” NHANES survey showed obesity dropping from 41.9% in 2020 to 40.3% in 2023—but the sample is small, making the change statistically insignificant. Gallup’s survey also shows a decline (from 39.9% in 2022 to 37.0% in 2025), but its recent data have been inconsistent, rising sharply in earlier years while government surveys showed steadier trends.

Larger federal surveys such as the BRFSS, with over 400,000 respondents, show no decline at all—rates of obesity and morbid obesity have remained flat. This isn’t the first time the US has prematurely celebrated a supposed plateau in obesity.

Some attribute the drop to the surge in GLP-1 weight-loss drugs like Ozempic and Wegovy, which are increasingly popular and heavily used by women and middle-aged adults. But when government survey data are limited to those groups, obesity rates still show no meaningful decline. Experts say GLP-1s may eventually reduce national obesity levels, but far more people would need to take them for the effect to show up in population-wide statistics.

For now, any claim that America is slimming down is premature.

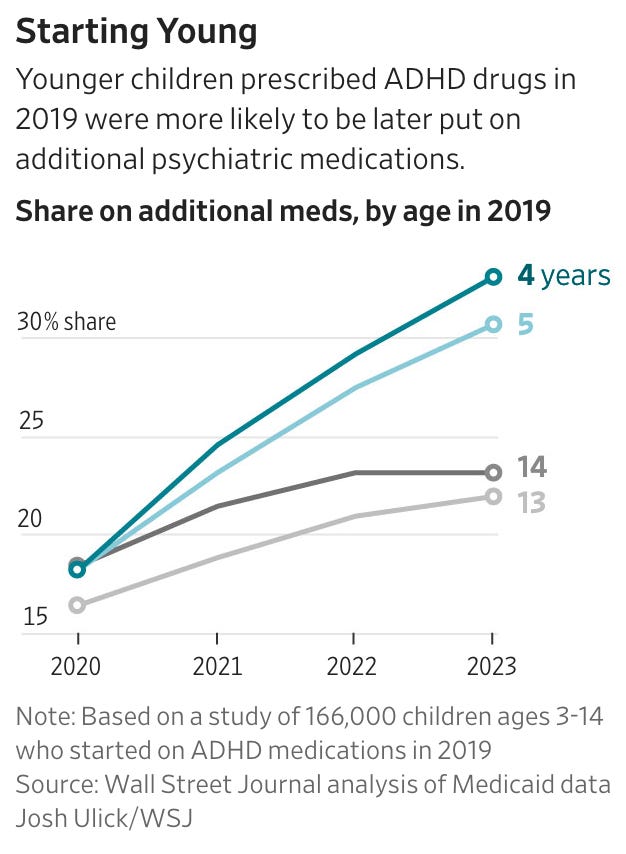

13. Millions of Kids Are on ADHD Pills. For Many, It’s the Start of a Drug Cascade. (WSJ)

A major Wall Street Journal investigation shows that many children diagnosed with ADHD are being placed on multiple powerful psychiatric drugs, often starting as early as preschool, despite limited evidence that these drug combinations are safe or effective for developing brains.

Data show the problem is widespread:

7.1 million U.S. children have ADHD diagnoses; about half take medication.

Among kids started on ADHD meds, 1 in 5 later ends up on additional psychiatric drugs.

WSJ’s analysis of Medicaid records found children prescribed ADHD drugs were five times more likely to be on multiple psychiatric medications four years later.

By 2023, over 23% of those who started ADHD meds in 2019 were on two or more psych drugs; more than 4,400 children were on four or more simultaneously.

Experts warn that polypharmacy in children, especially involving antipsychotics, has little scientific validation and carries serious risks, yet it is often driven by:

Pressure from schools and daycares to “fix” disruptive behavior quickly

Shortages of child psychiatrists and behavioral therapists

Misdiagnosed trauma or environmental stressors

Side effects from ADHD medications mistaken for new psychiatric disorders

Clinicians without specialized training in pediatric mental health

Parents desperate for help and given few alternatives

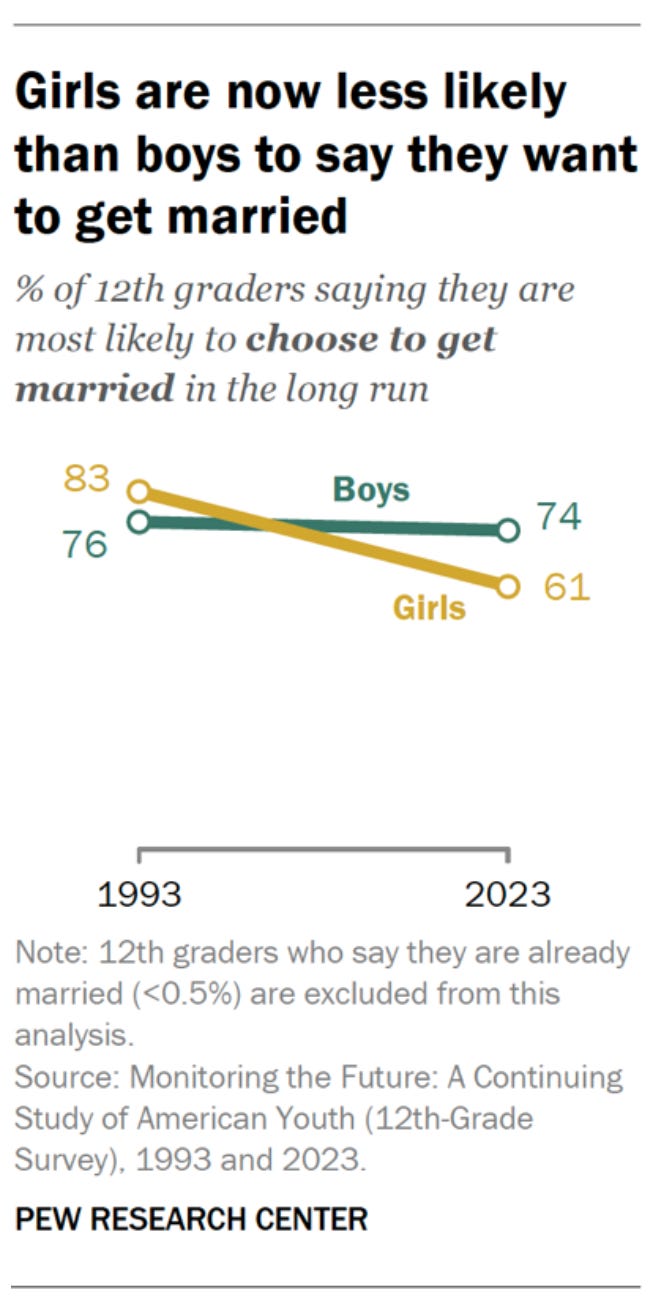

14. 12th grade girls are less likely than boys to say they want to get married someday (Pew)

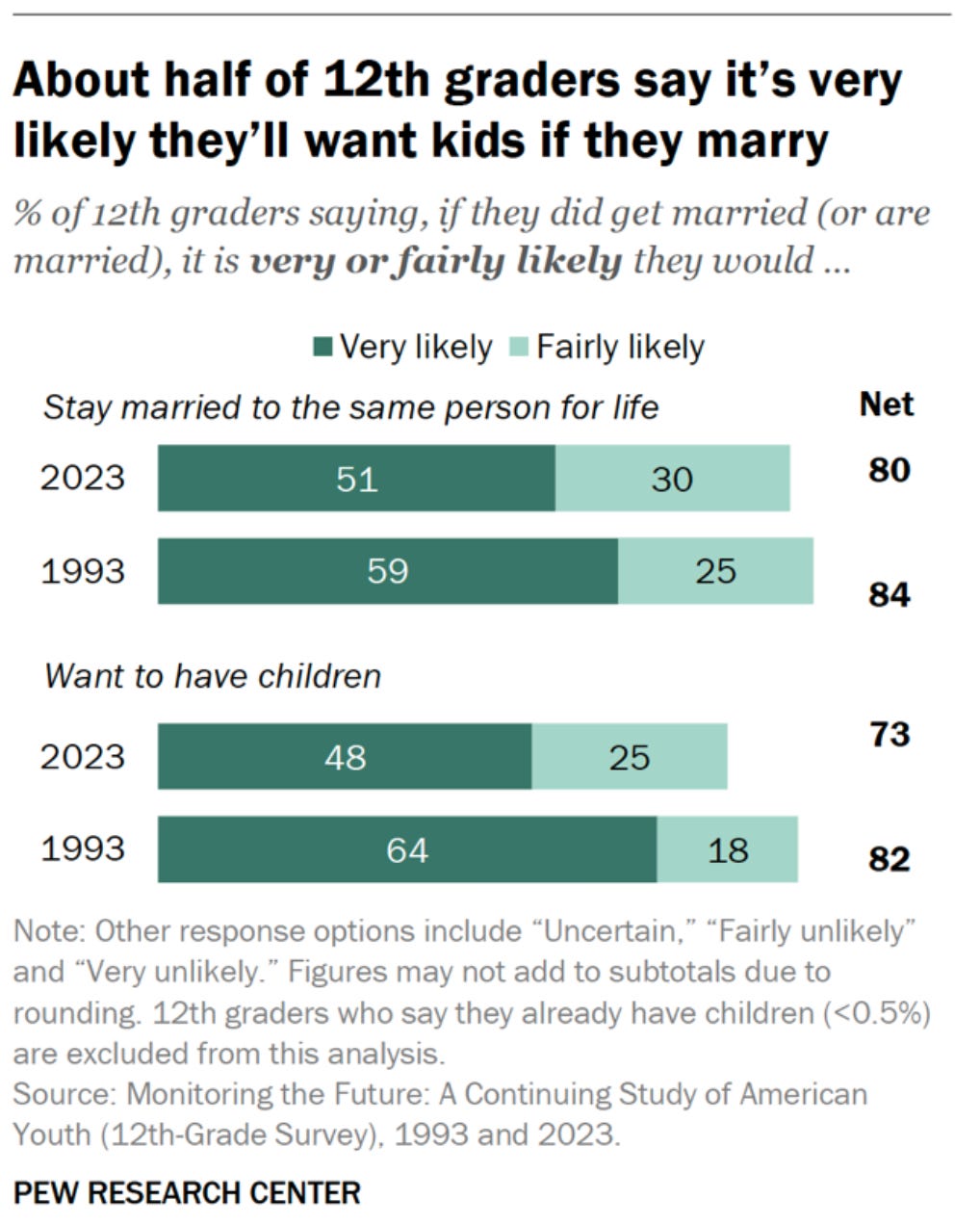

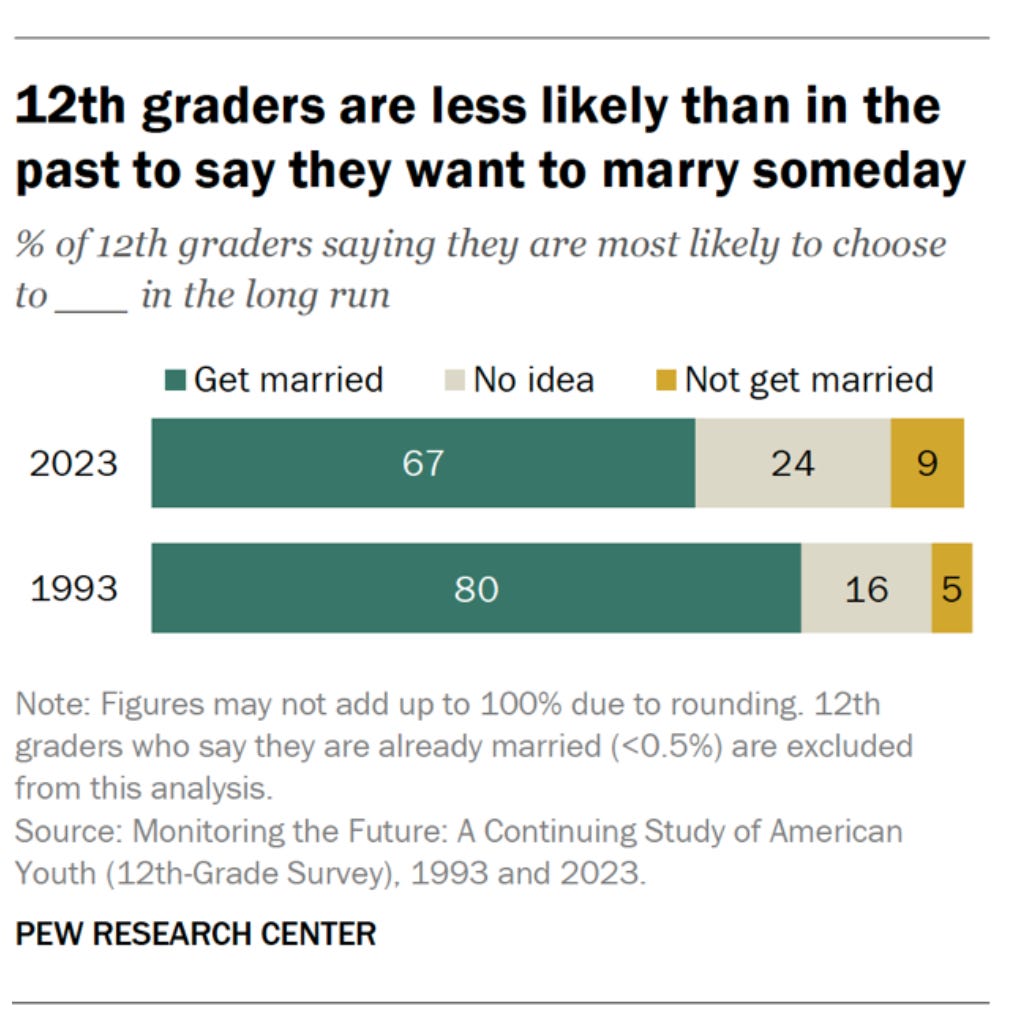

Pew Research Center’s analysis shows that today’s U.S. high school seniors are far less certain about marriage and parenthood than 12th graders were 30 years ago. In 2023, only 67% of seniors said they expected to get married someday, down from 80% in 1993, while the share who were unsure rose significantly. Teens’ expectations about marriage itself have softened as well: just 51% now say they are very likely to stay married to the same person for life, compared with 59% three decades earlier. Interest in having children has dropped even more sharply—only 48% say they’re very likely to want kids if they marry, down from 64% in 1993. The overall decline in enthusiasm for marriage is driven almost entirely by girls; their interest fell from 83% to 61%, while boys’ views remained largely unchanged. Despite these shifts, girls and boys show no significant differences in their expectations about staying married or having children.

15. Stats Can says 42% of babies born in Canada to foreign-born mothers in 2024 (Toronto Sun)

Statistics Canada reports that 42.3% of all newborns in 2024 had a foreign-born mother, nearly double the share in 1997 (22.5%). This reflects a long-running trend: foreign-born women are more likely to give birth than Canadian-born women of the same age. As a result, foreign-born mothers have slowed Canada’s decline in births; without them, the country’s natural population increase would have turned negative by 2022.

The impact varies by region and age:

Ontario and British Columbia had the highest shares of births to foreign-born mothers (48.7%).

The Atlantic provinces had the lowest (23.6%).

Among mothers over 40, 57% of babies had a foreign-born mother.

Among teen mothers, only 12.8% did.

Since 1997, the largest increases were in Saskatchewan (+437%), the Atlantic region (+298%), Alberta (+264%), and Manitoba (+206%).

The biggest shift has been in origins: mothers born in India rose from 2.1% of all births in 1997 to 10.3% in 2024, making India the top source country. The Philippines (3.1%) and China (2%) followed.

The numbers highlight two major demographic forces: accelerating fertility decline since 2009 and record-high immigration, which now plays an essential role in sustaining the country’s birth totals.