1. Wall Street Blows Past Bubble Worries to Supercharge AI Spending Frenzy (WSJ)

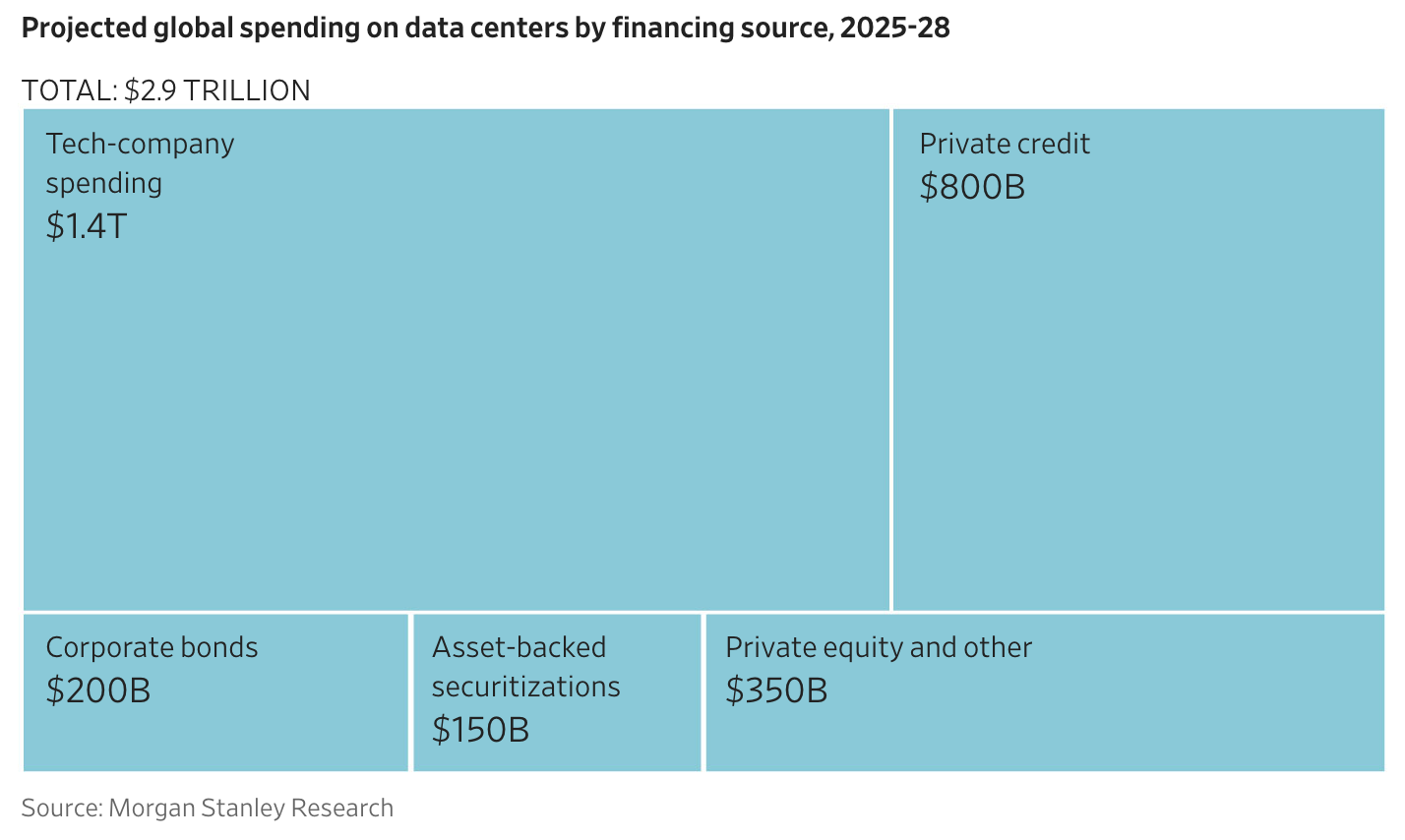

Wall Street has rapidly transformed into the financial engine of America’s AI boom, pouring unprecedented sums into data-center construction for companies like Meta, Microsoft, Oracle and OpenAI. Firms such as Blue Owl—once focused on midmarket corporate lending—now arrange multi-billion-dollar financing packages for AI infrastructure, often using complex, highly leveraged structures. Private credit, private equity, and corporate bonds are all being tapped as Big Tech’s capital spending heads toward nearly $3 trillion by 2028—far more than tech companies can fund from cash flow.

Despite growing concerns about an AI investment bubble, fear of missing out is driving banks and asset managers to chase massive fees. Some deals have produced instant windfalls, such as Pimco’s $1–2 billion paper profit on Meta data-center bonds. But the risks are substantial: Oracle is heavily indebted; many financing arrangements are circular; and five-year loans backing mega-projects could be hard to refinance if AI demand falters or chips become obsolete.

The AI build-out is already larger than the fracking boom, and its debt is spreading widely through pension funds, mutual funds, insurers, and retail portfolios. If the AI market cracks, the fallout could be far-reaching.

NOTE: In my post this weekend, I talked about how most AI investment was coming from internal company funding and that many people were hopeful. This appears to be changing, and debt is coming more into the picture, and concerns are rising:

2. He’s Been Right About AI for 40 Years. Now He Thinks Everyone Is Wrong. (WSJ)

Yann LeCun—one of the pioneers of modern AI and Meta’s longtime chief AI scientist—has grown increasingly out of step with Meta’s strategy as the company pours vast resources into large language models like Llama. LeCun argues that LLMs are a dead end and that future breakthroughs will come from “world models” that learn about the physical world the way animals or children do. While he once led Meta’s influential FAIR research lab, he stepped back years ago to focus on long-term research, and Meta’s recent restructuring has sidelined him further, installing new leadership and shifting resources toward fast-paced, product-driven AI work. LeCun has been talking to colleagues and investors about launching a startup centered on his world-models vision. A historically independent thinker who helped create fundamental neural network advances, he now spends much of his time traveling, speaking, and openly advising young researchers not to work on LLMs—even as Meta doubles down on them.

3. Will AI lengthen lifespans or shorten them? (FT)

Artificial intelligence is transforming scientific fields, and the advances are fueling optimism about radical life extension. Yet recent mortality research shows that rising deaths among younger and middle-aged adults in countries like the US, UK and Canada are offsetting gains among older populations. These deaths are not simply “deaths of despair” or the result of drug availability; they disproportionately occur among cohorts hit by severe joblessness early in life, compounded by social isolation.

This combination raises concerns that AI could lower life expectancy even as it improves healthcare. If AI eventually causes widespread, lasting job displacement, the resulting loss of purpose, structure and social connection could mirror the conditions that currently drive self-destructive behaviors. Increased reliance on digital interactions—including with AI—may further deepen isolation. The likely outcome is a split: AI-boosted longevity for those who reach old age, and heightened mortality risks for younger and middle-aged groups.

4. Market Rout Intensifies, Sweeping Up Everything From Tech to Crypto to Gold (WSJ)

Markets fell sharply Monday, with a broad selloff hitting tech stocks, crypto, and gold. Investors pulled back ahead of Nvidia’s earnings and delayed jobs data, worried about massive, debt-fueled AI spending by big tech firms. The Nasdaq dropped 0.8%, the S&P 500 0.9%, and the Dow 1.2%, breaking below key 50-day moving averages for the first time since spring.

AI-related stocks—Nvidia, Amazon, Meta, AMD, SMCI, Dell, Oracle, and CoreWeave—all slid. Bitcoin plunged to about $92,000 and gold also fell. Fresh economic data showed weakening nonresidential construction outside of data centers. Fed uncertainty added to caution, with traders dialing back expectations of a December rate cut. The 10-year Treasury yield ended at 4.13% as officials urged a slow approach to easing policy.

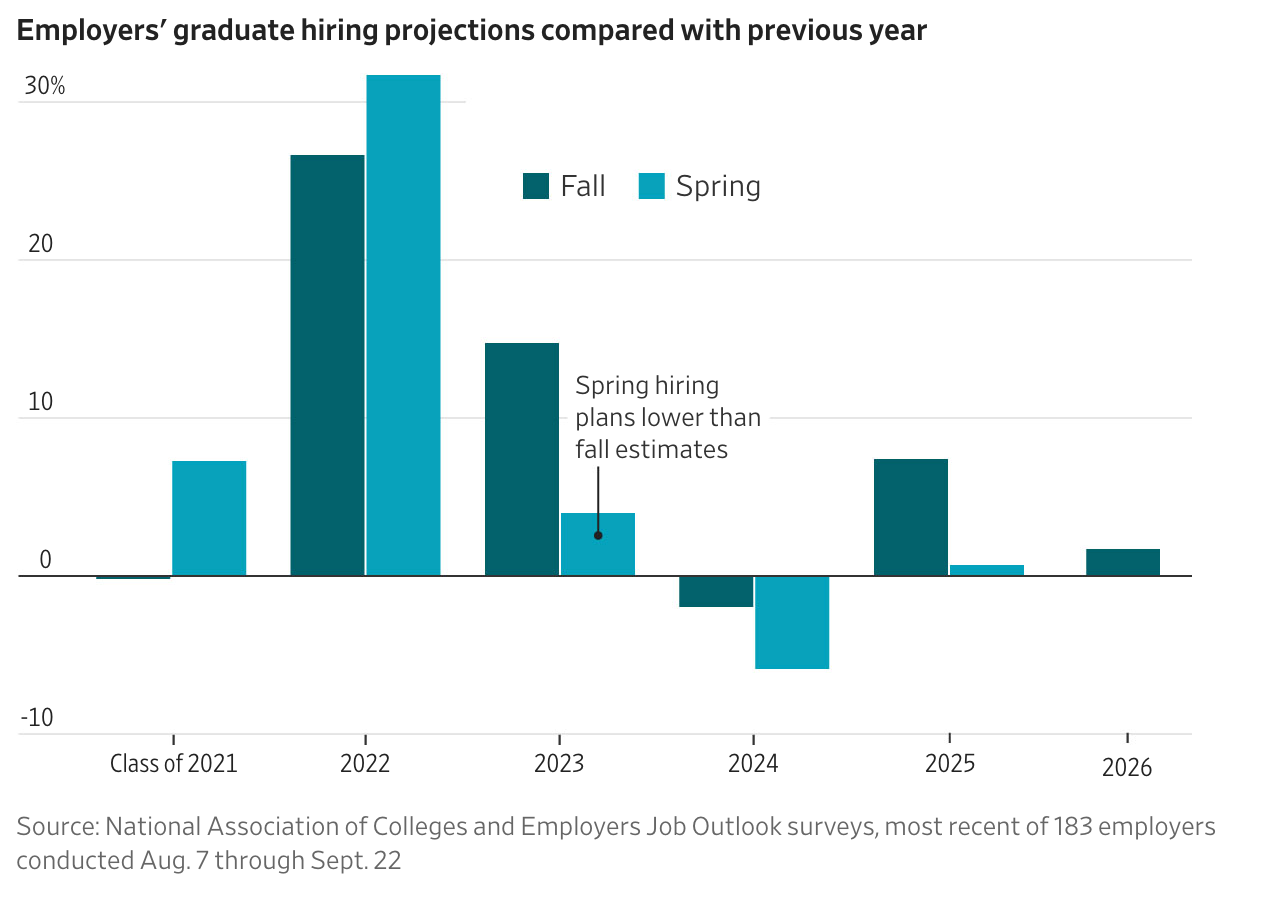

5. Companies Predict 2026 Will Be the Worst College Grad Job Market in Five Years (WSJ)

Employers are increasingly pessimistic about hiring the Class of 2026, with more than half rating next spring’s job market as poor or fair—the bleakest outlook since the pandemic. Corporate layoffs at Amazon, UPS and Verizon, plus economic uncertainty and AI-driven job restructuring, are pushing companies to prioritize candidates with experience rather than new graduates. Recent grads also face competition from laid-off junior workers, and the unemployment rate for new degree holders has climbed to a four-year high.

Job postings are down more than 16% year-over-year, applications per job are up 26%, and over 60% of 2026 seniors feel pessimistic. Hiring freezes, efficiency layoffs, and slow growth dominate most industries, though healthcare, education, and manufacturing show some demand. Many students are applying to hundreds of jobs, often unsuccessfully, while experienced workers compete for entry-level roles, leaving many early-career job seekers anxious and discouraged.

6. Niall Ferguson: The AI Boom Is a House of Cards (FP)

Like the 1920s stocks, today’s markets are being driven overwhelmingly by expectations, with massive capital expenditures from Big Tech and extraordinary valuations concentrated in a handful of companies.

AI adoption is rapid and economically significant, but history suggests that even transformative technologies (like railroads) have triggered financial crashes when investor expectations proved too optimistic. OpenAI is as the epicenter of a potentially unstable, circular, debt-like financing Companies Predict 2026 Will Be the Worst College Grad Job Market in Five Yearsecosystem involving Microsoft, Nvidia, Oracle, Amazon, and others. OpenAI’s spending commitments—far outpacing its revenue—rely on complex arrangements where suppliers also act as investors.

Ferguson identifies four reasons investors might sour on AI: (1) AI may be less transformative for productivity than hoped, with most real-world use generating “workslop”; (2) OpenAI faces stiff competition from Google and Anthropic; (3) Chinese open-source models are becoming cheaper and more widely adopted; and (4) GPUs used as de facto collateral are short-lived assets.

A downturn could spread if highly leveraged firms like Oracle face stress. While financial conditions remain easy today, the Ferguson warns that AI’s financial structure resembles past speculative booms—and may not end well. He concludes with the Seuss refrain: he does not like “green eggs and ham,” nor the risks of the current AI mania.

Meanwhile, in other news:

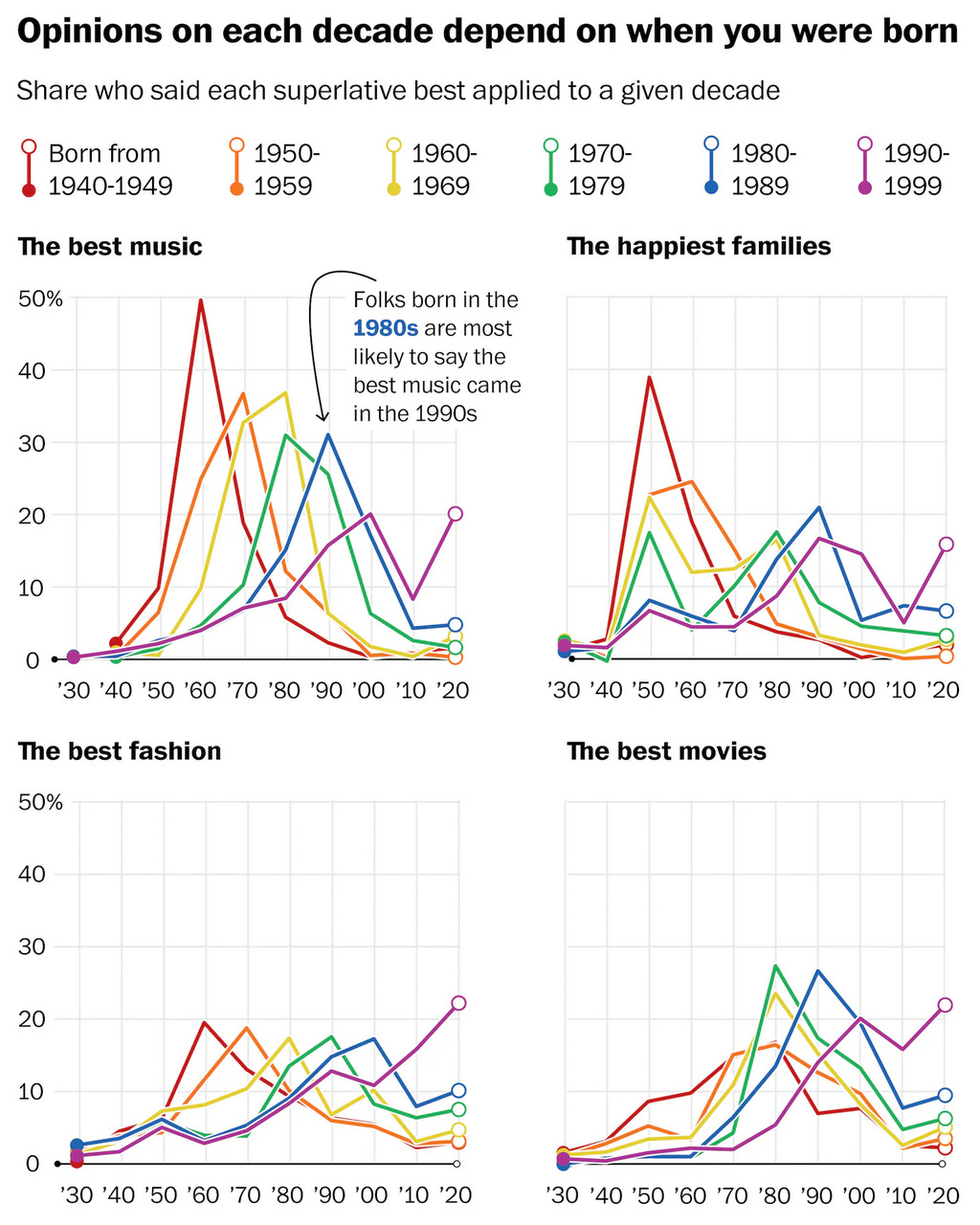

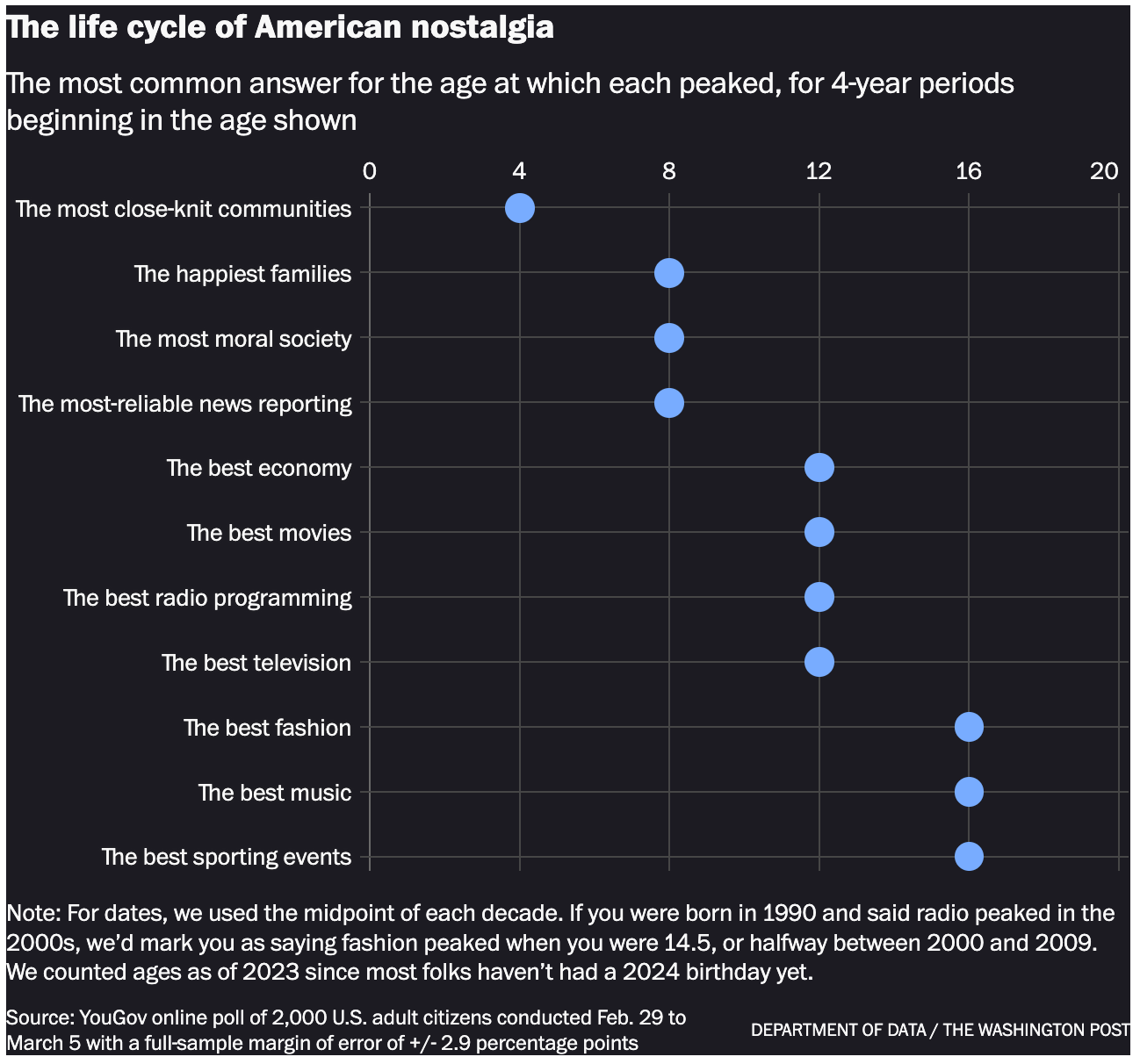

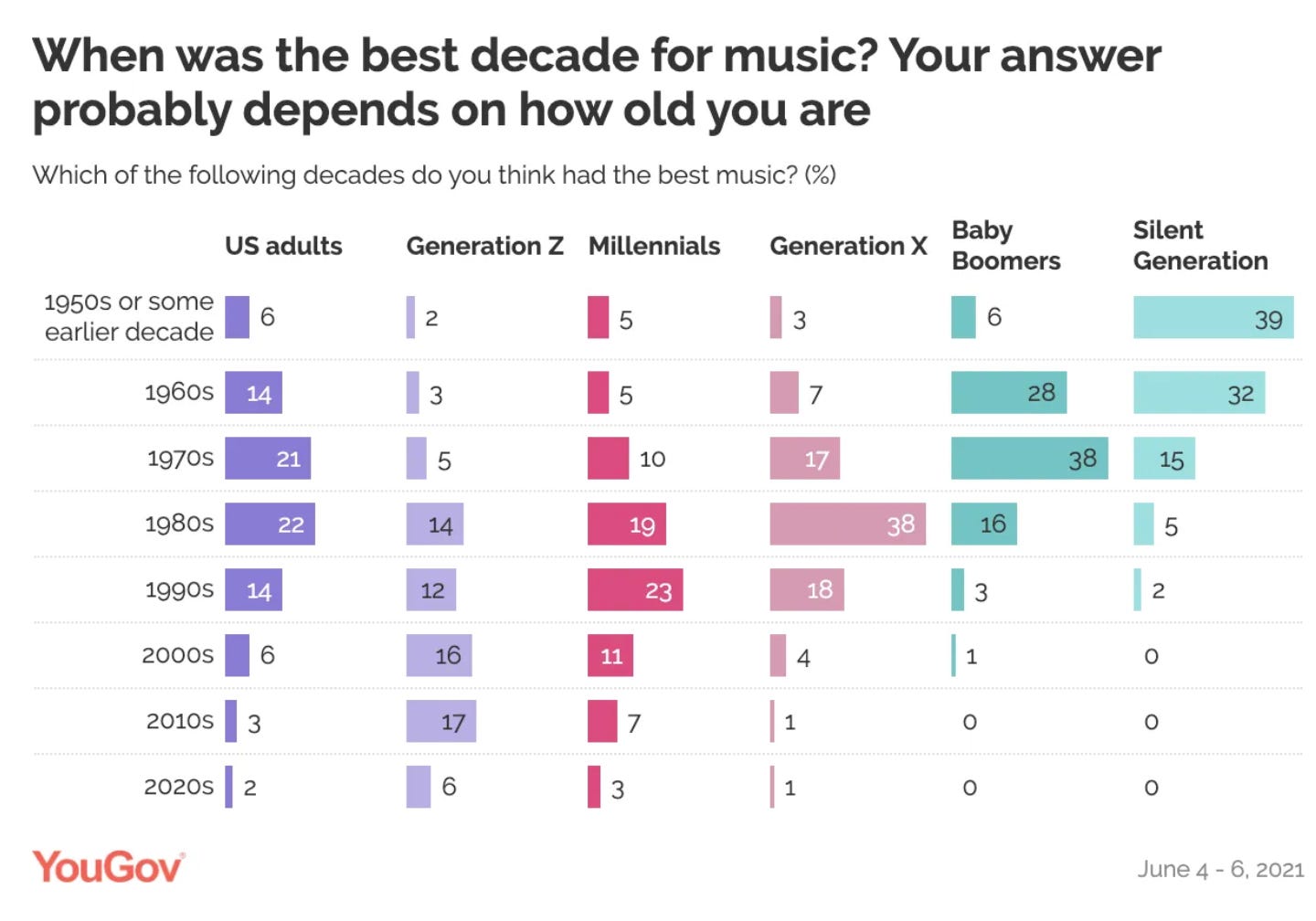

7. America’s best decade, according to data (WP)

A large YouGov survey found no consensus on which decade was objectively “best” or “worst” across measures like music, movies, economy, morals, or family life. Political and racial differences appeared—such as Republicans and White respondents idealizing the 1950s more than Democrats and Black respondents—but these gaps were small compared with the influence of age. The clearest pattern was that people consistently romanticize the decade in which they were children or teenagers. Across categories, Americans tend to believe the best communities, families, entertainment, and economy existed when they were roughly 4 to 19 years old, reflecting nostalgia for one’s own formative years rather than reality.

When asked about the “worst” decade, Americans overwhelmingly choose the present, even when that choice contradicts historical facts. Researchers attribute this to “declinism,” the tendency to believe that conditions are deteriorating over time, which is amplified by partisan attitudes and selective media exposure. Yet when people rate specific cultural items—such as songs—they don’t show unusual hostility toward current eras, suggesting broad “worst” questions measure pessimism, not actual evaluation. Psychological research shows that negative experiences fade and positive memories strengthen, meaning even the 2020s—widely labeled as the “worst” today—are likely to become future generations’ “good old days.”

NOTE: Article contains LOTS of fun charts!

8. Which Decade(s) Saw the Greatest Change in Popular Music? A Statistical Analysis (Stat Significant)

As people age, their openness to new sounds declines, but mainstream music also evolves constantly, with measurable shifts in composition—tempo, mood, instrumentation—accumulating into major stylistic changes each decade. Big transformations in the early 1980s and 2000s reshaped the charts as rock collapsed and genres like pop, hip-hop, rap, and country surged, driven by new technology and fresh creative approaches. These cycles of rise and decline show up clearly when tracking Billboard data: genres pass the baton, new styles bloom, old ones fade, and listeners tend to bond most with whatever dominated when they were teenagers. The result is a form of “sonic Darwinism” where music never stops mutating, making each generation feel confused by the next—yet that constant evolution is what keeps culture vibrant and gives young people something that feels uniquely their own.

9. Pornhub says UK visitors down 77% since age checks came in (BBC)

Pornhub says its UK traffic has dropped 77% since the Online Safety Act began requiring strict age verification for adult sites, a shift partly reflected in Google search data and a surge in VPN downloads as users attempt to bypass the rules. Ofcom, UK’s regulator for communication services, reports that overall UK visits to pornography sites have fallen by about a third and argues the law is working as intended to prevent children from easily accessing explicit content. Pornhub contends that enforcement is uneven, with non-compliant sites gaining users, and says requiring individual sites to verify ages is impractical, advocating instead for device-level checks. Regulators and experts disagree on the best approach, but maintain that most traffic now goes to sites with age-assurance systems in place, and the government insists protecting children online remains a top priority.

10. The College Kids Who Can’t Do Basic Math

UC San Diego reports a sharp rise in incoming students who lack even middle-school–level math skills: since 2020, the share has increased nearly thirtyfold, with about one in eight first-years now unable to solve problems expected of eighth graders and roughly 20 percent unable to correctly count basic coins. Remedial math enrollment—originally designed for about 1 percent of students—has surged to 8.5 percent, with an additional 3.3 percent placed into high-school-level catch-up courses. The trend mirrors broader national learning loss, driven by pandemic disruption, chronic absenteeism, grade inflation, and test-optional admissions that make academic transcripts less reliable indicators of readiness. NAEP data show record-low proficiency in reading and math, and UC San Diego notes that deficiencies increasingly overlap: many students needing remedial math also require remedial writing. Experts argue that while COVID worsened the situation, deeper systemic issues in K–12 education continue to erode academic preparation even at top universities.

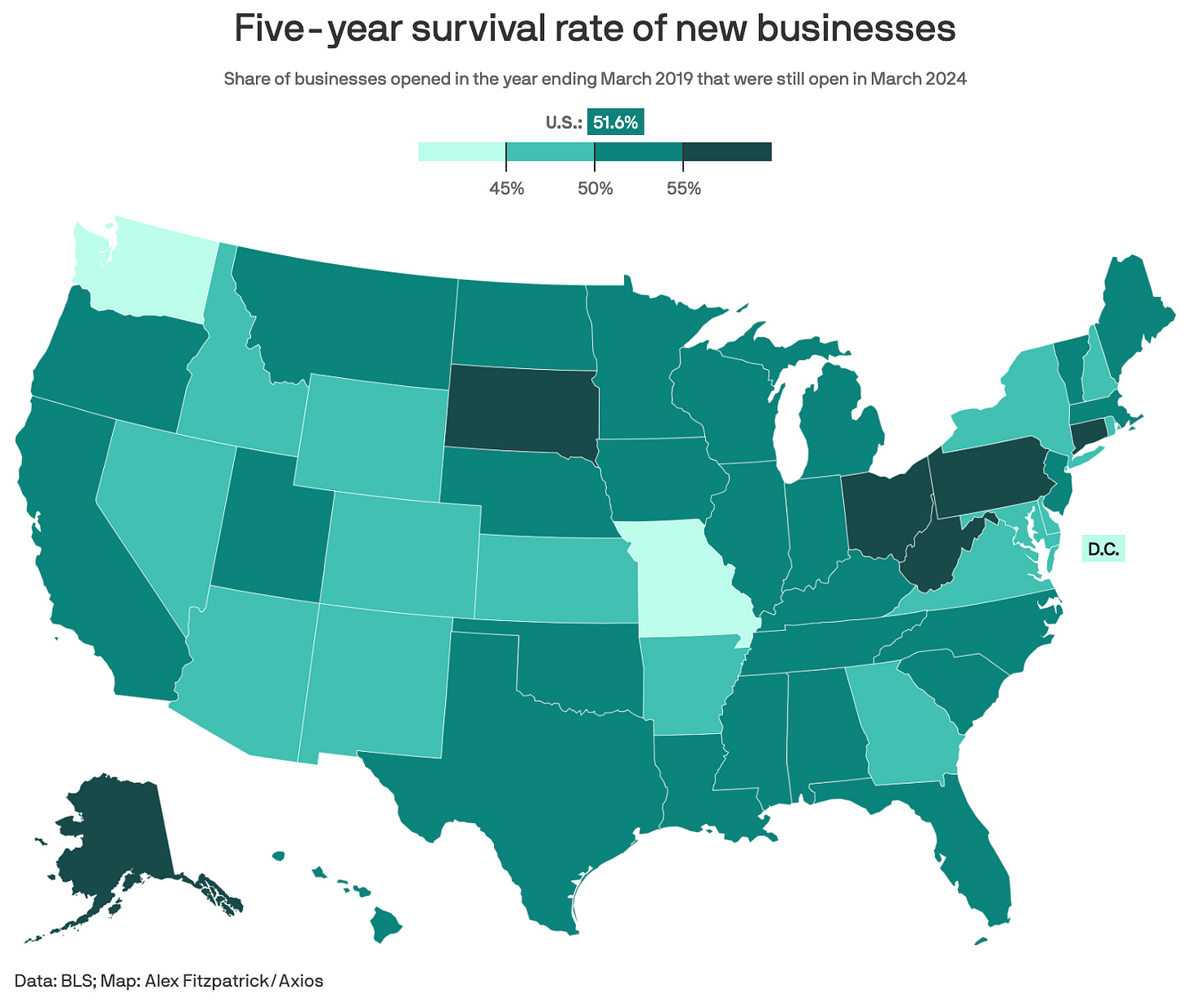

11. Half of new US companies disappear within 5 years — and only 1 in 3 makes it to year 10 (Sherwood)

About half of new U.S. startups survive five years, and those founded in 2019 are outperforming historical patterns despite the pandemic. BLS data show that 51.6% of firms launched in March 2019 were still operating in 2024—part of a long-term curve in which one-third of businesses reach 10 years, one in five reach 20, and only about 13% last three decades. Survival rates vary by geography and industry: states like West Virginia and Connecticut perform best, while Washington, Missouri, and D.C. lag behind; sectors with stable demand and high entry barriers, such as agriculture and utilities, tend to endure longer than volatile fields like mining or tech. Historically, startups born during recessions fare worse, but those launched just before the pandemic bucked the trend, potentially benefiting from emergency loans, stimulus-driven demand, cheap borrowing, and booming e-commerce.

12. Putin Is Turning Eighth-Grade Classrooms Into Army Training Grounds (WSJ)

Russia is rapidly militarizing its school system, embedding war themes, weapons training, and pro-Kremlin ideology throughout the curriculum as the Ukraine conflict enters its fourth year. Even first-graders now take part in uniformed drills with frontline soldiers, while by eighth grade students must learn to assemble Kalashnikovs, fly drones, and study battlefield tactics. History textbooks portray the West as an enemy and Ukraine as a NATO-controlled threat, and a state-run Youth Army claims nearly two million members aged 8–18. Funding for “patriotic education” has soared, schools are being supplied with model weapons, and occupied Ukrainian territories are forced to adopt the same curriculum. Supporters see this as preparing disciplined patriots; critics warn it is creating an indoctrinated generation without the critical thinking to question future wars. Teachers who resist the program face intimidation or prosecution, underscoring how deeply the Kremlin is leveraging education to shape Russia’s future soldiers and worldview.

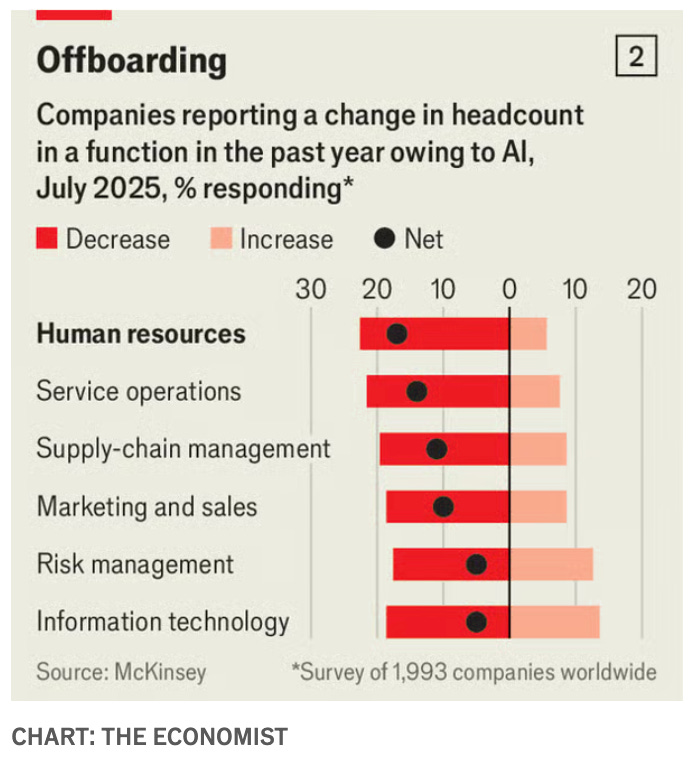

13. How HR took over the world (Economist)

Human resources has expanded rapidly over the past decade, becoming one of the fastest-growing parts of corporate life. In the U.S., HR employment is up 64% in ten years—far outpacing overall job growth—and CHROs are gaining pay, influence, and even rising to CEO roles. This surge reflects tight labor markets, rising demand for specialized skills, constant workplace upheavals (#MeToo, Covid-19, remote work, return-to-office battles), and the growth of DEI initiatives, all of which increased the need for compliance, conflict management, and employee-relations oversight. But the boom may be peaking: hiring has slowed, layoffs are up, enthusiasm for DEI is cooling, and many HR teams are being cut—Amazon among them. AI accelerates the risk, since companies increasingly automate hiring tasks, employee inquiries, and paperwork; a recent McKinsey survey shows HR is the function most often reporting headcount reductions due to AI. After years of expansion, HR may be the next corporate department facing contraction.