12 Things From the Week | 3 Aug 25

News from the past week, and a few other things.

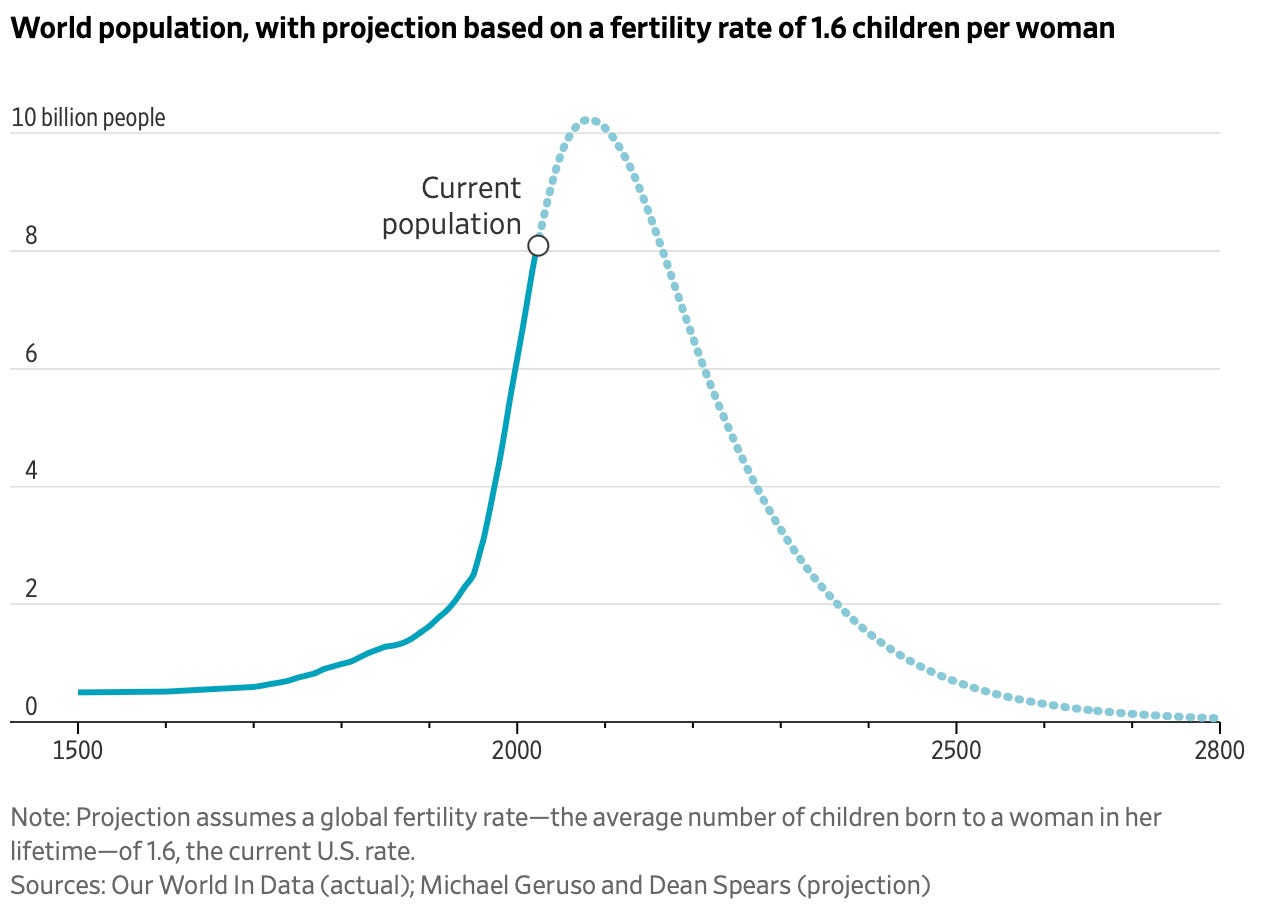

1. The Depopulation Bomb (WSJ)

If humanity’s existence were threatened by plague, nuclear war or environmental catastrophe, people would surely demand action.

But what if the threat came from our own, passive acceptance of decline? This is not some theoretical curiosity: It is a reasonable extrapolation of globally declining fertility rates.

People aren’t demanding action. In fact, some think a smaller population is actually a good thing.

Dean Spears and Michael Geruso, economists at the University of Texas at Austin specializing in demographics, want to change that. Their book “After the Spike: Population, Progress, and the Case for People” is a deep dive into the facts and consequences of depopulation, and an impassioned argument against letting it happen.

They rest their argument not on the familiar need for workers to propel economic growth or shore up Social Security but on a more fundamental proposition: More people is a good thing in and of itself.

Global fertility—the number of babies a woman is expected to have over her lifetime—averaged 2.25 last year, the United Nations estimates, the lowest in recorded history, barely above the replacement rate of 2.1 that keeps population stable.

Where fertility levels out is unknown. But the authors note that depopulation will happen so long as it goes below two, and two-thirds of the world’s population now lives in countries with fertility below two. In most others, including throughout sub-Saharan Africa, fertility is generally falling.

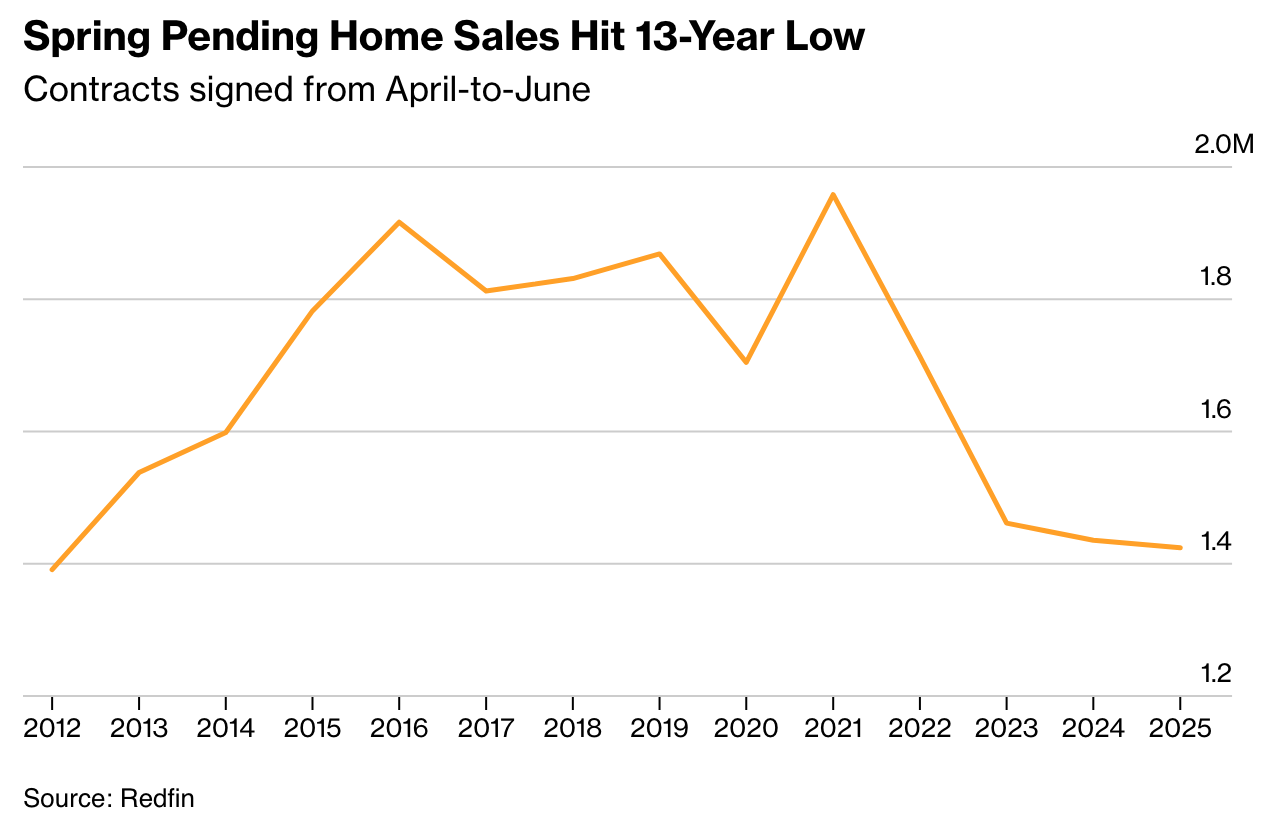

2. US Housing Market Posts Worst Spring Selling Season in 13 Years (Bloomberg)

Spring is traditionally the busiest season in real estate, not unlike Christmas for retailers. And while the most unaffordable housing market in decades has sidelined all but the most determined buyers, there were signs earlier this year that conditions were right for a rebound.

By April, mortgage rates dipped, price growth flattened and the years-long inventory drought looked like it had finally broken. But that coincided with President Donald Trump’s “Liberation Day” tariff bombshell, which sent shock waves through financial markets and pushed house hunters back into hiding.

Fewer sales contracts were signed in the US from April through June than in any year since 2012, according to data from Redfin. That was back when the housing market was still finding its footing after the collapse that fueled the financial crisis.

NOTE: As my wife would say, this is in the aggregate, individual (by city) results may vary.

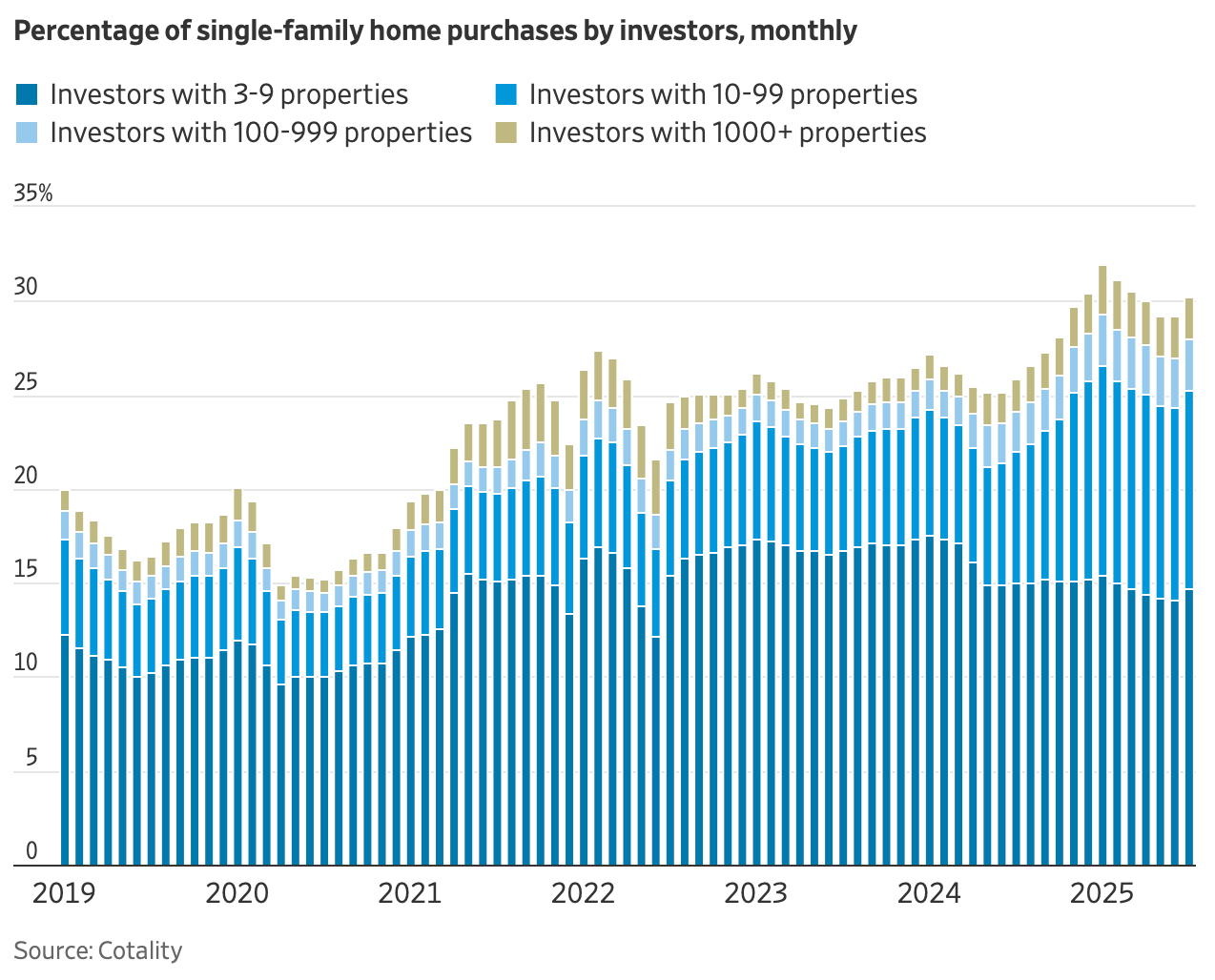

3. With Individual Home Buyers on the Sidelines, Investors Swoop Into the Market (WSJ)

Individual home buyers are largely locked out of the housing market as home prices continue to climb and interest rates remain stuck. But investors are buying, and dominating the market.

So far in 2025, investors who buy homes to flip or rent out have made up about 30% of purchases of both existing and newly built single-family homes, the highest share on record, according to property analytics firm Cotality, which started tracking the sales 14 years ago.

There is also a change in the makeup of single-family residential investors, who have become a powerful force in the U.S. housing market. This buying group was once flooded with large private-equity firms such as Blackstone and Starwood Capital Group.

But in the first half of this year, small investors made up about 25% of these home purchases while large investors accounted for about 5% on average, according to Cotality’s data. This shift happened mostly because large investors and traditional home buyers have slowed down while small investors are holding steady.

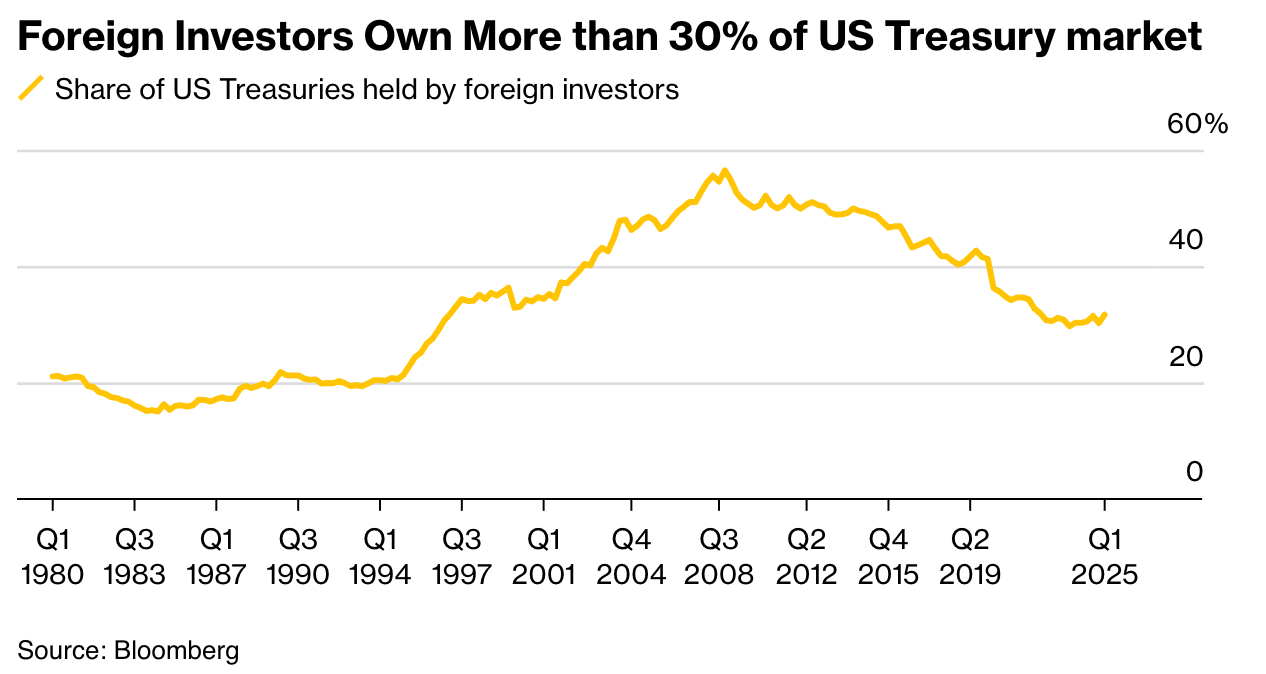

4. Foreign Holdings of Treasuries Rose in May, Led by Canada Jump (Bloomberg)

Foreign investor holdings of Treasuries climbed in May, led by a surge in Canadian purchases, in a sign of resilient overseas demand for US government securities. Canada was the outstanding buyer in May, with $65.8 billion of net purchases of notes and bonds, taking its overall holdings of Treasuries to a record high of $430 billion. According to Priya Misra, a portfolio manager at JPMorgan Investment Management, "Underlying demand for Treasuries is robust despite concerns about the deficit" and foreign investors are continuing to participate in the Treasury market.

5. Democrats Get Lowest Rating From Voters in 35 Years, WSJ Poll Finds (WSJ)

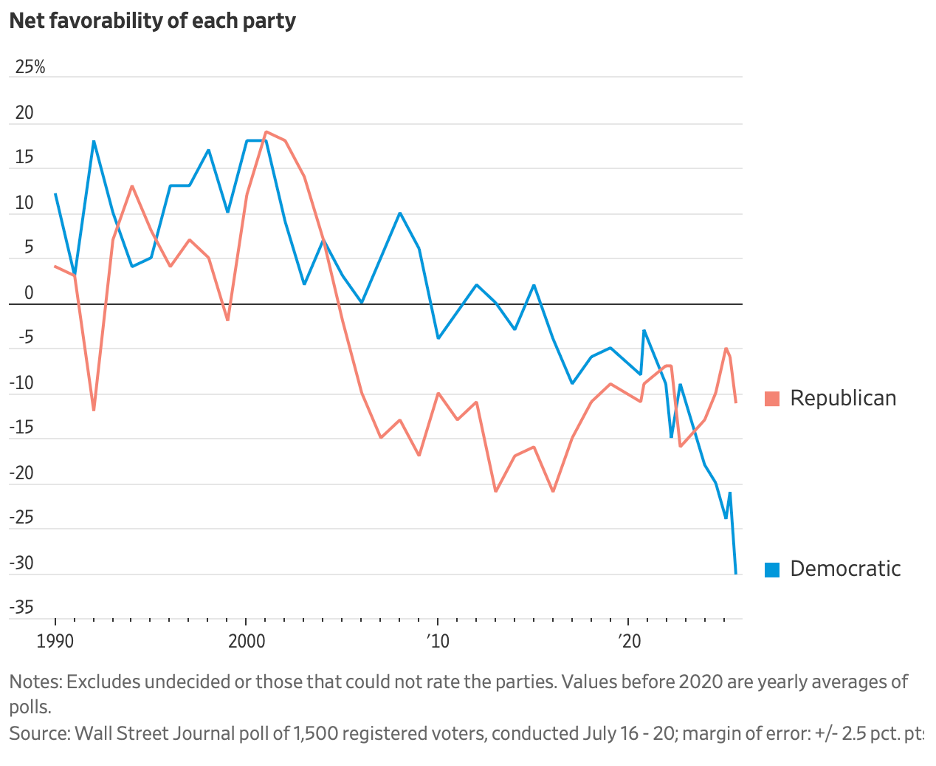

The Democratic Party’s image has eroded to its lowest point in more than three decades, according to a new Wall Street Journal poll, with voters seeing Republicans as better at handling most issues that decide elections.

The new survey finds that 63% of voters hold an unfavorable view of the Democratic Party—the highest share in Journal polls dating to 1990 and 30 percentage points higher than the 33% who hold a favorable view.

That is a far weaker assessment than voters give to either President Trump or the Republican Party, who are viewed more unfavorably than favorably by 7 points and 11 points, respectively. A mere 8% of voters view the Democrats “very favorably,” compared with 19% who show that level of enthusiasm for the GOP.

Democrats have been hoping that a voter backlash against the president will be powerful enough to restore their majority in the House in next year’s midterm elections, much as it did during Trump’s first term. But the Journal poll shows that the party hasn’t yet accomplished a needed first step in that plan: persuading voters they can do a better job than Trump’s party.

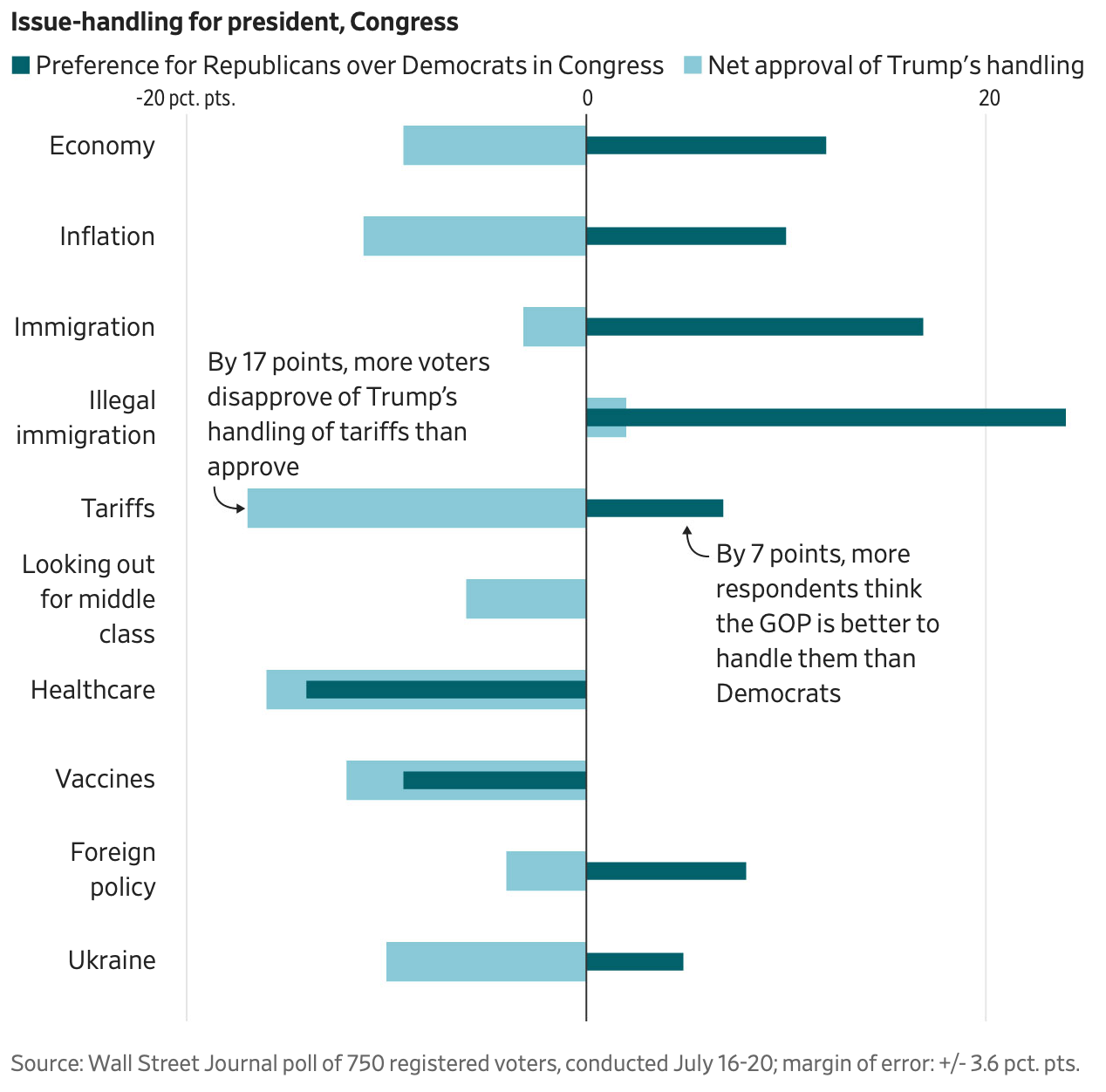

On the whole, voters disapprove of the president’s handling of the economy, inflation, tariffs and foreign policy. And yet in each case, the new Journal poll found, voters nonetheless say they trust Republicans rather than Democrats to handle those same issues in Congress.

In some cases, the disparities are striking. Disapproval of Trump’s handling of inflation outweighs approval by 11 points, and yet the GOP is trusted more than Democrats to handle inflation by 10 points. By 17 points, voters disapprove rather than approve of Trump’s handling of tariffs, and yet Republicans are trusted more than Democrats on the issue by 7 points.

6. Divorce In Decline: About 40% Of Today’s Marriages Will End In Divorce (AEI)

We’ve all heard the mantra that half of all marriages end in divorce. This idea often gets peddled as a way of dissuading young adults from tying the knot. If you only have 50/50 odds of making it, is marriage really worth the risk?

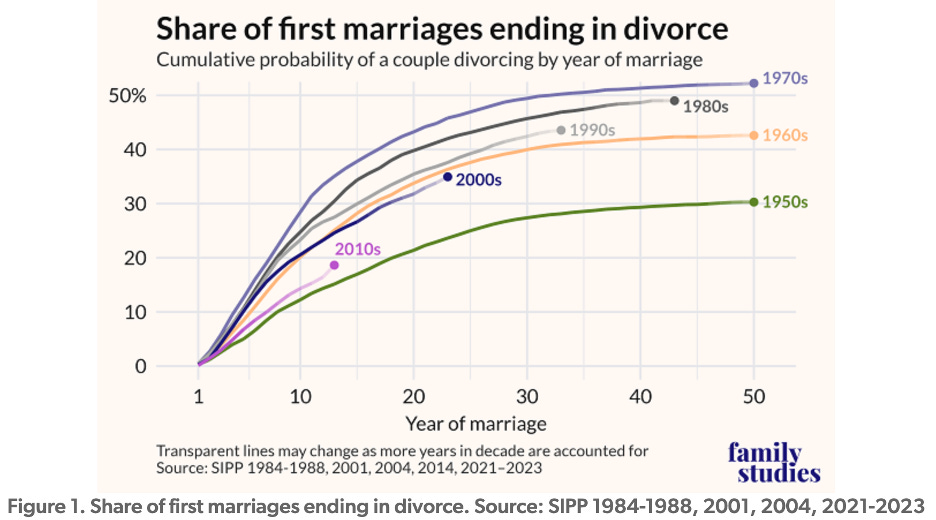

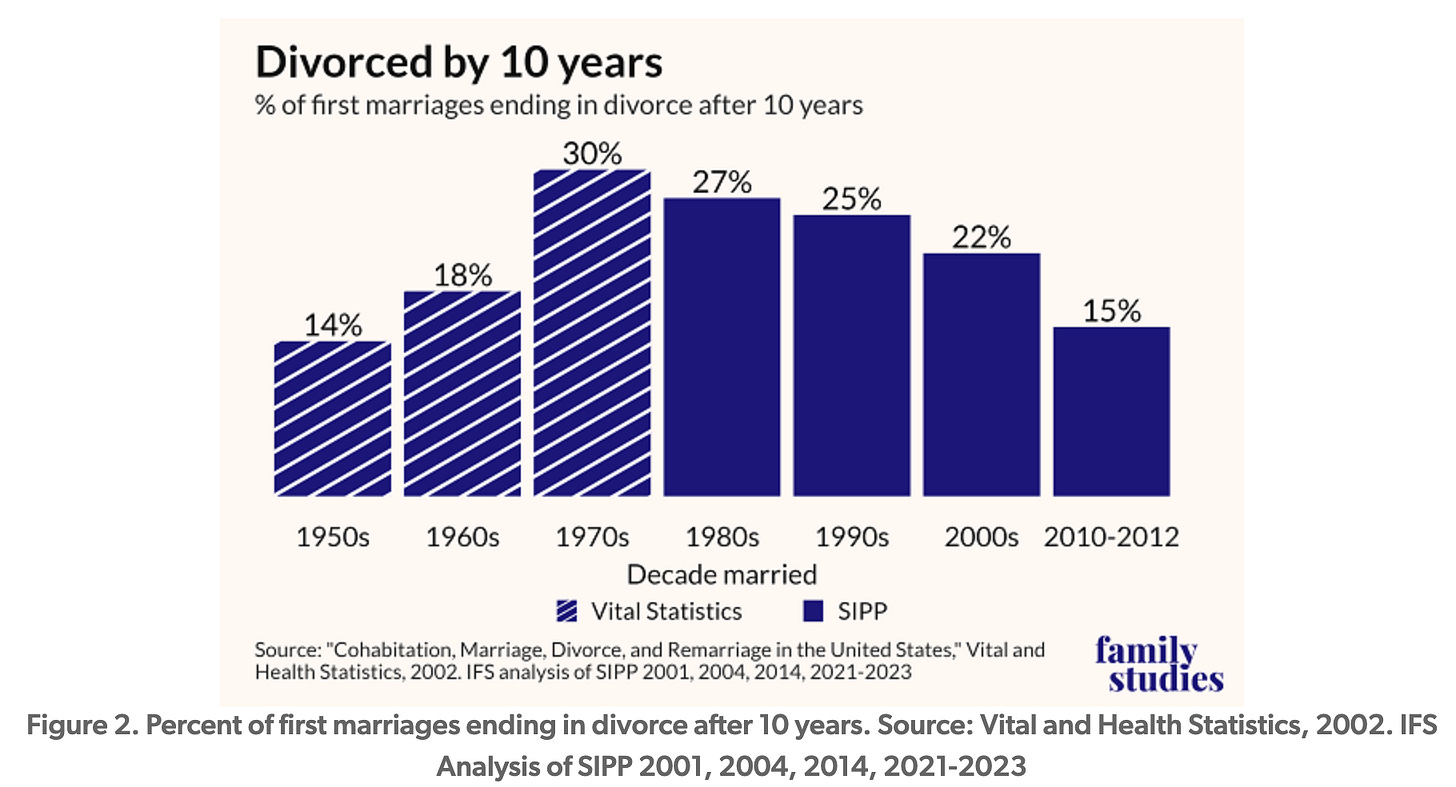

Much of this caution surrounding marriage comes from those who’ve personally witnessed broken vows or experienced the fallout that results. Prior to the divorce revolution, less than a third of marriages ended in divorce. But the cultural transformation of the 1960s and 1970s radically changed the stability of American unions. It’s from such marriages, formed during the heyday of hippies through the MTV era, that we get the idea that 50% of marriages end in divorce. And it’s this picture of marriage that has been pressed into the American understanding of the fate of newlyweds.

But the fortunes of marriage have changed in recent years. Marital stability looks much different than it did 30 years ago. Using the Survey of Income and Program Participation (SIPP), we found that new marriages are stronger today than every decade since the 1950s. While new marriages in the 2000s initially resembled those from the 1990s, divorce rates slowed down after 5 years into marriage. By 20 years in, marriages in the 2000s were performing similarly to those from the 1960s.

We’ve been witnessing an increase in marital stability since the end of the 1970s. And so far, marriages formed in the 2010s are sticking to this trend. Using the SIPP, we estimate that just 15% of marriages formed between 2010 and 2012 were divorced after 10 years. We found slightly lower 10-year survival rates for marriages from the 2010s using the American Community Survey, with about 19% divorcing. Compare this to 30% of marriages dissolving after 10 years from the 1970s. While not quite at 1950s levels (which saw only 14% of marriages dissolve after 10 years), the future of this new cohort looks much more stable.

That is, in part, because marriages formed between 2010 and 2012 have already put the hardest years behind them. Among 21st century new marriages, peak marital instability happens early on and earlier than those formed in the latter half of the 20th century. For instance, marriages formed in the 1970s saw peak marital instability around 8 to 10 years in. But for marriages made in the 2000s, divorce risk peaked around 5 years. Yearly risk of divorce has trended downward since.

7. 'Make America Fit Again': Trump brings back mile run, push up test for schools (USA Today)

On July 31, President Donald Trump will sign an executive order that reestablishes the Presidential Fitness Test for teens and preteens in America's public schools, said White House Press Secretary Karoline Leavitt.

The fitness test requires students to complete a range of physical challenges ranging from sit-ups to pull-ups.

The Presidential Fitness Test was a part of American physical education classes from the time it was first initiated by President Dwight Eisenhower in 1956 to the 2012-2013 school year. That's when President Barack Obama replaced it with a program designed to focus on long-term student health over physical performance.

The executive order says the Trump administration is reintroducing the test in the nation's public schools because of the high rates of obesity and chronic disease in the United States. Trump directed Secretary of Health and Human Services Robert F. Kennedy Jr. to renew the test.

NOTE: Brings back fond(ish) memories of climbing the rope and doing the sitting reach test in gym class back in the ‘80s.

8. Unemployed Americans Endure Longer Job Searches in a Cooling Market (WSJ)

Job seekers are out in the cold this summer. Especially the ones who have been hunting for a while.

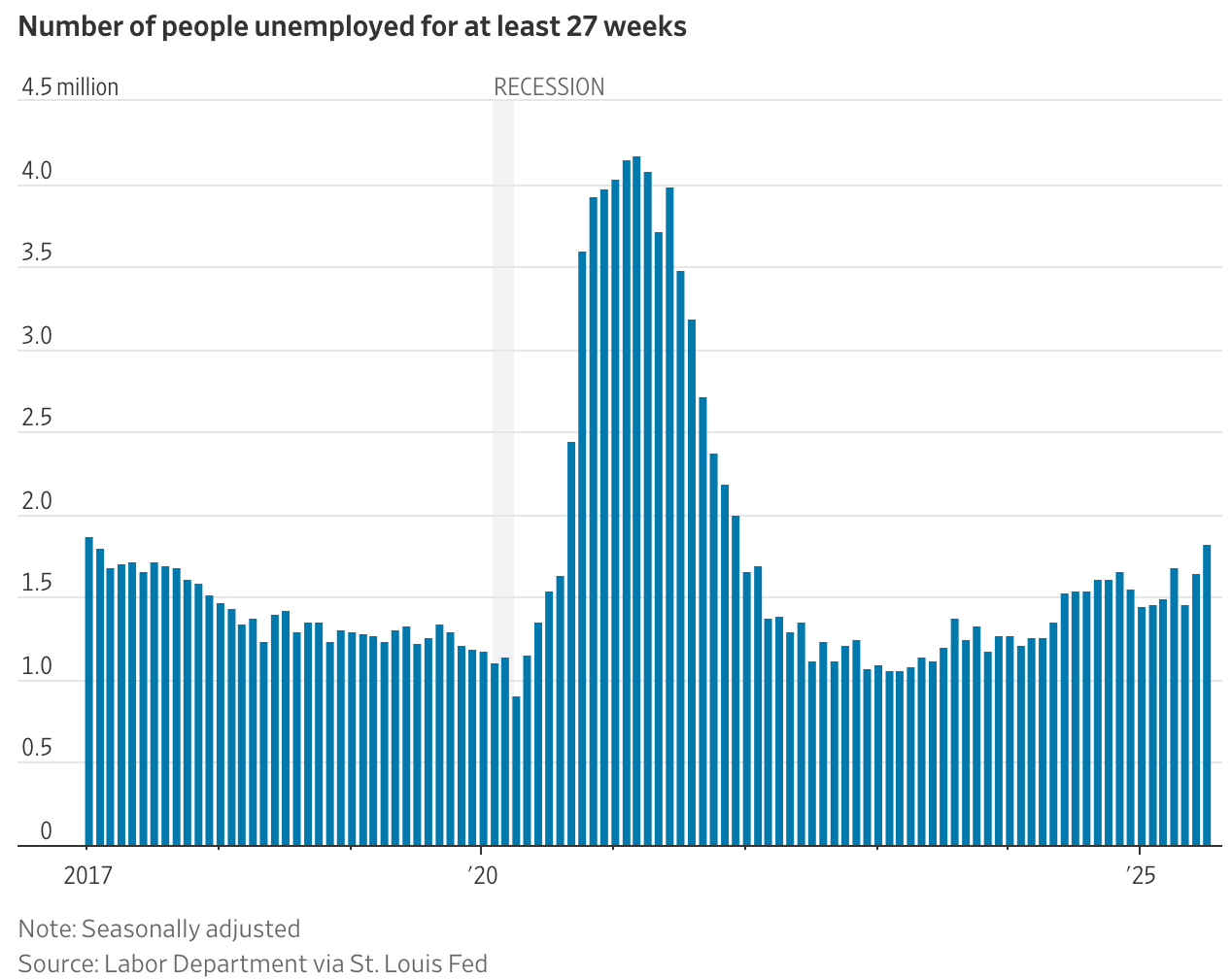

Beyond the headline-grabbing top-line numbers in the jobs report for July was another striking piece of data: The number of people unemployed for at least 27 weeks topped 1.8 million, the highest level since 2017, not counting the pandemic’s unemployment surge. The median length of unemployment in the U.S. has also ticked up, from a seasonally adjusted 9.5 weeks in July 2024 to 10.2 weeks last month.

This job-hunting struggle highlights a significant undercurrent in a labor market jolted by tariff uncertainty and cautious businesses. The latest numbers show job growth has been sluggish for months. While the unemployment rate, at 4.2%, remains low by historical standards, companies aren’t hiring much.

9. AI Is Wrecking an Already Fragile Job Market for College Graduates (WSJ)

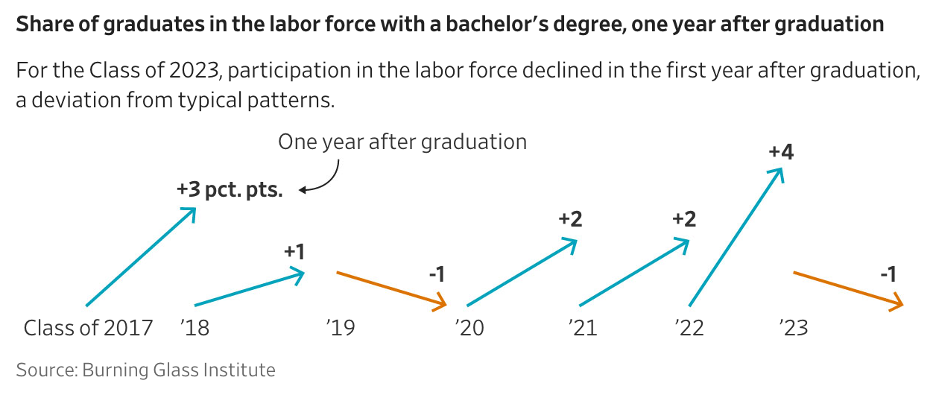

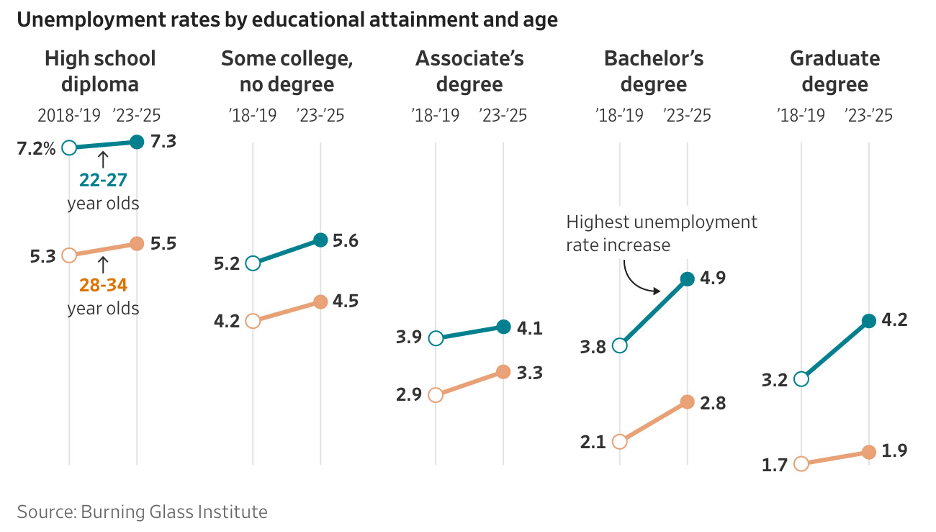

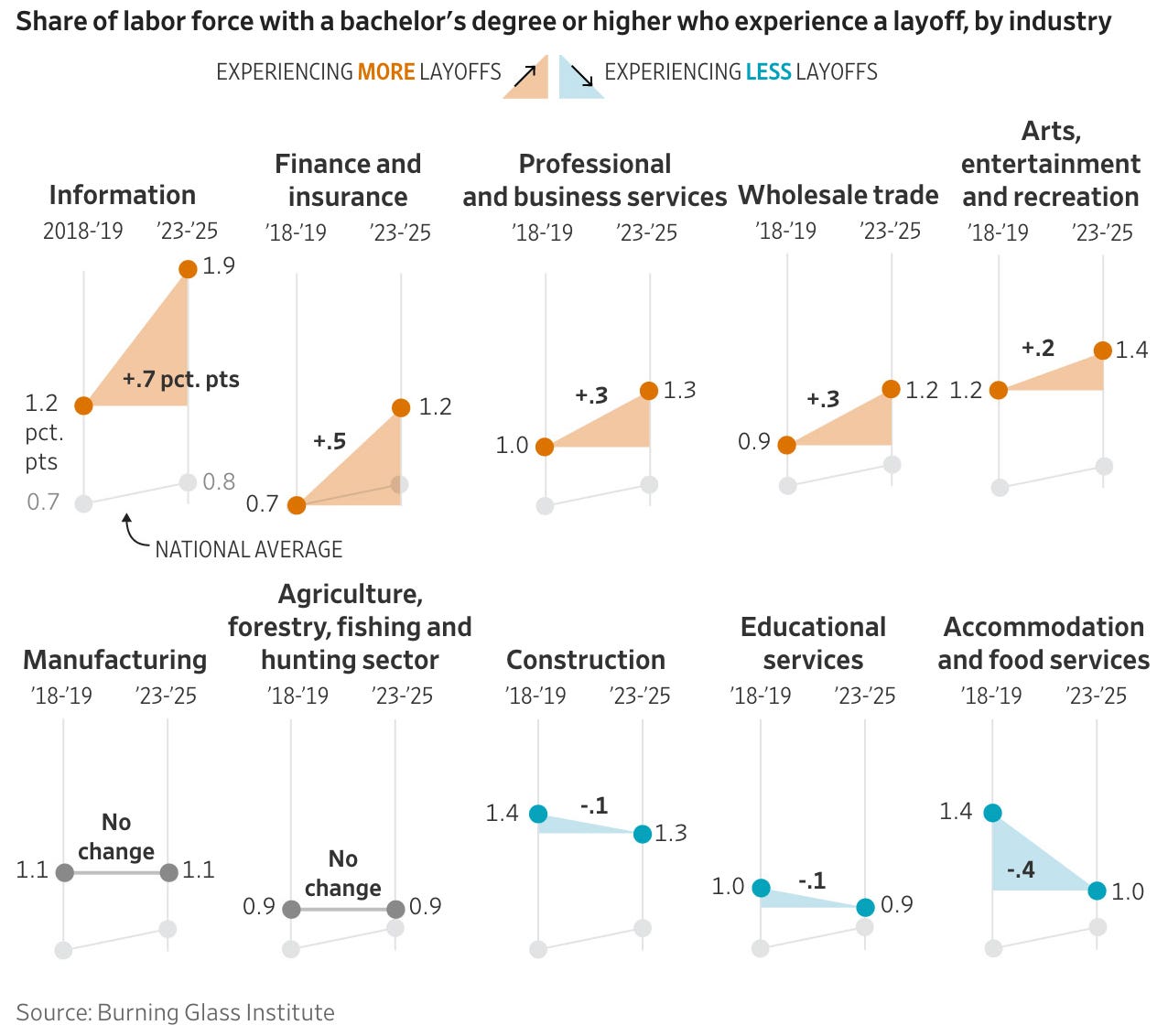

There’s long been an unwritten covenant between companies and new graduates: Entry-level employees, young and hungry, are willing to work hard for lower pay. Employers, in turn, provide training and experience to give young professionals a foothold in the job market, seeding the workforce of tomorrow.

A yearslong white-collar hiring slump and recession worries have weakened that contract. Artificial intelligence now threatens to break it completely.

That is ominous for college graduates looking for starter jobs, but also potentially a fundamental realignment in how the workforce is structured. As companies hire and train fewer young people, they may also be shrinking the pool of workers that will be ready to take on more responsibility in five or 10 years. Companies say they are already rethinking how to develop the next generation of talent.

AI is accelerating trends that were already under way.

10. ChatGPT's new study mode won't give you the answers (Axios)

OpenAI is trying to shed its reputation as a student cheating tool by launching a new study mode in ChatGPT that won't spit out answers. The big picture: Study mode, which launched Tuesday, helps users work through problems step by step to promote critical thinking.

Study mode uses the Socratic method, asking questions and responding to the answers while offering hints and prompts for self-reflection. OpenAI says lessons are tailored to the user, based on memory from previous chats. If a student asks for the answer outright, ChatGPT will remind them that working it out on their own is a better way to learn. Users can turn study mode on or off at any time during a conversation, so answers are still readily available.

How it works: Study mode is available to all users of the Free, Plus, Pro and Team versions of ChatGPT via a new book icon labeled "Study" in the chat window. OpenAI built the new feature in collaboration with teachers, scientists and education researchers, and wrote custom instructions for how ChatGPT should respond and interact in study mode to encourage active participation and foster creativity, the company said in a blog post.

11. It’s Not Too Late to Avert Dementia After Age 60, US Study Shows (Bloomberg)

There’s good news for older Americans at high-risk of developing dementia: simple steps to stay mentally and physically active improved thinking and helped keep Alzheimer’s disease at bay.

The key takeaways are to “move more, sit less, add color to your plate, learn something new, and stay connected,” Baker said at the Alzheimer’s Association International Conference in Toronto, where the results were presented. “Challenge yourself to do this on a regular basis.”

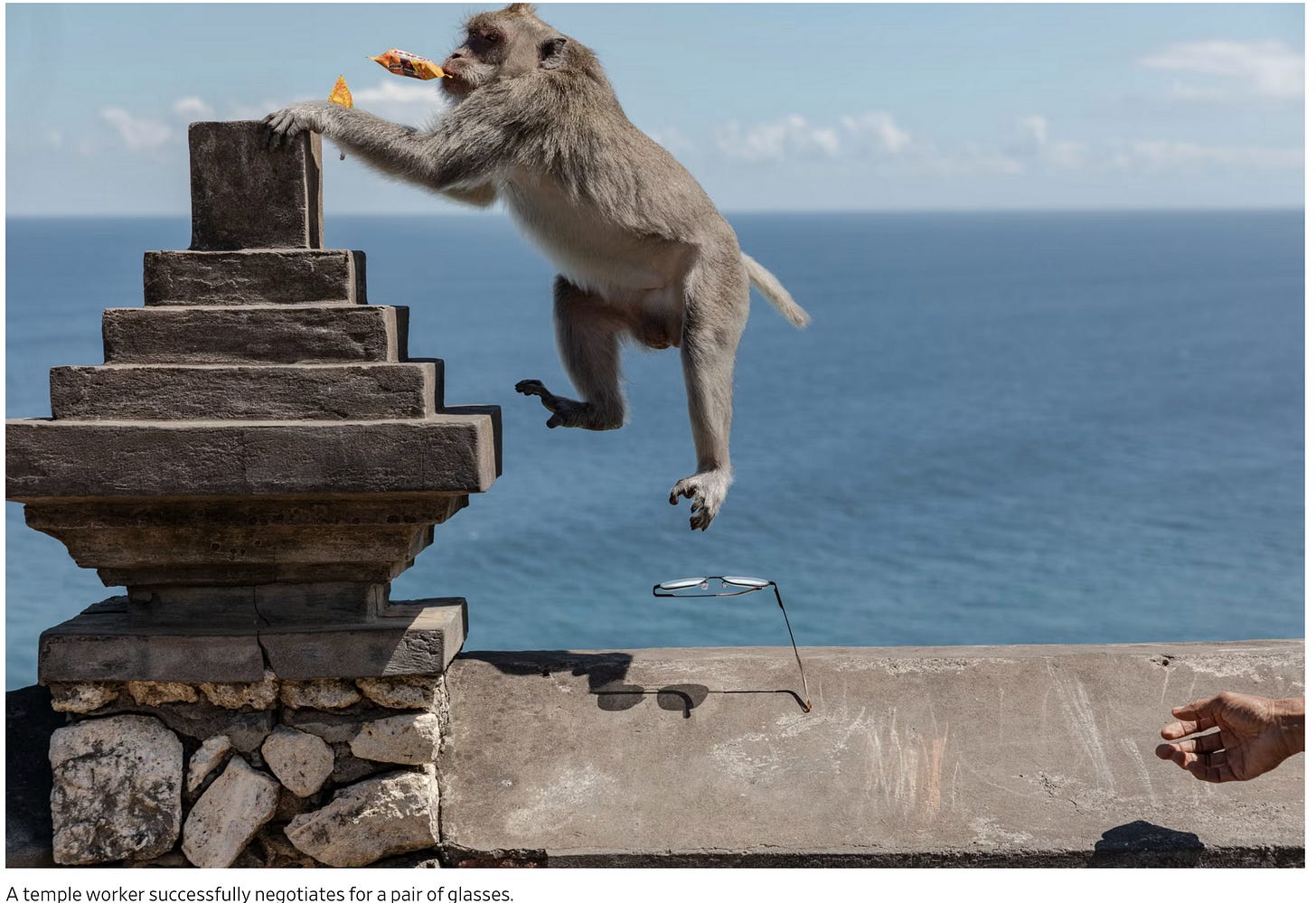

12. The Criminal Enterprise Run by Monkeys (WSJ)

At a cliff-side temple on the tropical island of Bali, an unexpected group of criminals is running one of the world’s most sophisticated scam operations.

Every week, they steal dozens of phones, wallets and other valuables from tourists in broad daylight and exchange them for handsome rewards. It’s been going on for decades and nobody’s been able to stop it.

The culprits? Long-tailed macaques.

“The monkeys have taken over the temple,” said Jonathan Hammé, a tourist from London whose sunglasses were stolen by a monkey during a visit last year. “They’re running a scam.”

On the southern tip of the Indonesian vacation hot spot known for its beaches, tourists flock to Uluwatu Temple for traditional fire dance shows and panoramic views at sunset with the Indian Ocean crashing below. The Balinese Hindu site dates back to at least the 11th century and the roughly 600 monkeys that inhabit it are considered by locals to be sacred guardians of the temple.

Primate researchers have found that the macaques steal belongings to use as currency to trade with humans for food. Some monkeys can distinguish between objects we highly value (smartphones, prescription glasses, wallets) and those we don’t (hats, flip flops, hair clips)—and will barter accordingly, according to a University of Lethbridge team that spent years filming the macaques and analyzing hundreds of hours of footage.

In other words, the monkeys have “unprecedented economic decision-making processes,” the researchers wrote in a 2021 academic paper. Talk about monkey business.

Have a great week!