12 Things from the week | 13 Sep 25

News from the past week, and a few other things.

1. OPINION | Charlie Kirk Was Practicing Politics the Right Way (NYT)

NOTE: This is a poignant opinion piece by Ezra Klein, a liberal political commentator and journalist. I’ve extracted some snippets below; however, I recommend reading the article in its entirety. But first, some thoughts from me.

Charlie Kirk—a prominent conservative activist—was shot and killed this week while taking part in a public debate on a college campus. His death is tragic enough on its own. But the fact that it occurred while he was exercising his First Amendment rights makes it even more disturbing—and the setting, a college campus where ideas should be debated openly and peacefully, makes it especially troubling.

In recently released results of a free speech survey of 68,000 college students by The Foundation for Individual Rights and Expression and College Pulse, 34% of students said that “using violence to stop someone from speaking on campus is acceptable, at least in rare cases.” This is two points higher than last year, and 10 points higher from four years ago. This is not okay.

The free and open exchange of ideas underlies intellectual inquiry and is the bedrock of a democratic society. We discover knowledge and advance as a society through the free exchange of competing ideas.

We know that different perspectives and beliefs will always be present; this is pluralism, and it’s a good thing. You are not always right, and neither am I. Together, through open inquiry, we explore any and all questions and problems. And through civil discourse and debate, we deliberate by examining ideas rigorously and defending our positions with truth and sound reasoning. Ultimately, we aim to advance in our collective pursuit of wisdom.

At least, that’s how it’s supposed to work—and why freedom of speech stands as the First Amendment to our Constitution.

Here are Klein’s words:

The foundation of a free society is the ability to participate in politics without fear of violence. To lose that is to risk losing everything. Charlie Kirk — and his family — just lost everything. As a country, we came a step closer to losing everything, too.

…

You can dislike much of what Kirk believed and the following statement is still true: Kirk was practicing politics in exactly the right way. He was showing up to campuses and talking with anyone who would talk to him. He was one of the era’s most effective practitioners of persuasion. When the left thought its hold on the hearts and minds of college students was nearly absolute, Kirk showed up again and again to break it. Slowly, then all at once, he did. College-age voters shifted sharply right in the 2024 election.

That was not all Kirk’s doing, but he was central in laying the groundwork for it. I did not know Kirk, and I am not the right person to eulogize him. But I envied what he built. A taste for disagreement is a virtue in a democracy. Liberalism could use more of his moxie and fearlessness. In the inaugural episode of his podcast, Gov. Gavin Newsom of California hosted Kirk, admitting that his son was a huge fan. What a testament to Kirk’s project.

…

American politics has sides. There is no use pretending it doesn’t. But both sides are meant to be on the same side of a larger project — we are all, or most of us, anyway, trying to maintain the viability of the American experiment. We can live with losing an election because we believe in the promise of the next election; we can live with losing an argument because we believe that there will be another argument. Political violence imperils that.

Kirk and I were on different sides of most political arguments. We were on the same side on the continued possibility of American politics. It is supposed to be an argument, not a war; it is supposed to be won with words, not ended with bullets. I wanted Kirk to be safe for his sake, but I also wanted him to be safe for mine and for the sake of our larger shared project. The same is true for Shapiro, for Hoffman, for Hortman, for Thompson, for Trump, for Pelosi, for Whitmer. We are all safe, or none of us are.

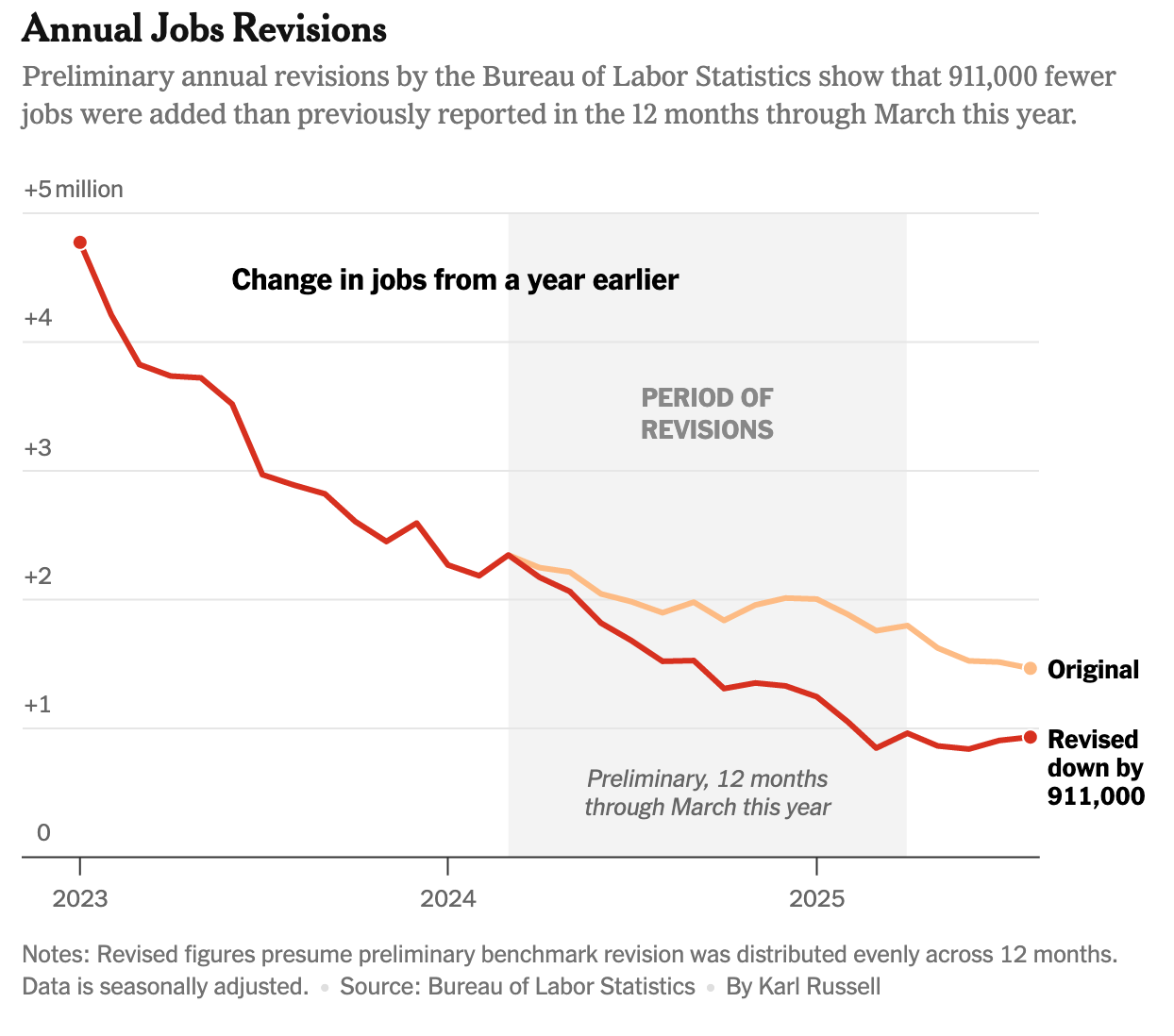

2. Employers Added Nearly a Million Fewer Jobs Than Believed, Data Shows (NYT)

The U.S. labor market appears weaker than initially believed after the Bureau of Labor Statistics (BLS) announced that job growth from 2024 through early 2025 was overstated by about 911,000 jobs, cutting the total gains for that period roughly in half. This preliminary revision, part of the BLS’s annual benchmarking process, comes amid political controversy following President Trump’s firing of the agency’s top official last month. The data suggest that recent employment figures may also have been inflated, a concern for Federal Reserve policymakers already facing signs of a cooling labor market, including a modest 22,000 jobs added in August and a rise in unemployment to 4.3%, the highest in nearly four years. The downward revisions were broad, especially in services, leisure and hospitality, retail, and information sectors. Final revised figures are expected early next year, but this would mark the largest downward adjustment since 2009.

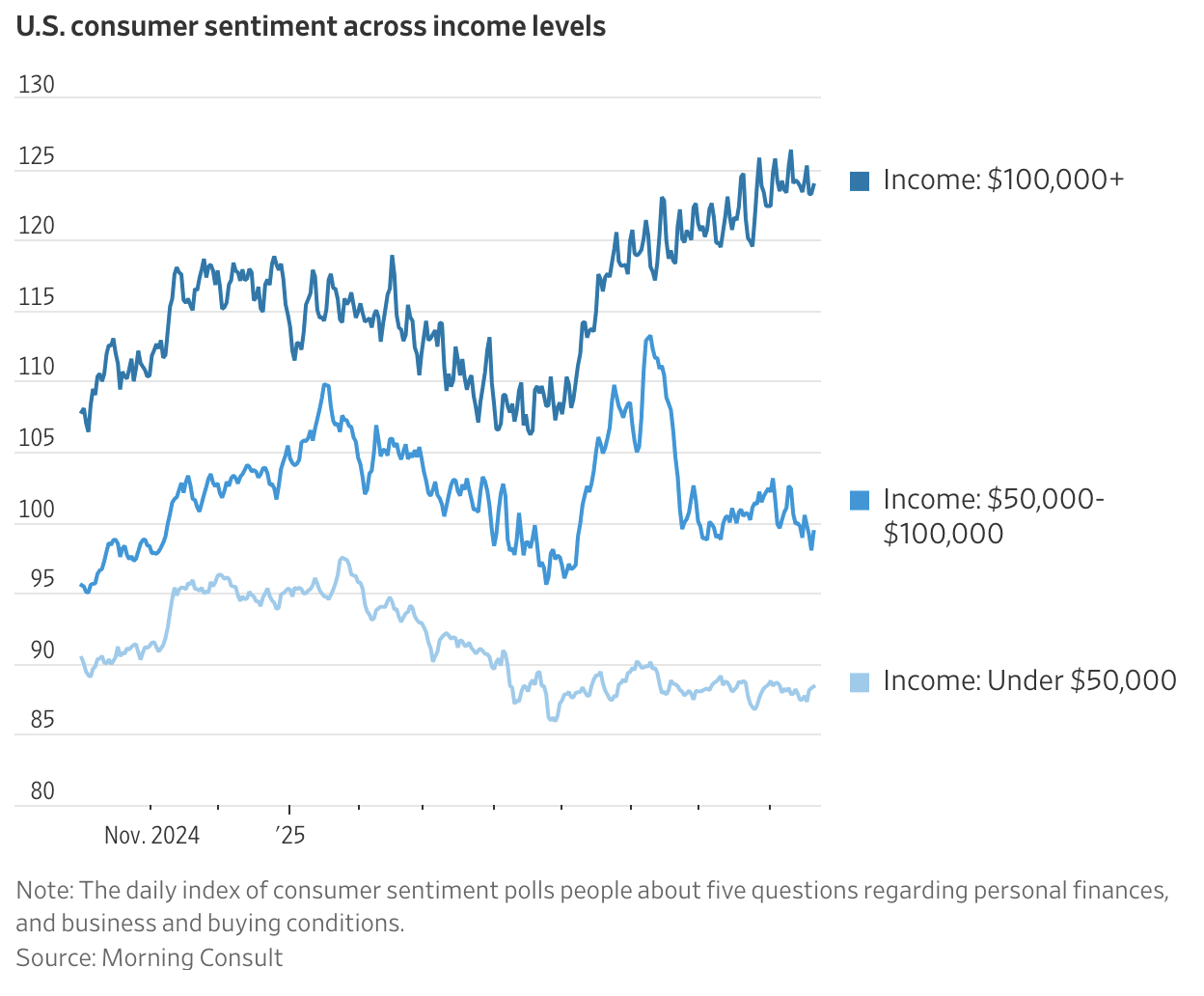

3. The Middle-Class Vibe Has Shifted From Secure to Squeezed (WSJ)

Consumer confidence among America’s middle class weakened significantly this summer after earlier signs of improvement. In August, overall sentiment fell nearly 6%, with surveys showing increased pessimism about the job market and more people expecting income declines. Households earning between $50,000 and $100,000—previously tracking with higher-income earners’ optimism—shifted sharply in June to align more closely with the gloomier outlook of lower-income groups. Economists and business leaders report mounting evidence that middle-class consumers are feeling increasingly squeezed, even as higher-income households continue to spend freely across industries such as retail, dining, fashion, and travel.

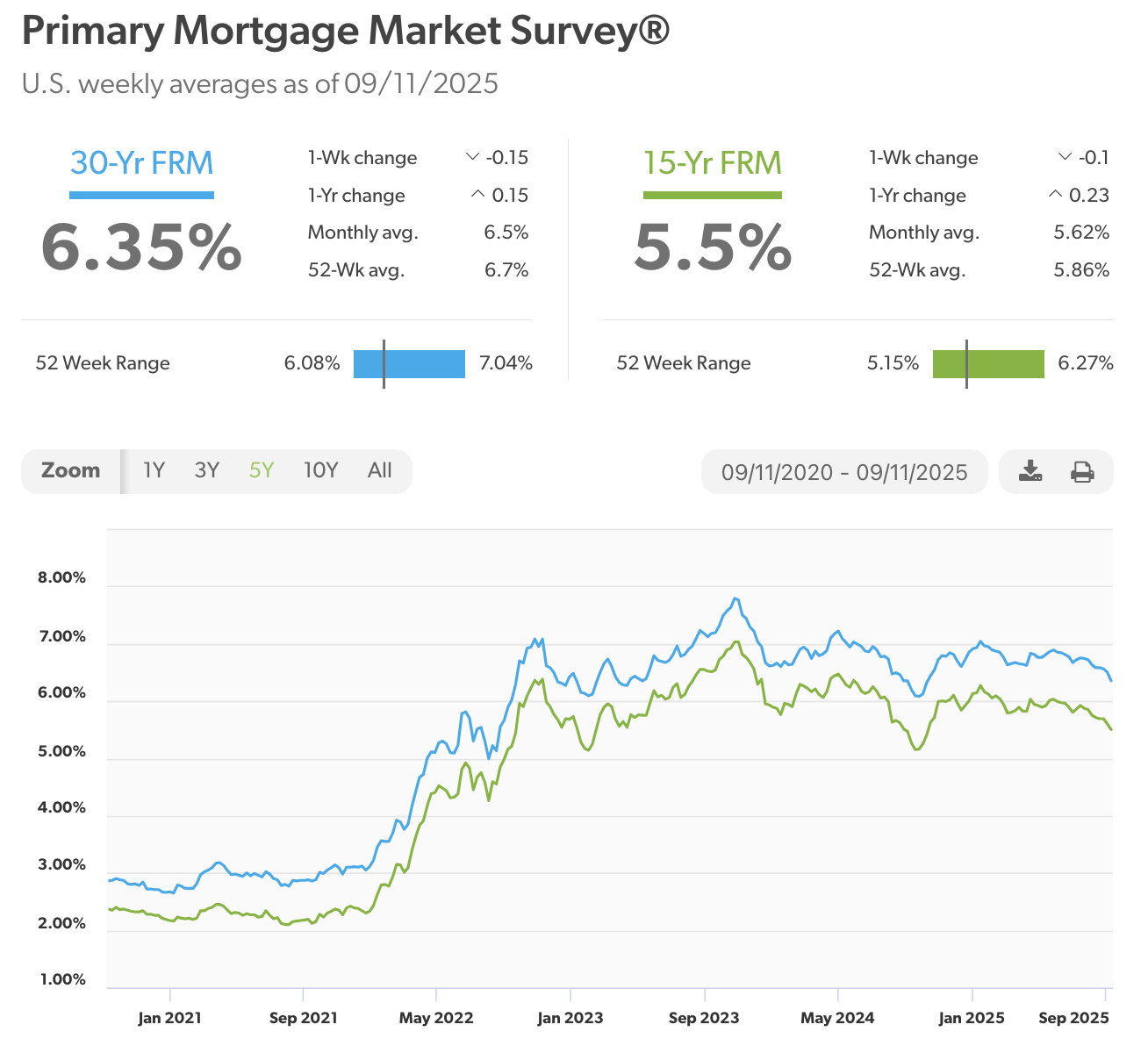

4. Mortgage Rates Are at an 11-Month Low. Will That Save This Housing Market? (WSJ)

Mortgage rates dropped this week to their lowest level in nearly a year, with the average 30-year fixed rate falling to 6.35% amid expectations of a Federal Reserve rate cut next week. This decline, from above 7% earlier this year, is giving buyers more purchasing power—a $3,000 monthly housing budget now covers a $466,000 home compared to $442,500 at 7%. Some prospective buyers are jumping in before rates—and potentially home prices—shift again, with purchase applications up 22% year-over-year in early September.

However, affordability remains a challenge as home prices have risen over 50% since 2019, along with higher insurance and property taxes. Many would-be buyers continue to wait, and analysts say even lower rates may not fully offset affordability issues unless they drop below 6%, or ideally into the 5% range. Builders offering sub-5% rates on new homes are attracting interest, but economists caution that affordability may improve only gradually, requiring years of income growth, stable home prices, and sustained lower mortgage rates to return to pre-pandemic levels.

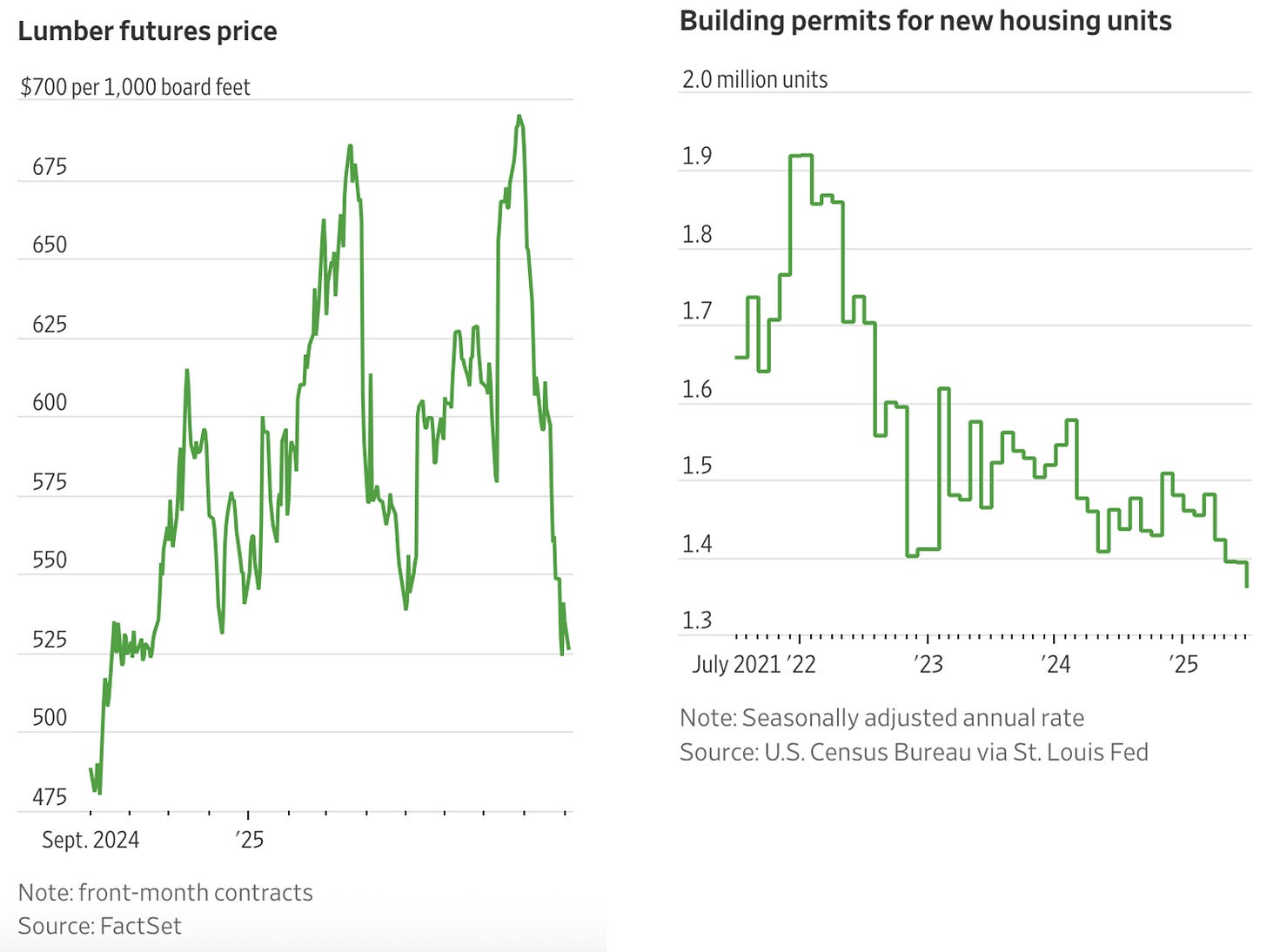

5. Lumber Prices Are Flashing a Warning Sign for the U.S. Economy (WSJ)

NOTE: I learned a new word from this article—sawyer—which means someone who saws wood. Makes sense.

Economists feared major disruptions when President Trump announced potential tariffs in April, but the U.S. economy has remained surprisingly resilient so far. However, the lumber industry is beginning to feel the strain. With uncertainty about whether tariffs would actually be imposed, some producers, like Dean’s plant, avoided stockpiling materials and instead relied on a cautious, “hand-to-mouth” supply approach. Lumber prices have since dropped about 12% since August 1, while residential construction permits have fallen to their lowest level since 2020, and total U.S. construction spending is down 3.4% from May’s record high. In response to declining prices and demand, major producers such as Interfor and Domtar have announced production cuts, temporary mill closures, and reduced shifts, with analysts predicting even more shutdowns ahead. Contributing to the glut, Canadian mills had already overstocked U.S. warehouses before tariff-related duties jumped from 15% to 35%, leaving ample supply despite slowing demand. Still, falling mortgage rates and the likelihood of a Federal Reserve rate cut could boost construction, home buying, and renovation activity in the coming months, potentially providing some relief for the lumber market.

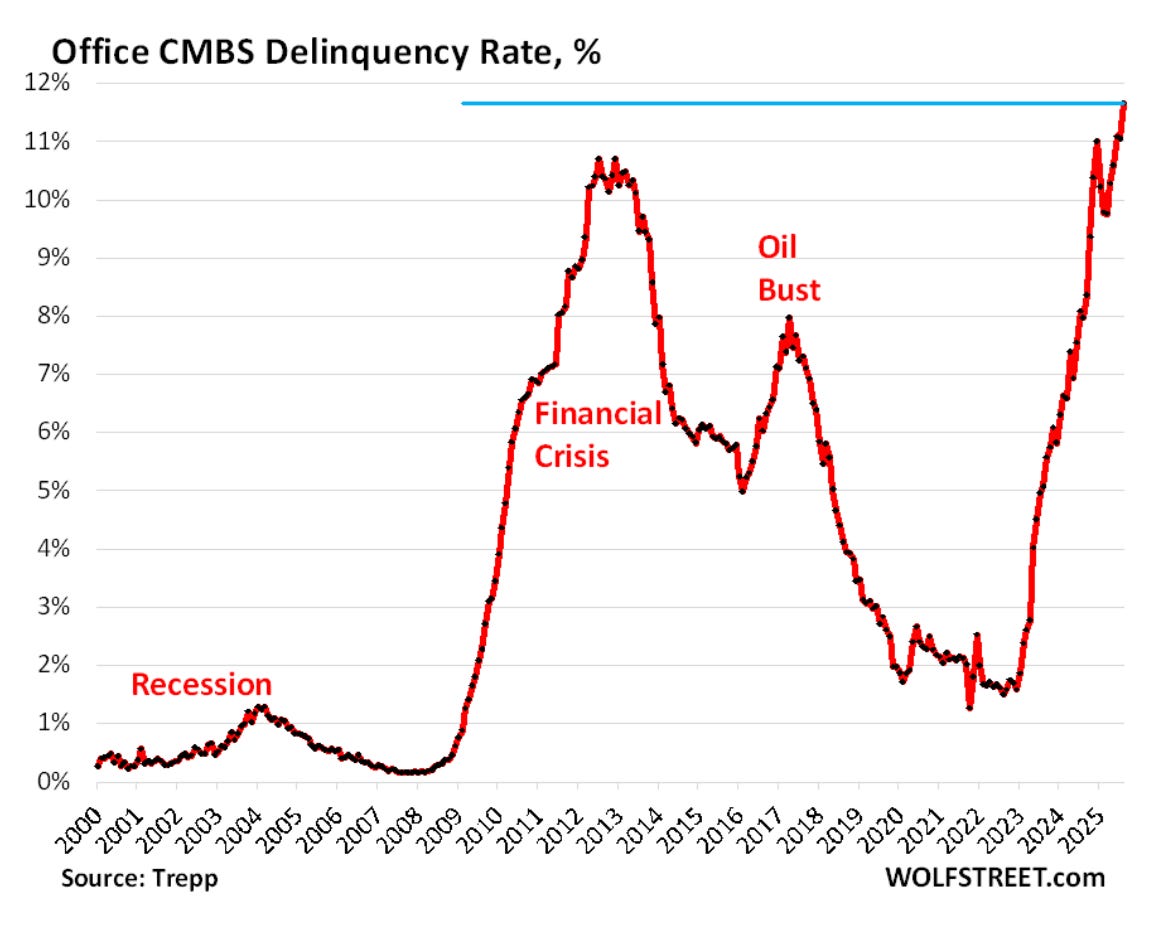

6. Office CMBS Delinquency Rate Spikes to Record 11.7%, Much Worse than Financial Crisis Peak. Multifamily Delinquencies also Spike (Wolf Street)

The office and multifamily sectors of commercial real estate (CRE) loans worsened sharply in August despite widespread efforts to extend loan terms and offer forbearance to avoid defaults. The delinquency rate for office mortgages packaged into commercial mortgage-backed securities (CMBS) surged to a record 11.7%, surpassing even the 2008–2009 financial crisis peak, driven largely by older office towers losing tenants to newer, higher-quality buildings. Multifamily CMBS delinquencies also climbed to 6.9%, their highest since 2015, making this the second weakest CRE category after offices, with lodging and retail following closely behind.

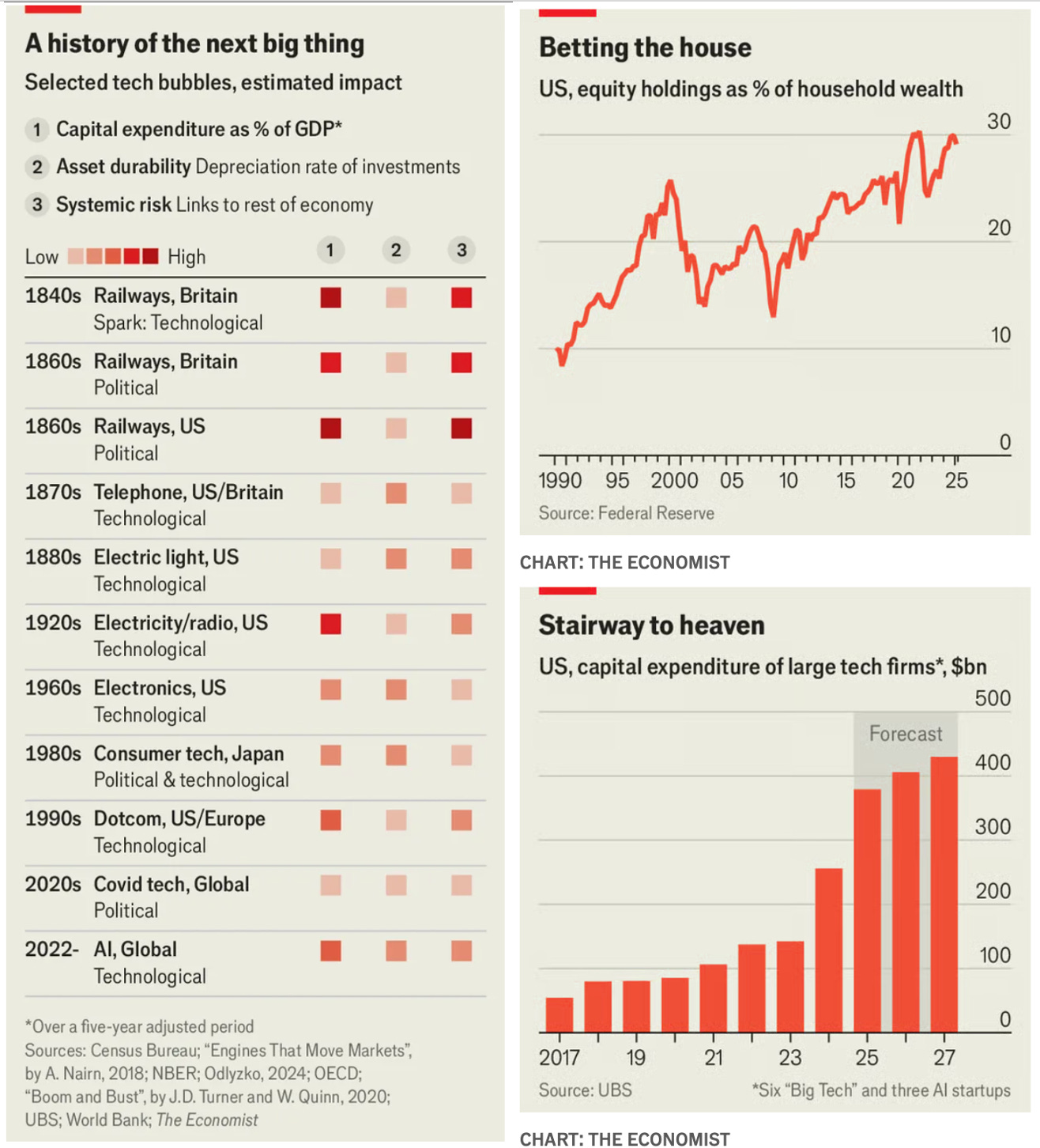

7. What if the AI stockmarket blows up? (The Economist)

Since ChatGPT’s release in 2022, America’s stock market has gained $21 trillion in value, with just ten firms—including Amazon, Nvidia, and Broadcom—driving over half the increase amid excitement about artificial intelligence. Investors argue AI could rival the Industrial Revolution in economic impact, fueling massive investments in data centers and technology infrastructure. Yet AI revenues remain modest at about $50 billion annually, and studies show most companies see little to no return on their AI spending so far, raising fears of a speculative bubble. Analysts note AI valuations now exceed those of the dotcom era, and even OpenAI’s Sam Altman admits investors may be “overexcited.”

Historical parallels suggest tech bubbles often burst but leave lasting innovations—railways, electricity, and the internet all endured after their booms collapsed. The risk for AI lies in heavy capital spending on assets that depreciate quickly and in the economic ripple effects if stock prices fall sharply, given record household exposure to equities and concentrated gains in a few firms. Still, because big tech firms and private investors, not banks, fund most AI investments, a crash would likely hit wealth and spending rather than trigger systemic financial collapse. Whether AI delivers on its transformative promise or becomes another cautionary tale remains uncertain, but history warns that even productive bubbles can end painfully when expectations race ahead of reality.

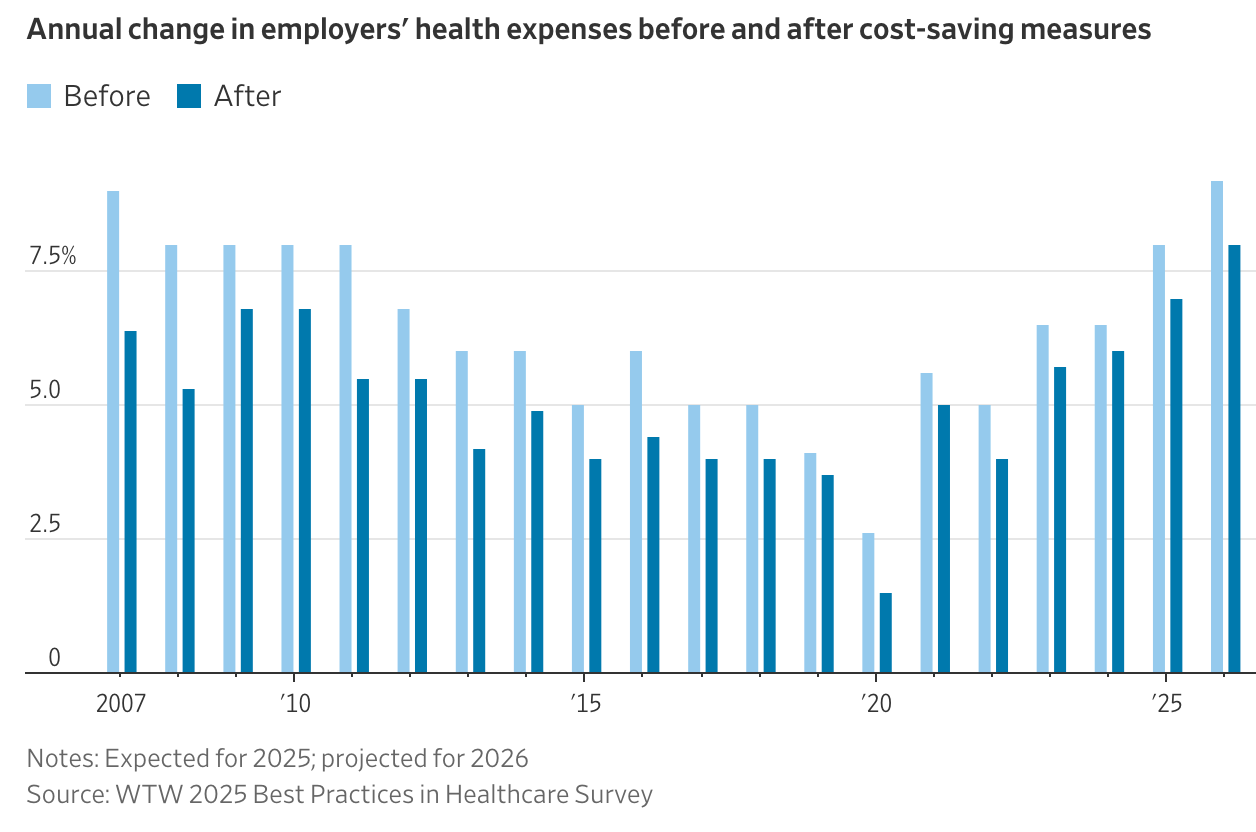

8. Health Insurance Costs for Businesses to Rise by Most in 15 Years (WSJ)

U.S. employers are facing the steepest health-insurance cost increases in at least 15 years, with expenses for family coverage projected to surge around 9.5% in 2026 after several years of already sharp hikes. Rising hospital prices, increased use of medical services for conditions like cancer and heart disease among working-age Americans, and the high costs of drugs such as GLP-1 weight-loss treatments are driving the escalation. Some companies are redesigning health plans, shifting more costs to employees, or seeking new insurance and pharmacy-benefit vendors to manage expenses.

Employers report growing frustration with the pace and breadth of these increases, noting that healthcare inflation, aggressive hospital billing, and expensive new therapies are pushing costs beyond sustainable levels. While some firms are cutting coverage for certain drugs or raising out-of-pocket maximums, others are considering switching carriers entirely to rein in costs. Experts warn this is the fastest escalation in employer health-insurance expenses in over a decade, raising concerns about long-term affordability for both companies and workers.

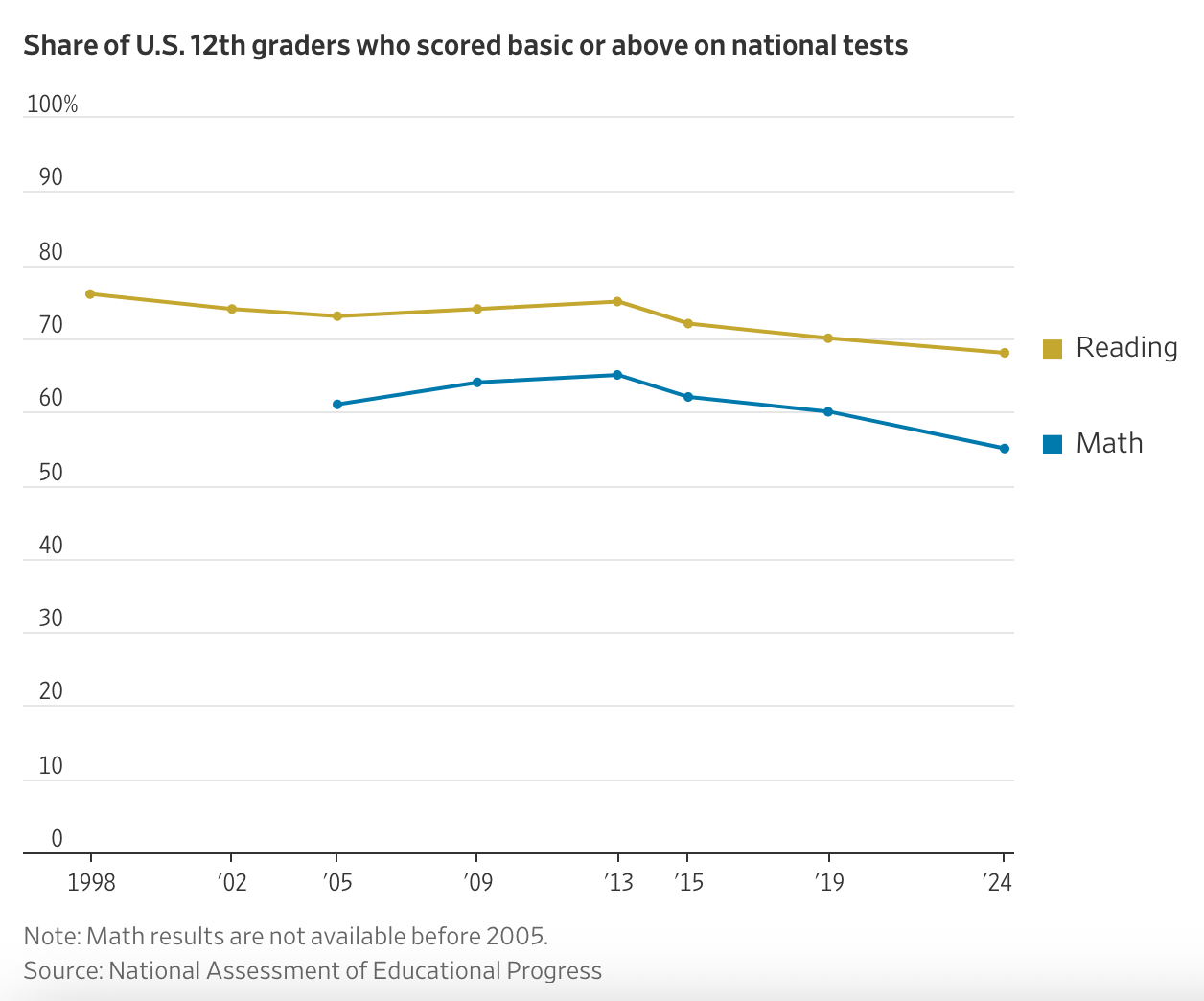

9. Twelfth-Grade Math and Reading Scores in U.S. Hit New Low (WSJ)

American high school seniors’ math and reading scores have fallen to their lowest levels on record, according to the U.S. Education Department’s latest data. Average math performance is at its worst since the assessment began in 2005, and reading scores are at their lowest since 1992. Only 22% of students were proficient in math and 35% in reading, both down two percentage points since 2019. Even more students fell below the “basic” level of performance, widening the gap between top and struggling students, with girls’ scores dropping faster than boys’. The declines began before the pandemic but have been worsened by school closures, high absenteeism, teacher turnover, and digital distractions. Researchers note that factors such as social media and smartphones may be playing a role, though no single cause fully explains the trend.

10. U.S. Population Growth Will Slow Even More, CBO Says (WSJ)

The U.S. population is projected to grow far more slowly in the coming decades as falling fertility rates and tighter immigration enforcement take hold, according to new Congressional Budget Office estimates. Deaths are now expected to outnumber births by 2031—two years earlier than previously forecast—and by 2055, the population will reach about 367 million, down from earlier projections of 372 million. Annual population growth, which averaged 0.9% from 1975 to 2024, is expected to fall to nearly zero by the early 2050s.

11. A giant “knife-fight” in the Pacific (Economist)

At the September 10th Pacific Islands summit in Honiara, Solomon Islands, leaders from Pacific-island nations, Australia, and New Zealand gathered while China, though not invited, tried to exert influence behind the scenes. China has been pushing for economic, diplomatic, and potentially military footholds across the Pacific, raising concerns among traditional partners like the U.S., Australia, and New Zealand, who have blocked efforts to establish Chinese bases in the region. Beijing has sought access to strategic ports, airfields, and policing agreements, especially in Melanesian countries such as the Solomon Islands, where its presence is most entrenched.

The competition goes beyond infrastructure. China has used its growing leverage to pressure Pacific nations diplomatically, even trying to prevent Taiwan from attending the summit—a move that could have fractured the regional Pacific Islands Forum. Ultimately, the Solomons banned all non-member observers, including China and the U.S., to avoid division. Despite Australia matching Chinese aid and influence efforts, the contest remains close. Analysts warn this is part of a “permanent contest” for power in the Pacific, with China expected to continue expanding its reach through ports, police academies, and diplomatic maneuvering.

12. World’s Biggest Animal Migration—and Few Outsiders Have Seen It (WSJ)

NOTE: Amazing! Article has great pictures and videos.

South Sudan is home to the Great Nile Migration, the world’s largest land-mammal migration, with nearly six million antelope—white-eared kob, tiang, Mongalla gazelle, and Bohor reedbuck—moving across a region the size of Illinois. Far bigger than the Serengeti’s famed wildebeest trek, this spectacle remains little known and rarely seen because of decades of civil conflict, lack of roads, and the difficulty of access. Researchers only recently discovered the full scale of the migration through aerial surveys, revealing its complexity as herds follow seasonal rains, flooding patterns, and largely avoid human activity.

While conservation groups like African Parks and the South Sudanese government hope to develop ecotourism, ongoing violence, oil development, road construction, and poaching by hunters with military-grade weapons threaten the herds’ survival. Interethnic conflicts have ironically created no-man’s-lands that shield the animals, but hunting pressure is rising, and history warns how quickly even vast herds can vanish—zebra once abundant in Boma National Park are now nearly gone. Conservationists stress that managing hunting and balancing development with protection are essential if the migration, described as “mind-blowing” by those few who have seen it, is to endure for future generations.