10 Things from the week | 27 Sep 25

News from the past week, and a few other things.

1. Have an Argument

Americans often think political division means too much disagreement, but the real problem is too little genuine engagement across differences. Most people stay in ideological bubbles—on social media, in partisan media, at universities, even in churches—talking about opponents rather than with them. This avoids real debate and turns politics into a battle of caricatures rather than a process for solving shared problems.

The U.S. Constitution assumes disagreement is inevitable and builds institutions like legislatures, courts, and newspapers to make argument constructive. But digital culture now fosters division instead of deliberation, rewarding outrage and separating people into echo chambers.

Lowering political tensions, the author argues, requires more direct and concrete disagreement, not less—debate focused on tangible issues and solutions, with the patience to negotiate and compromise. Political opponents are not enemies to be eliminated but fellow citizens shaping a shared future, and a healthy democracy depends on engaging them as such.

A few articles and charts on AI:

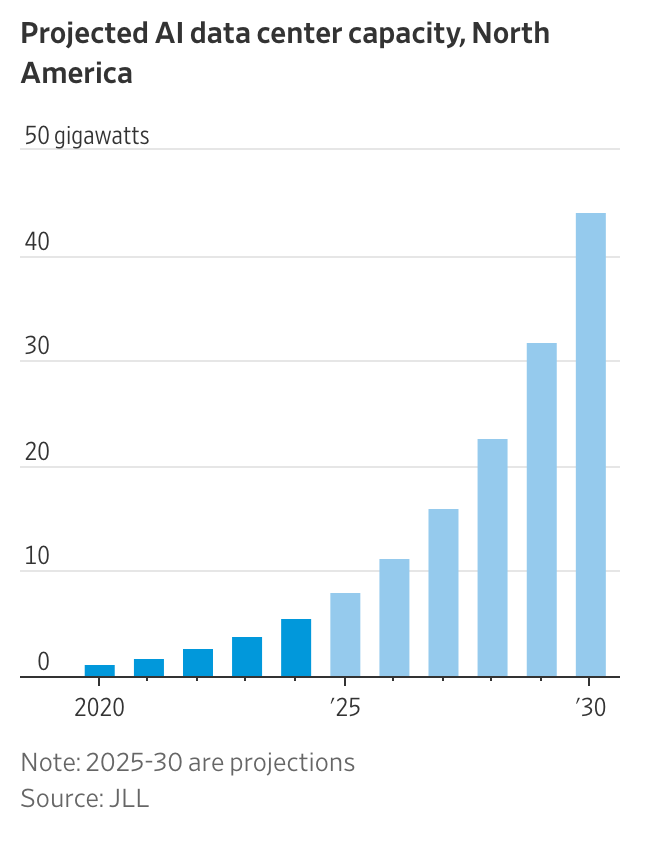

2. OpenAI Unveils Plans for Seemingly Limitless Expansion of Computing Power

OpenAI and its partners are rapidly building massive data centers across Texas, New Mexico, Ohio, and the Midwest, with projects capable of delivering a combined 7 gigawatts of capacity. The largest site near Abilene, Texas—already home to the first completed data center—houses rows of Nvidia GPUs, each reportedly worth as much as a Tesla Model 3, powering AI tasks at enormous scale.

3. Spending on AI Is at Epic Levels. Will It Ever Pay Off?

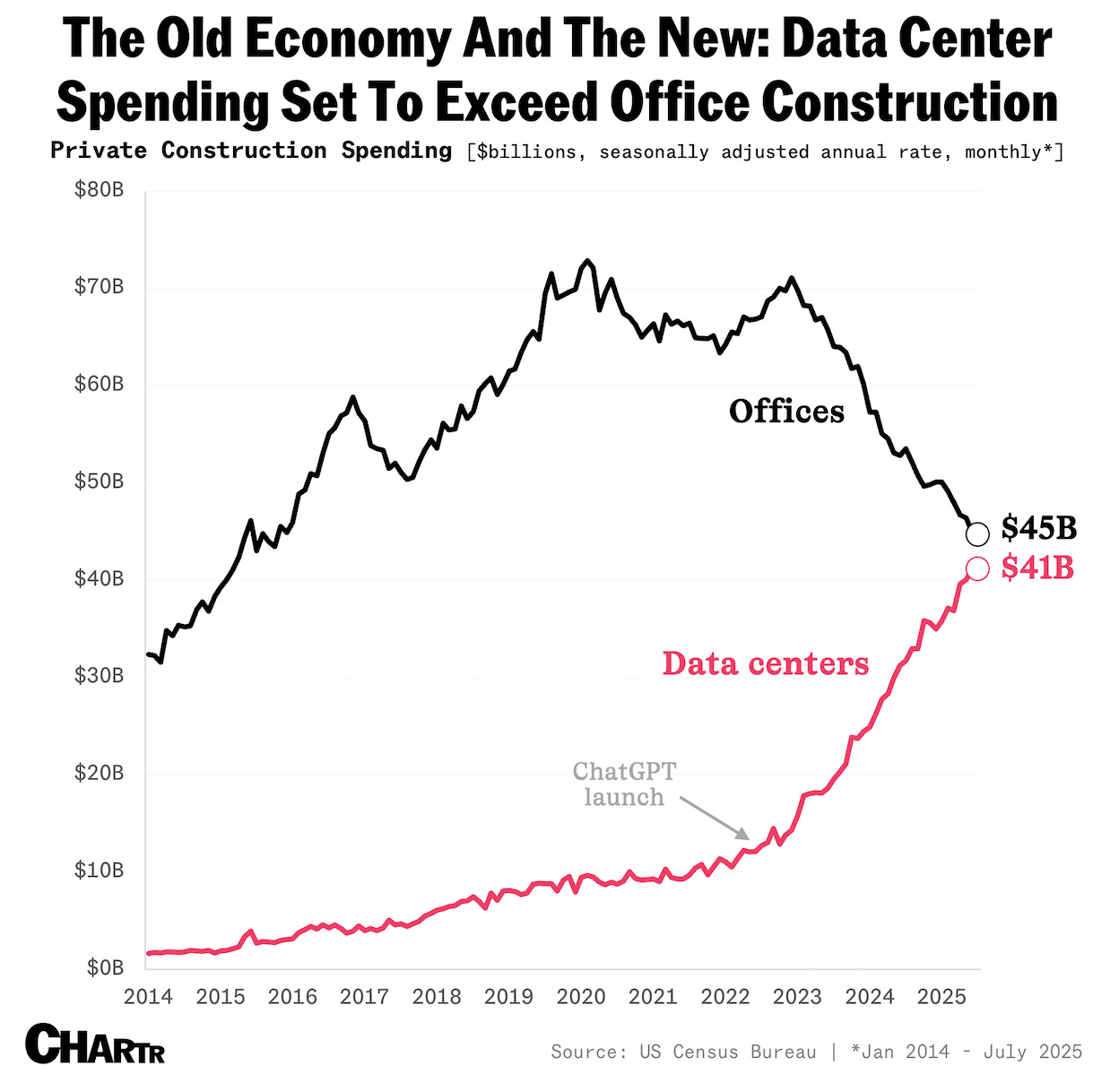

The tiny town of Ellendale, North Dakota, is at the center of a massive AI-fueled construction boom, with a half-built data center costing over $15 billion—about a quarter of the state’s entire annual economy. Tech giants like Microsoft, Meta, and OpenAI are pouring unprecedented sums into data centers, chips, and energy infrastructure, betting that AI will soon transform the economy and justify trillions in spending.

But this surge carries risks reminiscent of past tech bubbles, like the 1990s fiber-optic buildout that ended in overcapacity and financial collapse. Many AI models cost exponentially more to develop but show slower-than-expected improvement, and early research finds little measurable economic payoff so far. Meanwhile, companies like CoreWeave are piling on debt to finance construction, gambling that future demand will outpace costs before the tech becomes obsolete.

Despite concerns, investment continues at breakneck speed, reshaping small towns like Ellendale with new jobs, housing, and infrastructure—and leaving residents hoping the AI wave won’t crash before it pays off.

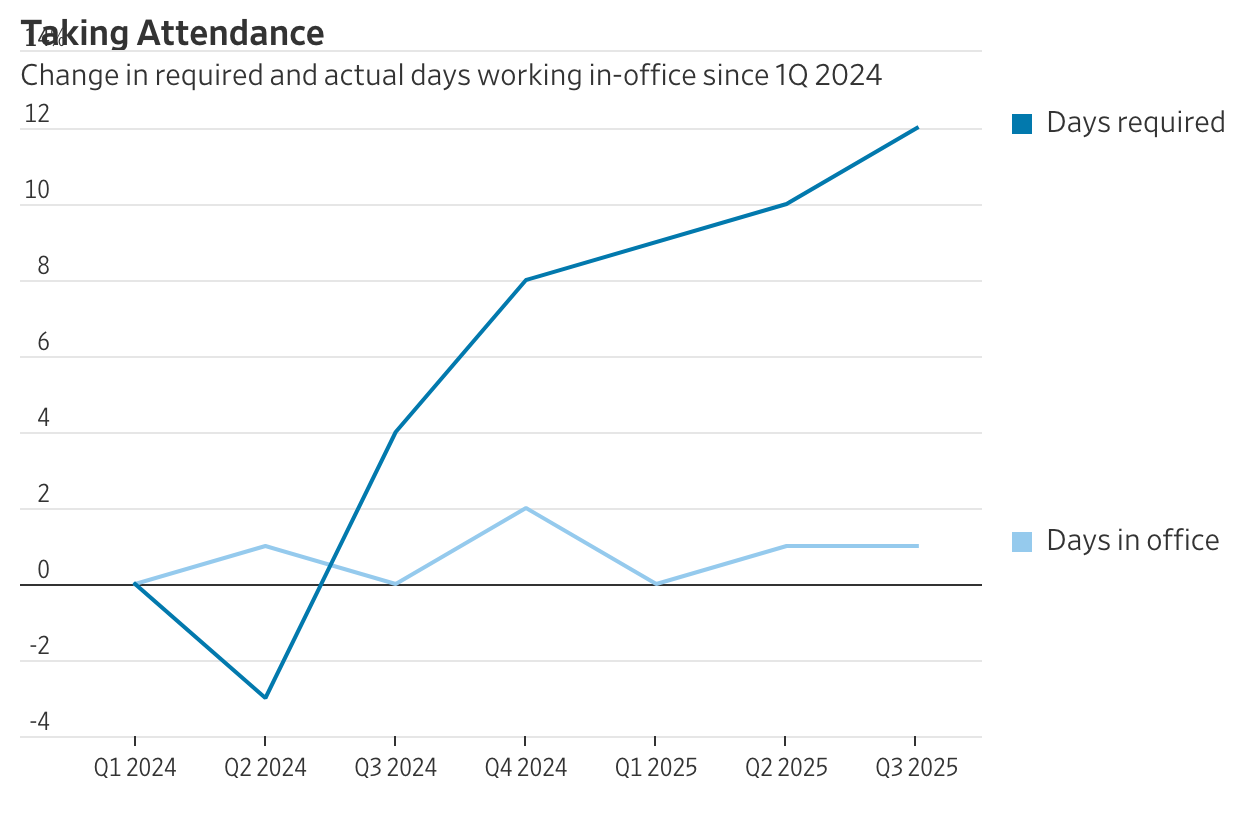

4. The Rush to Return to the Office Is Stalling

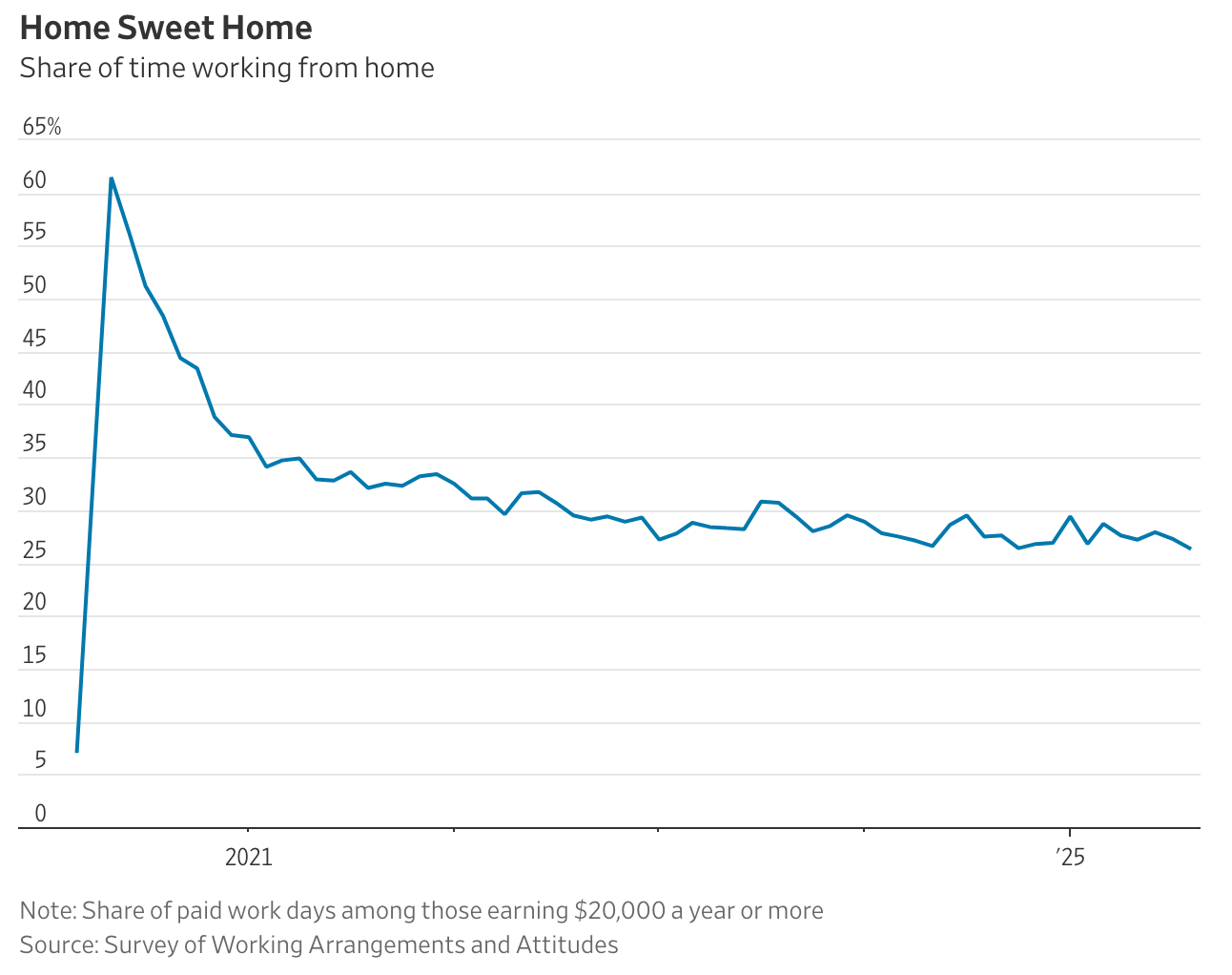

Big companies like Microsoft, Paramount, NBCUniversal, and Amazon are demanding more in-office work, with some requiring four or five days a week or offering buyouts to those unwilling to comply. Yet office attendance has barely risen, staying well below pre-pandemic levels as many employees and even managers resist full returns. Some firms quietly tolerate noncompliance, especially for top performers, while others use stricter mandates to reduce headcount through attrition.

Logistical challenges, like Amazon running out of desks and parking, complicate the push, and hybrid work remains common—Americans still work from home about 25% of the time, the same as in 2023. Compliance drops sharply when companies require three or more in-office days, suggesting that while return-to-office mandates are growing, employee resistance and practical hurdles are keeping attendance from rebounding fully.

And then there’s this:

But then there’s this:

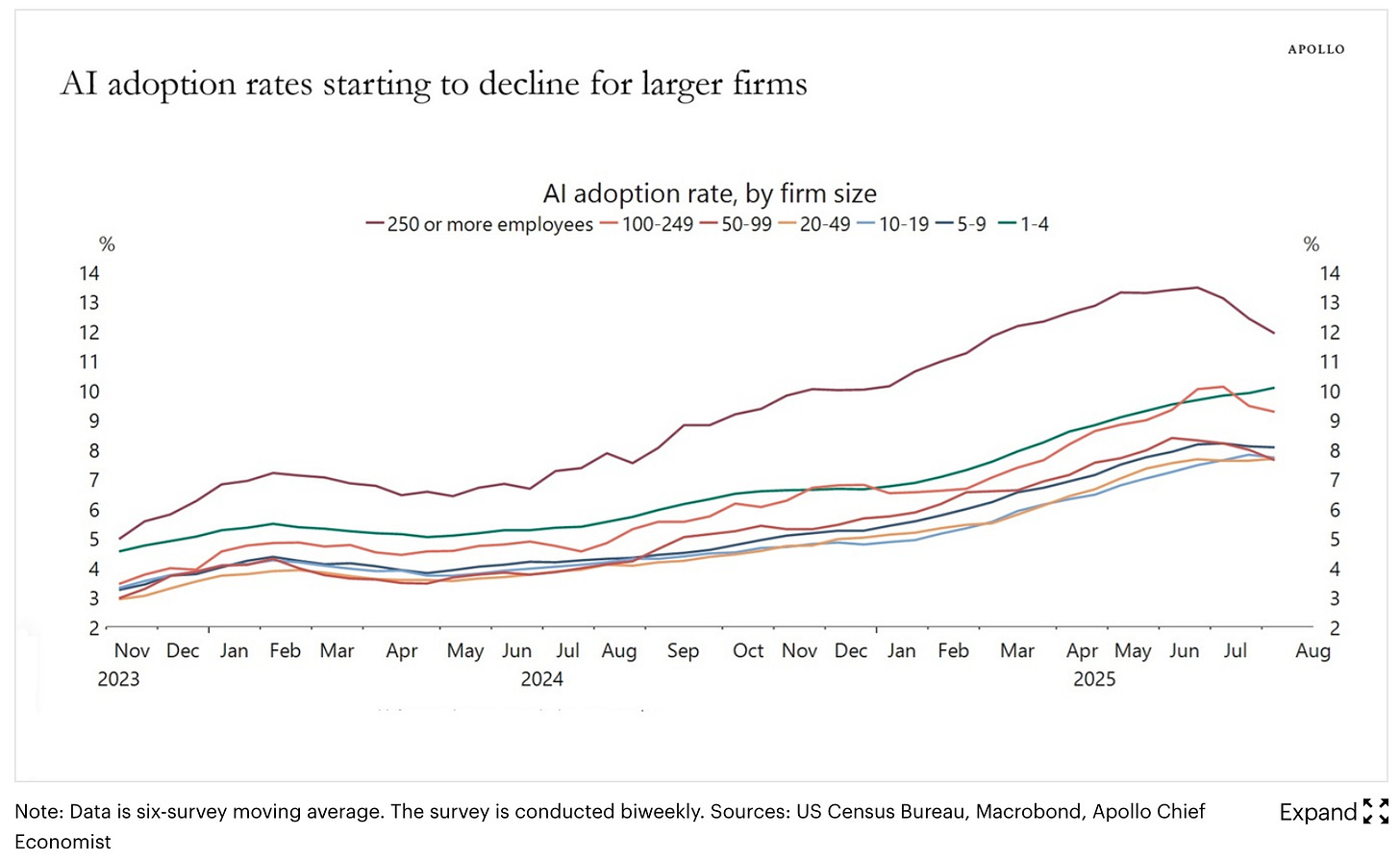

5. AI Adoption Rate Trending Down for Large Companies

The US Census Bureau conducts a biweekly survey of 1.2 million firms, and one question is whether a business has used AI tools such as machine learning, natural language processing, virtual agents or voice recognition to help produce goods or services in the past two weeks. Recent data by firm size shows that AI adoption has been declining among companies with more than 250 employees, see chart below.

Are we over investing in AI? Time will tell.

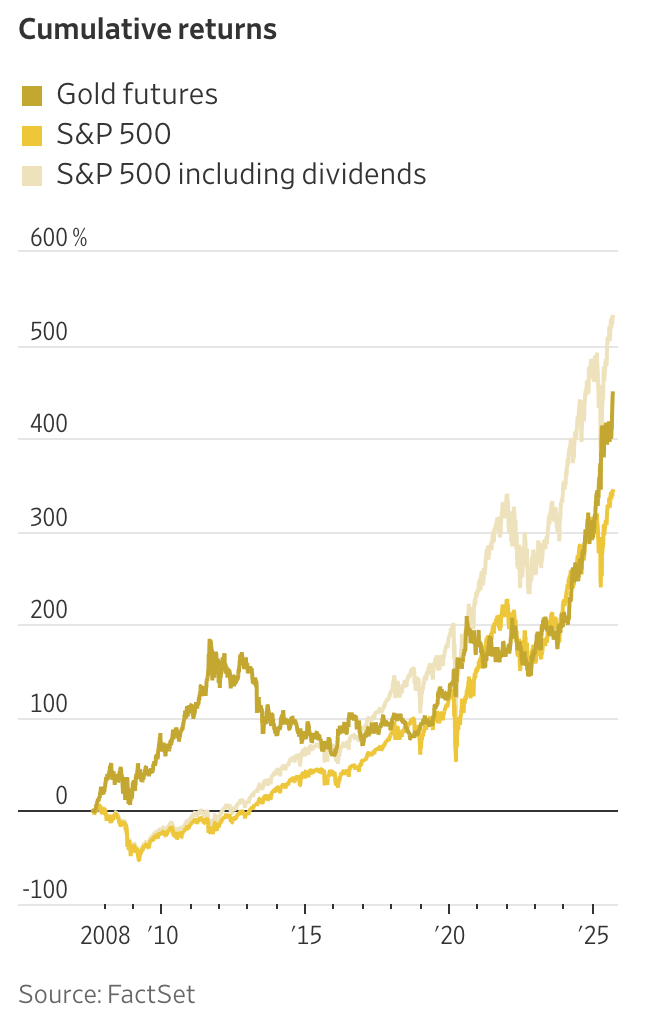

6. Gold Hasn’t Rallied This Much Since 1979

Gold prices have surged to record highs this year, climbing 40% and hitting $3,682.20 a troy ounce as investors flock to the metal amid economic and political uncertainty. The rally, the biggest since 1979, reflects growing concerns over inflation, volatile trade policies, the weakening U.S. dollar, and geopolitical tensions from wars in Ukraine to shifting U.S. foreign policy. Investors ranging from retirees to hedge funds and wealthy clients at vaults like IBV International in London have poured money into gold, with U.S. gold-linked ETFs seeing a 43% jump in assets since January.

Driving the momentum are fears of stagflation—a toxic mix of high inflation and slow growth—alongside expectations that the Federal Reserve will cut interest rates, making gold more attractive relative to bonds. Central banks, Chinese buyers, and Western investors alike have all contributed to the surge, while even Main Street Americans are cashing in old jewelry as prices soar. Analysts warn that unless confidence in U.S. economic growth and the dollar strengthens, gold’s appeal as a hedge against uncertainty will likely persist.

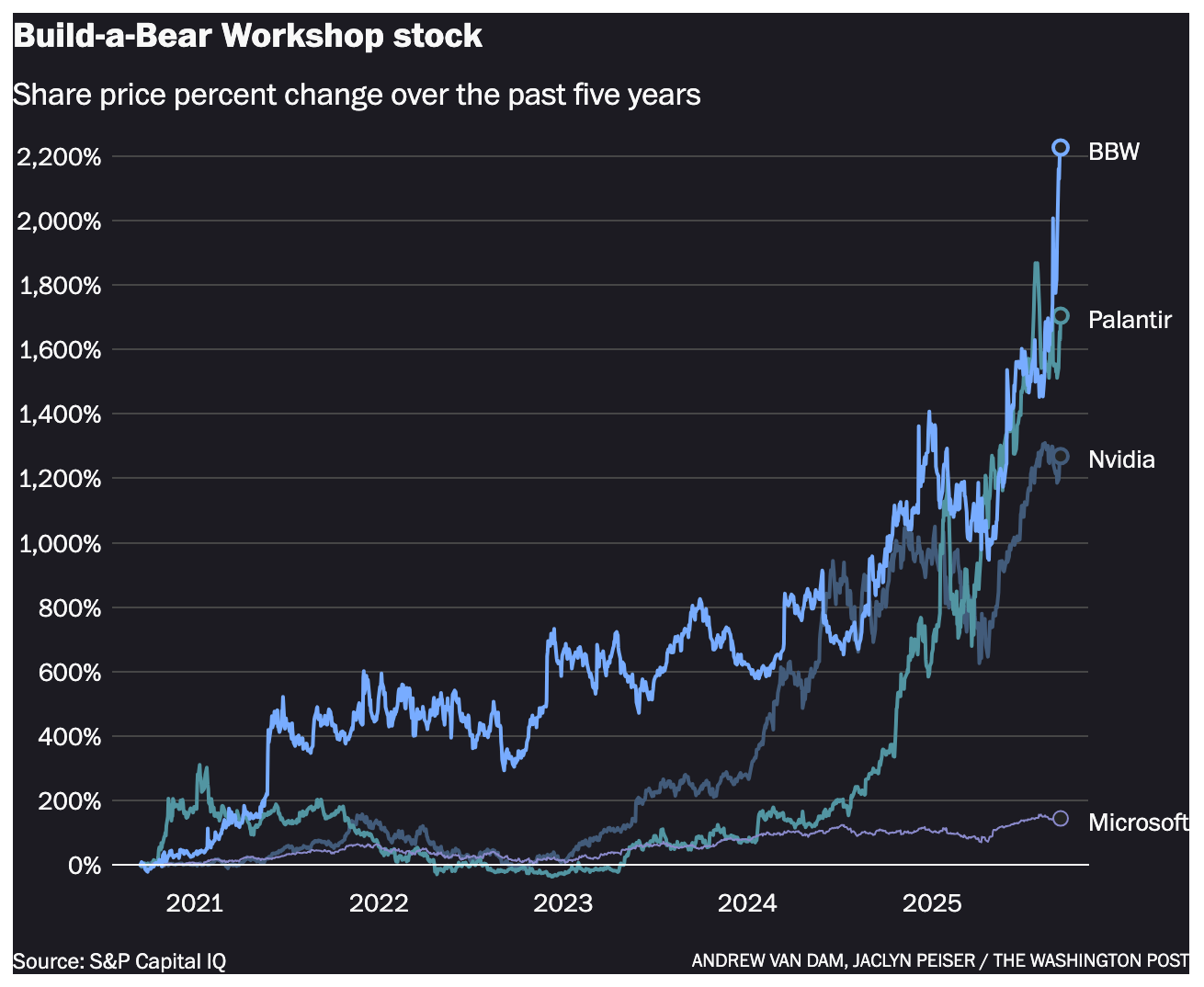

7. This toy company’s stock is outpacing Nvidia

Build-a-Bear Workshop has become one of the stock market’s biggest surprises, with its share price soaring over 2,000% in five years—outpacing tech giants like Nvidia and Microsoft. Analysts attribute this growth not to hype but to strong fundamentals, as the company continues to post record revenue and profits while expanding its global footprint. Unlike many struggling retailers, Build-a-Bear has thrived by leaning on its unique in-store experience, where customers personalize plush toys through rituals like stuffing, dressing, and even adding scents or voice recordings—an approach that has built deep emotional connections across generations.

The company has also diversified through e-commerce, licensing deals with major franchises like Disney and Pokémon, partnerships with tourist destinations, and limited-edition drops that cater to both children and the growing “kidult” market of adult collectors, who now make up about 40% of sales. Social media has amplified demand, turning special releases into viral events, while strategic cost-cutting and its vertically integrated model have helped weather tariffs and supply chain challenges. With store openings accelerating, online engagement booming, and nostalgia-driven adult consumers fueling growth, Build-a-Bear has transformed from a mall retailer into a global brand tapping into both sentimentality and savvy retail strategy.

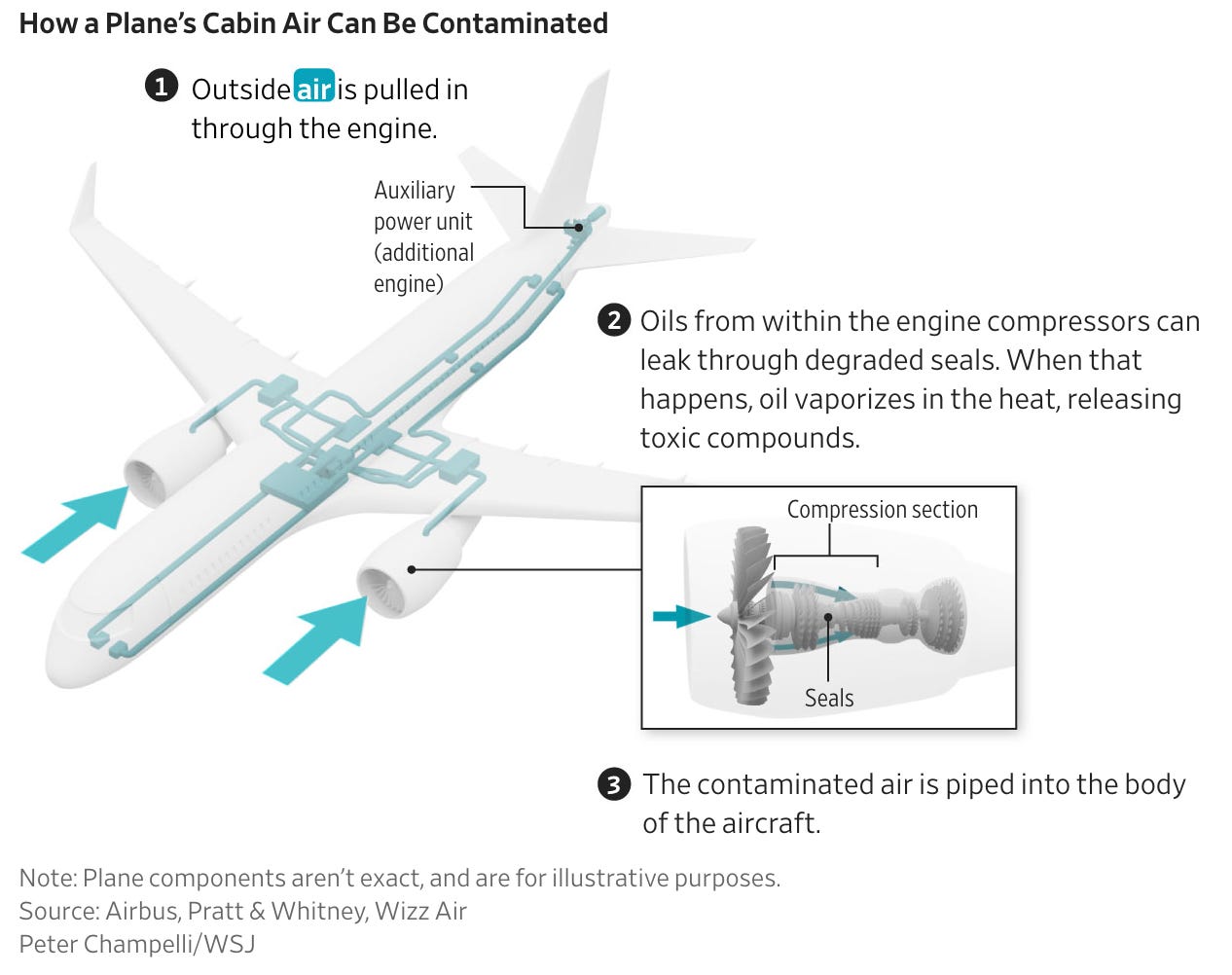

8. Delta Replaces Engine Units in Effort to Address Toxic-Fume Surge on Planes

Delta Air Lines is replacing auxiliary power units (APUs) on more than 300 Airbus A320-family jets after a surge in incidents where toxic fumes leaked into cabin air, causing health risks for passengers and crew. The APU, a small engine in the aircraft’s tail used for electricity and air supply, has long been linked to “fume events” when oil leaks vaporize and contaminate air systems. Delta began the upgrades in 2022 and has nearly completed the work, marking one of the most aggressive efforts by a U.S. airline to address the issue.

Airbus, Honeywell, and Pratt & Whitney have known about APU seal leaks for decades, with multiple failed fixes over the years. Recent lawsuits allege that contaminated air has led to serious illnesses among crew members, while FAA reports document incidents involving diversions, emergency masks, and passenger health complaints. Airbus is now testing design changes for new planes, including moving air inlets to reduce leaks, but older aircraft will rely on less effective measures. Despite upgrades, industry data shows fumes continue to be a persistent hazard across A320 jets worldwide.

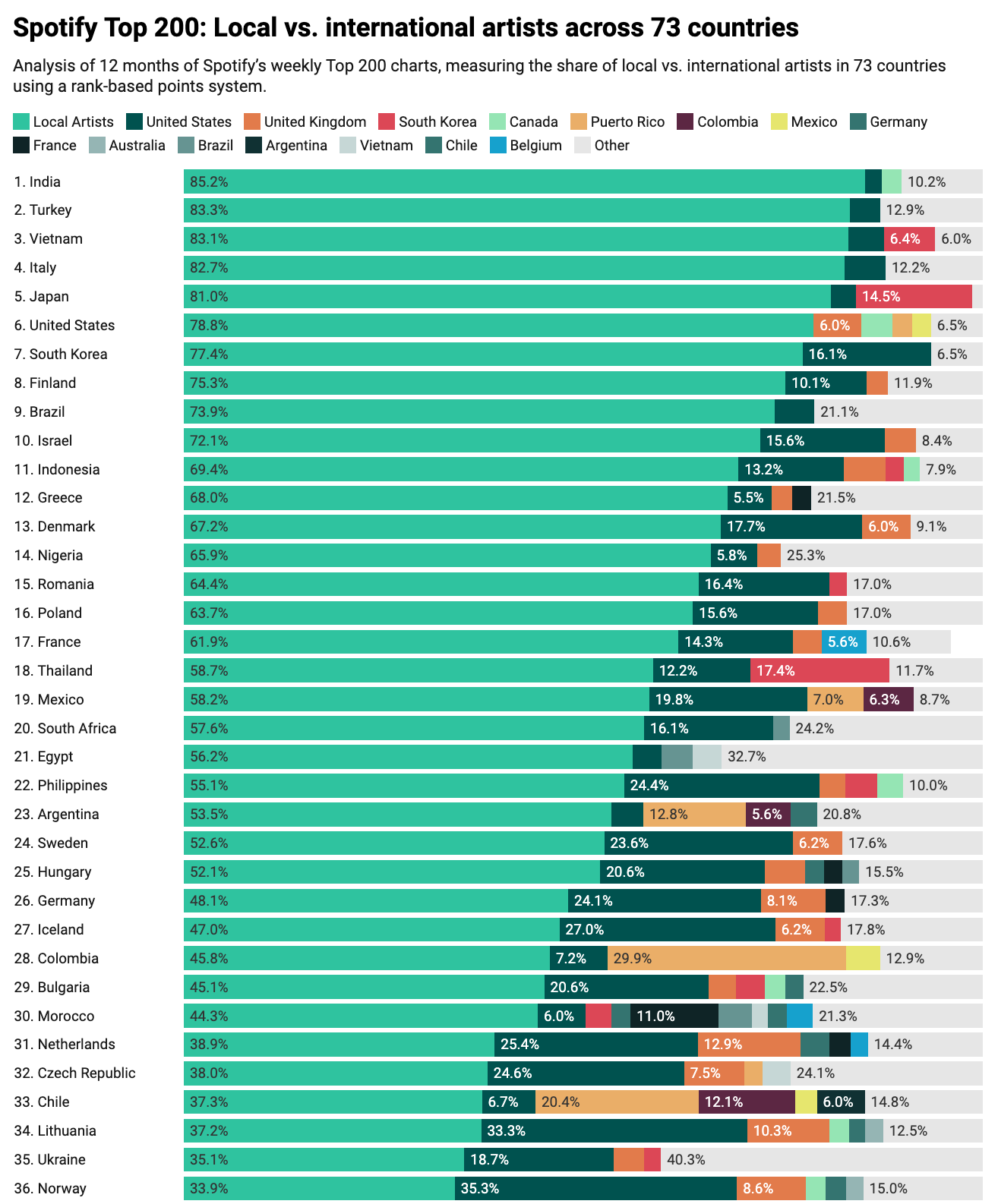

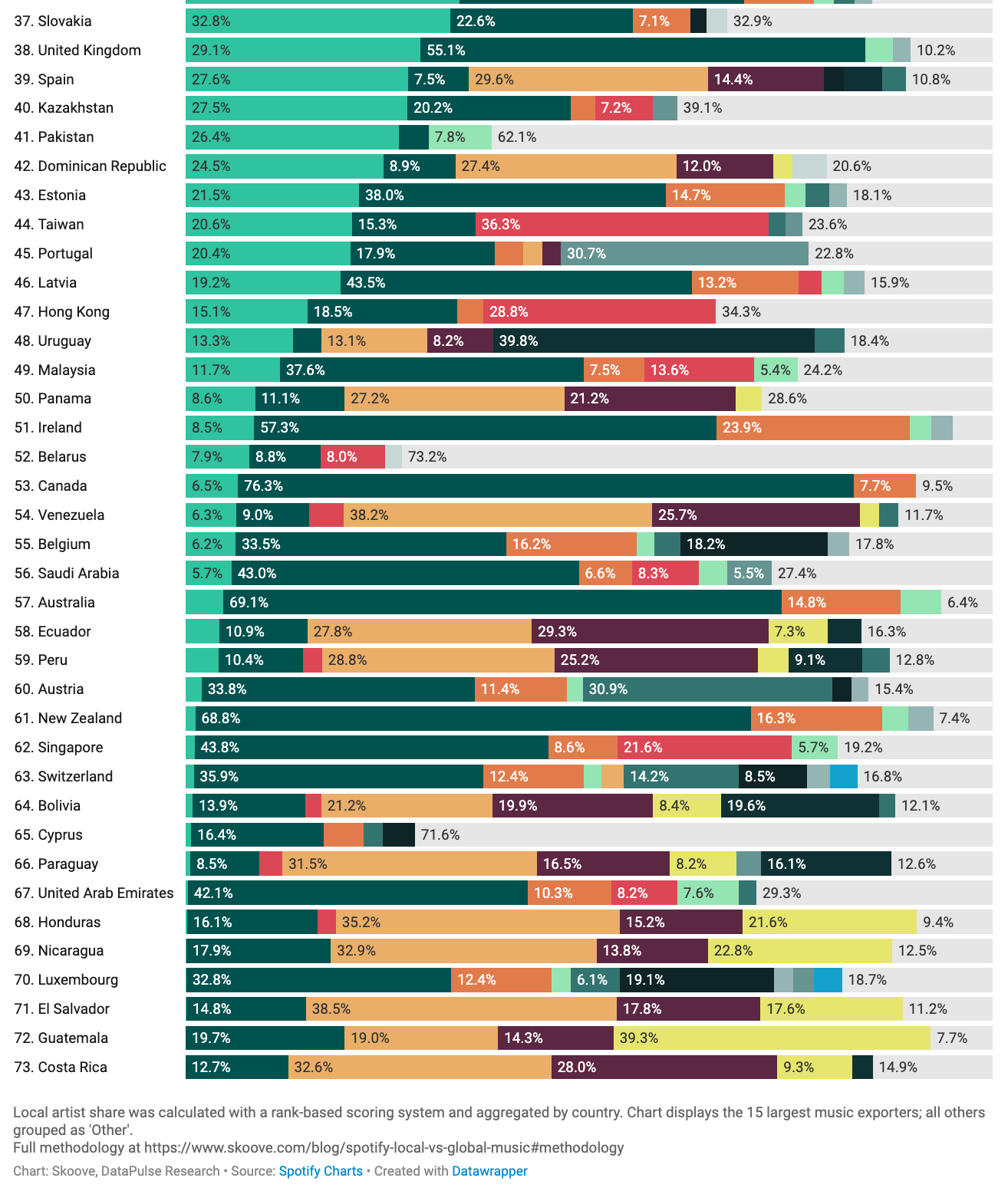

9. Spotify showdown: Which countries stream local artists the most

A global analysis of Spotify’s Top 200 charts across 73 countries over 59 weeks reveals stark contrasts in how nations embrace local versus international music. Nearly half the countries studied feature less than 30% local artists in their charts, with some—like Costa Rica—having none at all, as foreign acts dominate airwaves and playlists. Language plays a key role: countries with less globally spoken languages, such as Finland, Vietnam, and Italy, see 70–85% local representation, while English-speaking countries lag behind, with Ireland at just 9% and New Zealand at 1%.

Puerto Rico stands out for its outsized cultural influence, with artists from the island capturing huge audiences across Latin America and Spain despite its small population. Meanwhile, a “global playlist” effect has emerged, with the same 20 artists—from Billie Eilish to Bruno Mars—dominating charts worldwide. American music maintains unmatched reach, topping both its domestic charts (79%) and ranking in the top five in 70 of 73 countries.

10. Wait the Piña Colada song is about what?!

Admittedly, it was only after the song Escape (aka The Piña Colada song) by Rupert Holmes was used in the Guardians of the Galaxy movie did I actually pay attention to the lyrics…and just how ridiculous they are. This article has a lot of f-bombs, but it does a good job of capturing the insanity of the lyrics in this song. Popular songs and good beats don’t always equate to good lyrics. Feel free to play the song as you read the article.